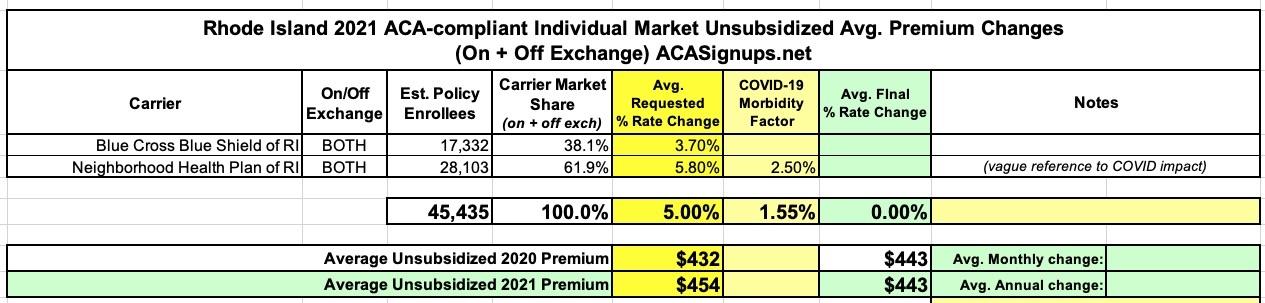

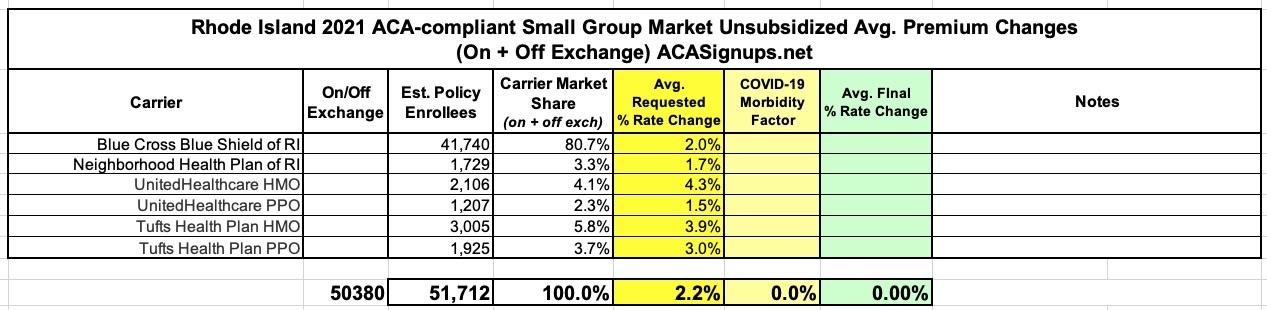

Rhode Island: Preliminary avg. 2021 #ACA premium rates: +5.0% (or 4.8%) indy mkt, +2.2% sm. group

via the Rhode Island Insurance Dept:

2021 Requested Commercial Health Insurance Rates Have Been Submitted to OHIC for Review

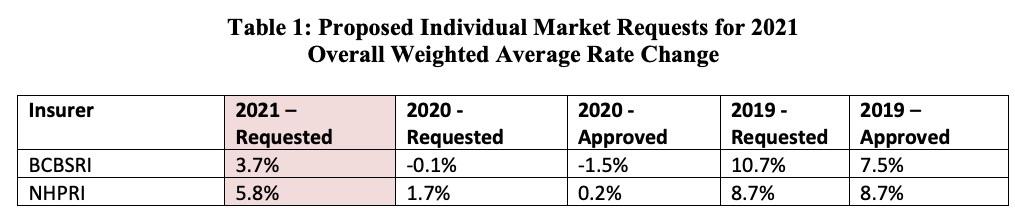

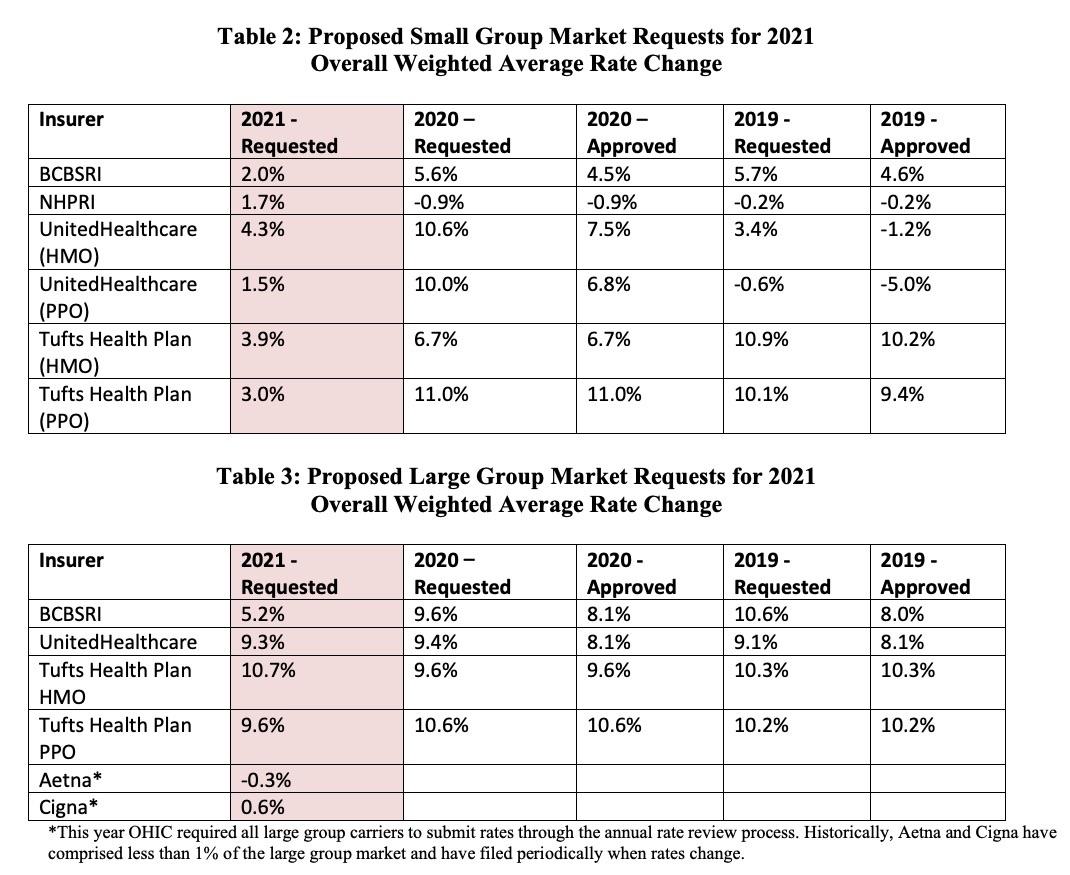

CRANSTON, R.I. (July 21st, 2020) – The Office of Health Insurance Commissioner (OHIC) today released the individual, small, and large group market premium rates requested by Rhode Island’s insurers. The requests were filed as part of OHIC’s 2020 rate review and approval process (for rates effective in 2021). Tables 1 – 3, below, summarize the insurers’ requests for 2021, and provide the requested and approved rate changes for the previous two years. Two insurers, Blue Cross Blue Shield of Rhode Island (BCBSRI) and Neighborhood Health Plan of Rhode Island (NHPRI) filed plans to be sold on the individual market for persons who do not receive insurance through their employer. In addition to BCBSRI and NHPRI, UnitedHealthcare and Tufts Health Plan filed small group market plans. Five insurers (BCBSRI, UnitedHealthcare, Tufts Health Plan, Aetna, and Cigna) filed large group rates.

Requested average rate increases ranged from 3.7% to 5.8% in the individual market. In the small group market, carriers requested average increases ranging from 1.5% to 4.3%, a significant moderation compared to last year. Large group market average rate changes range from -0.3% to 10.7%. Key factors influencing the rate requests for 2021 are increases in the cost of health care services, including prescription drug cost trends driven by new drug treatments and price increases. The rate requests also reflect the indefinite suspension of the federal health insurance tax, which has helped restrained overall rate increases. OHIC will review all pricing assumptions, administrative charges, and other information to assess the reasonability of the premium requests by each insurer. The Commissioner may approve as filed, modify, or reject an insurer’s rate filing consistent with powers vesting in the Office by the Rhode Island General Laws.

Note that there's no mention of COVD-19 as one of the "key factors", which is especially noteworthy given that Rhode Island has been one of the worst-hit states. Some of the individual carriers may mention it, however; I'll discuss that below.

Rhode Island also includes an interesting breakout of the rate change requests for every carrier/market, which is a first:

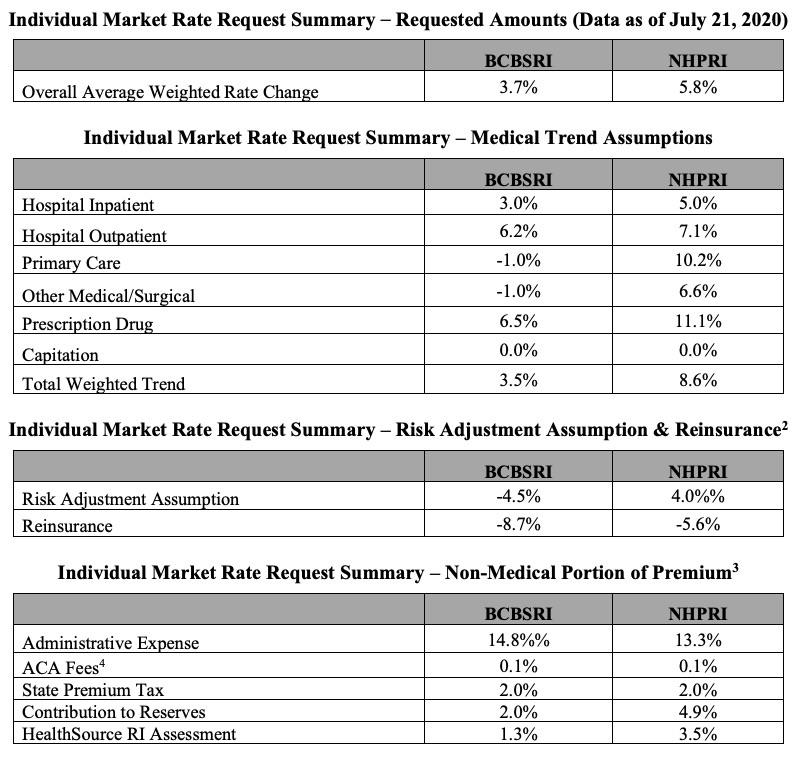

There are 32,537 individual policies covering a total of 45,435 consumers enrolled in individual market plans with these carriers (data as of March 2020). This represents approximately 23.5% of the fully-insured market (individual, small group, and large group markets).

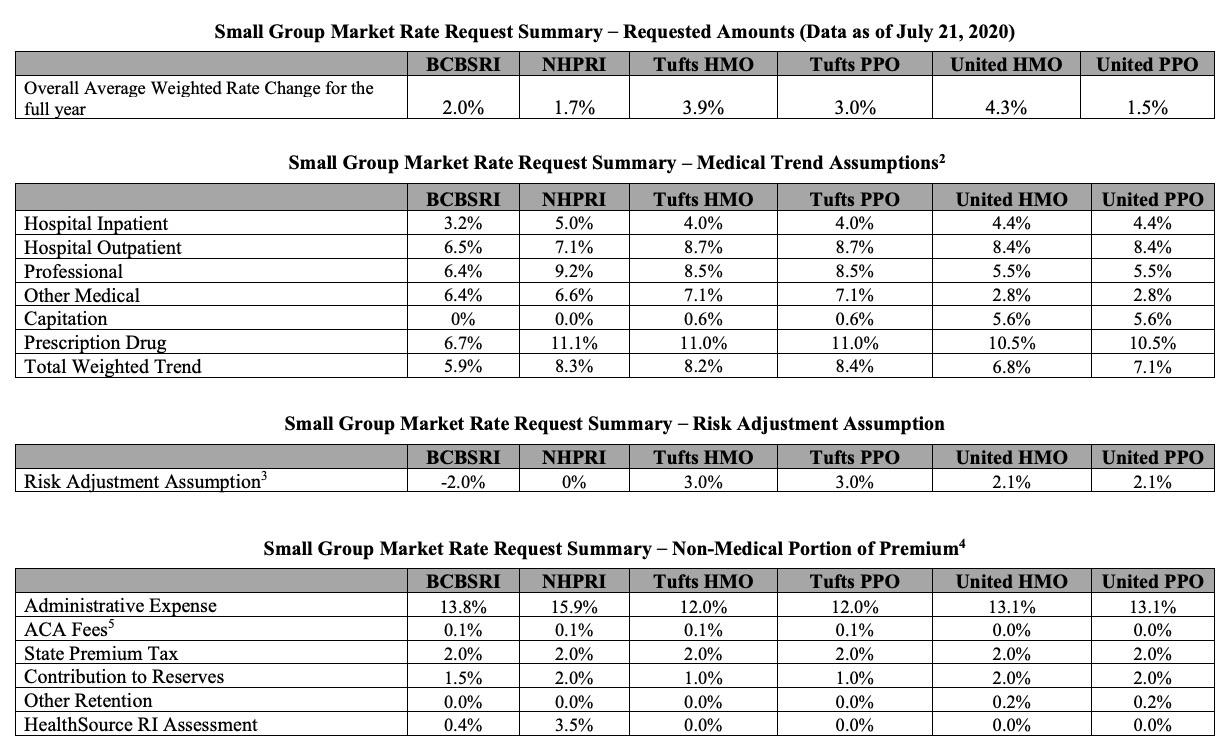

There are 50,380 consumers enrolled in small group market plans (data as of March 2020). This represents 26.1% of the fully-insured market (individual, small group, and large group markets).

Here's how these translate into actual weighted averages across the individual and small group markets (I've never tracked the large group market premiums at the same level of detail and don't see any need to do so here, but I'm glad they included it...very few states do so):

On the individual market, Blue Cross Blue Shield doesn't mention COVID-19 at all. They do give a precise number of enrollees (17,332), which means the remaining 28,100 or so should be enrolled in Neighborhood Health Plan policies.

Neighborhood Health Plan does mention COVID-19 as a factor, but doesn't go into any detail beyond this:

Key drivers of this rate increase, further described below, include:

- Financial experience of the products

- Changes in plan design to meet actuarial value requirements

- Uncertainty and additional costs associated with the COVID-19 pandemic

...Another driver of premium increases includes changes in enrollment in 2019 and 2020, increasing medical costs on paid claims for our members resulting in an approximate 8.6% medical/prescription drug trend assumption. Components of this trend also includes increase in unit costs of medical services due to inflation, increased medical utilization, increases in specialty drug expenses, technology advances in medicine, equipment and drugs, changes in network provider contracts, and other factors. To ensure members are getting the best high quality, cost-effective health care, Neighborhood regularly reviews medical expenses to find innovative ways to decrease medical costs for our members.

Oddly, the consumer summary lists Neighborhood's avg. 2021 rate increase request as only being 5.5% instead of 5.8%. I'm not sure what to make of that...if true, this would reduce the weighted average (see below) from 5.0% to 4.8% statewide. In the full actuarial memos, they do go into more detail...2.5% of the total premium cost:

Although there is uncertainty around the impact COVID-19 will have on setting premium rates, we have developed assumptions for this impact based on a likely pandemic scenario. This scenario takes into account the specific nature of Rhode Island’s and NHPRI’s economic and health risks as selected by NHPRI. Based on this scenario modeling, we incorporated a premium rate adjustment to reflect the estimated financial impact of the pandemic in 2021. These adjustments are formed based on assumptions regarding the spread of the disease, including, but not limited to, how many people are infected in a population, how that infection rate is different by age / gender, and how severe those infections are across the population. Scientific knowledge of these items is incomplete and new data on the spread of COVID-19 in the United States is still emerging. In addition, actions taken by federal and local Rhode Island governmental authorities and the healthcare system related to the COVID-19 pandemic are rapidly changing. Consequently, our analysis will evolve as new information becomes available and new actions are taken by the authorities and other stakeholders. Due to the limited information available on the pandemic, any analysis is subject to a substantially greater than usual level of uncertainty. NHPRI reserves the right to amend this Actuarial Memorandum and premium rates as more information becomes available that might impact the extent to which premium rates are either excessive or deficient.

4.3.7 Impact Due to COVID-19

NHPRI expects the COVID-19 pandemic will impact expected claim costs for 2021 due to a number of factors. This impact considered items such as the level of delivered services, population mix and extra costs due to the pandemic. We acknowledge there is substantial uncertainty regarding the impact of the COVID- 19 pandemic on potential 2021 costs, but based our assumption on information available at the time these rates were prepared.

To reflect the expected impact of the COVID-19 pandemic, reflecting items such as the level of delivered services, population mix and extra costs due to the pandemic (2.5% of premium)

As for the small group market, I'm a little confused by the insurance dept. guidance above. It says that the overall average weighted increase for the full year for BCBSRI is 2.0%. However, according to the actual BCBSRI memo:

This filing is being made to establish new rates to be used effective January 1, 2021 for BCBSRI’s portfolio of plans in the Small Group market. The proposed weighted average rate year increase for the Small Group market is 3.6%. This average premium increase was developed with regard to the entire Small Group market across all four quarters of 2021. The Q1 weighted average premium increase is 2.0 %. Given the difference between average increases each quarter in 2021, providing the average increase across the four quarters is a better representation of the increase small groups will experience in 2021. The actual rate impact on any given small employer group will depend on the age of its enrollees, and the plan selected.

This makes it sound like the state insurance dept. is listing the wrong increase, and that the 4-quarter average is actually 3.6%. Not sure how to handle that beyond this note about the discrepancy.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.