#ACA Open Enrollment: Some states still have time for Feb. coverage! Here's 15 important things to remember.

The 2025 ACA Open Enrollment Period (OEP) officially begins on November 1st.

This is the best OEP ever for the ACA for several reasons:

- The expanded/enhanced premium subsidies first introduced in 2021 via the American Rescue Plan, which make premiums more affordable for those who already qualified while expanding eligibility to millions who weren't previously eligible, are continuing through the end of 2025 via the Inflation Reduction Act;

- A dozen states are either launching, continuing or expanding their own state-based subsidy programs to make ACA plans even more affordable for their enrollees;

- 100,000 or more DACA recipients are finally eligible to enroll in ACA exchange plans & receive financial assistance!*

*Note: There's still some uncertainty about this, as 19 Republican Attorneys General have filed a lawsuit to block this, and oral arguments were heard just a week or so ago, so it's conceivable that an injunction will be placed before November 1st.

Update 12/09/24: As expected, a federal court has shot down the eligibility of DACA recipients to enroll in ACA exchange coverage in the 19 states involved in the lawsuit. In theory the roughly 2/3 of DACA recipients living in the other 31 states +DC should still be eligible.

Update 12/19/24: OK, never mind: Another federal court has put a stay on the DACA enrollment injunction, so for the moment DACA recipients can enroll in every state.

Update 12/23/24: Rhode Island has extended their 2025 Open Enrollment period all the way out through the end of February due to the nasty security breach of RIBridges, their social services IT system. Anyone who enrolls thru 2/28/25 will have their coverage made retroactive to January 1st.

And remember, millions of people will be eligible for zero premium comprehensive major medical policies.

If you've never enrolled in an ACA healthcare policy before, or if you looked into it a few years back but weren't impressed, please give it another shot now. Thanks to these major improvements it's a whole different ballgame.

Here's some important things to know when you #GetCovered for 2025:

1. DON'T DELAY; GET COVERED SOONER RATHER THAN LATER!

The official 2025 Open Enrollment Period runs from November 1st through January 15th in most states, but there are some exceptions at both ends:

- Idaho actually already launched their 2025 Open Enrollment Period on October 15th, and it only runs through December 16th.

- California, the District of Columbia, New Jersey, New York and Rhode Island have extended final deadlines of January 31st.

- Kentucky's final deadline is January 16th.

- Massachusetts' final deadline is January 23rd.

In all other states you can start enrolling (or re-enrolling, for those currently enrolled) starting Nov. 1st. If most states if you enroll by 12/15/24 your coverage will begin 1/01/25; if you enroll between 12/16/24 - 1/15/25 coverage will begin on 2/01/25. Here's a table summarizing the deadlines in every state (a few of these may be extended, which seems to happen every year):

Update 12/16/24: HealthCare.Gov & DC Health Link have quietly extended their deadlines to enroll for January 1st coverage out by 3 days, through 12/18/24.

Also, Connect for Health Colorado says:

"If you started the enrollment process but didn’t finish before Dec. 15, you can call the Customer Service Center by 8:00PM on Tuesday, Dec. 17 to complete your enrollment. Call 855-752-6749 to finish picking your plan and request a Jan. 1 start date."

Update 12/17/24: CoverME (Maine) has also bumped out their deadline for January 1st coverage through 12/18/24, stating:

"We have extended the deadline to midnight on December 18 for coverage that starts January 1. Call the Consumer Assistance Center at 1-866-636-0355 between 8am to 8pm to enroll."

Also, kynect (Kentucky) states that:

While kynect is not making any system changes, we will honor any request for a January 1st effective date for anyone enrolling by midnight December 18th, 2024. Individuals should enroll in coverage and then call the Contact Center and ask for coverage to begin January 1, 2025 (The Contact Center will then put a Special Request and Inquiry ticket for KHBE to make the change.

Update 12/19/24: I've updated the table below to reflect us being past the extended Jan. 1st coverage deadline in most states:

Update 12/23/24: Rhode Island has announced a dramatic enrollment deadline extension all the way out thru the end of February with coverage retroactive back to the beginning of January due to their RIBridges IT data breach.

Update 1/01/25: I've updated the table below to remove the Jan. 1st coverage deadlines:

Update 1/14/25: The Virginia Insurance Marketplace has announced that they're extending their 2025 Open Enrollment Period deadline out by another week, thru 1/22. In addition, in California, CMS has officially announced a Special Enrollment Period for victims of the LA fires. The SEP will run for 60 days after the end of the period designated by FEMA, which means at least thru mid-March and likely well beyond that. This won't be relevant until after OEP ends in California on 1/31 anyway, however.

Update 1/16/25: Connect for Health Colorado states: "If you started the enrollment process but didn’t finish before January 15, you can call the Customer Service Center by 8:00PM on Friday, January 17 to complete your enrollment. Call 855-752-6749 to finish picking your plan."

Update 1/16/25: Here's the states where Open Enrollment is still going on:

- California: Residents still have until January 31st*

- District of Columbia: Residents still have until January 31st

- New Jersey: Residents still have until January 31st

- New York: Residents still have until January 31st

- Rhode Island: Residents still have until February 28th

(& coverage will be made retroactive to January 1st)

*Residents impacted by wildfires have a Special Enrollment Period running 60 days after the end of the Public Health Emergency

Note that residents of most states earning less than 150% of the Federal Poverty Level are eligible to enroll year-round, although this isn't valid in MD, NV or VA. In a few states the income threshold is higher (200% FPL in NJ, NM & VT; 250% FPL in WA).

Members of federally-recognized Native American tribes or Alaska Natives can also enroll year-round.

In addition, people who are eligible for Medicaid or the Children's Health Insurance Program (CHIP) are eligible to enroll in those programs year-round.

There are also several state-specific programs which allow eligible enrollees to do so year round. These include "Covered Connecticut" in Connecticut; "ConnectorCare" in Massachusetts; MinnesotaCare in Minnesota and the Essential Plan in New York. I'll discuss each of these in more detail below.

If you want to enroll outside of the dates above, you'll likely have to qualify for a Special Enrollment Period (SEP). Qualifying Life Experiences (QLEs) which make you eligible for a SEP include things like:

- Losing employer-sponsored healthcare coverage

- Getting married or divorced

- Giving birth/adopting a child

- Turning 26 and having to move to your own policy

- Losing eligibility for Medicaid or CHIP

- Moving out of your current rating area

2. ONLY ENROLL VIA AN OFFICIAL ACA HEALTH EXCHANGE OR AN AUTHORIZED ENROLLMENT PARTNER.

ACA financial subsidies are available to millions more Americans than they used to be...but they're only availalble to eligible enrollees who sign up through an official ACA exchange or an authorized 3rd-party exchange entity, known as an Enhanced Direct Enrollment (EDE) entity.

There's a ton of junk plans and scam artists out there, especially these days. Fraudulent plans are being hawked endlessly via both robocalls, spam emails and fly-by-night websites. If you're enrolling online, make sure to use one of the official ACA exchange websites:

- CALIFORNIA: Covered California

- COLORADO: Connect for Health Colorado

- CONNECTICUT: Access Health CT

- DISTRICT OF COLUMBIA: DC Health Link

- GEORGIA: Georgia Access (new!)

- IDAHO: Your Health Idaho

- KENTUCKY: kynect

- MAINE: CoverME.gov

- MARYLAND: Maryland Health Connection

- MASSACHUSETTS: MA Health Connector

- MINNESOTA: MNsure

- NEVADA: Nevada Health Link

- NEW JERSEY: Get Covered NJ

- NEW MEXICO: beWellnm

- NEW YORK: NY State of Health

- PENNSYLVANIA: Pennie

- RHODE ISLAND: HealthSource RI

- VERMONT: VT Health Connect

- VIRGINIA: VA's Insurance Marketplace

- WASHINGTON STATE: WA Healthplan Finder

- As for EDEs, it's important to note that some of these may also sell non-ACA compliant plans. The largest EDE, HealthSherpa, only sells on-exchange ACA-compliant policies. Full disclosure: They advertise on this website.

2a. IMPORTANT: GEORGIA just launched their brand-new State-Based Exchange (SBE), which I've written about several times before.

One noteworthy feature about Georgia is that it that it will be the first time an SBE will utilize an EDE; until now EDEs have only been integrated with the federal exchange (HealthCare.Gov). Other SBEs will almost certainly start adding EDE compatibility in the future if Georgia's is successful.

Also note that while some insurance carrier websites are also hooked into the federal exchange via an EDE, they (understandably) only list their own plans. I still recommend only using one of the websites listed above. Remember, whether via an official exchange site or an EDE, you have to enroll on-exchange to be eligible for financial help!

On a related note...

3. IF YOU'RE ENROLLED OFF-EXCHANGE, SEE IF YOU CAN ENROLL ON-EXCHANGE INSTEAD.

As far as I can figure, somewhere around 2.3 million Americans are still enrolled in OFF-exchange, ACA-compliant individual market policies. Historically, the main reason for this has been that they didn't qualify for financial help, so didn't see the point of filling out any additional forms by enrolling on-exchange.

The reality, however, is that many of these off-exchange enrollees may have been eligible for ACA subsidies after all if they had enrolled in the exact same plan but had done so via their ACA exchange instead of directly through the carrier...and thanks to the dramatically improved subsidies of the American Rescue Plan/Inflation Reduction Act (plus supplemental subsidies in some states), many of these people are leaving thousands of dollars in savings on the table if they don't make the switch!

Again: If you weren't eligible a few years ago or even last year, check again this year; you may be in for a very pleasant surprise!

On average, full-price/unsubsidized ACA premiums went up around 3.5% overall in 2022, around 7% in 2023 and another 6% in 2024. It looks like they'll increase another 6.1% or so nationally in 2025, with wide ranges from state to state, carrier to carrier and plan to plan.

I can't repeat this enough times: If you enroll off-exchange, there's a good chance you'll be leaving potentially thousands of dollars in savings on the table.

4. MILLIONS OF AMERICANS CAUGHT IN THE "FAMILY GLITCH" MAY NOW BE ELIGIBLE FOR UP TO THOUSANDS OF DOLLARS IN SAVINGS!

As I explained here, due to how the U.S. Treasury Dept. and the Obama Administration interpreted an obscure provision of the Patient Protection & Affordable Care Act regarding employer coverage affordability thresholds, there are several million people who really should have been eligible for ACA subsidies for years now but who haven't been.

The very short version of the problem is this:

- Let's say you have healthcare coverage for yourself only through your employer, and you only have to pay, say, 5% of your annual household income for your premiums

- However, you're married with two kids, and adding each of them would tack on another 5% in premiums apiece. Covering all four of you would cost 20% of your annual household income, ouch.

- Because your individual premiums come in at less than ~9.12% of your income, the rest of your family doesn't qualify for ACA subsidies even though the premiums for the family as a whole costs far more than the maximum amount you'd otherwise have to pay for an ACA exchange plan.

Thankfully, since 2022, this is no longer an issue for most of these folks.

5. OTHERS WHO DIDN'T USED TO QUALIFY FOR FINANCIAL HELP NOW QUALIFY AS WELL!

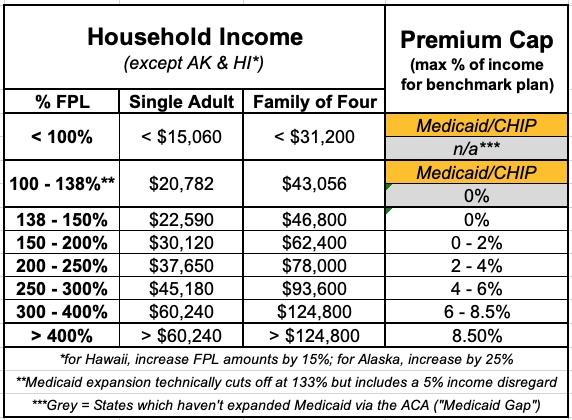

Before I get into this, it's important to understand what the Federal Poverty Line (or FPL) is. 100% FPL depends on how many people live in your household. For a single adult with no dependents, it's $14,580/year; for a family of four, it's $30,000/year. These amounts increase a bit each year to account for inflation.

Prior to the American Rescue Plan/Inflation Reduction Act, ACA subsidies were limited (on a sliding income scale) to enrollees earning between 100 - 400% FPL (roughly $60,000/year for one person or $125,000/year for a family of four). If you earned more than 400% FPL, however, you had to pay full price no matter how expensive the premiums were.

Thanks to the ARP/IRA, however, the ACA's infamous "Subsidy Cliff" has been killed at last at least through the end of 2025.

This means two extremely important things:

- First: Households earning less than 400% of the Federal Poverty Line (FPL) are now eligible for more generous financial assistance than they were pre-ARP/IRA.

- Second: Millions of people who earn more than 400% FPL, who weren't eligible for any financial help pre-ARP/IRA, are now eligible for financial help after all, which can mean thousands of dollars in savings for many of them.

Here's a table laying out the percent of your household income which you're restricted to paying for the benchmark Silver plan in your area for 2025:

6. TWELVE STATES ARE OFFERING *ADDITIONAL* SAVINGS *ON TOP OF* THE EXPANDED ARP SUBSIDIES!

In addition, several states have special programs and/or additional savings on top of the enhanced federal subsidies which can save many lower-income enrollees even more!

- CALIFORNIA: STATE-ENHANCED COST SHARING REDUCTION PROGRAM

Starting last year, over 600,000 CA residents were eligible to benefit from a new program which eliminates deductibles for all CoveredCA enrollees earning up to 250% FPL while also dramatically reducing co-pays & other cost sharing for those earning 150 - 250% FPL. This effectively turns all CSR Silver plans into Secret Ultra Platinum plans.

Well, in 2025 this program is being expanded further:

This year, Gov. Newsom and the California Legislature increased the amount of state funds available for the enhanced cost-sharing reduction program, appropriating $165 million to expand eligibility for it. As a result, in 2025 Californians with incomes above 200 percent of the federal poverty level (FPL) will be eligible to enroll in an Enhanced Silver 73 plan with no deductibles and reduced out-of-pocket costs, while those under 200 percent FPL will continue to have access to higher levels of benefits. This change will further reduce financial barriers to accessing health care and simplify the process of shopping for health insurance.

CoveredCA also plans on automatically upgrading ~35,000 enrollees into High CSR plans to save them money, while also covering the $1/month abortion rider fee for every enrollee.

- COLORADO: HEALTH INSURANCE AFFORDABILITY FUND

Over 70,000 CO residents are benefitting from this program, which upgraded enrollees earning up to 250% FPL to the same Platinum plan status as those earning less than 150% FPL by reducing out-of-pocket expenses (deductibles, co-pays, etc.) even further.

In addition, up to 11,000 undocumented immigrants earning up to 300% FPL who aren't eligible for federal subsidies are eligible for state-based premium subsidies as well via Colorado's unique OmniSalud program.

Unfortunately, in 2025 Colorado will have to reduce the scope of the affordability fund program by lowering the eligibility threshold to 200% FPL.

- CONNECTICUT: COVERED CONNECTICUT PROGRAM

This program, which has around 17,000 Ct residents enrolled, raises the actuarial value of ACA plans to a stunning 100% (ie, no cost sharing at all) for all Silver CSR enrollees earning up to 175% FPL. This even includes no-cost dental insurance and non-emergency medical transportation.

- MINNESOTA: MINNESOTACARE

Nearly 100,000 Minnesota residents with household income is up to 200% FPL are enrolled in the states expanded MinnesotaCare Basic Health Plan program.

Minnesotacare features $0 premiums for households earning up to 160% FPL and $4 - $28 premiums on a sliding scale for households earning 160 – 200% FPL. Children up to 20 years old have no cost sharing, and adults 21+ only pay $100 for ER visits and have very low co-pays for other typical services.

- MARYLAND: YOUNG ADULT SUBSIDY PROGRAM

Over 43,000 Maryland residents are enrolled in this program. If at least one of the enrollees in your household is between the ages of 18 - 37 and your household income is up to 400% FPL, they may qualify for additional premium savings. It reduces net premiums after federal subsidies are applied by an additional 2.5 percentage points for enrollees from 18-33 and by smaller amounts over that on a sliding scale.

- MASSACHUSETTS: CONNECTORCARE

Over 270,000 Bay Staters are enrolled in ConnectorCare plans, which are special Qualified Health Plans (QHPs) only available to MA Health Connector enrollees who earn up to 500% FPL (previously 300% FPL). They feature $0 deductibles, low out-of-pocket caps, low co-pays and nominal (or even $0) premiums.

- NEW JERSEY: NJ HEALTH PLAN SAVINGS PROGRAM

This program, which nearly every enrollee at Get Covered NJ benefits from to some degree, automatically further reduces premiums for eligible enrollees who earn up to 600% FPL. These are flat “wraparound” subsidies provided on a monthly basis as a supplement to the federal APTC subsidies.

- NEW MEXICO: HEALTH CARE AFFORDABILITY FUND

This program was introduced in 2023; it reduces benchmark Silver premiums for enrollees earning up to 200% FPL down to $0, while also reducing them by lesser amounts for enrollees earning between 200 - 400% FPL. It also dramatically upgrades the cost sharing reduction subsidies while rebranding Silver CSR plans as “Turquoise Plans” for easier consumer marketing.

In 2025, the program is being expanded:

...plans with 90% actuarial value (equal to a Platinum plan) will be available to enrollees with household income up to 400% of FPL. In 2024, the income limit to qualify for these 90% actuarial value plans was 300% of the federal poverty level.

- NEW YORK: THE ESSENTIAL PLAN

A stunning 1.3 MILLION New Yorkers are now enrolled in this Basic Health Plan program; similar to MinnesotaCare, residents earning up to 200% FPL are eligible for the Essential Plan, which has been expanded to the point that enrollees pay NO premiums and have NO deductibles! In addition, enrollees earning up to 150% FPL pay almost nothing in cost sharing, which is pretty nominal for those earning 150 - 200% FPL.

In April 2024, New York expanded their BHP program to residents earning up to 250% FPL, allowing an additional 100,000 residents to enroll in the program.

And now, starting in January, they're adding another financial aid program for those earning up to 400% FPL:

New York’s waiver amendment expands the affordability programs under its waiver plan to provide new state subsidies for certain Exchange enrollees. The amended waiver will include three new state subsidies beginning in 2025:

(1) state cost-sharing subsidies for on-Exchange silver plan enrollees with estimated household incomes up to 400% of FPL;

(2) state cost-sharing subsidies for certain diabetes-related services for all Exchange enrollees; and

(3) state cost-sharing subsidies for certain pregnancy and postpartum outpatient care, inclusive of mental health services, for all Exchange enrollees.

The state projects that 117,000 additional New Yorkers will see significant savings from the state CSR expansion program, averaging around $2,600 per enrollee per year!

- OREGON: HEALTH PLAN BRIDGE

In July, Oregon became the third state to launch a Basic Health Plan (BHP) program, dubbed the "Bridge Program," for adults earning between 138 - 200% FPL. Officially, Oregonians in that income bracket who are currently enrolled in ACA exchange plans have had the option of remaining in their existing plan vs. switching over to the new BHP program, but going forward, if they make any changes to their current status (contact info, projected income, address, etc) they'll have their eligibility status reviewed and in most cases will likely only be eligible for the new Bridge Program, which will be a far better deal for them in the vast majority of cases anyway.

- VERMONT: VERMONT PREMIUM ASSISTANCE

Available to Vermont residents (around 15,000 are enrolled at the moment) earning up to 300% FPL, VPA subsidies are unusual in that they reduce net premiums by 1.5 percentage points...which means that some low-income enrollees are technically paying negative premiums. In reality, the "excess" subsidies just go to cover any premiums for services not covered by federal subsidies (no, you don't actually get paid for enrolling).

- WASHINGTON STATE: CASCADE CARE SAVINGS

Available for enrollees earning less than 250% FPL who enroll in Silver or Gold “Cascade Care” plans (Cascade Care plans are Washington’s quasi-”public option” ACA policies). Further reduces net premiums down to as low as $0/month; most pay $10/month or less. Cascade Care plans have deductibles/co-pays around $1,000 lower than non-Cascade Care Silver plans.

The major change in Washington's Cascade Select program in 2025 is that these plans will now be available in every county statewide.

7. MILLIONS OF PEOPLE ARE ELIGIBLE FOR FREE "SECRET PLATINUM" PLANS (LABELED AS SILVER)!

As I explain in detail here, if your household earns less than 200% FPL in any state (around $29,000/yr if you're single; around $60,000/yr for a family of four), make sure to choose a SILVER plan! Thanks to the ACA's Cost Sharing Reductions (CSR) system, you'll receive additional financial help which will lower your deductible, co-pays and coinsurance so much it effectively transforms Silver plans into Platinum plans!

Furthermore, thanks to the expanded ARP/IRA subsidies, the premiums for these "Secret Platinum" plans are literally nothing for anyone earning under 150% FPL and max out at just 2% of your annual income from 150 - 200% FPL! (As noted above, in some states you may not have to pay a dime in premiums for a Silver plan even if your income is as high as 200% FPL).

8. VIA PREMIUM ALIGNMENT & SILVER LOADING, SOME SUBSIDIZED ENROLLEES MAY BE ABLE TO GET FREE GOLD PLANS!

As I explained here, due to a long, strange series of events, subsidized enrollees earning 200% FPL or more may end up getting a Gold plan for less than Silver, or a Bronze plan for free!).

In 2021, David Anderson ran an analysis and finds that there were 820 counties where at least one Gold plan was priced lower than the benchmark Silver plan even at full price! Once you add Silver Loading into the mix, this means many people will qualify for a ZERO-PREMIUM GOLD plan even if they earn over 200% FPL!

This is especially true in states which have fully embraced both Silver Loading and Premium Alignment, including Colorado, Maryland, New Mexico, Pennsylvania and Texas (both Illinois and New Jersey have bills in committee to do this as well; I hope Michigan will do so soon!)

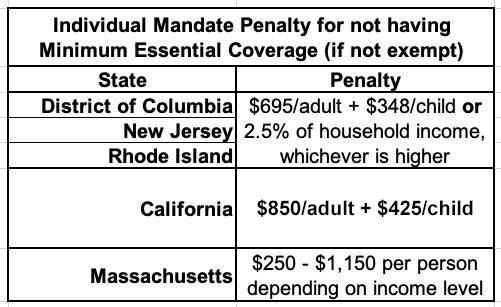

9. THE INDIVIDUAL MANDATE IS STILL AROUND IN FIVE STATES!

The single most controversial part of the Patient Protection & Affordable Care Act was the Shared Responsibility Provision, commonly known as the "Individual Mandate Penalty." In essence, all American citizens who didn't qualify for an exemption were required to either have ACA-compliant healthcare coverage (this could include Medicare, Medicaid, CHIP, qualifying Employer-Sponsored healthcare policies, or ACA exchange plans) or they would be charged a financial penalty for not having qualifying coverage.

The federal ACA individual mandate was reduced to nothing in 2019, so it isn't an issue any longer...but there are actually five states which have since reinstituted their own healthcare coverage requirement:

- CALIFORNIA

- DISTRICT OF COLUMBIA (I know, it's not actually a state...yet)

- MASSACHUSETTS

- NEW JERSEY

- RHODE ISLAND

In CA, DC, NJ & RI, the penalty either identical or very close to the old federal penalty. Massachusetts uses their own formula. The financial penalty for not having coverage (assuming you don't qualify for an exemption) will be charged when residents file their 2022 state taxes in spring 2023.

10. SOME CARRIERS HAVE EITHER NEWLY ENTERED OR EXITED DIFFERENT STATES

Every year sees churn on the ACA markets as new carriers enter or expand their coverage areas to more counties/states...or as currently-participating carriers pull out of them. In addition, existing carriers often add new plans or phase out current ones. Here's just some of the changes for 2025.

While I've been tracking most of these myself via my ongoing annual rate change project, my colleague Louise Norris has a great roundup of the major changes:

Entries:

- UnitedHealthcare – entering Indiana, Iowa, Nebraska, and Wyoming

- HAP CareSource – entering Michigan

- WellSense – entering New Hampshire

- WellPoint – entering Texas, Florida, and Maryland

- Simply Healthcare Plans, Inc. – entering Florida

- Ambetter/Iowa Total Care – entering Iowa

- Antidote Health – entering Arizona

- InStil Health – entering South Carolina

Exits:

- Celtic – leaving Indiana Marketplace (will still offer plans outside the Marketplace)

- Ascension (US Health & Life) – exiting Indiana, Kansas, Tennessee, and Texas

- Cigna – exiting Pennsylvania,28 South Carolina,29 and Utah

- Ambetter/Western Sky – exiting New Mexico

- PacificSource – exiting Washington

- Medica – exiting Arizona24 and Illinois

- Aetna Life – exiting in Virginia (Aetna Health will continue to offer plans)

Any time a carrier reduces their participation in a given county or state it means that anyone currently enrolled in their policies will either be automatically "mapped" to a similar plan with a different carrier or they have to actively seek out a new policy to enroll in.

11. STANDARDIZED PLANS ARE BACK!

I debated a long time on whether to make this its own separate category or not.

Several states such as California and Massachusetts already mandate "Standardized" ACA policies. This means that every plan offered within a given metal level category (Bronze, Silver, Gold, Platinum) has to have the same cost sharing across the board. That is, co-pays, deductibles, etc. have to be the same. This simplifies the decision process for enrollees by allowing them to focus on premiums and networks instead of having to sweat the co-pays for 80 different services.

Standardized plans were offered by some carriers on the federal ACA exchange a few years back, but it was pretty scattershot since they didn't have to. All carriers offering plans on HealthCare.Gov now have to include standardized plans at every metal level.

Related to this, a reminder that HC.gov is now limiting the total number of plans offered by each carrier to no more than 4 non-standardized plans per network type, metal level, service area & dental/vision benefit. This is being done in an attempt to reduce the mountain of confusing, virtually-identical plans offered on the exchange, although honestly that still allows for something like 24 plans per metal level per carrier. Still, it's a start; next year it will be reduced to 2 plans per option, which should help reduce the clutter.

So why was I hesitant to give standardized plans (aka "Easy Pricing") their own bullet point on this list? Because unlike CA & MA, the "Easy Pricing" plans which have to be included on HealthCare.Gov's offerings are in addition to the dozens (or even hundreds) of existing "non-standardized" plans already offered. This means that instead of simplifying the shopping experience, it could actually make it more confusing for some people.

All of this can get understandably confusing to the point that it becomes overwhelming. Fortunately...

12. THE NAVIGATOR PROGRAM IS BACK AT FULL STRENGTH, BABY!

Years ago, the Trump Administration effectively gutted both the ACA's marketing/outreach budget (slashing it down by 90%) as well as its "Navigator" program, causing dozens of organizations around the country devoted to helping ACA enrollees find their way through the confusing world of health insurance enrollment (as well as those needing guidance to get into Medicaid, CHIP and other healthcare programs).

Thankfully, those days are no more: The Biden Administration reversed this damage, quadrupling the number of ACA Navigators to over 1,500 and increasing the grant program to nearly $100 million this year.

The news is even better for underserved communities...those who need help the most:

Navigators serve an important role in connecting communities to health coverage, including communities that historically have experienced lower access to health coverage and greater disparities in health outcomes. Entities and individuals cannot serve as Navigators without receiving federal cooperative agreement funding, authorized in the Affordable Care Act, to perform Navigator duties.

To find authorized local help, search here. If you live in a state with its own ACA exchange you'll be redirected there.

13. *DON'T* LET YOURSELF BE PASSIVELY AUTO-RENEWED!

It's always been a good idea to actively shop around the ACA marketplace each Open Enrollment Period to see whether there's a better value for the upcoming year, but it's even more important now.

Between the massively expanded & enhanced subsidies thanks to the ARP/IRA, the dramatic increase in carrier participation in many states, the supplemental financial assistance being provided to many enrollees in nearly a dozen states, the seemingly counterintuitive pricing structure caused by "Silver Loading" and a host of other factors, you should absolutely NOT let yourself be "auto-renewed" this year!

My friend & colleague Louise Norris lists some important reasons for this:

In most states, you’ll have limited opportunities to pick a new plan after your coverage is auto-renewed. The auto-renewal process happens right after December 15, for people who haven’t manually renewed or selected a new plan. Since open enrollment now extends into January in nearly every state, enrollees in most states have until at least January 15 to pick a new plan if they ended up deciding that the auto-renewed option wasn’t the best choice after all.

Your subsidy amount will generally change from one year to the next. If your subsidy gets smaller, auto-renewal could result in higher premiums next year. If the cost of the benchmark plan changes, premium subsidy amounts in that area will also change. The benchmark plan for 2023 may or may not be the same plan that held the benchmark spot in 2022.

If you receive a subsidy, auto-renewal could be dicey even if the subsidy amount isn’t declining. If you rely on auto-renewal (as opposed to manually renewing and completing the financial eligibility determination process for the coming year), the exchange can renew your plan without a premium subsidy in certain circumstances. This includes situations in which you didn’t give the exchange permission to access your financial information in subsequent years, or if you failed to reconcile your premium subsidy on the prior year’s tax return.

If your plan is being discontinued at the end of 2022, auto-renewal will result in the exchange or your insurer picking a new plan for you. They will try to assign you to the plan that most closely matches the coverage you had in 2022, but selecting your own new plan is a better option.

Auto-renewal might result in a missed opportunity for a better value. Even if the plan you have in 2022 represented the best value when you selected it, there may be different plans available for 2023. Provider networks and benefit structures can change from one year to the next, as can premiums. You might still decide that renewing your 2022 plan is the best option for 2023. But it’s definitely better to actively make that decision rather than letting your plan auto-renew without considering the other available options.

Note that this doesn't necessarily mean that you shouldn't actively renew your existing plan--it may turn out that sticking with the same healthcare policy really is your best bet after all. Just don't assume that's the case, because even if nothing changes at your end (same income, same household size, etc.), the plans, premiums, networks and especially the subsidies you're eligible for could still change dramatically.

There's one caveat to this: Starting in 2024, HealthCare.Gov (as well as Covered California) began automatically moving passive-renewal enrollees to lower-cost plans if they meet certain criteria (ie, the new plan has to have the same provider network, the same drug formulary, be from the same carrier and so forth...and they'll only do it if it saves the enrollee money). Even so, I'd still advise actively shopping to get the best value.

IN SHORT: SHOP AROUND, SHOP AROUND, SHOP AROUND!

14. CMS CRACKS DOWN ON UNAUTHORIZED ENROLLMENTS & PLAN CHANGES:

This is a new bullet point which addresses an unfortunate problem which came to light last spring: Apparently some number of unscrupulous private health insurance brokers have been either signing people up for zero-premium healthcare policies without their knowledge (which the enrollee would usually never know about since they never received an invoice) or switching current enrollees from one policy to a different one without their knowledge or consent.

This caused quite an uproar within the health insurance & insurance broker communities, and over the course of the summer and fall CMS has studied the problem and addressed it in increasingly stronger measures. Just last week they issued another update:

...Beginning July 19, 2024, CMS began blocking agents and brokers from making changes to a consumer’s FFM enrollment unless the agent or broker is already associated with the consumer’s enrollment. If a consumer would like to work with an agent or broker not already associated with their profile, the consumer must conduct a three-way call with the Marketplace Call Center and the “new” agent or broker. The consumer can also submit the change to their enrollment directly through the Marketplace Call Center, HealthCare.gov, or an approved Classic Direct Enrollment or Enhanced Direct Enrollment partner website with a consumer pathway.

Throughout October 2024, CMS will implement updates to enhance the FFM’s ability to block agents and brokers from making changes to a consumer’s FFM enrollment without the consumer’s engagement.

I don't know exactly what sort of technical changes this refers to; my guess would be the addition of 2-Factor Authentication or something along those lines.

...Casework associated with consumer reports of unauthorized plan changes has dropped by approximately 30% since the changes went into effect, and the overall number of plan changes associated with an agent or broker has decreased by nearly 70%.

...Since July 19, 2024, changes to agent or broker commission information have decreased nearly 90%.

From January 2024 through August 2024, CMS received 90,863 complaints that consumers had their FFM plan changed without their consent (also known as an “unauthorized plan switch”). The agency has resolved 90,376 (99.45%) of these complaints and remains committed to addressing new and unresolved cases. CMS is currently resolving these cases within approximately 16 calendar days of receipt.

From January 2024 through August 2024, CMS received 183,553 complaints that consumers were enrolled in FFM coverage without their consent (also known as an “unauthorized enrollment”). The agency has resolved 183,095 (99.75%) of these complaints and remains committed to addressing new and unresolved cases. CMS is currently resolving these cases within approximately 52 days of receipt.

From June 2024 through October 2024, CMS suspended 850 agents and brokers’ Marketplace Agreements for reasonable suspicion of fraudulent or abusive conduct related to unauthorized enrollments or unauthorized plan switches. These agents and brokers are now prohibited from participating in Marketplace enrollment, including receiving related commissions.

In short: Yes, this was a real problem; yes, CMS should have been aware of and dealt with it much sooner; but yes, they're taking it very seriously now and have implemented major steps to crack down on the problem.

15. UPDATES & IMPROVEMENTS TO HEALTHCARE.GOV:

Just this morning (Oct. 25th), CMS posted a fact sheet laying out some significant (and some less-significant) changes to the federal ACA exchange utilized by 31 states, HealthCare.Gov, including:

- 97% of HC.gov enrollees will have access to at least 3 insurance carriers (up from 96% last year)

- A revamped HC.gov home page w/prominent calls to action, easier access to key info, a more consistent user interface, etc.

- The account management section of HC.gov has been redesigned to make it easier to access settings/preferences, have a more consistent interface from page to page, etc.

- The mobile version of HC.gov has been optimized and streamlined as well

- They're partnering with cultural marketing experts to target awareness/education campaigns to the Black community, Latinos, Asian American/Pacific Islanders, etc in multiple languages

- They'll be partnering with the IRS to inform households who may be uninsured that they could be eligible for low-cost health insurance coverage

- The Navigator program will be offering more non-traditional appointment hourse, in-person assistance via mobile units, virtual appointments, etc.

- They're partnering with over 1,000 local organizations active in outreach & education

There's a bunch of other stuff as well, but this provides the gist of it.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.