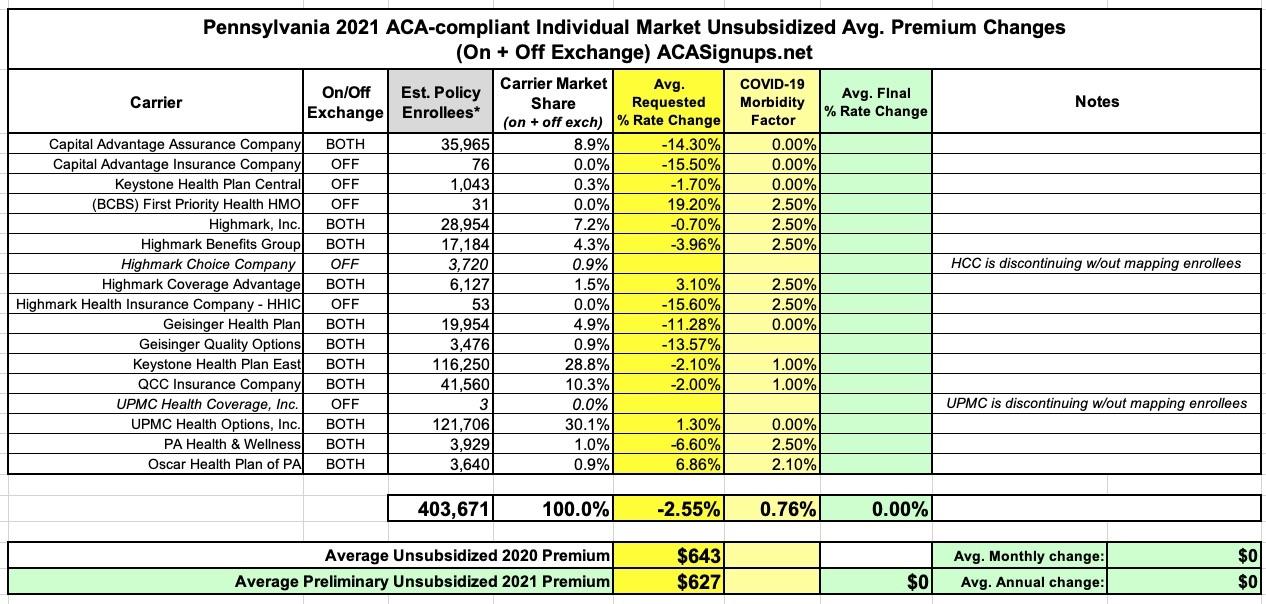

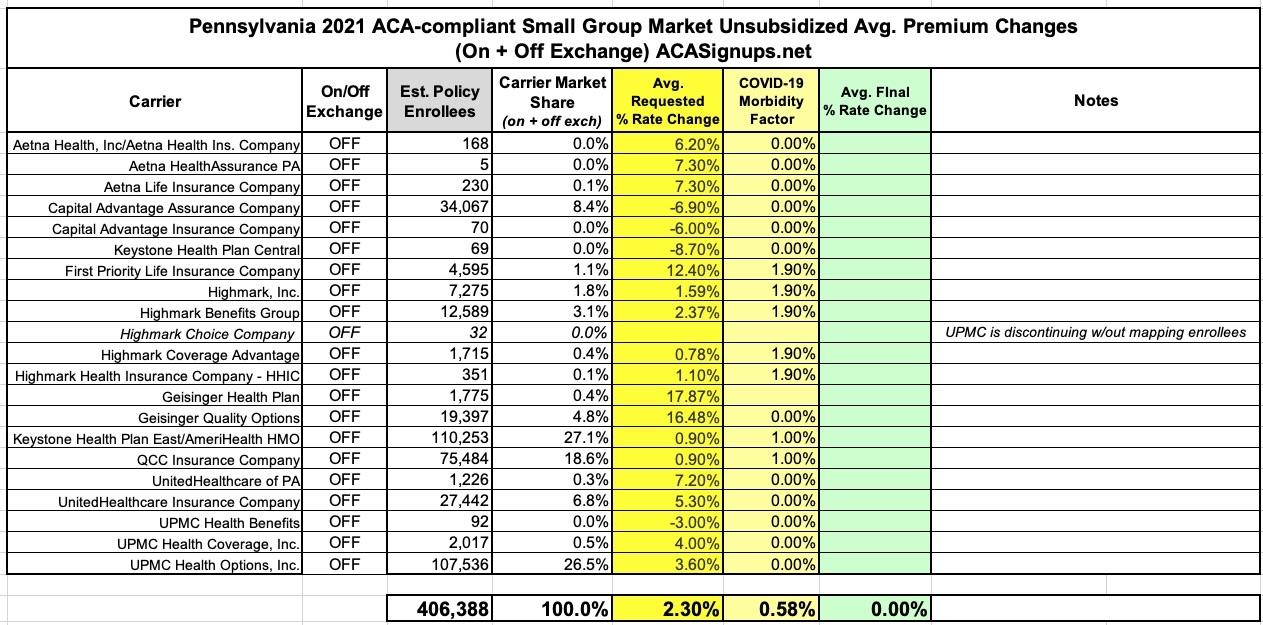

Pennsylvania: Preliminary avg. 2021 #ACA premiums: -2.6% indy market, +2.3% sm. group

Yesterday the Pennsylvania Insurance Dept. posted the preliminary 2021 rate filings for the individual and small group markets. On the surface, it appears that Pennsylvania has an absurdly competitive market, with 17 carriers listed on the indy market and 21 small group carriers...but when you look closer, many of these are simply branches of the same main company.

For instance, fully five of the individual market carriers are variants of "Highmark"...which is actually Pennsylvania's rebranding of Blue Cross Blue Shield. Two are branches of Geisinger and another two are both UPMC. The same is true in the small group market.

And don't even get me started about "Capital Advantage Assurance Company" and "Capital Advantage Insurance Company". Sheesh.

In any event, the overall rate filings average out to rougly a 2.6% premium decrease on the individual market and a 2.3% increase for small group plans, when weighted by carrier market share.

As for COVID-19, the trend we've seen so far in the other states which have released preliminary filings continues: It's a hodge-podge, with roughly half the carriers concluding that the pandemic won't have any net impact on 2021 premiums at all, while the other half are tacking on modest amounts just in case, and all of the carriers making sure to note that they reserve the right to refile their 2021 requests later this summer if the situation changes.

The actual rate filing summary tables for both markets are below; I've also listed some choice quotes re. COIVD-19 impact from various carriers:

Capital Advantage Assurance Company / Capital Advantage Insurance Company:

"COVID-19 adjustment of 1.0...No utilization adjustments are made for COVID-19."

Keystone Health Plan Central:

"No utilization adjustments are made for COVID-19."

First Priority Health:

"Pursuant to the Department’s July 10, 2020 COVID-19 Impact Guidance, the Company is adding a 2.5% morbidity load to account for anticipated increased claim expense in 2021 due to COVID-19."

Highmark:

Pursuant to the Department’s July 10, 2020 COVID-19 Impact Guidance, the Company is adding a 2.5% morbidity load to account for anticipated increased claim expense in 2021 due to COVID-19.

As an aside, note this ominous note which Highmark also threw into their filing memo:

Finally, modifications to the rate development may be necessary if significant unforeseen events occur. Examples include, but are not limited to, repeal or invalidation of the ACA or material developments in the course of the COVID-19 pandemic. As a result, Highmark reserves the right to submit a revised filing."

Also an important sienote: Highmark is phasing out one of their half-dozen sub-brands, Highmark Choice Company:

The proposed 2021 rate change does not apply. HCC is discontinuing all 2020 plans without mapping the 2020 enrollees into the one new plan.

- Current number of covered lives as of February 1, 2020: 3,720 covered lives

- Number of plans offered in 2021 and the change this represents from 2020: 1

The Company offered 20 plans in 2020. For 2021, the Company is offering 1 new plan in the Market and removing 20 plans from the Market. Please note that inclusion of premium rates in this filing for a given offering should not be construed to mean that the offering will ultimately be made available for sale in the Market. Final offering decisions will be made consistent with and within the timelines set forth in CMS rules and/or ACA regulations."

It sounds like they have to technically "offer" a single plan under this sub-brand for technical/legal reasons, but won't actually be making it available for sale. This has been done before by carriers which don't want to be banned from the market for five years (a clause in the ACA itself), but I don't think that's what's happening here since Highmark isn't leaving the market entirely, they're just stopping offers of this particular branding. I could be wrong, though.

GEISINGER HEALTH PLAN / GEISINGER QUALITY OPTIONS:

All documents continue to reflect our assumption that COVID 19 does not impact the 2021 ACA markets.

KEYSTONE HEALTH PLAN EAST:

COVID-19 Impact: Morbidity was increased by an additional 1% to account for the impact of COVID-19 on overall projected claims.

QCC INSURANCE CO:

Morbidity was increased by an additional 1% to account for the impact of COVID-19 on overall projected claims.

UPMC HEALTH COVERAGE, INC:

Due to the fact that the lone plan currently offered under the captioned company and market is being discontinued for 2021 and the three members enrolled are not being mapped to a new plan in 2021, it is not possble to calculate rate increases in Tables 10 and 11 of the PA Actuarial Memorandum Exhibits or section I, worksheet 2 of the URRT.

Yeah, when you only have three people enrolled in one of your divisions, probably not a bad idea to phase it out. Not sure why they don't just map them over to UPMC Health Options instead, though:

UPMC HEALTH OPTIONS, INC:

UPMC has revised its previously adopted COVID-19 morbidity factor adjustment from 2 percent to a net zero impact for 2021. While we believe that the entire range of the Department’s allowable COVID-19 morbidity factor is supportable, we believe the net zero impact will be most advantageous to consumers. As further support for adopting a net zero impact, we note that UPMC’s original estimates of COVID impact relied in part on publicly available analysis provided by Milliman and Wakely. Since the time of the Round 2 submission, UPMC has had the opportunity to incorporate into our modeling additional credible analysis that has substantially expanded the range of our assumptions with respect to COVID-19 impact. Specifically, a recent Society of Actuaries (SOA) study (“Impact of COVID-19 on Deferred Medical Costs and Future Pent-Up Demand,” April 2020) suggests that the 2021 impact of COVID could in fact be much lower and occur on a substantially different timeline than those incorporated in the Milliman and/or Wakely assumptions. We believe there is a reasonable likelihood that any additional morbidity due to COVID will be substantially confined to 2020 experience, which if ignored represents an increased risk of unnecessary premium increases for members in 2021. While many variables and factors are relevant to projections of COVID-19 impact, we believe it is notable that our internal hospital census data is tracking similarly to that hospital utilization described in the SOA study. Additionally, survey data from the Kaiser Family Foundation (“KFF Health Tracking Poll - May 2020,” published May 27, 2020) indicates that, while a substantial number of households have deferred care during the pandemic, this has not resulted in widespread deterioration of health/condition. Again, while we recognize that this is only one of myriad possible outcomes and believe that the entire COVID morbidity range is supportable, this more conservative assessment will be in the best interests of consumers. On this basis, we have incorporated a COVID-19 morbidity factor of zero in our current submission.

PA HEALTH & WELLNESS:

Incorporated a 2.5% adjustment to morbidity on Table 5 to account for the anticipated cost of the COVID-19 pandemic, consistent with the Pennsylvania Insurance Department’s Final COVID Guidance to Issuers dated July 10, 2020

This "PA Insurance Guidance" reference shows up several times by various carriers.

OSCAR HEALTH PLAN OF PA:

"Oscar is assuming the COVID-19 pandemic will persist into the rating period until an effective vaccine becomes available or widespread immunity is established. Oscar is projecting that the COVID-19 pandemic will increase 2021 allowed costs by approximately 2.1%. This adjustment reflects the anticipated combined impact of COVID-19-related cost drivers on healthcare utilization and intensity in the rating period, including the following:

- Direct cost of acute COVID-19 treatment including inpatient care with varying severity levels, outpatient emergency services, and primary care consultations.

- Cost of vaccination.

- Pent-up demand as deferred/elective care passes through the healthcare system following decreases in social distancing measures.

- Morbidity impact of economic disruption in the form of job terminations, leading to enrollment shifts from employer sponsored coverage to individual ACA and from individual ACA to Medicaid or uninsured.

The following additional considerations were taken into account, but no explicit adjustment was made:

- Cost of antibody testing.

- Changes in provider reimbursement associated with the COVID-19 pandemic, and its impact on provider finances and capacity.

- Morbidity impact of lasting population health changes precipitated by the pandemic, including healthcare complications following recovery from severe cases of COVID-19, and worsened health outcomes due to deferred or avoided preventive care and maintenance care for chronic conditions during social distancing period. "

SMALL GROUP: FIRST PRIORITY LIFE INS. CO:

The Change in Morbidity – All Other factor was increased by 1.9% to reflect the estimated impact of COVID-19 on 2021 claim costs. The drivers of the increase are costs directly related to COVID19, such as a possible vaccine and continued cost sharing waivers, as well as other care delivery changes. Due to these factors we are currently estimating an impact to 2021 claim costs of 1.9% in the PA Small Group ACA market. The components of the adjustment are discussed below.

COVID-19 Treatment Costs (1.6% increase in 2021 claims): The primary driver for 2021 is the cost of a potential new vaccine. We assume a vaccine is available and 90% of members get it in 2021, either in the office or at a retail pharmacy. Additionally, we assume some vaccines will be administered in an additional office visit with waived cost sharing. Also, we assume COVID-19 testing will be required before any outpatient procedure.

Care Delivery Change (0.3% increase in 2021 claims): We assume some increase in cost of care due to member health deteriorating slightly. Additionally, we assume a higher intensity of services per visit as providers re-engage with their patients. Finally, we assume some care will be shifted to more expensive sites of service."

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.