There Will Be Graphs: A deeper dive into how 14 states are dramatically mitigating the expiring tax credits

IMPORTANT: Premium Alignment is NOT a substitute for making the enhanced ACA tax credits permanent. It does little to help the lowest-income folks who are still better off with Silver plans thanks to robust CSR assistance, and the benefits of it will be mediocre for those over 400% FPL if the enhanced tax credits expire.

Even for those it benefits the most (primarily those who earn between 200 - 400% FPL), it's a complement to the upgraded subsidies, not a replacement for them.

HOWEVER, it's still hugely helpful to those who know how to take advantage of it, and particularly in the states newly implementing it, it should relieve a huge portion of the pain being caused by the enhanced APTC expiring next month.

Last week I posted a deep dive into how a bunch of states are taking action to at least partially cancel out the impact of the impending end of the enhanced federal Advance Premium Tax Credits (APTC) which have been in place since early 2021.

I discussed wonky health insurance policy pricing terminology like "Silver Loading" and "Premium Alignment" and included a few examples to demonstrate how some states have set up their pricing policies in such a way as to maximize the impact of the tax credit formula which we're scheduled to convert over to starting on January 1st.

The main takeaway is that by increasing the gross price of Silver plans, both the gross and net prices of both Bronze and Gold plans can actually be reduced substantially, even with the official tax credit formula becoming significantly less generous.

After publishing the piece, however, I realized that there are more states where ACA enrollees can take advantage of this pricing practice than I thought, so I embarked on what ended up being a much larger project than I had originally intended: I went through all 50 states (+DC) and entered both the gross and net premiums into a spreadsheet to see what the numbers look like in 2026 compared to 2025.

My conclusions are mostly what I expected, but with one or two surprises.

As I noted last week, most* enrollees who earn less than ~200% of the Federal Poverty Level (FPL) are probably better off sticking with a Silver plan regardless of the subsidy reduction due to the generous Cost Sharing Reduction (CSR) assistance provided to Silver enrollees at that income level...and enrollees who earn more than 400% FPL are losing access to any federal tax credits whatsoever, so most* (but not all) of the benefit of these subsidy-based pricing policies are lost on them as well.

Therefore, I'm again focusing on the 200 - 400% FPL income bracket: A single 50-yr old adult earning $50,000/year, which is 332% FPL in 2025 and will be 319% FPL in 2026.

*(I'll address both the < 200% and > 400% FPL populations after the main post.)

A quick reminder: ACA exchange plans are grouped together by "Metal Levels" of Bronze, Silver, Gold & Platinum. There's also Catastrophic plans, but that's a separate animal. OFFICIALLY, Bronze plans have the lowest premiums & highest deductibles, while Platinum plans have the highest premiums but the lowest deductibles.

Silver and Gold are in between, but the system is really set up towards Silver plans being the default choice for most enrollees: Not only is the tax credit formula itself based specifically on whatever the 2nd least-expensive Silver plan costs (the "Benchmark Silver" plan), but CSR subsidies (which dramatically reduce deductibles, co-pays & other out of pocket expenses) are only available with Silver plans as well.

As a result, over 56% of the ~24 million ACA individual market enrollees are currently enrolled in Silver plans, vs. 30% in Bronze, 13% in Gold and less than 1% in Platinum & Catastrophic plans combined.

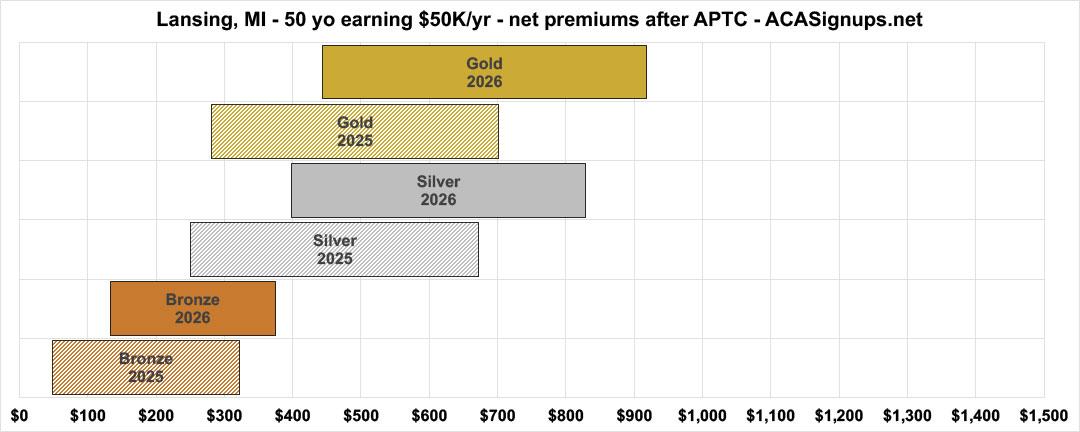

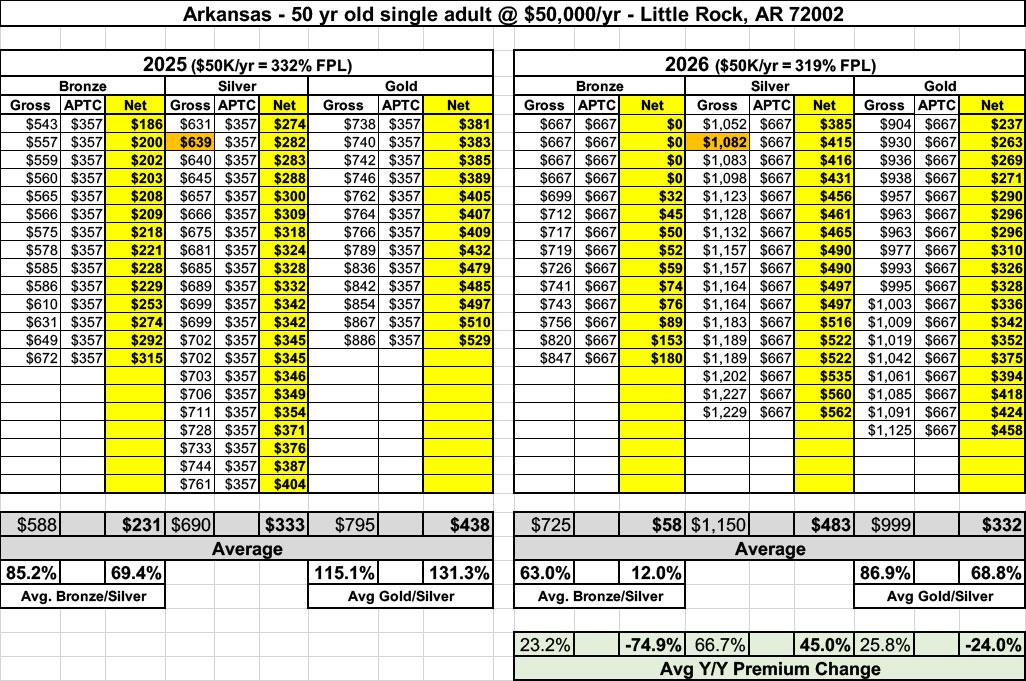

Here's what you'd normally expect the range of Bronze, Silver and Gold plan pricing to look like, using my home state of Michigan as an example: In both 2025 and 2026, Bronze plans are priced lowest, Silver plans are priced higher, and Gold plans cost the most. Makes sense, right?

The point of both last weeks article as well as this one is to look at states where, as counterintuitive as it may seem, GOLD plans (which have much lower deductibles & out of pocket costs than non-CSR Silver plans) may cost the same or even less than SILVER plans...sometimes substantially lower...which is all the more remarkable given that this can still be the case even without the enhanced tax credits in place!

Alternately, in some cases, BRONZE plans could be available for nominal premiums or even none at all (ie, $0/month in some case).

In last week's post, I included a table provided by KFF (formerly the Kaiser Family Foundation) which sorted every state by the ratio of the Lowest Priced Gold Plan to the Benchmark Silver Plan. In other words, they looked at the least-expensive Gold plan (at full price) in each state and compared it to the 2nd-least expensive Silver plan.

Nationally, they list 20 states where the least-expensive Gold plan will cost less than the benchmark plan at full price. That caveat is important, however, since what ACA enrollees are interested in is the net price--how much they'll actually have to pay regardless of what the list price of the policy is.

In addition, six of those 20 states (along with 7 others) also have either supplemental subsidies or special healthcare programs for some enrollees which bring the net premiums down even more.

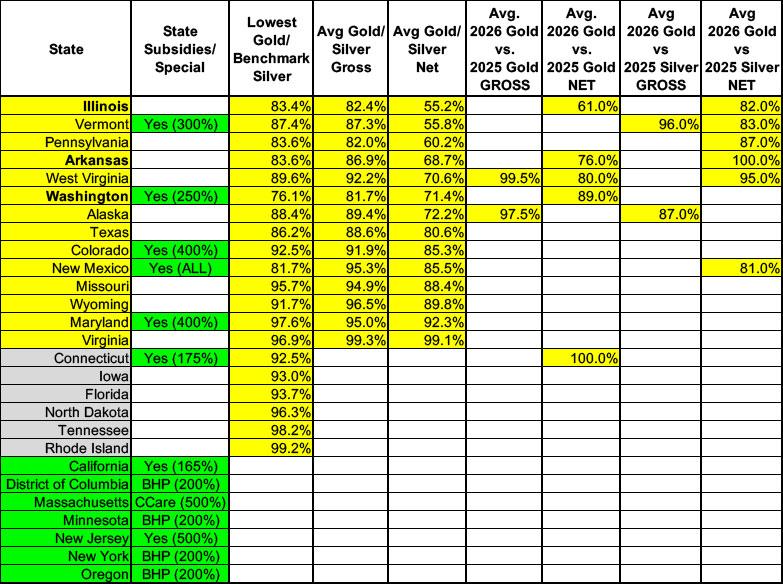

In going beyond KFF's chart, my own analysis found 14 states which I'd really consider "Premium Alignment" states. In addition to having at least 1 Gold plan priced lower than the Benchmark Silver plan, in all 14, the average Gold plan will be priced lower than the average Silver plan next year (for both gross and net premiums). I'd still urge enrollees in the other 6 to take a close look at Gold plans as well

I also found several of them where the Gold plans will cost less on average in 2026 than in 2025, and even some where the average Gold plan will cost less than the average Silver plan does this year.

Again, all of this is especially eyebrow-raising given both the 25.5% average gross premium increase as well as the 114% average net premium increase estimated by KFF nationally.

Before I dig in, a couple of important caveats:

- Again, all of these examples assume a single 50-yr old with no children who earns $50,000/year in each year.

- All of these examples also assume the enrollee lives in the capital city of each state.

- While the examples here should provide fairly accurate guidance, both the dollar amounts and percentages shown will vary widely depending on which part of the state you live in, how many people live in your household, how old each family member is and what the household income is.

- I should also note that my headline is slightly misleading: Only 3 of the states below are implementing Premium Alignment specifically in response to the expiring tax credits (Arkansas, Illinois & Washington State). The other states already put P.A. policies into effect at least a few years ago and are simply continuing to do so, which is still a very good thing; I'm hoping every other state does so in the future (especially my home state of Michigan!).

- On the other hand, most of the states which have their own supplemental subsidy programs are retooling and/or expanding them directly in response to the tax credit crisis.

With all that in mind, let's take a look...

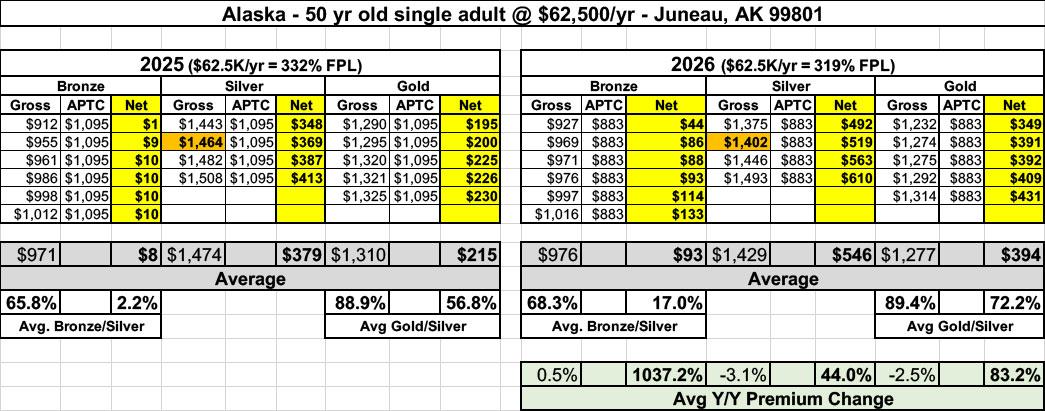

Alaska:

OK, right off the bat, I'm already contradicting myself on the ground rules: The Federal Poverty Level (FPL) is 25% higher in Alaska than in the 48 contiguous U.S. states, which means that I had to bump up the example enrollee's income by 25% (to $62,500/yr) as well to match the rest of the states. The other 13 states are all set to $50,000/yr.

Alaska is also unusual in that they're the only state in the country to see a slight reduction (by 1.1%) in average gross premiums from 2025 to 2026. This doesn't mean a whole lot, however, since The Last Frontier has the 4th highest gross premiums in the nation to begin with, but it helps a bit.

Fortunately, Alaska has been engaging in robust Premium Alignment policies for several years now, which you can see below: In both 2025 and 2026 Gold plans are priced significantly lower than Silver at full price (over 10% lower next year), which translates into an even more dramatic drop from Silver to Gold pricing after federal tax credits are applied...in fact, in 2026, for our theoretical 50-yr old earning $50K/yr, the average Gold plan will cost a whopping 28% less than the average Silver plan!

The tax credits expiring have made Gold plans more expensive, of course...but they've basically just brought them up to what Silver plans cost in 2025!

It's also worth noting how dramatically inexpensive the Bronze plans are both years.

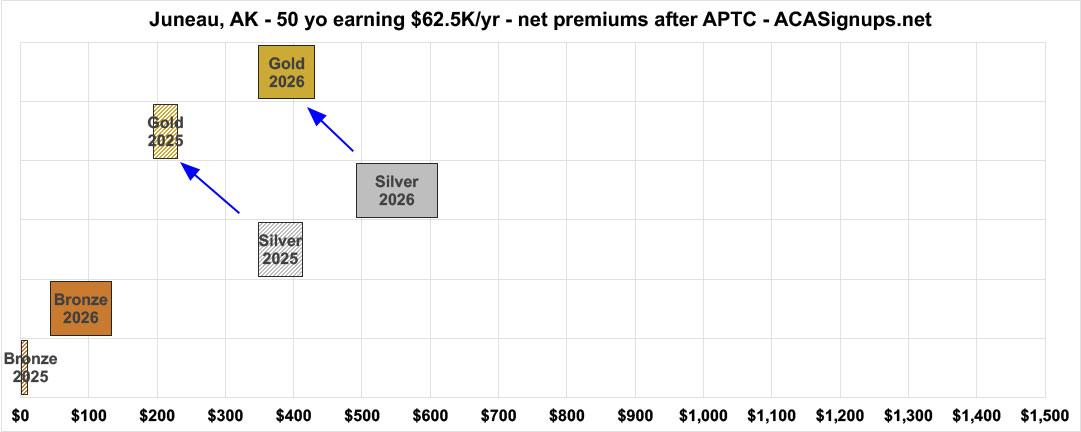

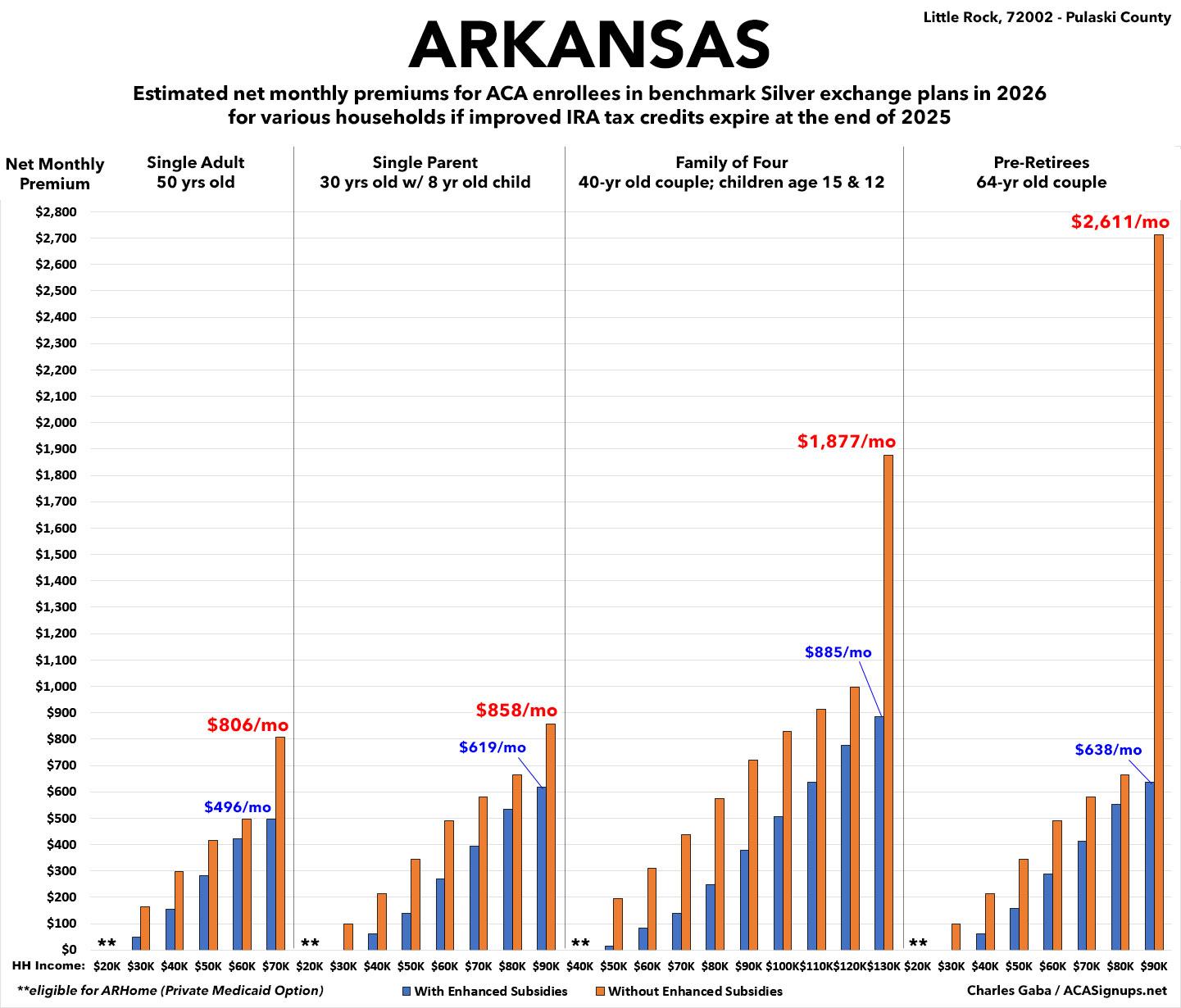

Arkansas:

I became a bit obsessed with the Arkansas Premium Alignment situation a couple of months ago due to some very confusing messaging on the state's part, but in the end, I have to give them credit: They're pulling off an impressively robust implementation of the policy, resulting in average Gold plans plummeting in net price year over year, from costing more than Silver in 2025 (15% more gross, 32% net) to costing far less than Silver in 2026 (13% less gross, 31% less net)!

Again, the positive impact on Bronze premiums is even more impressive....four of them are available for literally nothing per month (they'll still have a massive deductible, of course).

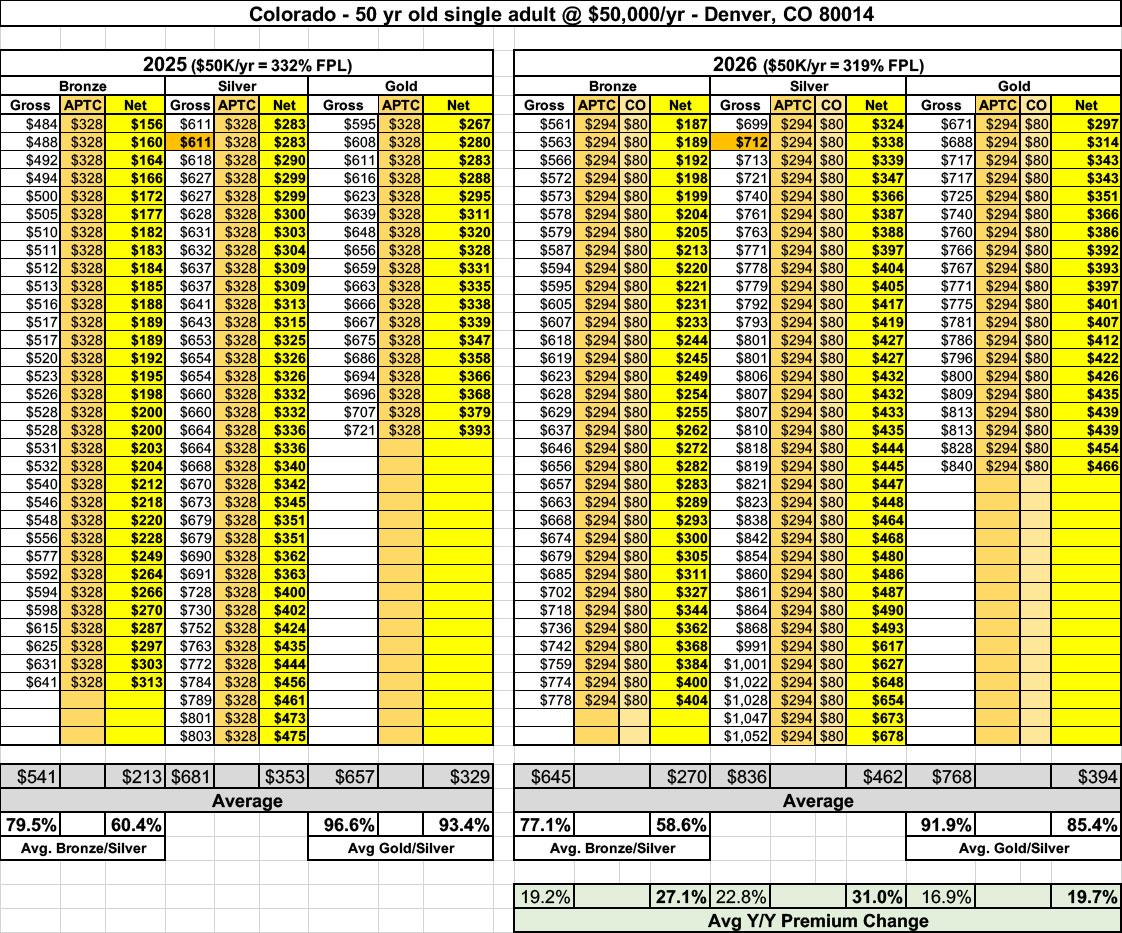

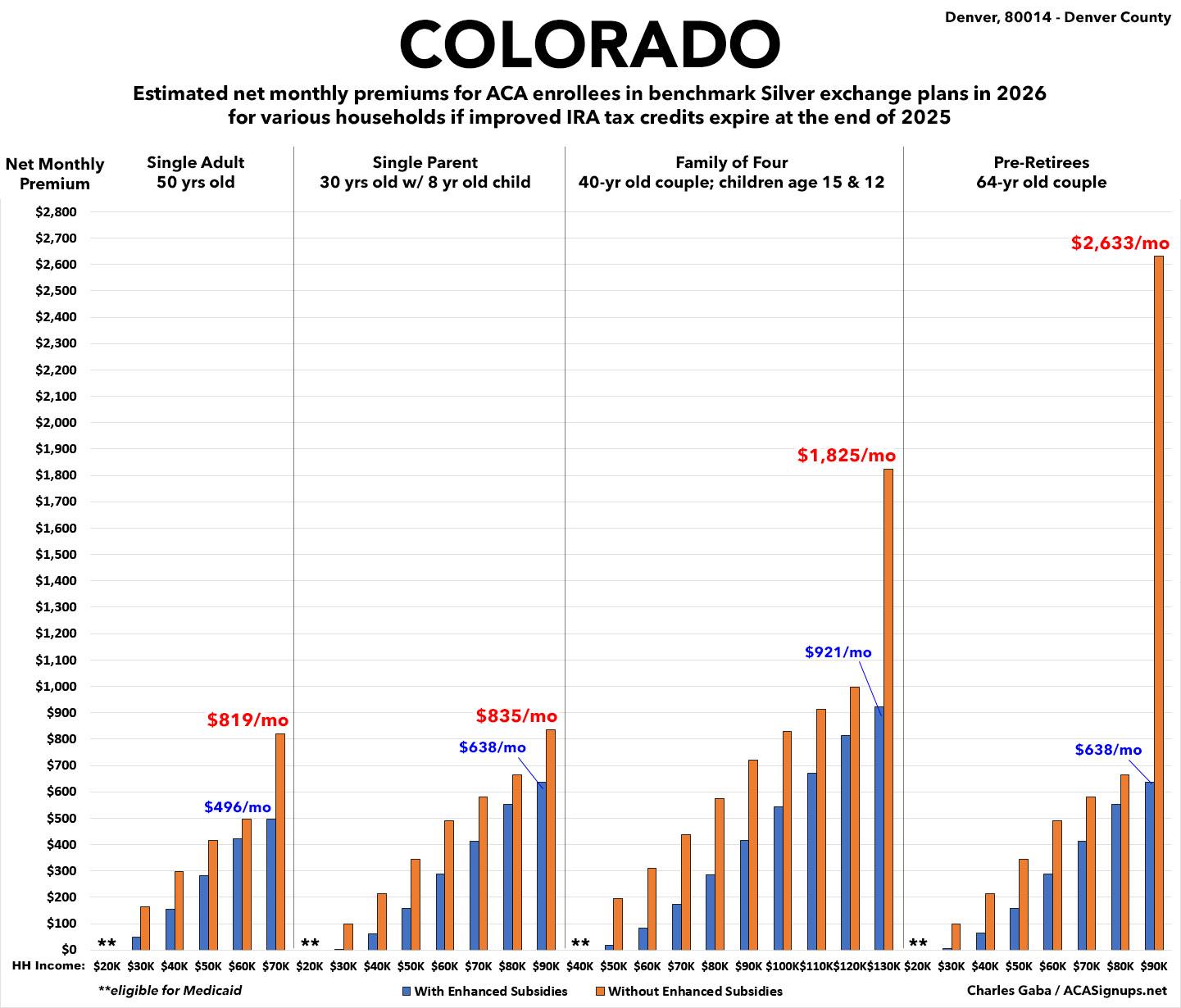

Colorado:

Colorado is another state which is has been utilizing Premium Alignment for years, although not especially robustly. On the other hand, they've also beefed up their state-based supplemental subsidy program this year, so that our 50-yr old has an additional $80/month knocked off his net premiums regardless of which plan he chooses.

The combination results in his average net premiums being 15% lower if he enrolls in a more comprehensive Gold plan vs. Silver.

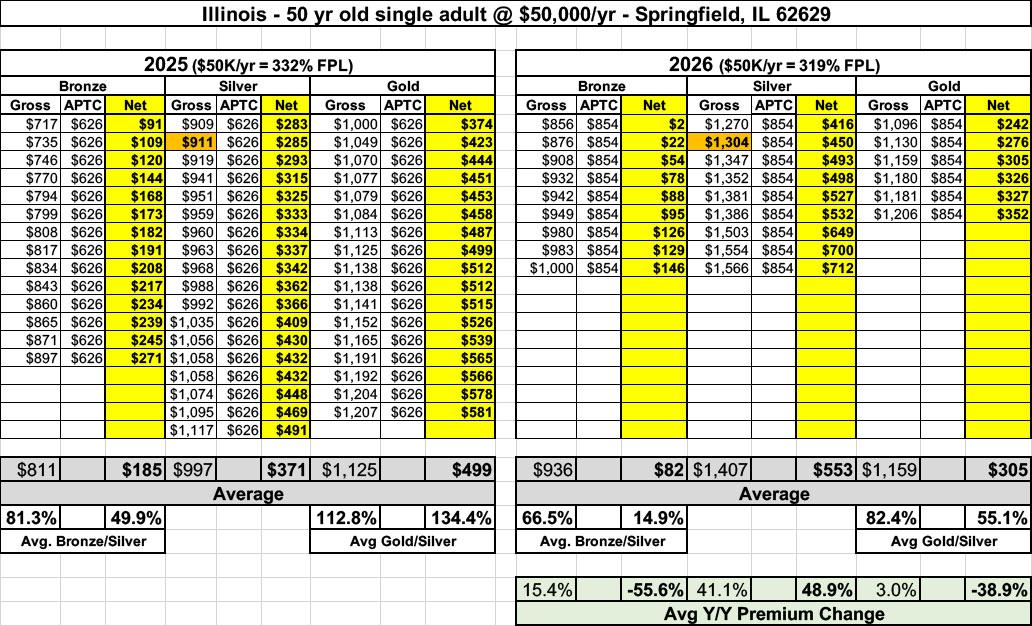

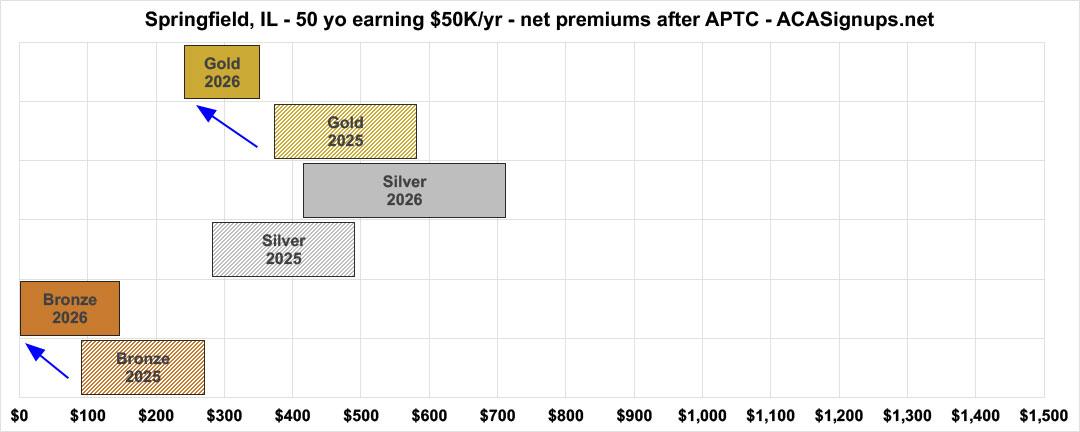

Illinois:

Illinois is the 2nd state (the others are Arkansas and Washington State) to officially implement robust Premium Alignment for the first time in 2026...and they've done it about as aggressively as I can imagine:

- In 2025, Gold plans cost an average of 13% more than Silver at full price and 35% more at net price

- In 2026, Gold plans will cost an average of 18% less than Silver at full price and a whopping 45% less at net price.

In fact, the average Gold plan will cost 18% less after the less-generous subsidies are applied in 2026 than the average Silver plan cost this year!

And again, there's a Bronze plan available for a nominal $2/month (albeit, again, with a likely huge deductible).

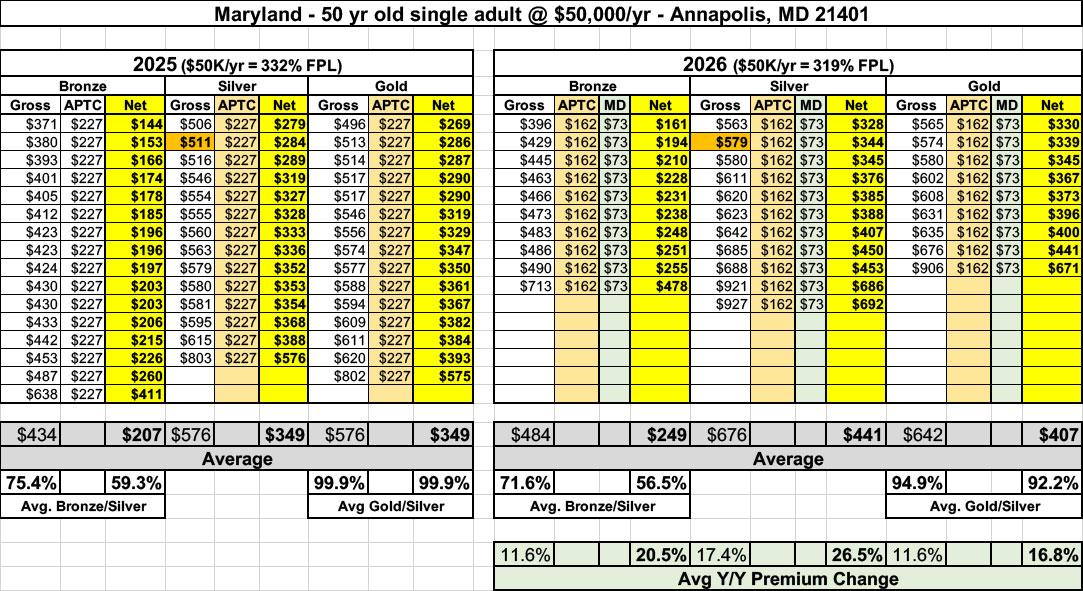

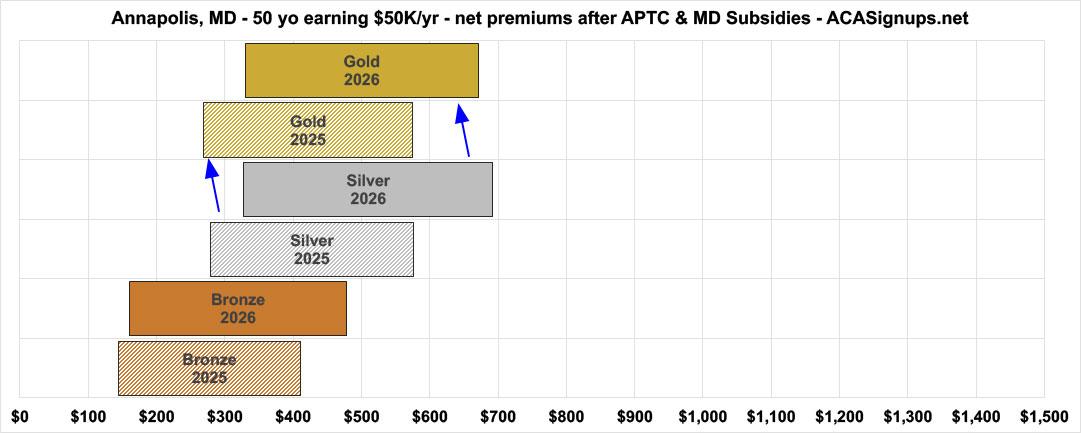

Maryland:

Maryland is another state which is continuing to implement Premium Alignment pricing. It's not super aggressive but is stronger than Colorado's...and like Colorado, Maryland has their own state-based subsidy program which is knocking an additional $73/month off the net premium.

As a result, average Gold plans, which already cost no more than Silver this year, will cost slightly less on average.

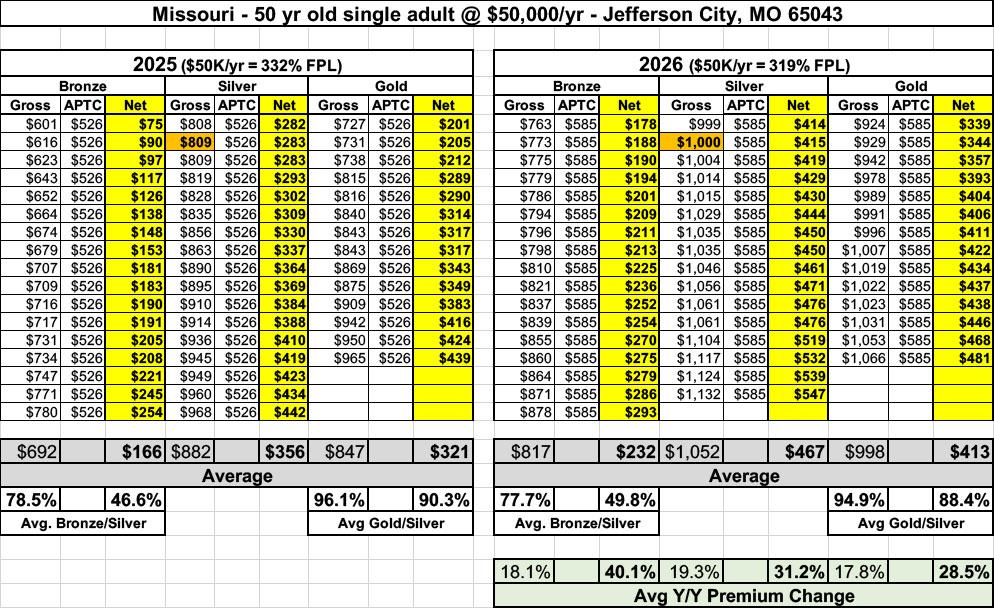

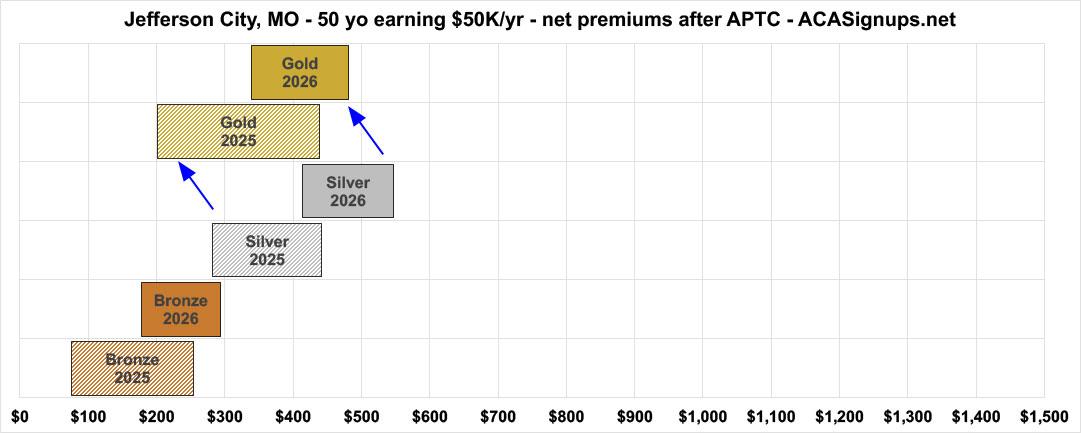

Missouri:

This one surprised the hell out of me; it looks like the Show Me State has had either strong Silver Loading or weak Premium Alignment in place for at least the last year or so: Gold plans cost about 4-10% less than Silver in 2025 and will cost 5-12% less than Silver in 2026, depending on whether you're talking about the gross or net premium.

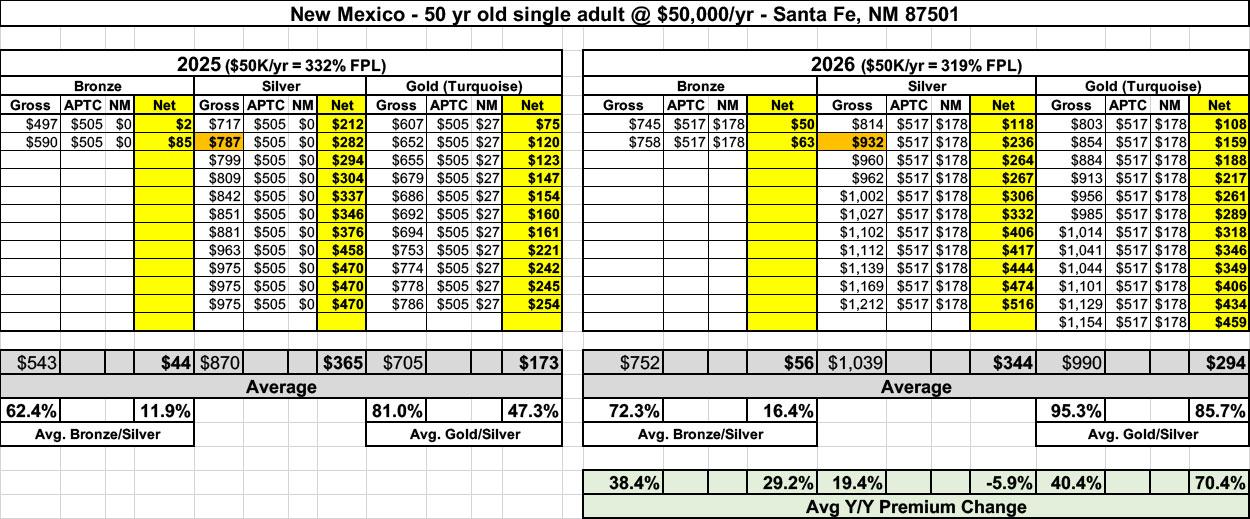

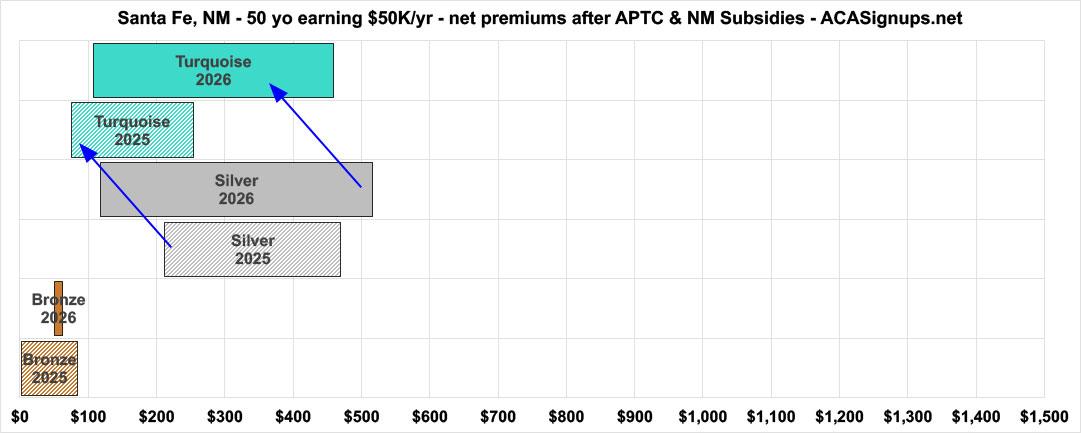

New Mexico:

New Mexico has been a dream state for the past couple of years as far as their ACA exchange is concerned, and for 2026 they're pulling off damned near a miracle: Not only are they backfilling the lost federal tax credits for all enrollees (even those over 400% FPL!), they're doing so while also keeping their Turquoise Plan savings program in place, which reduces cost sharing even further!

The mechanics of this are a little weird; it does not mean a direct dollar-for-dollar match year over year, since the plans and gross pricing are still different, but it ultimately means that New Mexico enrollees are basically being held completely harmless in 2026, with Gold plans costing an average of 5 - 14% less than Silver plans.

Oddly, the net impact of all of this is that the only 2 Bronze plans available in Santa Fe would cost either more or less in 2026 than in 2025, which is a bit odd I admit.

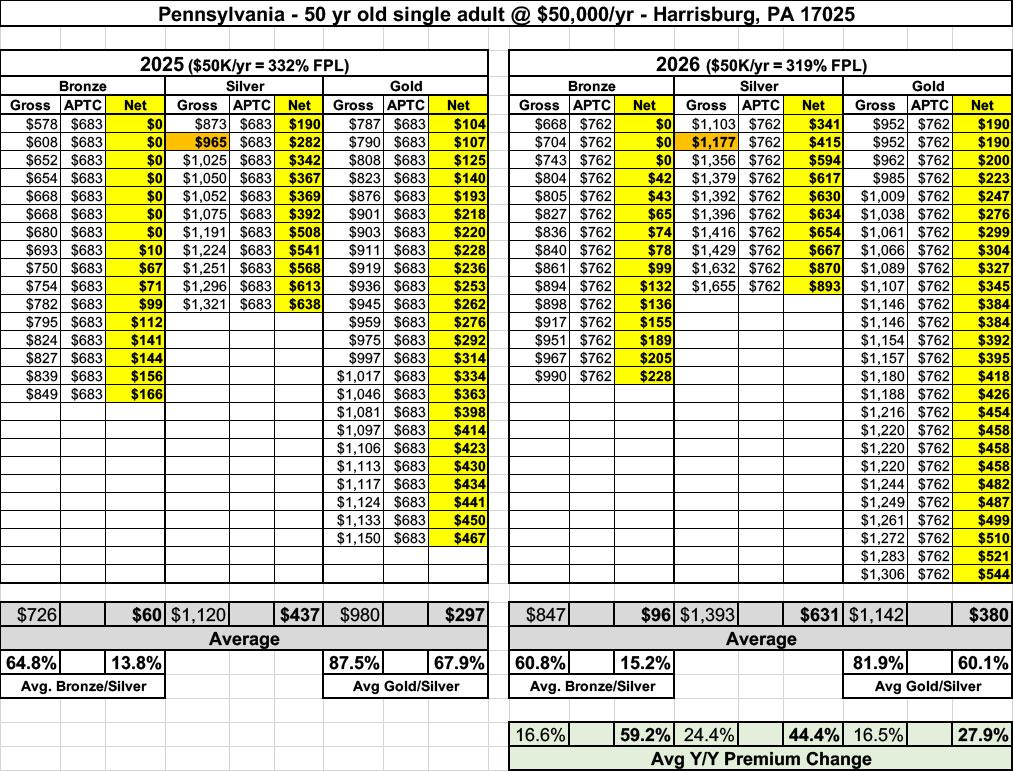

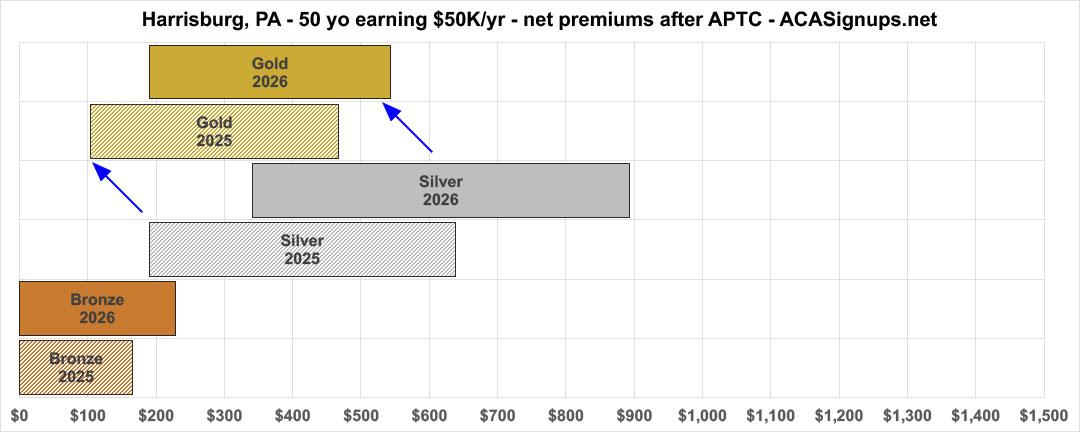

Pennsylvania:

Pennsylvania is another state which quietly implemented robust Premium Alignment policies several years back and are continuing to do so into 2026. The average Gold plan, which runs between 13 - 32% less than Silver plans in 2025, has an even lower ratio next year: 22 - 40% less depending on whether you go by the gross or net premium.

Once again, there will still be three Bronze plans available for $0/month next year for this enrollee.

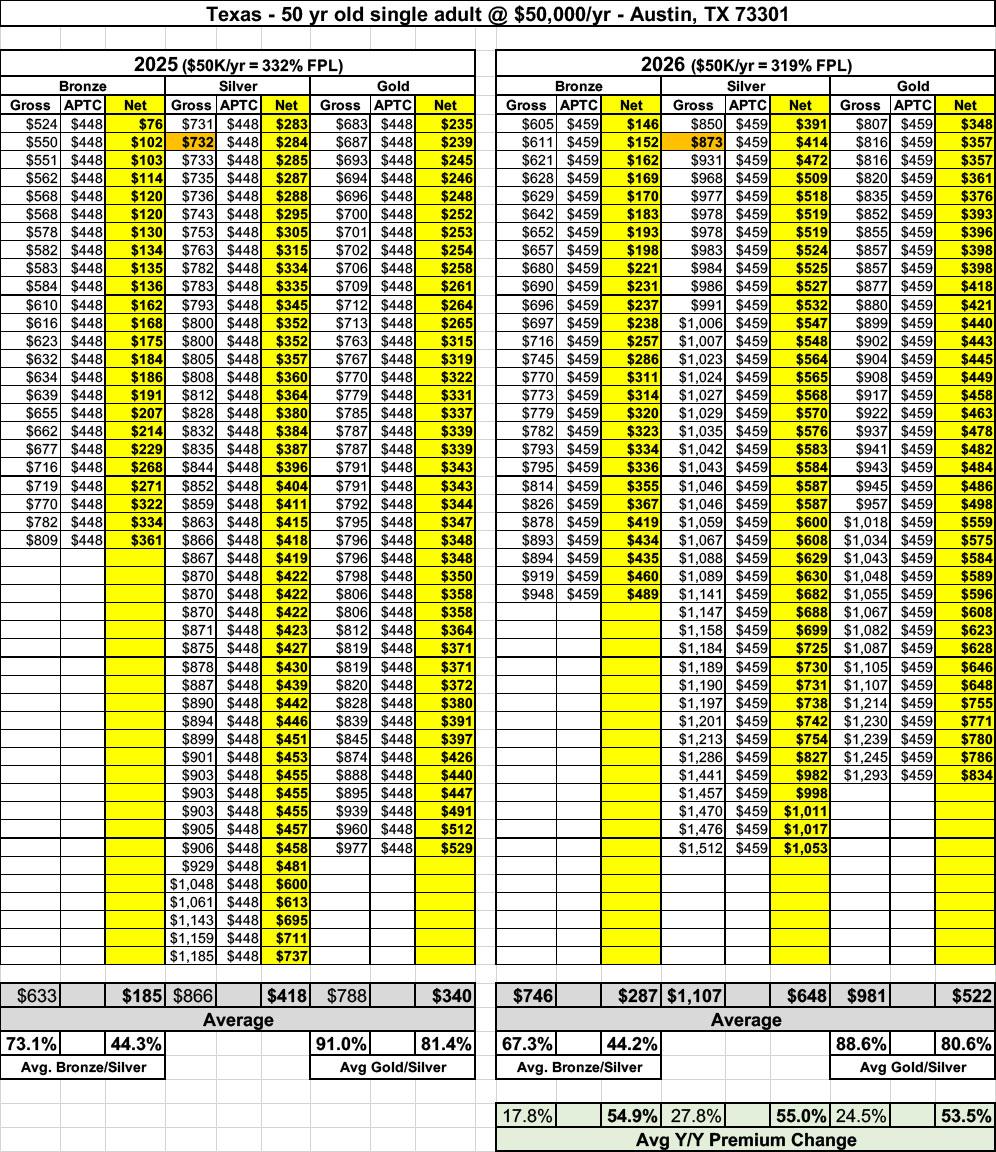

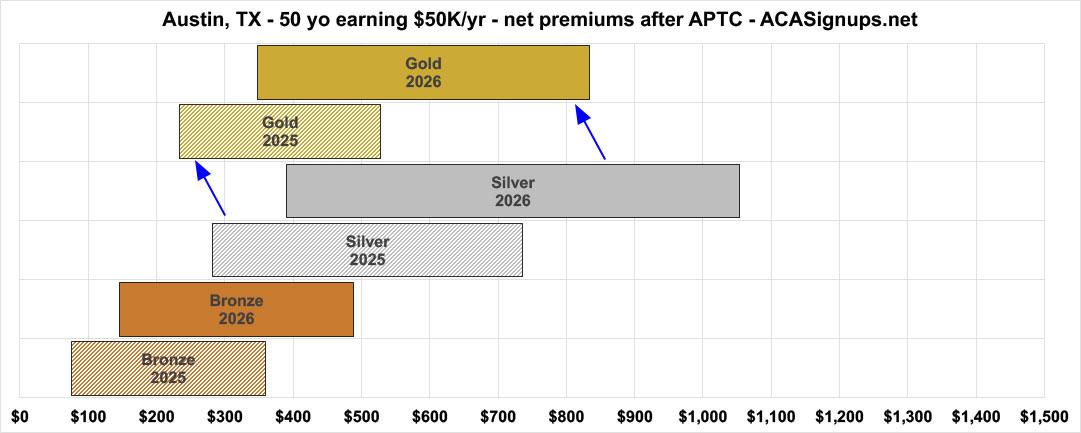

Texas:

While the states implementing Premium Alignment policies is pretty bipartisan, with both blue and red states alike listed here, Texas doing so several years back was still pretty shocking for one reason: It is, to my knowledge, the only red state to do so via actual legislation as opposed to simply doing so via regulatory guidance (I could be wrong about that).

It was a huge deal at the time; not only did it pass the Texas state legislature, it somehow did so unanimously and with almost no pushback to my knowledge.

In any event, Gold plans will cost 12 - 20% less than Silver plans on average next year, an impressive accomplishment.

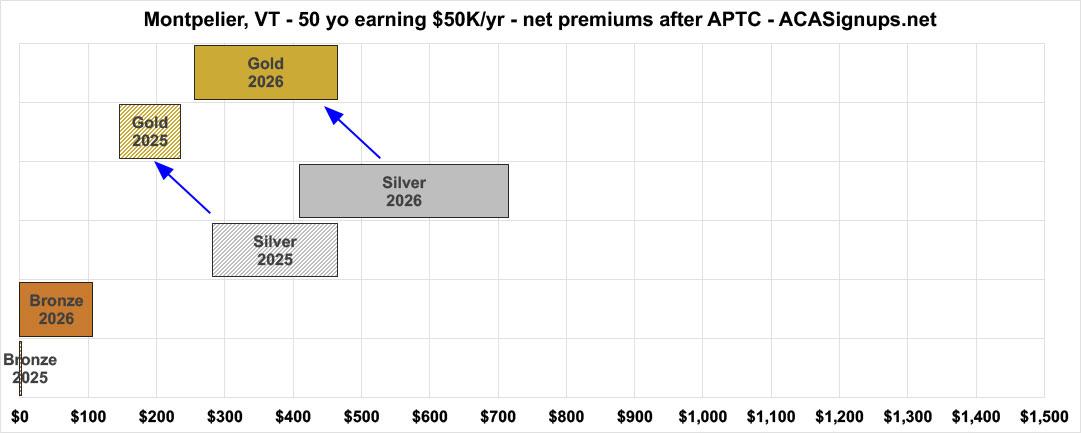

Vermont:

Another state which has had robust Premium Alignment policies in place for years now: Gold plans in 2026 will average 12 = 32% less than Silver plans next year, although they'll still cost a lot more than 2025 Gold plans did.

The greyed-out Silver plans in the table below are off-exchange plans which don't get counted towards the averages and aren't represented on the graph; those are only relevant for enrollees who earn more than 400% FPL and are looking to avoid the CSR premium spike.

Note: Vermont also has their own state-based subsidy program, but it only applies to enrollees who earn up to 300% FPL, which isn't relevant here.

What is relevant is that there will still be three $0-premium Bronze plans and two more for nominal fees.

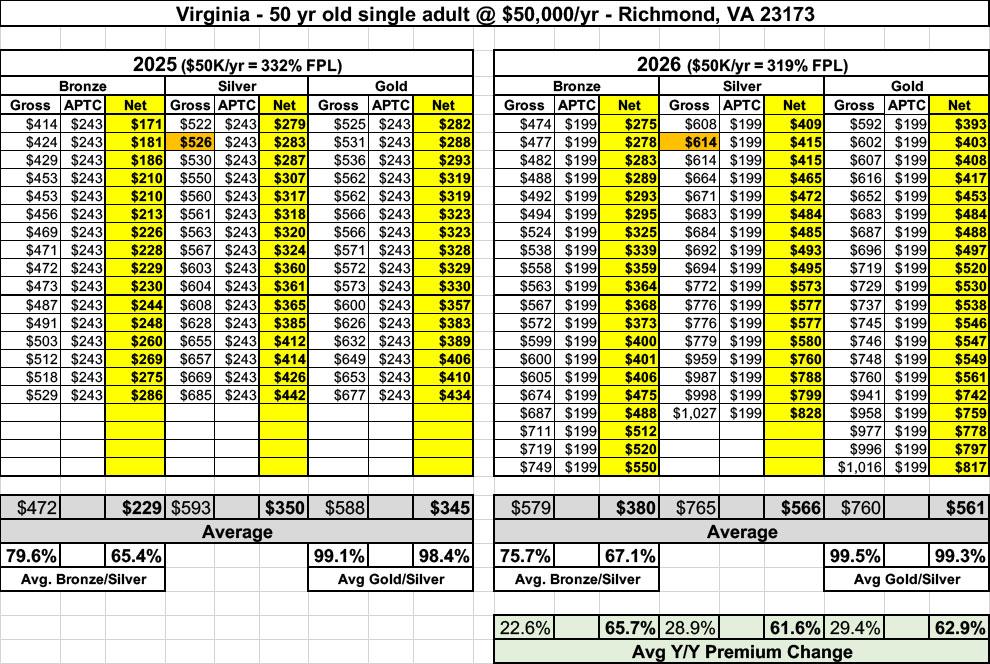

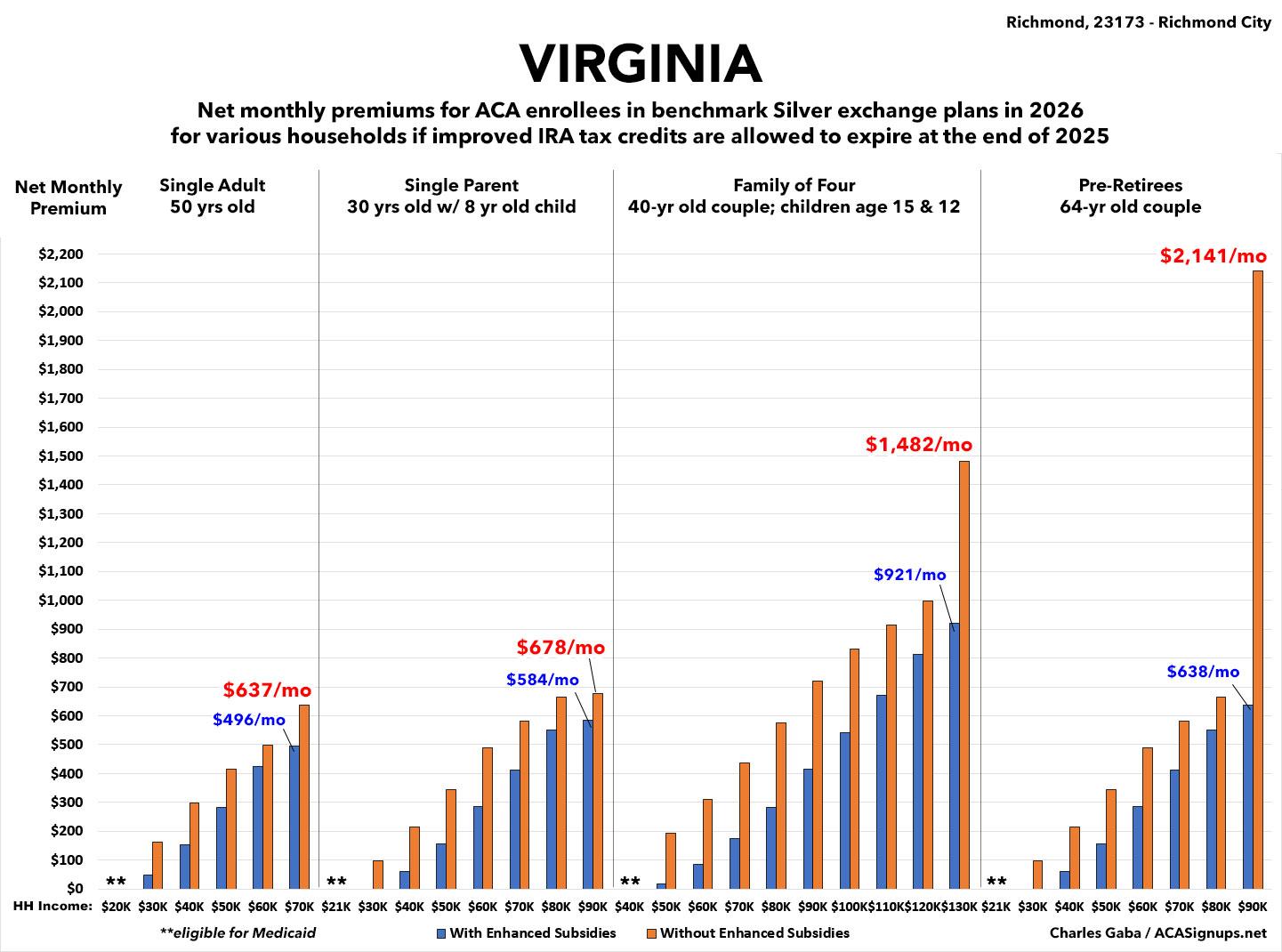

Virginia:

This one surprised me a bit as well, although it's fairly weak so it may simply reflect strong Silver Loading rather than full-bore Premium Alignment. I'm afraid Bronze, Silver and Gold plans are all still increasing dramatically compared to 2025 rates, but if you're considering a Silver plan in Virginia and earn more than 200% FPL I'd still take a close look at a Gold plan instead.

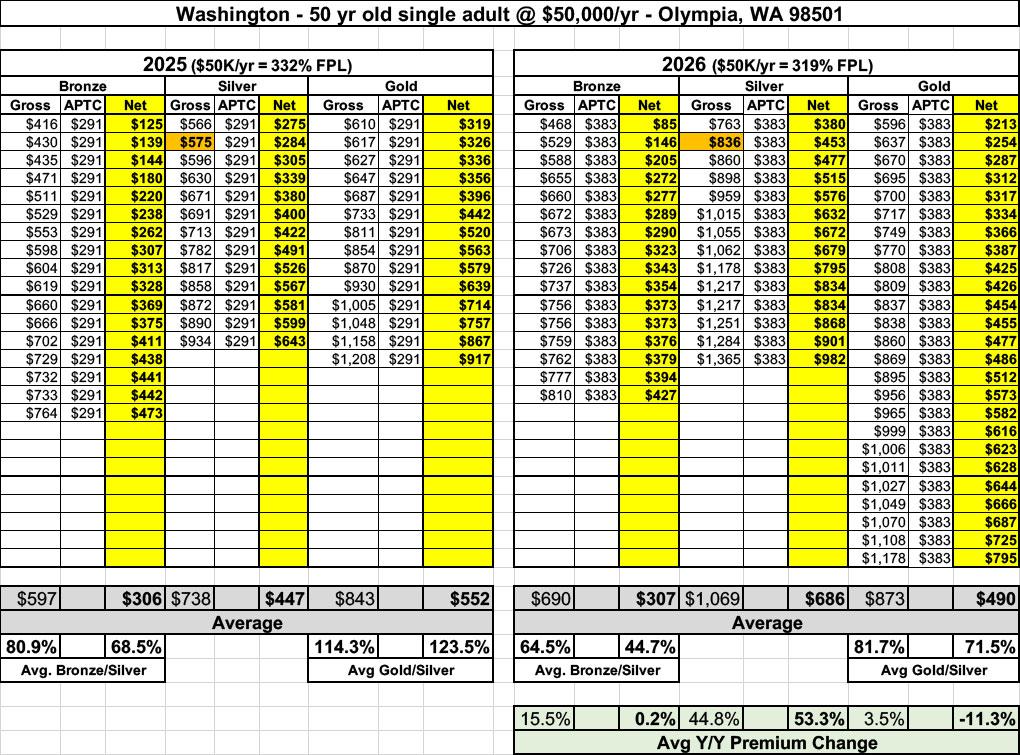

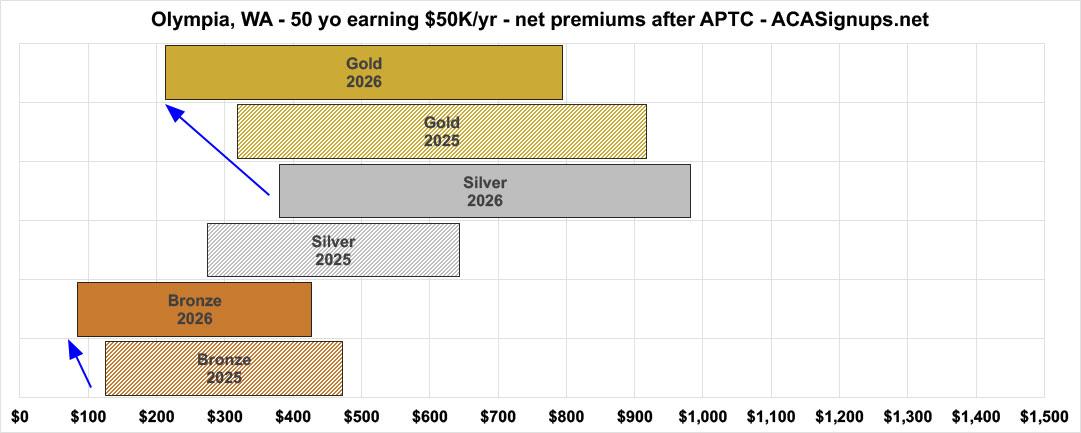

Washington:

This is the third state newly-implementing robust Premium Alignment in 2026, and you can see it clearly shown in the graph, as both Bronze and Silver plan prices shift heavily to the left year over year.

On average, Gold plans, which cost an average of 14 - 24% more than Silver this year will instead cost 18 - 28% less starting in January.

Again, Washington has their own state-based subsidy program (Cascade Care Savings), but it cuts off at 250% FPL.

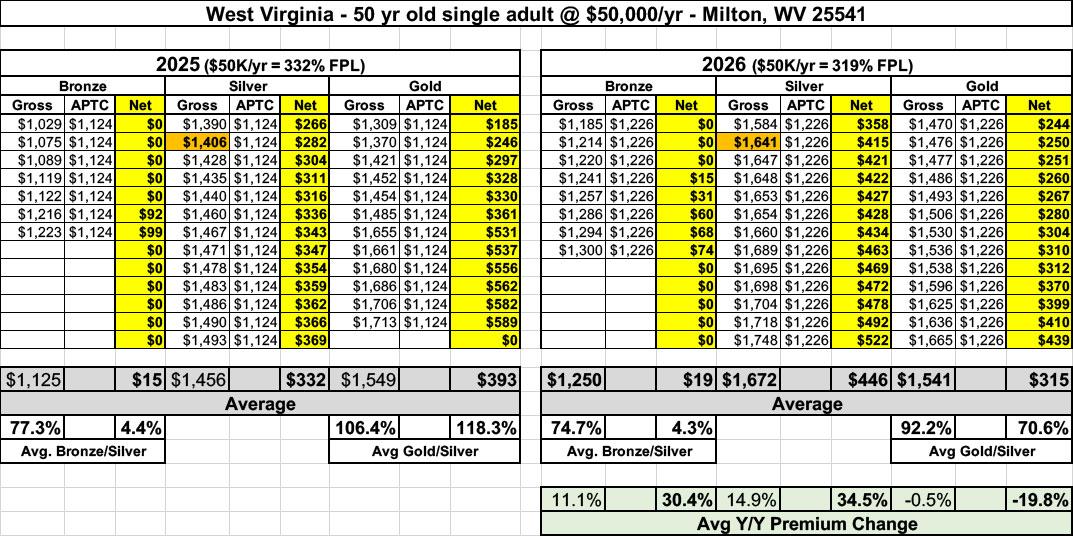

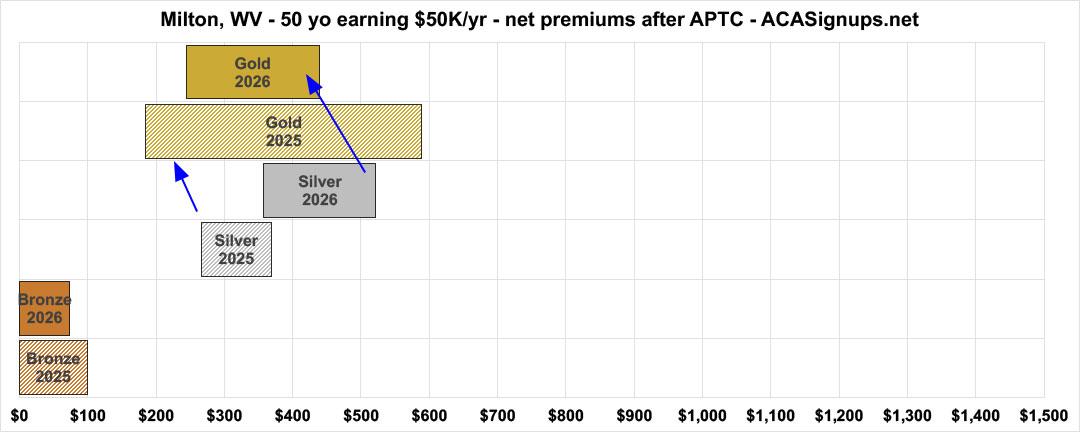

West Virginia:

This one is more of a judgement call. Yes, Bronze and Gold plan prices are dropping somewhat at the upper end...but it's more a matter of prices converging into a narrower range than anything, since the lowest-priced Gold will cost more in 2026 than in 2025.

On the other hand, overall 2026 Gold plans will still cost around 8 - 29% less than Silver plans next year, so...sort of? And again, they'd be eligible for several $0-premium Bronze plans.

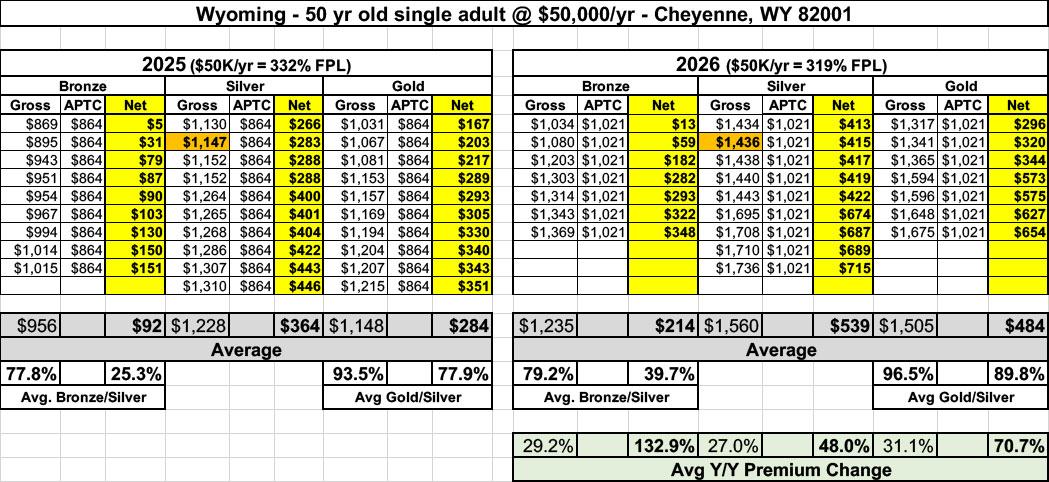

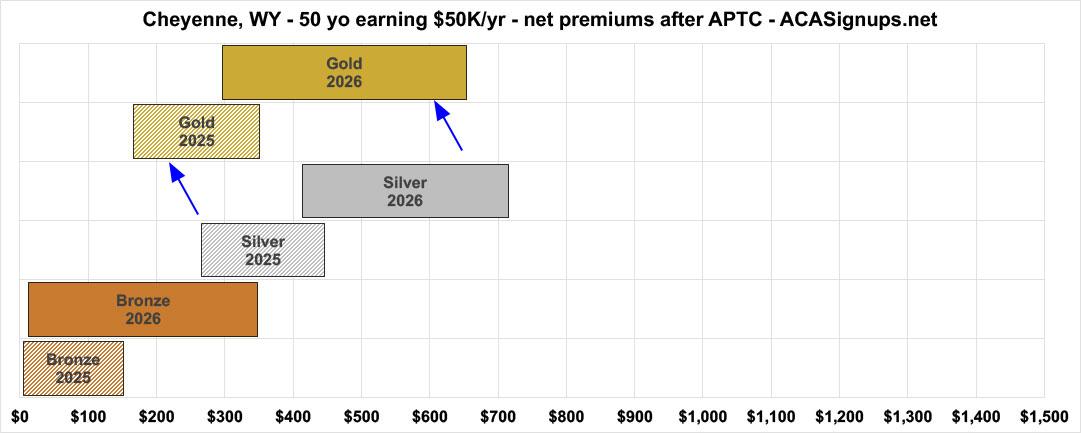

Wyoming:

Finally, we come to the lowest-population state, Wyoming, which has had mid-level Premium Alignment in place for years now. The good news is they're continuing to do so. The bad news is that within each metal level the average net price is still shooting up significantly next year.

So, there you have it. Again, Premium Alignment isn't a panacea for every ACA enrollee in these states, but it should significantly help many of them as long as they do the research and choose the best value available.

here's a summary of all 14 states, along with some additional info on two other groups of states:

- The other six which KFF says have gold plans priced below the benchmark Silver plan next year

- The other seven states which haven't implemented Premium Alignment yet but which do have their own state-based subsidy programs (or alternate healthcare programs for low-income residents) in place.

What about enrollees who earn less than 200% FPL or more than 400% FPL?

In my post last week I made it sound like everyone who earns below 2x the poverty level should stick with a Silver plan because of the robust Cost Sharing Reduction (CSR) assistance. I later added a caveat that there may be exceptions, but that was still the main takeaway.

Since then, however, I've realized that this thinking was largely based on the current APTC formula, in which enrollees who earn up to 200% FPL can get the benchmark Silver plan for as little as $0/month up to just 2% of their income.

Under the new formula starting January 1st, this changes to anywhere from 2.1% - 6.6% of their income, which is a massive increase for people earning so little. By contrast, a $0- or low-premium Bronze plan might be a better option for many of them, especially if they're in pretty good health right now, and some of them may even be eligible for a Gold plan which costs less than Silver as well.

As for those who earn more than 400% FPL and will thus become ineligible for any APTC assistance starting in January, as the summary table above shows, there's a handful of states (Alaska and Vermont) where the average full-price Gold plan in 2026 will cost less than the average full-price Silver plan does this year.

The larger point is that you should always shop around and check out the options each year regardless of whether you live in a state listed above or not, since there are always big changes in the plan offerings, pricing and, of course, your subsidy eligibility which can have a major impact on how much you have to pay.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.