REMINDER: Residents of Colorado & Maryland still have time to #GetCovered!

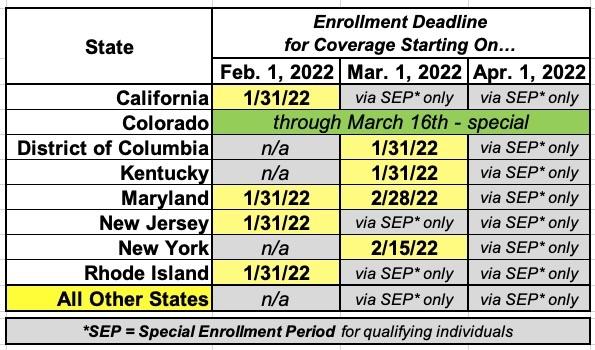

IMPORTANT: The official 2022 Open Enrollment Period has now ended in most of the country, but there's 8 states where residents still have time to #GetCovered, with their new healthcare policies going into effect starting either February 1st or March 1st.

The 2022 OEP is by far the best ever for the ACA coverage, with dramatically expanded financial help for millions more people (including many who weren't eligible last year), reinvigorated expert, unbiased assistance, more choices in many states and counties, and FREE policies for more people than ever before.

If you've never enrolled in an ACA healthcare policy before, or if you looked into it years ago but weren't impressed, please give it another shot now. Thanks to the American Rescue Plan (ARP), it's a whole different ballgame.

Here's some important things to know when you #GetCovered for 2022:

1. RESIDENTS OF COLORADO, MARYLAND & NEW YORK STILL HAVE TIME!

As noted above, as usual, some of the states which operate their own ACA exchanges have extended final Open Enrollment deadlines. Here's a summary:

COLORADO is, as. noted, a special case. The final deadline is March 16th, but there's a few caveats: First, you have to have been "impacted by the COVID-19 pandemic (who hasn't been??) or the recent Colorado wildfires. Second, this is only open to those currently uninsured. See here for details.

If you want to enroll after the dates above, you'll have to qualify for a Special Enrollment Period (SEP). Qualifying Life Experiences (QLEs) which make you eligible for a SEP include things like:

- Losing employer-sponsored healthcare coverage

- Getting married or divorced

- Giving birth/adopting a child

- Turning 26 and having to move to your own policy

- Losing eligibility for Medicaid or CHIP

- Moving out of your current rating area

If you're a member of a federally-recognized Native American tribe or are an Alaskan Native you can enroll in an ACA exchange plan year-round regardless of what state you live in.

In addition, if you're eligible for Medicaid; the Children's Health Insurance Program (CHIP); Massachusetts' "ConnectorCare" program; Minnesota's "MinnesotaCare" program; or New York's "Essential Plan" program, you can enroll year-round.

2. ONLY ENROLL VIA AN OFFICIAL ACA HEALTH EXCHANGE OR AN AUTHORIZED ENROLLMENT PARTNER.

ACA financial subsidies have been dramatically expanded for 2022 thanks to the American Rescue Plan...but they're only availalble to eligible enrollees who sign up through an official ACA exchange or an authorized 3rd-party exchange entity, known as an Enhanced Direct Enrollment (EDE) entity.

There's a ton of junk plans and scam artists out there, especially these days. Fraudulent plans are being hawked endlessly via both robocalls, spam emails and fly-by-night websites. If you're enrolling online, make sure to use one of the official ACA exchange websites:

- CALIFORNIA: Covered California

- COLORADO: Connect for Health Colorado

- CONNECTICUT: Access Health CT

- DISTRICT OF COLUMBIA: DC Health Link

- IDAHO: Your Health Idaho

- KENTUCKY: kynect

- MAINE: CoverME.gov

- MARYLAND: Maryland Health Connection

- MASSACHUSETTS: MA Health Connector

- MINNESOTA: MNsure

- NEVADA: Nevada Health Link

- NEW JERSEY: Get Covered NJ

- NEW MEXICO: beWellnm

- NEW YORK: NY State of Health

- PENNSYLVANIA: Pennie

- RHODE ISLAND: HealthSource RI

- VERMONT: VT Health Connect

- WASHINGTON STATE: WA Healthplan Finder

- As for EDEs, it's important to note that some of these may also sell non-ACA compliant plans. The only EDEs I'm aware of which only sell on-exchange ACA-compliant policies are HealthSherpa and W3LL. Full disclosure: I have a banner ad agreement with both.

Note: While you could also enroll in ACA-compliant policies directly via the insurace carrier's website I STRONGLY recommend only using one of the exchange websites listed above. You have to enroll on-exchange to be eligible for financial help!

If you live in Kentucky, Maine or New Mexico, it's important to note that all three states have moved onto their own ACA exchange platforms for the 2022 Open Enrollment Period! Kentucky is an unusual case, in that it moved from its own exchange to HealthCare.Gov and now back onto its own exchange platform again (Nevada is the only other state to have done this so far).

On a related note...

3. IF YOU'RE ENROLLED OFF-EXCHANGE, IF AT ALL POSSIBLE SEE IF YOU CAN ENROLL ON-EXCHANGE INSTEAD.

As far as I can figure, somewhere between 2.3 - 3.0 million Americans are still enrolled in OFF-exchange, ACA-compliant individual market policies. Historically, the main reason for this has been that they didn't qualify for financial help, so didn't see the point of filling out any additional forms by enrolling on-exchange.

The reality, however, is that some of these off-exchange enrollees may have been eligible for ACA subsidies after all if they had enrolled in the exact same plan but had done so via their ACA exchange instead of directly through the carrier...and thanks to the American Rescue Plan's dramatically improved & expanded subsidy formula, the odds are that as many as half or more of those 2.3 - 3.0 million people will be leaving hundreds or thousands of dollars on the table if they don't make the switch!

Again: If you weren't eligible a few years ago or even last year, check again this year; you may be in for a very pleasant surprise!

Having said that, if it turns out you really don't qualify for subsidies even with the ARP's expanded eligibility, you can take at least some comfort in knowing that ACA policy premiums have remained remarkably stable over the past few years, even as the COVID pandemic raged across the country.

On average, full-price/unsubsidized ACA premiums were essentially flat in 2020 nationally and again in 2021, while in 2022 it looks like they're only going up around 3.5% overall.

4. MILLIONS OF AMERICANS WHO DIDN'T QUALIFY FOR FINANCIAL HELP LAST YEAR DO NOW...AND THEY COULD SAVE THOUSANDS OF DOLLARS!

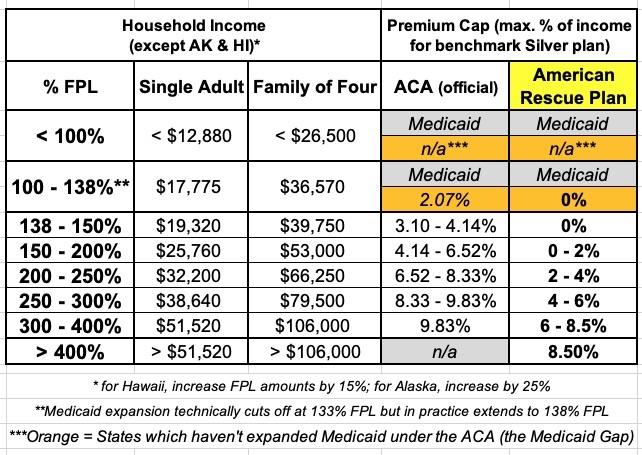

Before I get into this, it's important to understand what the Federal Poverty Line (or FPL) is. 100% FPL depends on how many people live in your houseold. For a single adult with no dependents, it's around $12,900/year; for a family of four, it's around $26,500/year. These amounts increase slightly each year to account for inflation.

Prior to the American Rescue Plan, ACA subsidies were limited (on a sliding income scale) to enrollees earning between 100 - 400% FPL (up to around $51,000/year for one person, or $106,000/year for a family of four. If you earned more than 400% FPL, however, you had to pay full price no matter how expensive the premiums were.

With the passage and signing of the ARP, the ACA's infamous "Subsidy Cliff" has been killed at last (through at least the end of 2022, anyway; after that it depends on the fate of the Build Back Better bill).

This means two extremely important things:

- First: If you were already eligible for ACA subsidies last year (i.e., you earn under 400% of the Federal Poverty Line, or FPL), you'll likely see a significant increase in how much financial help you're eligible for.

- Second: If you didn't qualify for financial help last year because your income was too high, you're now likely eligible for ACA subsidies for the first time ever!

Here's a table laying out the percent of your household income which you're restricted to paying for the benchmark Silver plan in your area under the original ACA formula and the new American Rescue Plan formula:

You can also read my more detailed explainer, including a bunch of case studies for comparison. For example:

- A 26-year old single adult could save as much as $1,500 in premiums compared to a year ago

- A 50-year old single adult could save as much as $3,300 in premiums compared to a year ago

- A 40-year old couple w/2 kids could save as much as $7,400 in premiums compared to a year ago

- A 60-year old couple could save as much as $18,000 in premiums compared to a year ago

5. TEN STATES ARE OFFERING *ADDITIONAL* SAVINGS *ON TOP OF* THE EXPANDED ARP SUBSIDIES!

In addition, several states have special programs and/or additional savings on top of the enhanced federal subsidies which can save many lower-income enrollees even more!

- If you live in California, they've had their own supplemental state subsidy program for the past few....which have been rendered moot for 2022 by the enhanced ARP subsidies, which are even more generous yet. For the moment, CoveredCA is quietly knocking $1/month off of everyone's net premiums, whether they're receiving federal subsidies or not.

That's only $12/year, of course, but even a nominal fee can make a difference to low-income enrollees who'd otherwise have to pay an invoice each month; the fact that it'd only be $1 doesn't change the hassle factor.

- If you live in Colorado, enrollees earning between 150 - 200% FPL will see their out of pocket expenses (deductibles, co-pays, etc.) significantly reduced (even beyond the federal Cost Sharing Reduction (CSR) assistance) thanks to the states new Health Insurance Affordability Fund.

- If you live in Connecticut, have at least one child under 19 and a household income between 160% - 175% FPL, you're likely eligible for their new "Covered Connecticut" program.

- If you live in Minnesota and your household income is below 200% FPL, you're likely eligible for MinnesotaCare.

- If you live in Maryland and at least one of the enrollees in your household is between the ages of 18 - 34, they'll may qualify for additional premium savings via the states new Young Adult Premium Subsidy program.

- If you live in New Jersey, the NJ Health Plan Savings program will automatically reduce premiums for eligible enrollees who earn up to 600% FPL.

- If you live in New York and your household income is below 200% FPL, you're likely eligible for the Essential Plan.

- If you live in Massachusetts and your household income is below 300% FPL, you're likely eligible for ConnectorCare.

- If you live in Vermont and your household income is below 300% FPL, you're likely eligible for Vermont Premium Assistance (VPA).

- If you live in Washington State and you're an employee of a licensed child care facility with a household income under 300% FPL, you're eligible to pay nothing in premiums as long as you enroll in a Silver plan.

- UPDATE: In New Mexico, the new Health Care Affordability Fund is scheduled to savings for most ACA exchange enrollees, but that's apparently not going into effect until 2023.

6. MILLIONS OF PEOPLE ARE ELIGIBLE FOR FREE "SECRET PLATINUM" PLANS (LABELED AS SILVER)!

As I explain in detail here, if your household earns less than 200% FPL (around $25,500/yr if you're single; around $52,000/yr for a family of four), make sure to choose a SILVER plan! Thanks to the ACA's Cost Sharing Reductions (CSR) system, you'll receive additional financial help which will lower your deductible, co-pays and coinsurance so much it effectively transforms Silver plans into Platinum plans!

Furthermore, thanks to the American Rescue Plan, the premiums for these "Secret Platinum" plans are literally nothing for anyone earning under 150% FPL and max out at just 2% of your annual income from 150 - 200% FPL! (As noted above, in a few states you may not have to pay a dime in premiums for a Silver plan even if your income is over 150% FPL).

7. VIA SILVER LOADING, SOME SUBSIDIZED ENROLLEES MAY BE ABLE TO GET FREE GOLD PLANS!

As I explained here, due to a long, strange series of events, subsidized enrollees earning 200% FPL or more may end up getting a Gold plan for less than Silver, or a Bronze plan for free!).

In fact, for 2022, David Anderson has run an analysis and finds that there are 820 counties where at least one Gold plan is priced lower than the benchmark Silver plan even at full price! Once you add Silver Loading into the mix, this means many people will qualify for a ZERO-PREMIUM GOLD plan even if they earn over 200% FPL!

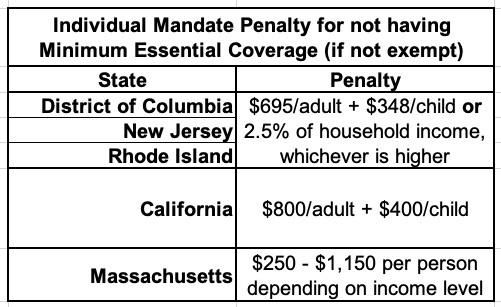

8. THE INDIVIDUAL MANDATE IS STILL AROUND IN FIVE STATES!

The single most controversial part of the Patient Protection & Affordable Care Act was the Shared Responsibility Provision, commonly known as the "Individual Mandate Penalty." In essence, all American citizens who didn't qualify for an exemption were required to either have ACA-compliant healthcare coverage (this could include Medicare, Medicaid, CHIP, qualifying Employer-Sponsored healthcare policies, or ACA exchange plans) or they would be charged a financial penalty for not having qualifying coverage.

The federal ACA individual mandate was reduced to nothing in 2017, so it isn't an issue any longer...but there are actually five states which have since reinstituted their own healthcare coverage requirement:

- CALIFORNIA

- DISTRICT OF COLUMBIA (I know, it's not actually a state...yet)

- MASSACHUSETTS

- NEW JERSEY

- RHODE ISLAND

In CA, DC, NJ & RI, the penalty either identical or very close to the old federal penalty. Massachusetts uses their own formula. The financial penalty for not having coverage (assuming you don't qualify for an exemption) will be charged when residents file their 2022 state taxes in spring 2023.

9. MANY STATES & COUNTIES WILL HAVE MORE CARRIER & PLAN CHOICES THAN EVER.

Arizona is welcoming three new carriers to the state's individual market in 2022. North Carolina is adding five. Pennsylvania is adding one. Across many states, some insurance carriers which abandoned the ACA markets years ago like Aetna are jumping back in again, or expanding into either new states or additional counties in states where they're already operating.

According to the Kaiser Family Foundation, 32 additional carriers are joining the 33 HealthCare.Gov states alone for a total of 213, and HC.gov enrollees will have nearly twice as many total plans to choose from on average as they did in 2021.

Of course, while more choice is normally a good thing, in this case it can also get so confusing that it becomes overwhelming. Fortunately...

10. THE NAVIGATOR PROGRAM IS BACK AT FULL STRENGTH, BABY!

Four years ago, the Trump Administration effectively gutted both the ACA's marketing/outreach budget (slashing it down by 90%) as well as its "Navigator" program, causing dozens of organizations around the country devoted to helping ACA enrollees find their way through the confusing world of health insurance enrollment (as well as those needing guidance to get into Medicaid, CHIP and other healthcare programs).

Thankfully, those days are no more: The Biden Administration has reversed this damage, quadrupling the number of ACA Navigators to over 1,500 and increasing the grant program to $80 million this year.

The news is even better for underserved communities...those who need help the most:

Awardees will focus on outreach to people who identify as racial and ethnic minorities, people in rural communities, the LGBTQ+ community, American Indians and Alaska Natives, refugee and immigrant communities, low-income families, pregnant women and new mothers, people with transportation or language barriers or lacking internet access, veterans, and small business owners.

To find authorized local help, search here. If you live in a state with its own ACA exchange you'll be redirected there.

11. IF YOU LIVE IN A STATE W/A LATER OPEN ENROLLMENT DEADLINE, YOU CAN STILL CHANGE YOUR 2022 POLICY TO A BETTER ONE!

Every year, millions of Americans make the mistake of allowing their current ACA policy to automatically renew for another year without bothering to check & see whether there's a better value available the following year, whether their provider network is the same, or whether their financial subsidies have changed significantly in the new year.

If you're in that situation, you may think you're stuck with the new policy for the full year...and if the final OEP deadline has already passed, that may be true. If you live in one of the states listed above, however, you may be able to switch to a different ACA plan for the balance of 2022! Your new policy won't start until the first of the following month, and your deductible/maximum out of pocket costs may reset, but other than that you could still save potentially thousands of dollars in premiums or be able to make sure your preferred doctors, hospitals & prescription drugs are in-network.

SHOP AROUND, SHOP AROUND, SHOP AROUND!