Tennessee: Preliminary avg. 2021 #ACA premiums: +5.0% indy market, +5.5% sm. group

Tennessee has also posted their preliminary 2021 rate filings for both the individual and small group markets. Aside from being one of the few states where a significant number of carriers are including any COVID-19 pandemic factor at all (in both markets), Tennessee has several new entrants and one significant withdrawl (I think).

On the individual market, UnitedHealthcare is newly entering, while Cigna is expanding their coverage areas as noted here. Cigna is also newly entering Tennessee's small group market, as is Bright Health Insurance.

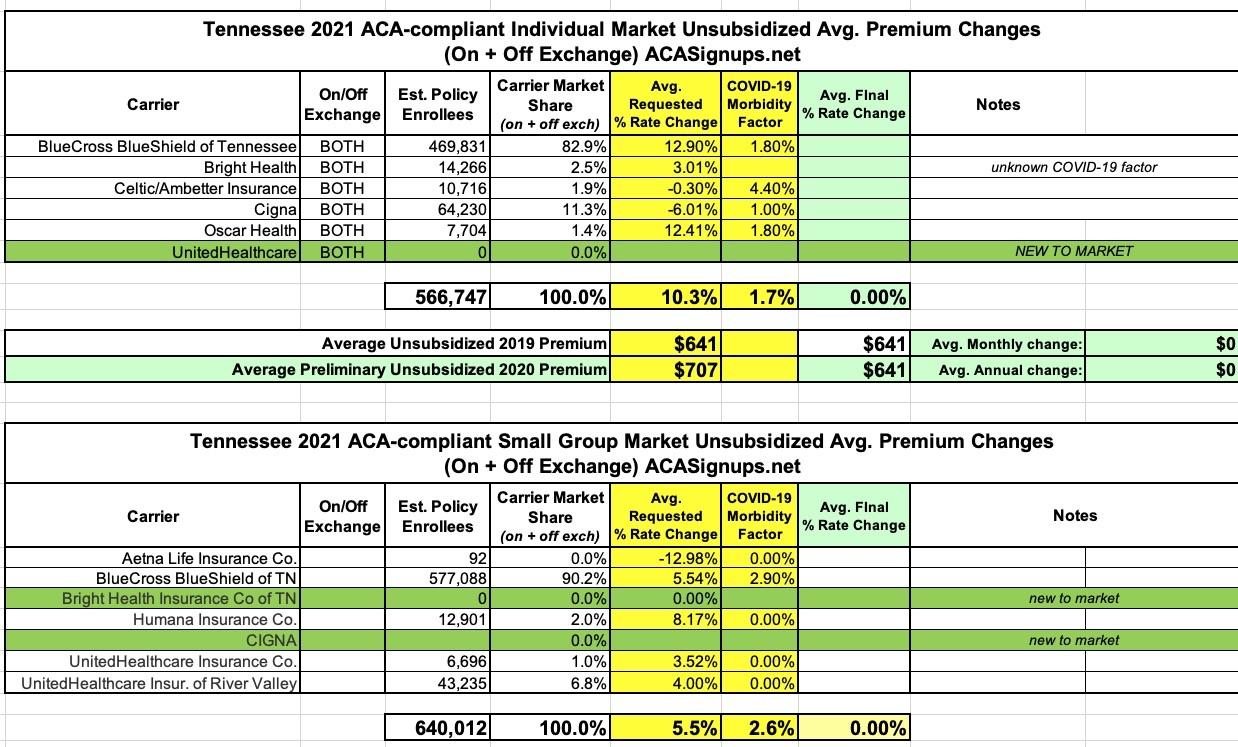

Overall, Tennessee carriers are asking for a 10.3% increase on the indy market (the second highest so far after New York's 11.7% average), mostly driven by Blue Cross Blue Shield, which holds a whopping 83% of the market. On the small group market, the average increase is 5.5%.

COVID-19 accounts for 1.7 points of the increase on average in the indy market and 2.6 points in the small group market. This, again, is the highest statewide average COVID impact I've seen after New York state so far.

There's one interesting omission from the small group market, however: Oscar Insurance Co., which only had ~150 enrollees in 2019, appears to be giving up on Tennessee's sm. group market entirely; I don't see any listing for them at all.

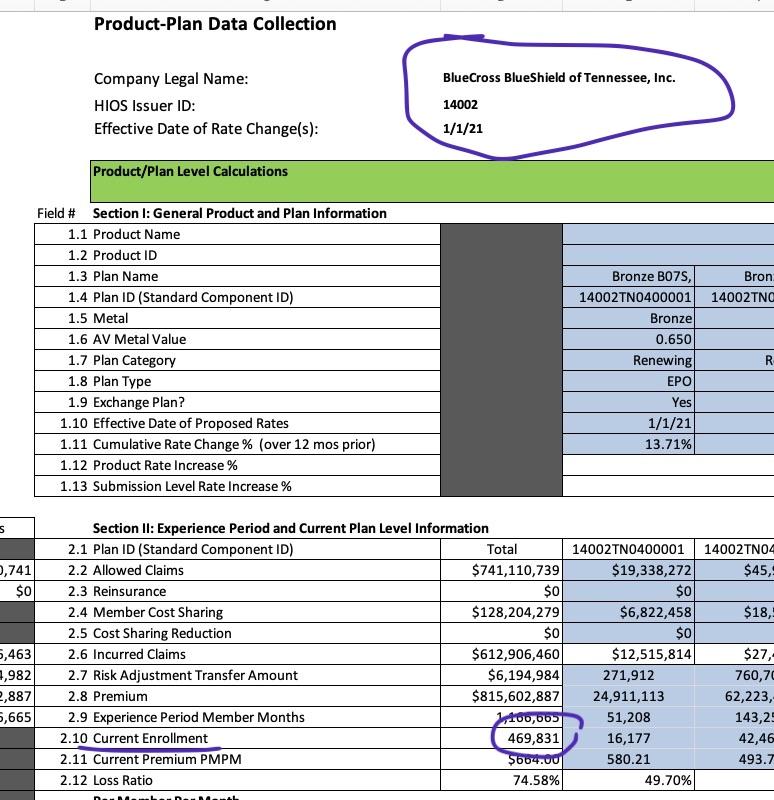

There is one very odd thing here, however...according to BCBSTN's filing, they currently have nearly 470,000 people enrolled in individual market plans...but that's four times last year's indy market numbers (112.6K). Furthermore, Tennessee's entire 2019 individual market enrollment size was only 217,000 (and nearly all of that was on-exchange). I'm not sure what's going on, but assuming this is wrong, Tennessee's average rate incrase is probably quite a bit lower than the 10.3% I have right now...stay tuned...(assuming BCBSTN's total enrollment is actually the same as it was last year, the statewide average increase would only be 5.7% instead of 10.3%).

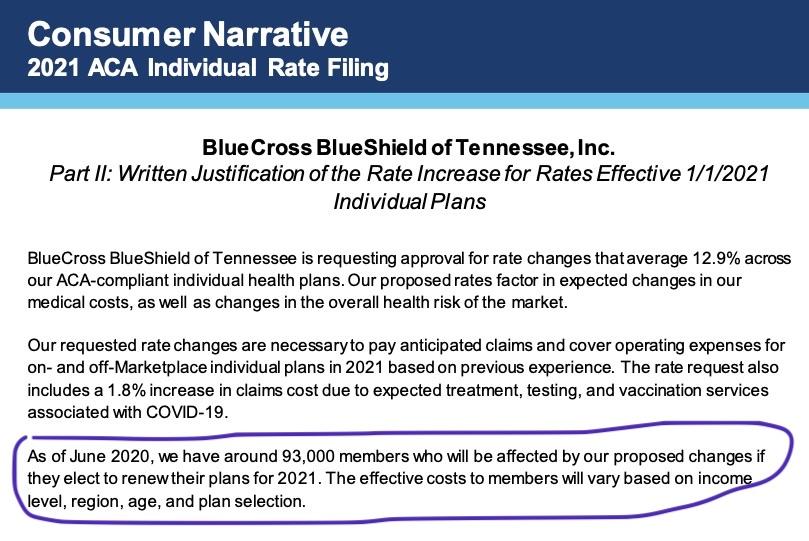

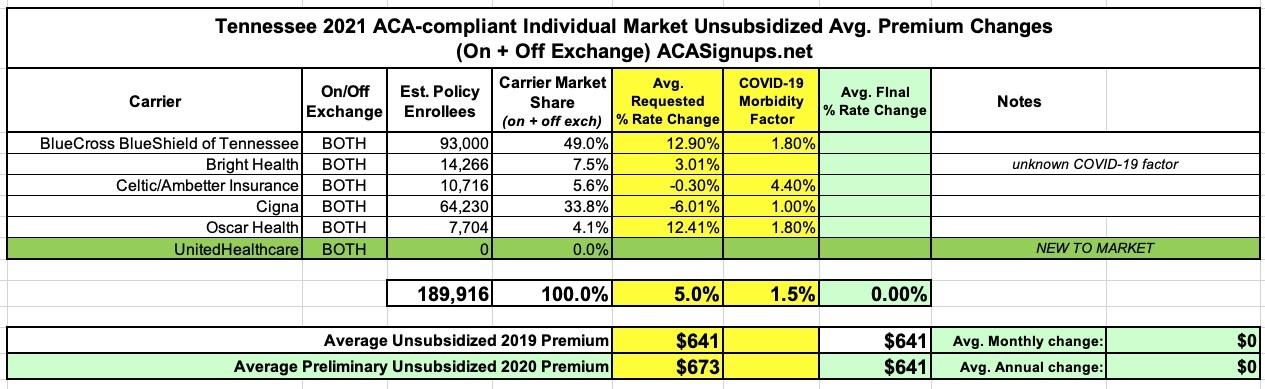

UPDATE 7/31: OK, this is very strange...I found the "Consumer Narrative" from BCBSTN, and sure enough, it only pegs their total individual market enrollment as of June 2020 as 93,000 people! This would make Tennessee's total Indy market just 190,000, which is a lot closer to what I have it pegged at (Mark Farrah Associates just pegged it at around 221,000, and that includes some number of short-term plans).

That being the case, I've updated my spreadsheet and now peg the average preliminary rate increases at around 5.0%, with COVID-19 making up roughly 1.5% of the total.

Here's some of the statements from the carriers regarding the impact of COVID-19 on their 2021 rate filings. While the numbers vary, they have in common the "we reserve the right to refile later this summer" clause:

Blue Cross Blue Shield of Tennessee:

"The rate change proposed in this filing is an average increase of 12.9%, not including the impact of aging. The increase is primarily driven by:

- The rising cost of medical services

- A deterioration of the market level risk

- A 1.8% increase in claims cost due to expected treatment, testing, and vaccination services associated with COVID-19.Claims in the experience period were adjusted to recognize the projected impact of COVID19. In developing this proposal, we considered the following COVID-specific assumptions and how they impact 2021. Note that there is a considerable degree of uncertainty in each of these factors.

--Deferral claim impact

--Infection rate trend, as well as the resulting testing and treatment

--Development of a vaccine

--Social distancing impact

--Economic conditions and line of business enrollment changes (e.g. increase in individual enrollment as small group enrollment decreases).

BRIGHT HEALTH INSURANCE OF TN:

COVID-19: Wakely developed a proprietary model to estimate COVID-19 impacts based on individual WACA data. We identified a subset of diagnoses and claims to mimic a population infected with COVID-19. We then modeled how this COVID-19 population and a corresponding non-COVID-19 population would be impacted under a range of possible scenarios. Assumptions related to the following were used to project all data forward, split into COVID-19 related and non-related subsets, to a 2021 basis: infection rate, hospitalization rate, utilization and cost of potential tests, vaccinations, drugs, and telehealth visits, and reduction in costs due to delayed services or those that will never occur. For each of these assumptions, a reasonable range was identified. Then, a simulation was run to develop a range of estimates based on varying the assumptions above."

"Due to the rapidly changing landscape due to the SARS-CoV2 / COVID-19 pandemic, Wakely and BHICTN would like to reserve the right to change the COVID-19 impact assumption up until the rates are approved, to the extent state and federal rules allow."

CELTIC OF TENNESSEE:

At the time of this rate filing submission, we acknowledge there is substantial uncertainty regarding the impact of the COVID19 pandemic on claim costs and required premium rates in 2021, but have made a preliminary adjustment to reflect the increased risk and uncertainty associated with the pandemic and its secondary effects. We have incorporated an overall premium adjustment to account for the combined impact of several key COVID-19-related cost drivers. These adjustments are derived from a model that is premised on assumptions of the spread of the disease, including assumptions as to how many people are infected in a population, how that infection rate is different by age/gender, how severe those infections are across the population, as well as assumptions regarding actions taken by governmental authorities, employers, and consumer and healthcare provider behavior in response to the pandemic.

Scientific knowledge of these items is incomplete and new data on the spread of COVID-19 in the United States is still emerging. In addition, actions taken by governmental authorities and the healthcare system related to the COVID-19 pandemic are rapidly changing. Consequently, our model results will evolve as new information becomes available and new actions are taken by the authorities and other stakeholders. Due to the limited information available on the pandemic, any analysis is subject to a substantially greater than usual level of uncertainty. If subsequent information becomes available that would materially affect this rate filing submission, we would like to work with the Tennessee Department of Commerce and Insurance to update our pricing assumptions regarding the impact of COVID-19 and resubmit this rate filing.

In addition to the aforementioned items, premium rates have been increased 4.4% to reflect the estimated impact of the COVID-19 pandemic and associated secondary effects on the cost to provide healthcare coverage in 2021. Appendix 2.1 shows the components of this adjustment (i.e. morbidity, cost trend, and the statewide average premium component of the risk adjustment transfer).

--Direct COVID-19 costs: 1.0%

--Deferred Care & Pent-Up Demand: 2.5%

--Economic Factors: 0.0%

--Population Health Morbidity: 0.5%

--Provider Reimbursement: 1.5%

--Risk Adjustment Payment/Charge: Statewide Avg. Premium: 4.5%The morbidity adjustment also reflects the anticipated combined impact of COVID-19-related cost drivers on healthcare utilization and intensity in 2021, including the following:

1) Direct cost of acute COVID-19 treatment, testing, and vaccination.

2) Pent-up demand as deferred care passes through the healthcare system following social distancing “lockdown” measures.

3) Morbidity impact of economic disruption in the form of job terminations, leading to enrollment shifts from employer sponsored coverage to individual ACA and from individual ACA to Medicaid or uninsured.

4) Morbidity impact of lasting population health changes precipitated by the pandemic, including healthcare complications following recovery from severe cases of COVID-19, and worsened health outcomes due to deferred or avoided preventive care and maintenance care for chronic conditions during social distancing lockdown periods

CIGNA OF TN:

COVID-19 pandemic impact: CHLIC estimates that healthcare costs in the individual market will increase by 1% in 2021 compared to the pre-pandemic expectation for 2020.

OSCAR OF TN:

The starting claim experience was adjusted from the manual period to the projection period to reflect the anticipated impact of pent-up demand, the introduction of antibody testing, vaccination costs, and market morbidity associated to membership migration from the employer markets in response to the COVID-19 pandemic on the individual market in Tennessee. Future regulatory, legislative, or economic changes may affect the extent to which the rates presented herein are neither excessive nor deficient.

Impact of the COVID-19 Pandemic

Scenario testing was performed for various macroeconomic forecasts to understand the sensitivity of varying unemployment rates and associated changes in market membership to the individual market in Tennessee. In the baseline forecast, Oscar is projecting an unemployment rate that is expected to peak at 15.0% in Q4 2020 and Q1 2021. The resulting impact on anticipated market membership for the 2021 plan year is net growth of 12.6%, which is primarily driven by quarterly SEP activity and membership migration from the employer markets — large group self insured, large group fully insured, and small group fully insured with distributions of 40.0%, 25.0%, and 35.0%, respectively. An adjustment was included to reflect changes in the anticipated market morbidity associated with anticipated membership migration across segments. The estimated impact on an allowed cost basis is -0.5%.

Oscar additionally applied an adjustment for the assumed pent-up demand cost associated with elective, non-emergent procedures that were delayed during the peak of the pandemic. Oscar relied upon the study titled Deferred Procedures to Pressure Near-Term EBITDA and published by J.P.Morgan on March 18, 2020 to help establish baseline parameters of what proportion of health spend is currently elective by service category. A plausible range suggests that 30.0% to 80.0% of elective, non-emergent services will be cancelled, but that the remaining services deferred will eventually take place towards the end of 2020 and throughout 2021. The estimated impact on an allowed cost basis is 1.7%.

Oscar is assuming the pandemic will persist into the 2021 plan year until an effective vaccine becomes available or widespread immunity is established. Treatment for COVID-19 includes, but is not limited to, inpatient care with varying severity, outpatient emergency services, medically necessary diagnostic testing, and primary care consultations. The estimated impact on an allowed cost basis is 0.3%.

Lastly, an adjustment was included to account for the anticipated costs associated with the introduction of a vaccination in the 2021 plan year. Oscar assumed a 35% adoption rate across the projected membership distribution and a cost of $75 to administer the vaccination. The estimated impact on an allowed cost basis is 0.3%.

UNITEDHEALTHCARE (NEW)

Impact of COVID-19. Given the significant amount of uncertainty, we are not making an explicit adjustment to the rates to account for the net impact of COVID-19 on the 2021 claim cost at this time. We recognize that there are potential offsetting impacts on 2021 claim costs as a result of incremental costs resulting from testing, vaccinations, COVID treatment and delayed medical services that would have been incurred in 2020 that are expected to be deferred until 2021. We have relied on UHC actuaries for this assumption.

Due to the rapidly changing landscape due to the coronavirus, Wakely and UHC would like to reserve the right to change the COVID-19 impact assumption up until the rates are approved, to the extent state and federal rules allow.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.