2026 Final Gross Rate Changes - Alaska: -1.1%...but up to ~27,000 enrollees are STILL likely looking at MASSIVE rate hikes regardless (updated)

Originally posted 8/11/25

Overall preliminary rate changes via the SERFF database, Alaska Insurance Dept. and/or the federal Rate Review database.

Moda Assurance Co:

(Moda has heavily redacted their actuarial memo and isn't providing the number of current enrollees)

The average rate change is X.XX% as shown on Worksheet 2 of the URRT. The proposed rate Proposed Rate Increase change varies by product and plan, and the proposed rates vary by plan, age, geographic area, and tobacco use. The average rate change was calculated by comparing the weighted average premium for members on current plans and rates to the weighted average premium for members on renewal plans and rates.

A summary of the major components and their contribution to the rate change is provided in the table below.

Components of the rate change / % Impact

- Base Period Experience (redacted)

- Pricing Trend % Leveraging (redacted)

- State Reinsurance (redacted)

- Federal Risk Adjustment (redacted)

- Exchange User Fees (redacted)

- Metal Mix (redacted)

- Age Calibration Factor (redacted)

- Administrative Costs (redacted)

- Other (redacted)

- Total Impact (redacted)

Premera Blue Cross Blue Shield of AK:

(Premera has heavily redacted their actuarial memo and isn't providing the number of current enrollees)

The proposed average rate change is X.XX% The rate increase varies by plan due to plan design changes. Addionally, the consumer adjusted premium charged to a family may vary due to changes in allowable rang factors (e.g., age, locaon, smoker status) and the number of covered dependents.

Reason for Rate Increase(s)

There are addional items that contribute to the rate increase which are demonstrated in Appendices 1 through 4 submied to the state for review.

(redacted)

Unfortunately, while the federal Rate Review database at least provides the average rate changes for each carrier overall, neither Moda nor Assurance provide their actual current enrollment in their actuarial memos this year (nor does either one provide a rate justification summary. Both memos are heavily redacted.

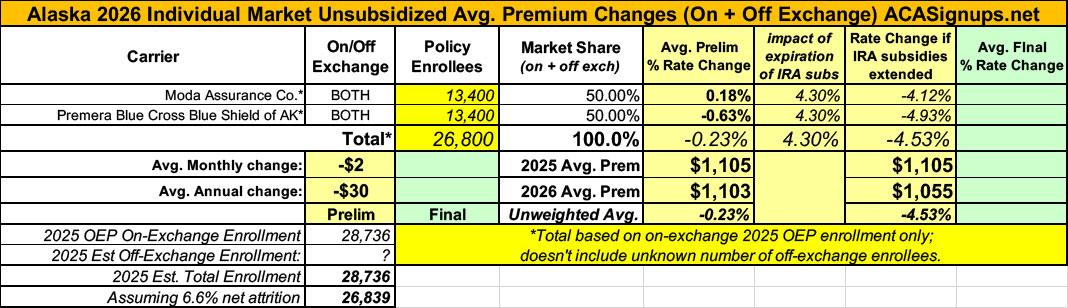

As a result, I don't know the current enrollment for either one...nor am I able to estimate the off-exchange enrollment in Alaska as the 2024 CMS liability risk score report doesn't include off-exchange member months for Alaska. On-exchange 2025 OEP enrollment was 28,736, but according to CMS's April Medicaid/CHIP report, exchange enrollment had dropped by 6.6% nationally, which would put Alaska at around 27,000.

I therefore have to settle for an unweighted average rate change of...-0.23%. That's right: I've finally found a state where average unsubsidized individual market rates are dropping in 2026 (if only ever so slightly). I should also note that even if it was weighted properly it would be close to the same, since the gap between Moda (+0.2%) and Premera (-0.6%) is extremely narrow.

So, the good news for Alaska ACA enrollees is that their gross premiums are remaining pretty much identical in 2026 at the same time that every other state is raising rates by over 20% on average. The bad news, however, is that...

...this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

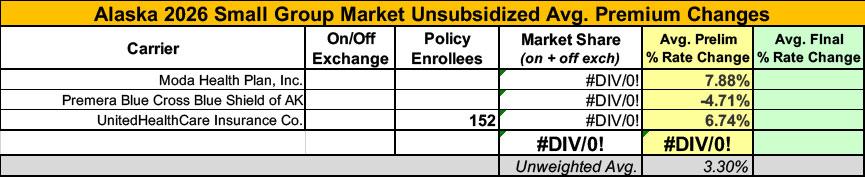

I also have no enrollment data for two of the three small group carriers; the unweighted average 2026 rate hike there is a modest 3.3%.

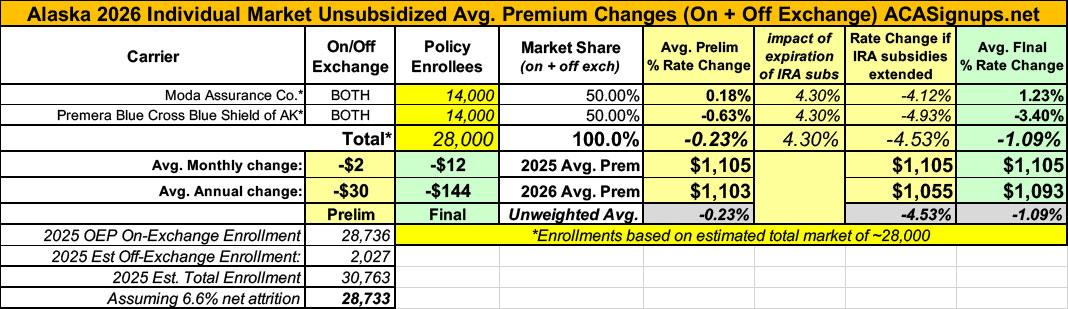

UPDATE 10/31/25: On the eve of Open Enrollment launching, the federal Rate Review database has finally been updated with the final, approved 2026 rate filings for every state, allowing me to fill in Alaska, which ends up with a slightly larger reduction than I previously had them pegged at (-1.1%). Keep in mind that this assumes a 50/50 market share split between the two carriers, which likely isn't the case; the actual average ranges somewhere between 1.2% higher and 3.4% lower: