EXCLUSIVE: Arkansas Insurance Dept. going all in on Premium Alignment...but are they overplaying their hand?

Warning: This isn't just gonna get deeply wonky, it also requires digging deep into hisory. You've been warned.

Chapter 1: The (simplified) Backstory:

- The ACA includes two types of financial subsidies: Advance Premium Tax Credits (APTC), which reduce monthly premiums; and Cost Sharing Reductions (CSR), which cut down on deductibles, co-pays & other out-of-pocket (OOP) expenses for low-income enrollees.

- In 2014, then-Speaker of the House John Boehner filed a lawsuit on behalf of Congressional Republicans against the Obama Administration, in part because they claimed that CSR payments were unconstitutional because they weren't explicitly appropriated by Congress in the text of the Affordable Care Act.

- A long legal process ensued, the end of which resulted in a federal judge ruling in the GOP's favor and ordering that CSR payments stop being made...but also staying that same order pending appeal of her decision by the Justice Department (then still run by the Obama Administration).

- After Donald Trump took office the first time around in 2017, he started publicly threatening to "cutting off" CSR payments...and eventually did just that by having the Justice Dept. drop the appeal of the court decision on the CSR lawsuit.

- The way the CSR program worked until this point was unusual: Since the exact amount of OOP expenses varies widely month to month, insurance carriers would cover these costs up front and then submit their receipts to the federal government to be reimbursed.

- In other words, it wasn't the CSR assistance itself which Trump cut off; it was the reimbursement payments to the insurance carriers.

(Put another way, the Trump Administration started stiffing federal contractors, which may sound familiar, but I'm getting off topic...)

- Ever since then, in order to prevent having to eat the costs of billions of dollars in CSR assistance, insurance carriers have instead simply jacked up their premiums to cover their CSR losses...and in most cases have placed the full load of CSR costs on Silver plans only, a practice known as...Silver Loading.

Chapter 2: Silver Loading (simplified):

Let's say in a carrier projected that overall claim expenses in the next year would increase around 5%. To keep things simple, let's say they offered just 3 plans: One Bronze, one Silver (which happens to also be the "benchmark Silver" used to determine subsidies) and one Gold, priced at an average of $450, $600 and $750/month.

This carrier had exactly 100,000 enrollees & had to pay out $120 million in CSR assistance in Year 1.

They assume that total enrollment and their CSR costs will be around the same (and in the same ratios) for Year 2. In other words, this assumes that all 100,000 current enrollees renew their existing policies for another year.

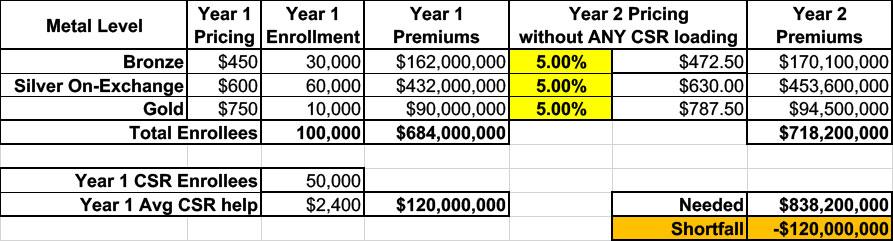

Since the carrier knows they won't get reimbursed from the federal government for that $120M in CSR costs, raising their premiums by just 5% across the board would mean having to eat a $120 million loss. Ouch:

So, what did they start doing instead?

They loaded their projected CSR losses onto the premiums instead.

Basically, they took the total amount ($120 million), divided that by 12 months ($10 million/month) and then divided that across their projected enrollment to figure out how much to tack onto each enrollee's monthly premium to make up the difference.

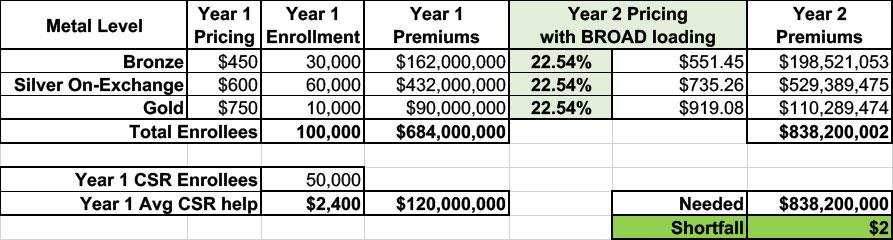

Now, if they simply divided that $10 million/month across all of their enrollees, regardless of the plan, they'd have to raise their premiums for every plan at every metal level by around 22.5% to make up that difference, as shown below. This is called Broad Loading:

In 2018, some carriers did it this way, but most carriers in most states started doing something else instead: They Silver Loaded.

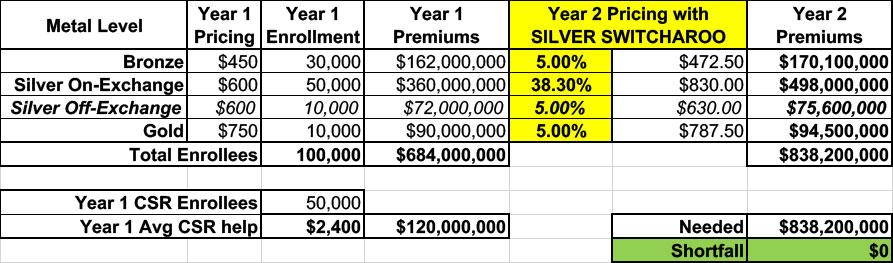

Silver loading involves concentrating the CSR costs so that they're only added to the Silver plans on the ACA market (as opposed to Bronze, Gold or Platinum).

This means that instead of every plan going up by 22.5%, the Silver plans would go up 32.8% while the other metal tiers only goes up 5%:

The good news is that doing it this way holds the 40% of enrollees in Bronze or Gold plans harmless (along with Platinum enrollees, although there aren't many of those these days anyway); they only see their premiums go up by the "normal" amount.

The bad news is that Silver plan enrollees, who make up the bulk of all ACA enrollees, are royally screwed, right?

Well...no. Those who are unsubsidized are indeed screwed--they have to either downgrade to a Bronze plan or upgrade to a Gold plan to avoid getting hit with that 33% rate hike (in the latter case, notice that the Gold plan actually costs less at full price now even with the lower deductible...it's now a better value!)

However, the vast majority of exchange enrollees receive APTC subsidies...and the formula for those subsidies are based on the price of the 2nd lowest-cost Silver plan...but they can be applied towards any plan.

Are you still with me? Good.

This is important for two reasons:

- First, it means that subsidized Silver plan enrollees see their subsidies increase by roughly the same rate that the premiums increased: Silver premiums go up ~33%, APTC subsidies go up ~33%. So Silver enrollees end up paying pretty much the same amount either way.

- More importantly, however, notice again that the Gold plan now costs LESS than the Silver plan...but the subsidies have still gone up as much as the Silver plan!

Let's say an enrollee qualified for $400/month in APTC in Year 1 (because the maximum they have to pay for the benchmark Silver is $200/month). In Year 2, their APTC would increase from $400/mo to $597/month...but they can use that $597/mo for any plan.

The Silver still costs them $200/mo, but suddenly the Gold plan, which would have cost $350/mo in Year 1, only costs $190/mo in Year 2!

(Alternately, the Bronze plan, which would have cost them $50/mo in Year 1, will cost nothing in Year 2 since the APTC amount is actually more than the full-priced Bronze premium).

OK, but that still leaves off-exchange Silver enrollees (who are by definition also unsubsidized) being stuck with a 32.8% premium hike.

That's where a fourth pricing strategy comes in, which I (to my eternal shame) labeled "the Silver Switcharoo" back in 2017. Let's just call it "Silver Switching" going forward, shall we?

This takes Silver Loading one final step further: Instead of loading the CSR premium cost onto all silver plans, a carrier loads them onto on-exchange Silver plans only.

They then offer a nearly-but-not-100%-identical Silver plan off the exchange (called a "Mirrored Silver" in some states) which only increases by 5%.

When you do this, the table looks like the following (I'm assuming ~50K choose on-exchange Silver while only ~10K choose off-exchange Silver):

Notice how the CSR load has been concentrated even further:

- Bronze enrollees only pay 5% more

- Gold enrollees only pay 5% more

- Silver enrollees (off exchange) only pay 5% more

- Silver enrollees (on exchange) pay 38.3% more.

This holds off-exchange Silver enrollees harmless as well...while simultaneously bumping up the benchmark Silver plan further yet, so that the enrollee who qualified for $200/mo in tax credits in Year 1 is now eligible for $630/mo in tax credits in Year 2.

Since they can apply that towards any exchange plan, they can get the Gold plan for just $157.50/month! That's far less than the $200 they'd have to pay for the Silver plan.

As of 2025, depending on the state, some carriers Silver Load while others Silver Switch, although a lot of carriers & state regulators just call it "Silver Loading" either way since "Silver Switcharoo" is a stupid name.

In any event, in a bit of tremendous irony, in attempting to sabotage the ACA, Donald Trump ended up unintentionally strengthening it.

Sidenote: No, this was not some type of 11th Dimensional Chess move on his part; he barely understands how the ACA works much less how CSR subsidies operate. Some career employees at CMS understood this, but he sure as hell didn't.

By 2019, most carriers in most states were either Silver Loading or Switching to some extent, and as of today I think Mississippi is the only state which doesn't have it at all.

Silver Loading has, over the years since 2018, resulted in millions of subsidized ACA exchange enrollees receiving more financial help than they would have otherwise, since a Bronze or Gold plan would now cost either about the same, less, or even nothing in premiums depending on where the enrollee lives.

This meant that the carriers got to be made whole on their CSR losses while millions of enrollees received more financial help and thus had lower net premiums for their policies.

And this is how things have been operating for the past eight years.

Chapter 3: Arkansas:

OK, that brings things up to date.

So, what does any of this have to do with Arkansas?

Well, you'll notice that above I used some vague language: "Most carriers in most states" do Silver Loading "to some extent."

The thing is, the practice of "Silver Loading" ("Premium Alignment" is a more accurate term for the principle at play here--aligning premiums to reflect the real world actuarial value of the plan rather than the official "face value" of them) is still fairly laissez faire in practice: Most state insurance regulation agencies don't provide a lot of guidance about the specific calculations the carriers have to use when determining how much to "load" onto Silver plans.

In addition, while how the CSR cost is "loaded" has by far the greatest impact on Premium Alignment, there are some other factors as well which can impact it--some of this involves "Induced Demand" and other actuarial concepts. If done properly, robust Premium Alignment can significantly benefit ACA enrollees. Since 2018 perhaps a dozen states have put more formal Premium Alignment rules into place, either via regulatory changes or, in some cases, via actual legislation.

I should note that this doesn't seem to have any particular partisan bias either way: Blue states like New Mexico and Illinois have done so...but so have red, ACA-hostile states like Texas, and the results have been remarkably positive so far: The percent of ACA enrollees with "Gold or Better" coverage has increased dramatically in states which have implemented strict, robust Premium Alignment policies.

I've actually been pushing my own state legislature here in Michigan to pass strict Premium Alignment legislation for several years now.

As for Arkansas, they actually did implement some level of Silver Loading as early as 2018, and even moved to full Silver Switching in 2019...but it sounds like the state insurance department left it at that until this year.

Why do I think this? Well, that's finally where the latest development comes into play.

Chapter 4: What's New for 2026?

Benjamin Hardy, the managing editor of the Arkansas Times, has been closely following & reporting on the 2026 ACA Rate Hike Saga in the Natural State (seriously, that's their nickname, apparently).

Most recently he cited some of my work in his post about GOP Gov. Sarah Huckabee Sanders fuming over the preliminary 2026 rate filings by the state's ACA carriers even though she's been fully onboard with everything the Trump Administration & Congressional Republicans have been doing to help cause those massive rate hikes.

Last week Hardy asked for my help in understanding a couple of documents he managed to acquire from the Arkansas Insurance Dept (AID) via Freedom of Information Act (FOIA) requests.

The first (see link below) is an email exchange between:

- Jimmy Harris, the Interim Arkansas Insurance Commissioner (he replaces Alan McClain, who by coincidence (?) just happened to announce his resignation on August 6th, the same day that Gov. Sanders went on a rant about the preliminary rate filings);

- Hugh McDonald, the Arkansas Secretary of Commerce; and

- Allison Hatfield, McDonald's Chief of Staff.

The email exchange happened on August 11th, less than a week after Sanders' rant & McClain's resignation:

Attached is a draft response document Jimmy worked on while working through the rates issue with the GO. I have included the bulletin he references here as well too. Also, attached an email from BCBS with its explanation of increases. Jimmy is working on a one-pager bullet point type document for us, but I thought I would go ahead and send a few things. Hope these are helpful.

--Allison Hatfield

Chief of Staff-----

"We share Governor Sanders' frustration with the rise in insurance premiums. The Arkansas Insurance Department is conducting a thorough review of these filings to ensure they are actuarially sound, are not excessive, or unfairly discriminatory.

The Affordable Care Act (ACA) has two types of federal financial assistance for lower-income enrollees: assistance with monthly premiums ("premium subsidies") and assistance with deductibles, coinsurance, and other out of pocket expenses through cost share reductions (CSR). These types of financial assistance are original to the ACA and are not expiring or changing.

After direct CSR payments from the federal government to insurers ended in 2017, most insurers raised silver plan premiums substantially to account for the loss of these federal payments, allowing the CSR subsidy to flow to the insurer through premium, rather than a direct payment. This practice is known as "silver loading". In 2018, the Trump administration issued guidance encouraging state regulators to allow insurers to increase only the premium on silver plans offered on-exchange*, so that off-exchange silver plans could be priced without the silver load. The 2026 CMS Notice of Benefit and Payment Parameters codified the practice of silver loading.**

*Sidenote: I have a very different recollection of the Trump Administration's views of Silver Loading/Switching specifically in 2018, and by "very different" I mean the complete opposite of "encouraing state regulators" to do this.

In fact, here's a post from March 2018 in which the first Trump Administration (via then-HHS Secretary Alex Azar & CMS Administrator Seema Verma) appeared to be strongly considering banning Silver Loading/Switching entirely for awhile. Confusion over this continued for at least another month, as I had another post in April in which Verma was still talking about mandating Broad loading instead. Nothing ever came of this, thankfully, but the Trump Administration clearly was NOT "encouraging" carriers to proceed with either Silver Loading or Silver Switching.

**Sidenote: It's true that Silver Loading was indeed codified by the 2026 NBPP...except that this was done by the outgoing BIDEN Administration (it was published on January 14, 2025, less than a week before Trump took office).

But I digress...

State and federal tax dollars are used to pay all, or a large portion of the premium, for most of these individual exchange plans either through Medicaid dollars that fund the ARHOME program or through federal premium subsidies. It's imperative we are good stewards of those funds and ensure they are used efficiently and effectively to help the most Arkansans.

The American Rescue Plan Act (ARPA) premium subsidies will expire at the end of 2025 and will impact premium across the country. To lessen that impact, Governor Sanders took proactive steps to maximize the value of the remaining federal subsidies flowing into Arkansas.

Earlier this year, Bulletin 4-2025 was issued by the Arkansas Insurance Department that provided standardized guidance on the application of the silver load. In previous years, the amount of this load was determined by each insurer, based on their individual experience. This standardized guidance will protect access to zero-premium and lower deductible plans for low- and middle-income individuals by ensuring remaining federal subsidies go where they are most effective for Arkansans.

I've attached the bulletin cited below. The most relevant portion is here:

Using 2025 Open Enrollment data, AID has calculated the CSR load for On-Marketplace Silver plans to be 1.46. Issuers must incorporate this factor for plan year 2026 in accordance with this guidance.

...The Pricing AV for each On-Marketplace Silver plan must then be multiplied by the AID-prescribed CSR load (e.g., 1.46 for plan year 2026). This requirement standardizes the CSR load across all issuers and ensures consistency in premium development for On-Marketplace Silver plans.

...The 1.46 CSR load represents a higher factor than has typically been applied in prior years. As a result, membership distribution among metal levels — as well as between Silver variants — may change due to potentially higher Premium Tax Credits for eligible enrollees. Issuers should make reasonable, data-driven assumptions regarding these shifts and reflect the resulting enrollment and risk impact in their rate filings.

Put more simply, AID is telling carriers to bump up premiums for Silver plans by a whopping 46% to cover the CSR load instead of whatever percentage they otherwise would have.

This is exactly what I discussed above: Silver Loading/Switching has mostly been all over the place depending on the carrier & state, with some maximizing it (robust Switching), some doing a half-strength version of Loading, some (even now) not doing either Loading or Switching at all, and all points in between.

What states like Texas, New Mexico, Illinois and now Arkansas have done is to standardize the specifics to maximize the positive impact of Silver Loading/Switching, and good for them for doing so!

So far, I have nothing but praise for what the Arkansas Insurance Dept. is doing here (although this is really something which every state should have been doing all along, going back to 2014, even before the CSR payments were discontinued and even with the enhanced tax credits in place). Doing this should indeed mitigate some of the lost federal subsidies (ironically by effectively making the non-enhanced subsidies more generous instead).

Chapter 5: Things Start Getting Weird...

The updated pricing approach leverages existing federal funding to lower out-of-pocket costs for thousands of Arkansans, expand access to better health plans, and will apply these tax funds more effectively, without increasing state spending. By adopting mandated silver loading, Arkansas delivers better value and improved access to consumers through a transparent premium structure to make better use of federal dollars through the Affordable Care Act.

Preliminary rate filings for 2026 indicate that average gross premiums may increase on the Arkansas health insurance exchange by approximately 20-50%. However, a part of that increase could be attributed to the cost-share reduction (CSR) load applied to on-exchange silver plans only, which drives down effective premiums for most Arkansans on the exchange.

You have to read the exact phrasing of this & similar statements with a huge grain of salt for reasons I'll explain below.

Our actuaries are in constant contact with the insurers and are confident that an agreeable solution that will shield Arkansans seeking coverage on the marketplace from enormous rate hikes while still meeting the CMS submission deadline of August 13, 2025.

Where are we currently?

- Our actuaries are still reviewing filings and objection responses from insurers. Both companies have been responsive and cooperative throughout this process.

- At the request of BCBS CEO, Curtis Barnett, we had a call with him at 12:30 August 11, 2025. He was inquiring about CMS approval timelines and expectations for them. I told him that I hope to have guidance for their companies soon.

- Centene will be refiling rates late Monday, August 11, 2025. There are expectations for a filing with lower average rates than the previous one.

- BCBS companies have a separate deductible on Non-EHBs. It does not appear Centene took that approach. We have a current inquiry to Centene about whether or not it would have a material impact on their rate filing if we asked them to do that.

- There was a lively discussion at the CMS/State regulator round table at NAIC in Minneapolis on August 10, 2025. Several states expressed concern with having filing determinations completed by the CMS deadline of August 13. Several states inquired about submission extensions being granted, but it appears unlikely CMS will be extending the deadline for any state.

- However, CMS indicated, if necessary, states may utilize the September 11-12th limited data correction window to allow issuers to submit revised rate filings and finalize state determinations. AID would require any rate revision to be submitted to for review no later than September 4, 2025.

So far, so good. However...

What is a rough estimate of actual impact of these individual marketplace rates for Plan Year 2026?

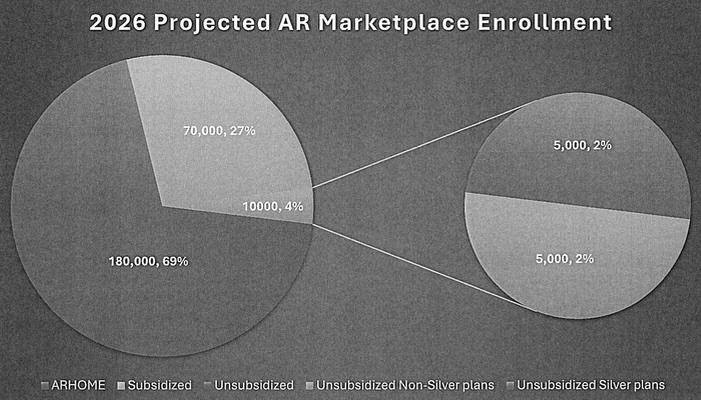

- Projected marketplace enrollment for 2026 is 260,000.

- For the 180,000 in ARHOME, this population is insulated from large rate increases. This rate increase does not apply to them.

THERE's the problem: Arkansas marketplace enrollment (NOT including ARHOME enrollees) as of the end of the 2025 Open Enrollment Period (OEP) was 166,639. When you include the roughly ~191,000 ARHOME enrollees as of May 2025, the combined total is around 357,000.

Even accounting for some net enrollment attrition, that still leaves around a ~90,000 enrollee discrepancy. And sure enough, according to the official actuarial filings from the carriers themselves, as of spring 2025 there were around 345,000 ACA-compliant individual market enrollees total.

The Arkansas Insurance Dept. is openly admitting that over half of the ~160,000 exchange-based marketplace enrollees in Arkansas will NOT be enrolled in ANY ACA-compliant individual market plans on OR off exchange next year.

- Of the roughly 80,000 people that will purchase policies from the exchange, around 70,000 will receive ACA subsidies and should see lower effective premiums in 2026.

Do you see what they did there? They're claiming that ~88% of ACA exchange enrollees will see "lower effective premiums" in 2026 because the other half will drop marketplace coverage entirely.

HOWEVER, they're also claiming that those who stay enrolled will see "lower effective premiums"...but if that's the case (that is, if robust Silver Loading/Switching is so effective that it more than cancels out the lost federal subsidies), why would ~85,000 enrollees drop out of the market altogether??

The question here is, what does "lower effective premiums" refer to?

If it means "lower than what their premiums would be without Silver Loading," then that's definitely possible (although only for those not enrolled in CSR Silver plans).

If it means "lower than what they're paying for the same or similar plan THIS year" then I find that difficult to believe. Silver Loading pushed to its limits can be very effective, but there ARE limits.

- Around 10,000 people will purchase plans off the exchange and will not qualify for any subsidies. We don't have a great estimate of tier split for this group, but we will assume 5,000 are Silver plans and 5,000 are non-Silver plans. The 5,000 people with non-silver plans should see lower premiums for 2026 plan year.

Again: What does "Lower premiums for 2026" actually mean? Lower than what they're paying in 2025? I doubt it, especially if the enrollee is currently in an even slightly subsidized Bronze or Gold plan.

- The 5,000 people with unsubsidized silver plans will need to rationally decide to move to an off-exchange silver plan to avoid the impact of silver loading or choose a bronze or gold plan that meets their needs. This is the population that is negatively impacted by these rate increases.

This is the "Silver Switch" crowd: Those who move to an off-exchange Silver plan to avoid the CSR load hit.

Chapter 6: How will this compare with 2025?

If Arkansas had been Broad Loading until now, I can definitely see how going all the way from that to full-bore Premium Alignment (which includes maximized Silver Loading) could result in dramatic net rate hikes for most enrollees which could potentially cancel out just about all of the lost federal tax credits.

HOWEVER, as I noted above, Arkansas has supposedly been fully Silver Switching since 2019. I even checked this year's Actuarial Memos for several of the carriers and sure enough, they include notes like this (unfortunately I can't find the actual CSR Load Factor for 2025; Arkansas memos are heavily redacted):

Celtic, QCA Health Plan, QualChoice Life and Health Insurance Company:

Note that the requested rate change may not be the same across all plans within a product due to changes to the member cost sharing amounts by plan. Additionally, the defunding of CSR subsidies has contributed to the rate levels being higher than if the subsidies were to be funded.

HMO Partners dba Health Advantage; USAble HMO, Inc. d/b/a Octave; USAble Mutual Insurance Company:

The reasons for the requested rating impact include the following:

...Assumption that 2025 plan Federal cost-sharing reductions (CSRs) will not be paid for the year, in which case the expense will be spread across all On-Exchange silver plans

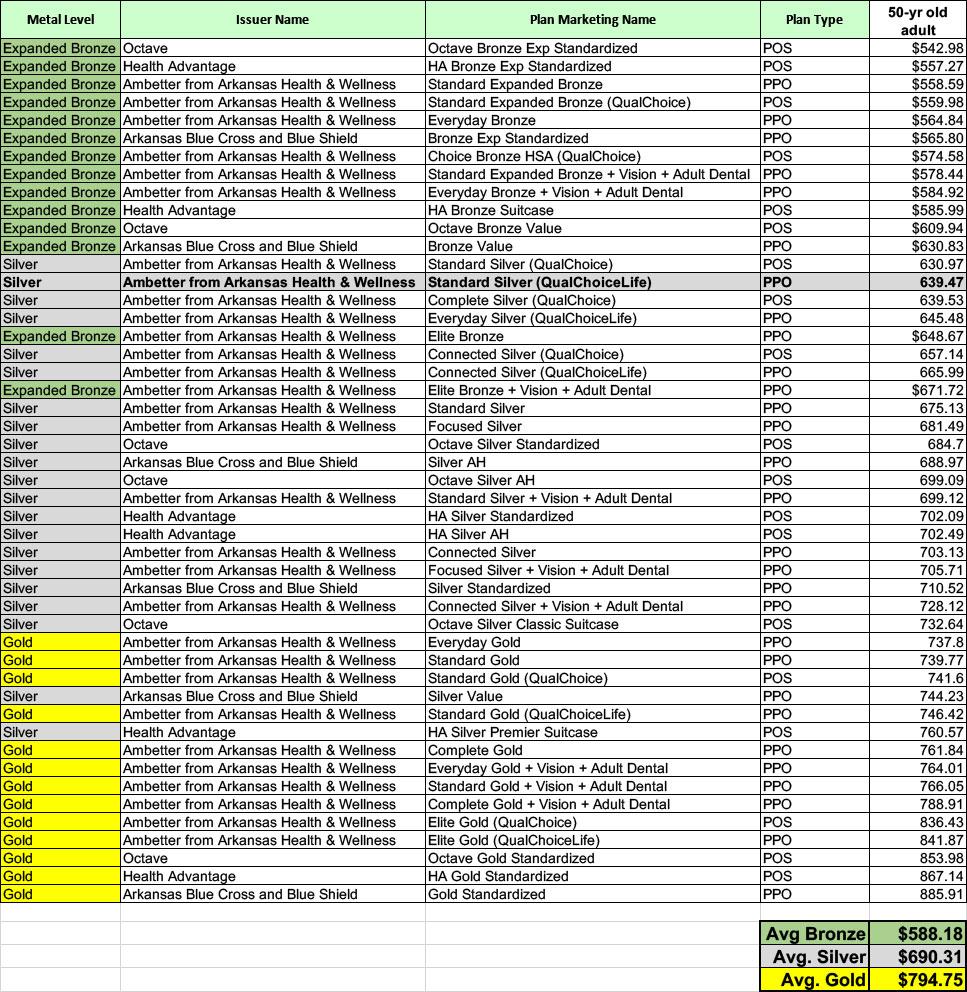

On the other hand, I also checked the full-price premiums for all 48 plans offered in Little Rock, Arkansas this year, and for the most part the Silver plans are priced pretty much how you'd expect them to be without any sort of Silver Loading or Premium Alignment: Bronze lowest, then Silver, then Gold.

There's a couple of exceptions to this, but what this tells me is that if Arkansas carriers are Silver Switching, they're doing a fairly "weak" version of it.

Chapter 7: Conclusion

Again, it's possible that I'm misunderstanding or misinterpreting what the Arkansas Insurance Dept. is doing here, but as far as I can tell, it boils down to:

- What they're ACTUALLY doing: Mitigating SOME or MOST of the damage caused by the expiring tax credits by imposing robust Premium Alignment

- What they CLAIM to be doing: Mitigating ALL of the damage (and then some?)

The first of these is genuinely praiseworthy (although again, it's something every state should have been doing all along anyway).

The second--assuming I'm understanding what they're saying correctly--is not; in fact, it seems to be a counterproductive if pitched this way.

One of the oldest rules in public opinion is to underpromise but overdeliver. Don't claim to be canceling out all of the damage if you're only canceling out some of it.

On the other hand, it's conceivable that AID really is planning on pushing benchmark Silver premiums up so high that the additional APTC really does cancel out 100% or more of the officially changed formula...for those earning up to 400% FPL, anyway.

If so I'll stand corrected.

One More Thing:

As I wind down the absurdly long post, I want to quickly revisit Gov. Huckabee Sanders temper tantrum over the seemingly crazy-high preliminary rate hikes from last month; On August 6th she issued the following statement:

LITTLE ROCK, Ark. – Following today’s filings from Centene Corporation and Blue Cross Blue Shield to raise premium rates on the insurance plans they offer in Arkansas by as much as 54% and 25.5%, respectively, Governor Sarah Huckabee Sanders released the following statement:

“Arkansans are tired of getting outrageous bills from multi-billion-dollar insurance companies, and my administration will not allow them to take advantage of our people. Nothing justifies year-over-year premium increases of this scale – it’s wrong and prohibited under Arkansas law.

“Arkansas’ Insurance Commissioner is required to disapprove of proposed rate increases if they are excessive or discriminatory, and these are both. I’m calling on my Commissioner to follow the law, reject these insane rate increases, and protect Arkansans.”

Again, she issued this the same day that the state insurance commissioner announced his resignation.

Compare that with this snippet from the internal email from within her own administration sent 5 days later:

Preliminary rate filings for 2026 indicate that average gross premiums may increase on the Arkansas health insurance exchange by approximately 20-50%. However, a part of that increase could be attributed to the cost-share reduction (CSR) load applied to on-exchange silver plans only, which drives down effective premiums for most Arkansans on the exchange.

Again, I'm not saying there's anything nefarious or scandalous going on here, it's just...interesting.

Did Sanders blow a gasket because she didn't understand how Premium Alignment works? If so, did she get into a fight with her Insurance Commissioner over it and push him out? If so, though, why would his replacement have no problem proceeding with it (remember, the original Bulletin mandating Premium Alignment was sent out back in March)? Or is McClain announcing his resignation the same day Sanders put out her screed a legitimate coincidence?

Stay tuned...