Not joking: Texas Republicans pass law which dramatically improves the ACA. CMS should follow suit.

I talked about it endlessly throughout 2017 & 2018, but it's been awhile since I last discussed the ACA's quirky Silver Loading pricing strategy in detail.

In order for the rest of this entry to make sense, we need to review what Silver Loading is and how it works:

- The ACA includes two types of financial subsidies. Advance Premium Tax Credits (APTC) reduce monthly premiums for low- and moderate-income.

- Cost Sharing Reductions (CSR), meanwhile, reduce deductibles, co-pays and other out-of-pocket expenses for low-income enrollees.

- In 2017, Donald Trump cut off CSR reimbursement payments in a failed attempt to sabotage the ACA, thinking this would cripple the ACA exchanges. Instead, insurance carriers implemented a very smart alternative pricing mechanism to make up for their CSR losses, which came to be known as "Silver Loading."

- The carriers basically calculated how much they expected owe in CSR expenses the following year...and then simply added that amount to their premiums for the following year instead.

- While there's several ways that carriers can add the extra CSR cost to their premiums, "Silver Loading" involves doing so by adding 100% of the extra cost to Silver plans only, as opposed to spreading it out across Bronze, Silver, Gold & Platinum plans.

For example:

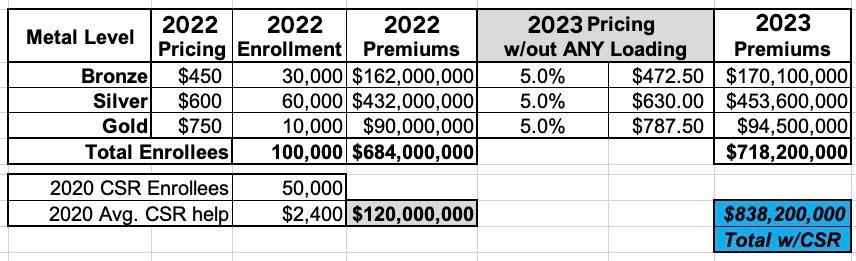

A carrier thinks overall claims next year will increase by around 5%. To keep things simple, let's say they offer just 3 plans: One Bronze, one Silver and one Gold, priced at an average of $450, $600 and $750/month.

This carrier has 100,000 enrollees this year and expects to pay out $120 million in CSR assistance. They assume total enrollment and CSR costs will be around the same (and in the same ratios) next year.

They know they aren't gonna get reimbursed from the federal government for their CSR costs next year, so simply raising their premiums by 5% would mean a $120 million loss. Ouch:

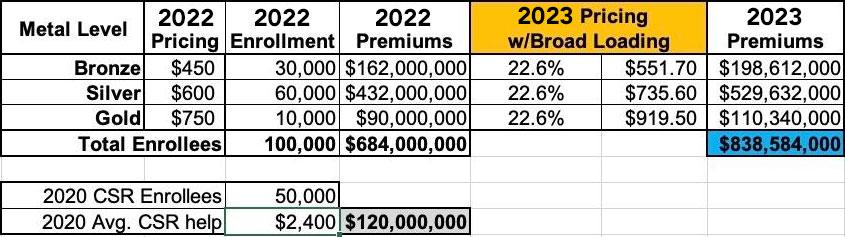

What happens if they load their projected CSR losses evenly onto the premiums instead?

They take the $120 million total and divide it by 12 months ($10 million/mo), then divide that across the projected enrollment for each plan.

If they do it this way, premiums for all three plans would go up by 22.6%. This is known as Broad Loading:

If a carrier Broad Loads (let's assume, again for simplicity, that one of their Silver plans is also the benchmark Silver that APTC subsidies are based on), then the subsidies also increase by roughly 22.6% to match the premium increase. This makes the net cost of Silver plans for subsidized enrollees roughly the same, Bronze plans slightly less expensive, and Gold plans slightly more expensive than they otherwise would've been...because a 22.6% price increase on a larger number is going to be more than the 22.6% premium increase based on the Silver plan.

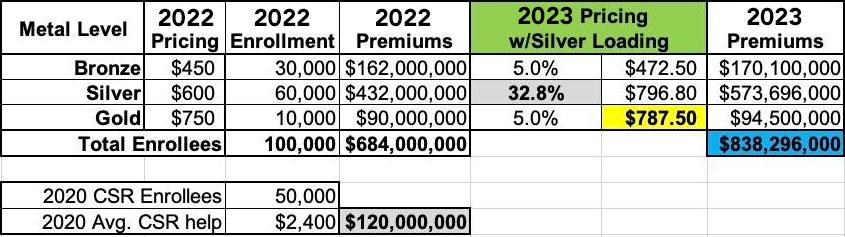

HOWEVER, what happens if you Silver Load instead?

In this case, they tack the full $120M onto the cost of Silver plans only. Bronze & Gold plans go up by 5% while Silver plans jump by 32.8%:

Whether the carrier Broad Loads or Silver Loads, they still end up covering their CSR losses, right?

So what's the point of Silver Loading?

Well, the key to this is that the formula for the premium subsidy tax credits(APTC) is based on the cost of the benchmark Silver plan...but the subsidies themselves can be applied to ANY plan.

Notice how the Gold plan is now priced LOWER than the Silver plan? That means that an enrollee can now get a Gold plan (which have lower deductibles/other cost sharing) for less than (or around the same as) a Silver plan instead. Even more important, it means that the APTC subsidies are increased, thus making Bronze plans free (or dirt cheap) for many subsidized enrollees...and even some Gold plans.

In fact, last year there were over 600 counties nationwide where many people could get $0-premium Gold plans...in large part thanks to Silver Loading. There are millions of ACA enrollees who earn more than 200% of the Federal Poverty Line who have been saving thousands of dollars since 2018 thanks to this policy.

Now, in 2018, Silver Loading was pretty scattershot; some carriers utilized it, others Broad Loaded instead; still others didn't load CSR costs at all and took a massive loss that year. It was kind of all over the place.

By 2019, far more carriers were Silver Loading to some extent, and as of 2022 I believe Mississippi is the only state left which doesn't at least allow Silver Loading.

OK, so what's all this have to do with Texas Republicans?

As clever and helpful as Silver Loading may be given the "no CSR reimbursement" status the ACA has been in since late 2017, the problem is that many carriers are still either not Silver Loading at all or, if they are, aren't maximizing the benefit.

This is where Texas Senate Bill 1296, sponsored by Democratic State Senator Nathan Johnson and passed unanimously through both TX chambers & signed into law by TX Governor Greg Abbott last year comes into the story.

Over at The American Prospect, my colleague Andrew Sprung has posted a fantastic explainer about the history of the bill and how, against all seeming political conventional wisdom, a bill sponsored by a Democrat which significantly strengthens a Democratic law which has been reviled by Republicans for over a decade ended up passing unanimously through both GOP-controlled legislative bodies and signed into law by a staunch Republican Governor:

But silver loading has stopped halfway. As the author of the “focused rate review” bill, Texas state Sen. Nathan Johnson, points out in the bill analysis, “insurers have not approached silver loading in a uniform manner. The resulting misalignment of premiums has caused Texans to lose out on hundreds of millions of dollars in federal marketplace subsidies, making coverage less affordable.”

Why? Since a majority of marketplace enrollees have incomes below 200 percent of FPL, silver is still the most popular metal level, and so when insurers are in a competitive market, the price of a silver plan gets competed down (though when there is just one insurer, or a dominant insurer, they can and do take advantage of the rules, often to create huge discounts).* In most of the country, gold plans are still priced well above silver, and bronze plan discounts are not as big as analysts (including the Congressional Budget Office) expected them to be when anticipating Trump’s cutoff of direct payments for CSR. A handful of states, however, have effectively ordered insurers to fully price the value of CSR into silver plans.

With Johnson’s bill, Texas joined them. S.B. 1296 directed the Department of Insurance to, as the bill analysis phrases it, “focus its rate review in a manner that uniformly maximizes the benefits of silver loading, making coverage more affordable.”

In short, instead of leaving it up to individual insurance carriers to decide whether--and how aggressively--to Silver Load, the state insurance dept. is now mandating that they do so starting in 2023.

In fact, not only does the law require carriers to Silver Load, it actually includes specific instructions on what level it must be done at:

On March 28, the Texas Department of Insurance issued a proposed rule to flesh out that legal directive. The rule directs insurers to use a “CSR pricing factor” of 1.35—that is, to price silver plans at 1.35 times what they would charge if there were no CSR. That rule effectively prices silver plans close to a platinum level. Gold plans are generally priced at about 1.2 times the cost of silver with no CSR.

The CSR pricing factor is slightly below the level implemented in 2022 in New Mexico, 1.44, which led to the lowest-cost gold plan in each rating area being priced an average of 11 percent below the benchmark silver plan. In New Mexico markets, several gold plans are priced below benchmark. Accordingly, in 2022, 69.5 percent of New Mexico enrollees with incomes above 200 percent of the federal poverty level chose gold plans, compared to 24.4 percent of Texas enrollees above the same threshold.

S.B. 1296 didn't arise out of nowhere. It was sponsored and lobbied for by Sen. Johnson, but he also teamed up with a staunch conservative Republican in the TX House, Tom Oliverson. And how did it come to the attention of Sen. Johnson?

The story begins with a pair of politically conservative actuaries, Greg Fann and Daniel Cruz of Axene Health Partners, who have worked effectively as statehouse evangelists for maximal silver loading—or, as they prefer to call it, “premium alignment”—requiring insurers to price plans at different metal levels in strict proportion to their actuarial value. (On this front, they have been allies of Stan Dorn of the progressive health advocacy organization Families USA.) In this case, they teamed up with Charles Miller, a former aide to Gov. Abbott who now works at Texas 2036, a policy shop with the stated mission to “enable Texans to make policy decisions through accessible data, long-term planning and statewide engagement.”

I urge you to read Sprung's entire article. It's a fantastic example of the rarest of rarities in today's political climate: Democrats & liberals working with Republicans & conservatives to dramatically improve a law passed exclusively by Democrats in a state controlled exclusively by Republicans for the benefit of moderate-income Americans.

Besides New Mexico and now, Texas, other states which have passed similar laws (or at least regulatory guidance requiring Silver Loading) include Colorado, Maryland, Virginia and Pennsylvania. I don't know that all of these are quite as specific about how strictly carriers have to adhere to the pricing as New Mexico and Texas, however.

Now if we could just get the HHS Dept. to follow suit at the federal level for other states, as Sprung and another colleague, David Anderson, urged them to do in a Health Affairs op-ed last year:

Regulatory actions that would maximize silver loading and thus render ACA marketplace coverage significantly more affordable are not hard to find.

...require insurers to price plans at each metal level in strict proportion to their actuarial value. That could entail pricing silver plans at the average AV obtained by all of an insurer’s enrollees (i.e., enrollees obtaining 94, 87, 73 and 70 percent AV) Alternatively actuaries Greg Fann and Daniel Cruz have proposed pricing silver as if all enrollees obtain 94 or 87 percent AV. If silver is so priced, gold plans with characteristics similar to a silver plan from the same insurer will be less expensive for enrollees with incomes over 200 percent FPL, and the premise that virtually all silver plan enrollees will have incomes under 200 percent FPL will become a self-fulfilling prophecy.

...Strict silver loading—which means strict pricing according to real value—would make coverage not only more affordable, but more predictable. Gold plans would consistently be priced below silver plans. Every subsidy-eligible enrollee would have access to a plan with an actuarial value of 80 percent or higher priced lower than the benchmark. Bronze plans discounts would also expand.

Trump, in an avowed attempt to destroy the ACA marketplace, endowed it with badly needed additional funding. The Biden administration should make sure it scoops up every dollar Trump left on the table.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.