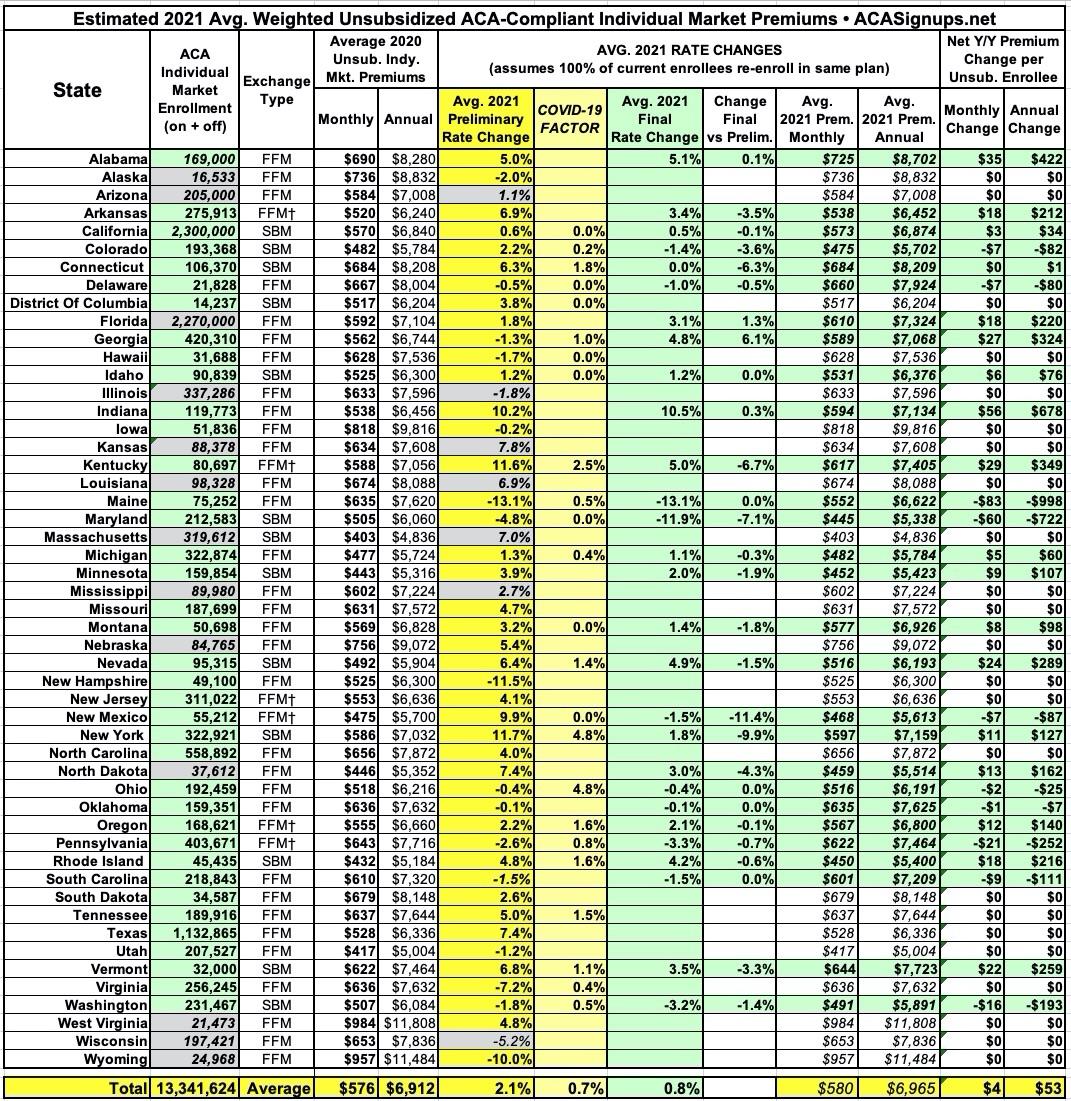

2021 Rate Changes

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have enrolled in ACA-compliant individual market policies;

- What their average projected premium rate increase (or decrease) is for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

- In 2015, I projected that the overall average rate increases for 2016 would be roughly 12-13% nationally. It turned out to be around 11.6%.

- In 2016, I projected that the overall average rate increases for 2017 would be roughly 25% nationally. It turned out to be around 22%, but that only included on-exchange Silver plan enrollees across 44 states (I included all metal levels, both on and off exchange, across all 50 states).

- In 2017, I projected that the overall average rate increases for 2018 would be around 29% nationally, and that 60% of that would be due specifically to deliberate Trump Administration actions designed to sabotage the ACA markets. It turned out to be around 28% nationally.

- In 2018, I projected that the overall average rate increases for 2019 would be around 2.8% nationally, and that premiums would have dropped around 5.4% on average if not for the ACA's individual mandate being repealed & short-term & association plans being expanded. Hhealthcare think tank Avalere Health came to almost the exact same estimates on the actual rate changes, while Brookings Institute healthcare analyst Matthew Fiedler concluded that unsubsidized ACA individual market premiums would indeed have dropped by around 4.3% nationally on average in the absence of mandate repeal and expansion of #ShortAssPlans.

- In 2019, I projected that overall average rates would drop slightly (by 0.2% nationally). It later turned the drop was slightly more than that (hard to say for sure since a dozen states are missing from the CMS report).

In other words, I've had a pretty good track record of accurately projecting average premium increases for the upcoming year for five years in a row. With that in mind, below you'll find a table tracking the state-by-state preliminary and final rate changes for the 2021 ACA-compliant individual (and sometimes small group) markets. Scroll down for individual state entry links.

For 2021, the biggest new factor is, of course, the impact of the COVID-19 pandemic on both 2020 and 2021 medical claims expenses. I've added a new column which attempts to separate that out, though not every carrier does so, while some simply refer to the impact of COVID-19 in a fairly vague way.

(click image for higher-resolution version)

Pages

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.