Mazel Tov to the #ACA on its bar mitzvah! #ACA13 (Part 7)

Note: I'm breaking this analysis into several sections:

Part 1 / Part 2 / Part 3 / Part 4 / Part 5 / Part 6 / Part 7

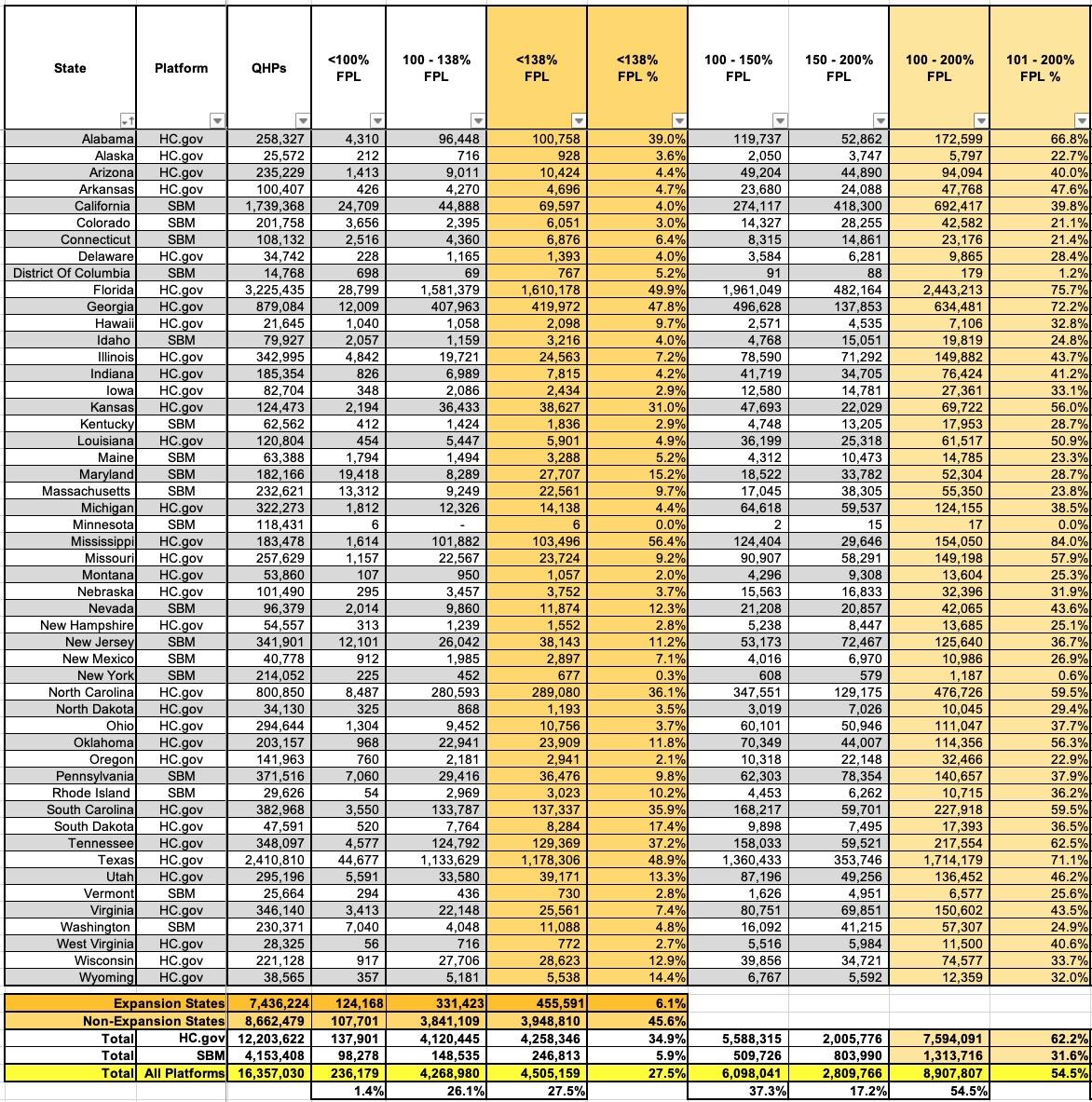

Finally, we come to HOUSEHOLD INCOME BRACKETS.

This is, of course, extremely important since household income is one of the most critical factors in calculating how much financial assistance enrollees receive, as well as whether or not they're eligible for Advance Premium Tax Credits (APTC).

I've broken the table below into two sections since it has so many columns. The first breaks out national enrollment by state for various income brackets up to 200% of the Federal Poverty Level (FPL); the second breaks it out for incomes over 200% FPL.

The first noteworthy numbers are those under 138% FPL. This is critical since ACA Medicaid expansion covers residents who earn up to 138% FPL (technically 133%, but there's a 5% "income disregard" making it effectively 138%). I've summarized these exchange QHP enrollees below, and there's several important totals:

- While APTC assistance is normally only available to enrollees earning more than 100% FPL, there are some exceptions to this:

Estimated household income at least 100% of the federal poverty line. You may qualify for the PTC if your household income is less than 100% of the federal poverty line and you meet all of the following requirements:

- No one can claim you as a dependent for the year.

- You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

- The Marketplace estimated at the time of enrollment that your household income would be at least 100% of the federal poverty line for your family size for 2022.

- APTC was paid for the coverage of one or more months during 2022.

- You otherwise qualify as an applicable taxpayer (except for the federal poverty line percentage).

Alien lawfully present in the United States. Certain aliens with household income below 100% of the federal poverty line are not eligible for Medicaid because of their immigration status. You may qualify for the PTC if your household income is less than 100% of the federal poverty line if you meet all of the following requirements.

- No one can claim you as a dependent for the year.

- You or an individual in your tax family enrolled in a qualified health plan through a Marketplace.

- The enrolled individual is lawfully present in the United States and is not eligible for Medicaid because of immigration status.

- You otherwise qualify as an applicable taxpayer (except for the federal poverty line percentage).

As a result of these exceptions, it looks like roughly 236,000 exchange enrollees (1.4% of the total) earn less than 100% FPL.

- In NON-EXPANSION states, there's nearly 4 million exchange enrollees who earn less than 138% FPL (3.95M to be precise).* If every remaining holdout state were to expand Medicaid today, the Medicaid roles would swell by nearly 4 million people...while simultaneously reducing exchange QHP enrollment by nearly 25%, down to around 12.4 million or so.

- Those 3.95 million make up a stunning 45% of all exchange enrollment in non-expansion states...with nearly 2.8 million of them in Florida and Texas alone. If FL & TX were to expand Medicaid, their QHP enrollment would be lopped in half, putting California back on top as having the highest exchange enrollment by far (1.74M vs. around 1.62M and 1.23M respectively).

- Even more interestingly, even in the states which have expanded Medicaid, there's still 456,000 QHP enrollees who earn less than 138% FPL. Officially these folks should be enrolled in Medicaid instead, but I'm assuming there are various "special case" reasons why they aren't. I'm sure Louise Norris will have the answers on this one as she always does :)

UPDATE: Sure enough, Louise Norris reminded me that in most states, documented immigrants aren't eligible for Medicaid for the first five years they live in the U.S. but they are eligible for ACA exchange subsidies as long as their income is under 138% FPL, odd as that may sound...in fact, they're eligible for subsidies if their income is below 100% FPL, which is even more surreal given that U.S. citizens aren't usually eligible for APTC below that threshold.

*(this includes North Carolina and South Dakota, since neither of their recently-passed Medicaid expansion laws go into effect for at least several months)

Turning to the 100 - 200% FPL range (and ignoring Medicaid expansion), nearly 55% of all exchange enrollees fall into this income range (56% if you include those under 100% FPL as noted above). That's just over 8.9 million people total, and with extremely rare exceptions, just about every one of them should be enrolled in a Silver plan, aka "Secret Platinum", since the extremely generous Cost Sharing Reduction (CSR) assistance in the 100 - 200% FPL range turns Silver plans (which normally have a ~70% Actuarial Value) into either an 87% or 94% AV plan...effectively Platinum (90% AV). In layman's terms, High CSR Silver plans have either free or extremely low premiums along with extremely low deductibles/co-pays and so on.

At first glance, it might appear that 100% of this population is indeed enrolled in Silver plans...after all, the prior table showed that almost the exact same number of total enrollees have done so (8,907,979 enrolled in Silver; 8,907,807 earning 100 - 200% FPL). However, this is likely a coincidence; there's almost certainly several million people in this income range who enrolled in Bronze plans when they shouldn't have (and even a small number who likely enrolled in Gold plans). In most cases, those folks are leaving hundreds or thousands of dollars in federal assistance on the table which they likely can't afford to.

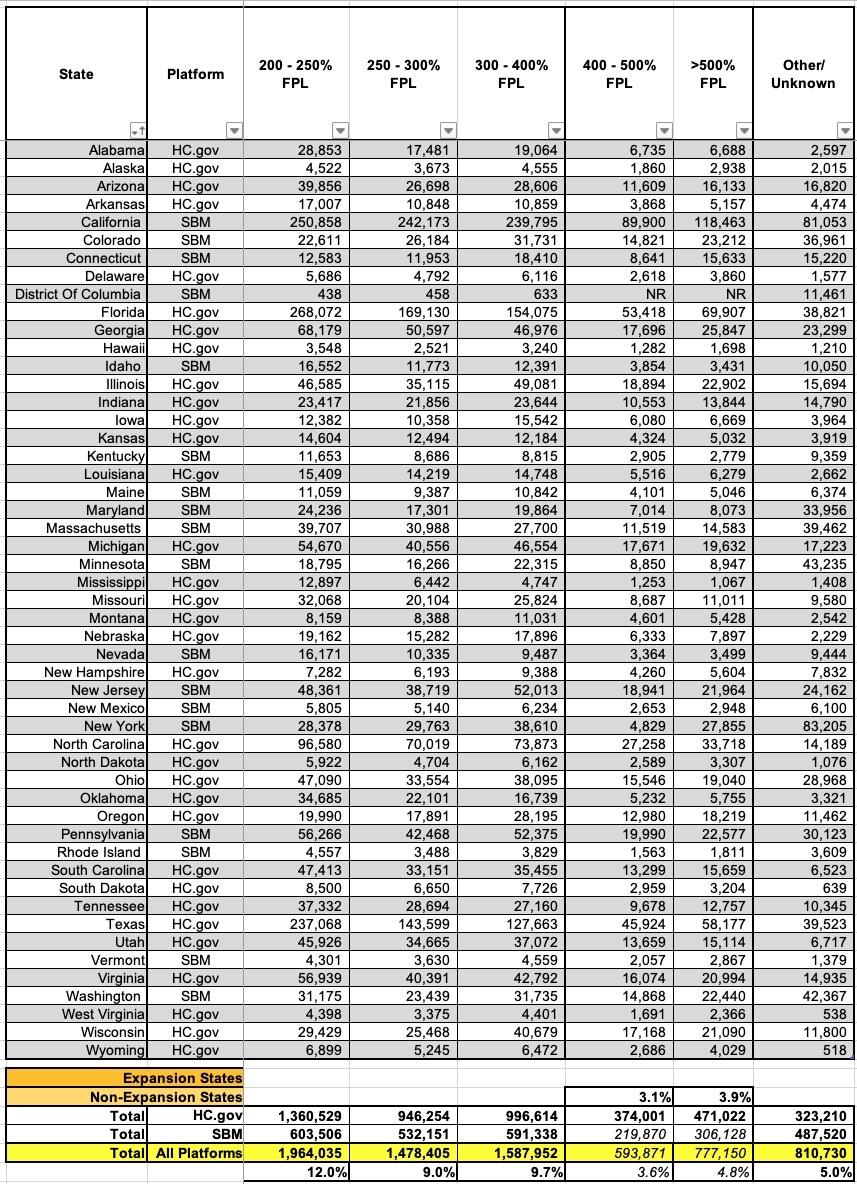

Next, let's look at exchange enrollees who earn more than 200% FPL. There's at least 6.4 million of these folks. Here things get murkier: Nearly 2 million of them are eligible for low-CSR (73% AV) Silver plans, but that extra ~3% in cost sharing assistance doesn't always reduce the deductible/etc. enough to give it a clear & obvious advantage over Bronze or Gold plans. I could go either way for some of these cases; it depends on the specific network, carriers available and so on.

If you earn more than 250% FPL, however, and you live in a state with strict, maximized Premium Alignment rules in place, you're probably going to be far better off with a Gold plan (or possibly even Platinum, if one is available) than a Silver one. Alternately, you might be better off going with Bronze if you're higher income.

However, since fewer than 2 million exchange enrollees chose Gold nationally this year, there's obviously quite a few people who, once again, didn't make the wisest choice. On the other hand, the Premium Alignment situation is all over the map (literally) and most people have no clue what it is or whether their carrier has priced their policies that way anyway. In addition, a less expensive Gold plan doesn't do you much good if the Silver plan from a different carrier has the provider network you require.

There's also around 810,000 enrollees whose household income is unknown for various reasons (likely because the enrollee never bothered even asking for APTC estimates, which probably means they're higher income). The actual Public Use File says "Other/Unknown" for the heading, but given that the listed income brackets range from "under 100% FPL" to "over 500% FPL" I'm not sure what "other" could be.

It's worth noting that the PUF It lists the 400 - 500% and >500% columns as "unknown" for state-based exchanges...but the only listing where this number is actually missing is the District of Columbia. Given that those numbers could only be up to ~11,000 or so no matter what (out of nearly 16.4 million), I've filled in the blank fields at the bottom (italicized).