Maryland: New state subsidy program to backfill 100% of lost tax credits for some enrollees & 50% of it for others

I just updated Maryland's final 2026 individual market rate change decisions here, but the post was already pretty long and they're also making a related announcement, so I decided to move the full press release into this separate entry:

Maryland Insurance Administration Approves 2026 Affordable Care Act Premium Rates

Despite increases, Maryland remains a national leader in affordable rates; new state subsidy to offset loss of enhanced federal tax credits

BALTIMORE – Maryland Insurance Commissioner Marie Grant today announced the premium rates approved by the Maryland Insurance Administration for individual and small group health insurance plans offered in the state for coverage beginning January 1, 2026.

The rates for individual health insurance plans under the Affordable Care Act (ACA) will increase by an average of 13.4% this year, largely due to the impacts of expiring federal tax credits that Congress has not yet taken action on to restore. The approved rates are 3.7% lower on average than insurance carriers originally requested, which represents a total annual premium savings of $55 million for Maryland consumers.

“Under this new federal administration, Washington has shirked its duty to help middle-class Americans and families in poverty get affordable health care. Congress should act without delay to avoid these federal tax credits being ripped away from hardworking families. No single state can fill the gap left by the federal government.

"But in Maryland, we will continue to do everything in our power to keep costs low for families and preserve access to affordable care,” said Governor Wes Moore. “Maryland has maintained its status as a leader in health care affordability, especially for families in poverty. And together, we will continue to protect our people, as we call on leaders in Washington to do their job.”

While the percentage increase is higher than recent years, Marylanders will continue to have some of the most affordable individual market rates in the country, largely because of the continued effectiveness of Maryland’s 1332 State Innovation Waiver in stabilizing the market. The 1332 waiver was the result of a bipartisan legislative effort in 2018, and is approved by the federal U.S. Centers for Medicare and Medicaid Services (CMS) through 2028. Rates are also lower due to the adoption of a state-based subsidy program by the Maryland Health Benefit Exchange, which will partially replace the anticipated loss of enhanced tax credits from the federal government.

The approved 2026 rates are 6% lower than the pre-waiver 2018 rates, and the waiver continues to keep rates 30% to 35% lower than they would be without it. This 13.4% increase was driven by the expiring federal tax credits, as well as increased medical and pharmaceutical costs. The anticipated expiration of enhanced federal tax credits at the end of this year is expected to result in lapsed policies and impact the overall health status of people who get insurance through Maryland Health Connection, and thereby the cost of coverage in the pool.

In addition, based on current trends, health care costs are expected to increase 6.5% – including 4.8% for hospital services, 6.1% for professional physician services and 10.4% for pharmaceuticals. Unlike in other states, hospital cost growth in commercial health insurance products is contained due to Maryland’s unique hospital payment model. Pharmaceutical use and costs continue to be a key driver of commercial health costs in Maryland.

About 78% of people who purchase their individual market policy on Maryland Health Connection, the state’s health insurance exchange, currently receive some reduction in premium through federal subsidies known as Advanced Premium Tax Credits (APTCs). The federal Inflation Reduction Act created enhanced APTCs through the end of 2025. The subsidies are scheduled to expire at the end of 2025, unless the U.S. Congress takes action to extend them.

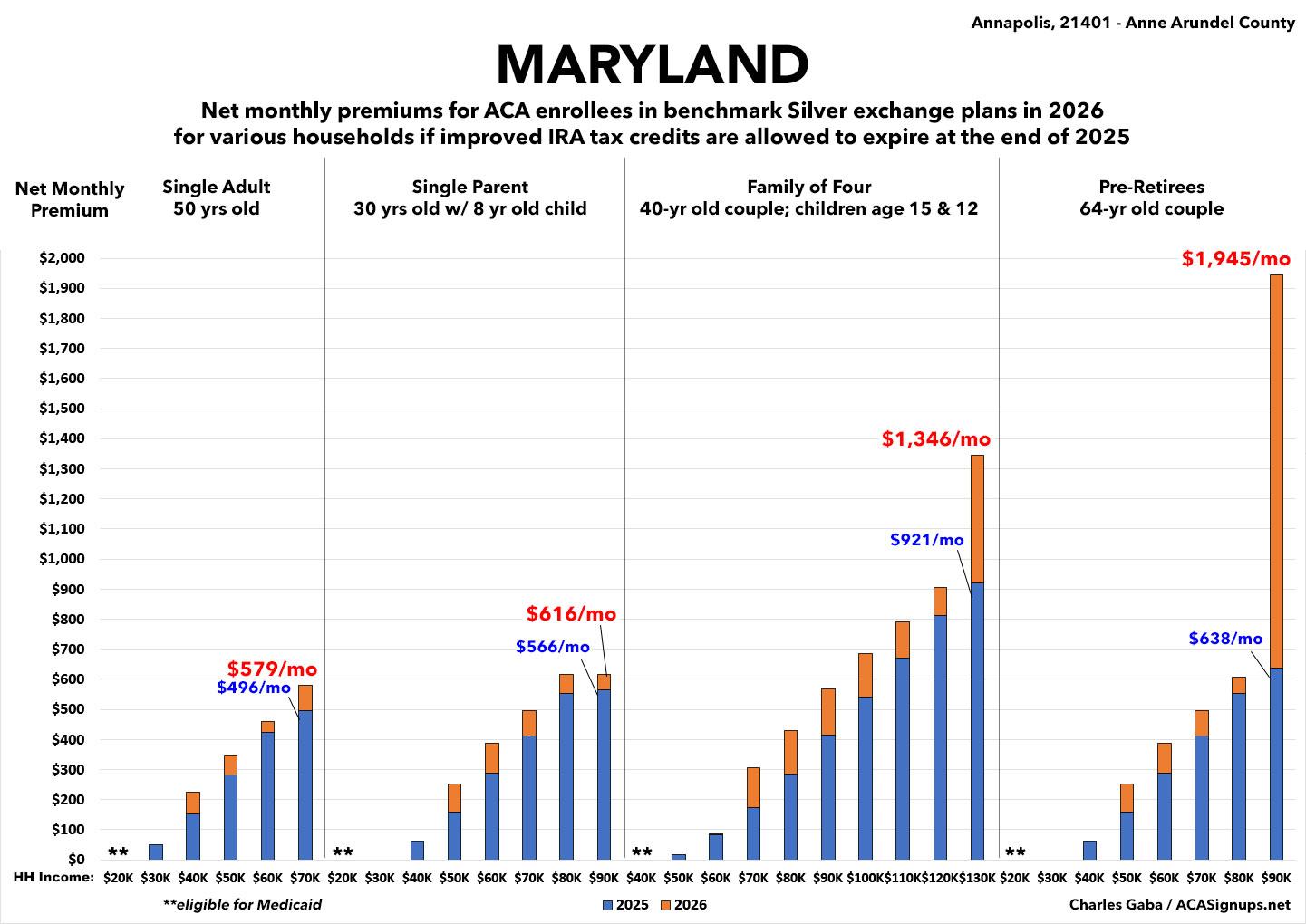

However, the state has created a new subsidy program for all ages for those who are under 400% of the federal poverty level to help offset the expiration of the enhanced federal subsidies. The state subsidy program will replace 100% of the enhanced federal subsidies for those under 200% of federal poverty level and will replace 50% of the enhanced federal subsidies for those between 250% and 400% of the federal poverty level. Those over 400% of the poverty level will not receive a state subsidy, and will be most impacted by the loss of federal enhanced APTC, unless Congress takes immediate action.

This isn't as generous as New Mexico, but it's still pretty damned good under the circumstances. Of the ~245,000 on-exchange ACA individual market enrollees in Maryland, around ~79,000 earn between 100 - 200% FPL, while another ~79,000 earn 200 - 400% FPL. Around 16,000 earn more than 400% FPL, and over 46,000 have an unknown household income. Finally, there's around ~49,000 off-exchange enrollees who aren't eligible for any tax credits regardless.

Basically, around 79,000 will be held fully harmless by the lost federal subsidies; another 79,000 will be hit for half the lost assistance; and the rest are divided between those currently subsidized who lose all federal assistance and have to pay 13.4% more and those who weren't subsidized in the first place and will "only" have to pay 13.4% on average.

Aetna announced in the spring of this year that it is exiting the Individual market in 2026, and all Aetna subscribers will have to choose a plan from a different insurance carrier when they renew during Open Enrollment. Consumers are encouraged to utilize insurance agents and navigators to help them determine which plan would work best for them.

Individual Non-Medigap Market

About 294,000 Marylanders are affected by the approved rates. The actual percentage by which the rates for a specific plan will change depends on the carrier and plan.

As an example, for a 40-year-old living in the Baltimore metro region, rate changes for the lowest cost off-exchange silver plans range from 4.7% to 14.7%, with average monthly differences ranging from $17 per month to $75 per month.

Rate changes for the lowest cost gold plan for that same 40-year-old in that same region range from 6.1% to 14.9%, with average monthly differences ranging from $24 per month to $75 per month.

Commissioner Grant urged Marylanders to work closely with health insurance agents and advisors, and to explore plans available through Maryland Health Connection. Individuals who purchase individual insurance through Maryland Health Connection may be eligible to receive federal premium subsidies or the federal tax credits.

“It is very important for individuals to work with Maryland Health Connection.” Commissioner Grant advised. “With the pending expiration of the enhanced federal tax credits and with the state subsidy only able to partially replacing the reduction, consumers may see sizable rate increases, much higher than in recent years. Consumers should carefully review their renewal notice and work with trusted advisors and the Maryland Health Connection in selecting a plan.”

Stand-Alone Dental Market

The Maryland Insurance Administration also approved an average rate decrease of -1.4% for dental rates in the individual market, compared to the -1.3% which was initially filed. Approximately 100,000 Marylanders purchase stand-alone dental plans in the individual market, representing 1/3 of total Individual market participants.

Small Group Market

The rates for small group health insurance plans under the Affordable Care Act will increase by an average of 4.9% in 2026. This is a reduction of 0.6% from the originally requested 5.5% average, reducing the market’s total annual premium by more than $10 million.

About 203,000 Marylanders are enrolled in small group market plans in 2025 and will be impacted by these rate increases. The primary driver of the rate increases in this market was trend, specifically drug trend which was running at 11%.

As is the case with the individual market plans, the actual percentage by which the rates for a specific plan will change depends on the specific carrier and plan. There are more than 225 plans offered this year in the Maryland small group market and plan sponsors are urged to shop carefully.

As an example, for a 40-year-old living in the Baltimore metro region, rate changes for the lowest cost off-exchange silver plans range from 2.9% to 13.9% with average monthly differences ranging from $13 per month to $67 per month.

Rate changes for the lowest cost gold plan for that same 40-year-old in that same region range from 3.5% to 11.4% with average monthly differences ranging from $19 per month to $69 per month.

The attached exhibits provide additional detail and context to the outcome of 2026 ACA premiums. As always, the approved rate increases vary by carrier and plan, with some

carriers decreasing rates and other carriers increasing rates more than the average. A member’s annual premium rate will depend on the approved rate increase for their plan, the year-over-year increase in age factor, and, when applicable, the change in subsidy.

Summaries of each premium decision are available on the MIA’s premium review website. Sample approved 2026 premiums for all companies by geographic region also are available online. The sample premiums do not reflect any employer contribution, any financial assistance a consumer may receive to reduce premiums or cost sharing for plans purchased through the state’s health insurance marketplace, MarylandHealthConnection.

I've updated my graph breaking out what this means for different household/income scenarios to include both the reduced average gross premium hikes (13.4%) as well as the new state subsidy program (100% up to 200% FPL, 50% from 200 - 400% FPL). Here's what it looks like now: