Dear Democrats: I'm the guy who's moving heaven & earth to get the tax credits extended, and I'm telling you not to cave for a short-term fix.

This is gonna be one of the stranger references I've made on this site, but bear with me.

Back in 1996 there was an HBO movie called "The Late Shift" which told the story of the Late Night TV show battle between David Letterman and Jay Leno over who would succeed Johnny Carson as host of The Tonight Show. As stupid as this may sound today, this was actually a Really Big Deal in the '90's...one of those absurd pop culture stories which dominated the headlines and the tabloids for several years.

The movie itself was decent, with some interesting casting including Kathy Bates and Treat Williams, but nothing special. The main problem is that the audience is expected to root and feel sympathy for a couple of dudes who were already rich & famous and who would both continue to be rich & famous no matter how the story played out. The stakes weren't exactly the fate of the world, is what I'm saying.

However, there was a scene near the end of the film which seems relevant to me today. After months of all sorts of legal & PR shenanigans, Letterman's producer manages to finally get NBC to give Letterman an offer to take over the Tonight Show...maybe. Sort of. The wording of the offer has a lot of loopholes and vague language.

Letterman, who has spent his entire life dreaming of hosting The Tonight Show, is anguishing over whether to take the offer or not, and has this discussion with his producer:

Dave: "I'm still thinking of taking it. I want that show!"

Pete: "What show?"

Dave: "I deserve that show!"

Pete: "Johnny's show? Don't you get it David? They are not offering you the Johnny Carson Tonight Show; that's gone forever. They're offering you damaged goods. They're offering you the Jay Leno show. And they're not even offering it now; they're making you wait."

Dave: "I lost that show once, Pete. I'm not gonna do it again. I can't..I just can't say no."

Pete: "Then don't say yes yet. Make one more phone call."

Dave: "Jeez...why are you doing this to me? Don't you understand? I don't care. I cannot lose the Tonight Show twice...once to Jay Leno, and once because I was too dumb to take a second chance. They're offering me a second chance, Pete!"

Pete: "David, you don't understand: I'm the guy who moved heaven and earth to get you that second chance, and I'm telling you...it's not right. It's leftovers. It's shoddy."

I thought of this scene, and Pete's final words, as I read stories about the upcoming federal government funding battle in the U.S. Congress. As Josh Marshall puts it over at Talking Points Memo:

...there’s a big argument among Democrats about the looming shutdown fight. Senate Democrats seem set on making it a negotiation about Obamacare subsidies, the biggest part of the BBB cuts that kick in before 2026. Meanwhile, you have a growing chorus of people who aren’t Senate Democrats saying this is wrong. It’s not time for small-bore policy revisions. You’ve got to do something dramatic to rein in Trump’s increasingly dictatorial rule...

...But if you’re going to have a confrontation, you need to make that stand on the issue where your issue advantage is the greatest. And that’s on the health care subsidies.

...There’s already a slice of Republicans who very much want to [extend the subsidies...temporarily]. That’s mostly the endangered members in the House and to a degree in the Senate. The leadership and White House won’t say so of course but they’d probably like to kick those cuts past the 2026 midterms as well.

...If the optimal plan is to force a confrontation on the most salient and Dem-leaning issue, then what Senate Democrats are planning is the exact opposite of that because they’re trying to avoid a confrontation.

I don't think it's an exaggeration for me to say that there's literally been no bigger champion of extending the ACA's enhanced Advance Premium Tax Credits (eAPTC) which have been in place since 2021 than me.

I've spent years pushing for the formula to be made dramatically more generous, and I've spent the better part of the past year obsessing over exactly how many enrollees will be damaged and by just how much in every state across the country if the current APTC structure reverts back to where it was prior to 2021. Tracking this sort of data is the very DNA of ACA Signups, after all.

This is also true on a personal level: Both my wife and I are self-employed and have relied on ACA exchange coverage off and on over the years (we switched to her university plan when she went back to school to get her counseling degree a few years back, but moved back onto an exchange plan after she graduated a year or so ago).

I'm not going to go into the specifics of our income beyond stating that it varies widely from year to year, generally ranging between 300 - 500% of the Federal Poverty Level.

Furthermore, one of us has a fairly expensive chronic medical condition which requires ongoing treatment.

While we're definitely better off overall than millions of other ACA enrollees, this means that the elimination of the much-hated "Subsidy Cliff" at 400% FPL was always a constant fear of ours, as moving even $1 over that cap used to mean the difference between paying less than 10% of our income in premiums, or having to pay full price, which (given our requirements) can still top 25% of our gross income as it stands...and assuming eAPTCs do expire, our provider network requirements mean that our current plan would likely end up costing us at least $11,000 more next year.

Since there's no way we can afford that type of hit (especially on top of the other Trump tariff inflation swirling around every other purchase in our lives), we'd have to downgrade to a worse plan with far higher deductibles & co-pays.

My point here is that while there are certainly many families in an even worse situation than ours, this is not a case of us living in a golden tower while dictating the sacrifices that the masses should make either: If the eAPTCs expire, we're seriously screwed right along with millions of other families.

EVEN SO...

And a confrontation isn’t just good in the abstract or the way to have some kind of blue-state catharsis. Without a big confrontation, it’s just a Senate sausage-making deal like every other continuing resolution negotiation. No one who’s not very plugged into politics and thoroughly committed in their politics will even know it happened. Most of the people who are going to be hit by those subsidy hits don’t even know about it yet. And if Democrats “win” this it will be as though it never happened at all.

... So that whole plan is one that does nothing for Obamacare recipients or for Democrats electorally or to help the country try to fight off an authoritarian takeover.

If the decision is that you make this fight over health care coverage, you’ve got to up the ante substantially. That means bringing back the Obamacare subsidies on a permanent basis and the Medicaid budgets that were cut as well. They’re both really really important.

...I’ve already made my argument for why you want to get in the authoritarian takeover issues too...But if you want to draw the line on bringing back everyone’s health care, you need to do it like this, by pushing for everything. A lo-fi bit of horse trading to bring back the subsidies for six months only to cut them again after Democrats have no chance to do anything about it is bad on every front.

One minor quibble: The "agreement" is supposedly for a 1-year extension of the eAPTC (thru 12/31/26), not 6 months, but the point is made.

As he says, ideally Democrats shouldn't raise a finger to avoid a government shutdown this time around without ironclad guarantees that the Trump Administration's worst abuses of power and lawlessness will be reined in.

This includes things like:

- ICE gestapo running out of control;

- His military invasions of U.S. cities;

- Deporting civilians and non-civilians alike to torture prisons both locally and abroad;

- Imposing tariffs left & right without Congressional approval;

- Being required to actually spend Congressionally-allocated funding on the projects and programs that Congress, you know, allocated them for.

HOWEVER, if you're going to focus on "kitchen table economic issues" and the like, for God's sake at least don't go small bore on those.

You know I'm a pretty mainstream Democrat. I'm not demanding Medicare for All here. What I am urging on the healthcare front is for three clear demands:

- Restore the massive funding cuts to the NIH & other critical medical/scientific departments of the federal government;

- Repeal the draconian cuts to Medicaid (especially the disaster-as-a-feature-waiting-to-happen "work reporting requirements;" and...

- Make the enhanced ACA premium tax credits (eAPTC) permanent so we can avoid this Sword-of-Damocles worry which is paralyzing carriers, providers and enrollees every few years.

At a bare, bare minimum, do not settle for a one- or two-year extension of the eAPTCs.

Kicking this particular can down the road for only one or two years would not only be an absolute gift to Republicans politically (since it would push the pain out until just past the midterms, which is of course the only reason why any Republicans are willing to discuss doing so at all), but it would also mean we'd be right back here with the exact same scary headlines a year or two from now, with 24 million people never knowing whether their health insurance premiums are going to skyrocket from year to year.

Nothing is worse for the insurance industry than uncertainty, and anytime they're uncertain about anything you can be sure they'll jack up rates as a "just in case" cushion.

WITH ALL THAT SAID, I could see at least some room for negotiation on the specific parameters of the permanently extended enhanced ACA tax credits.

For instance: One legitimate criticism of how the ACA functions which was first reported on by Julie Appleby of KFF has been the rise of broker fraud, in which unscrupulous health insurance brokers have apparently been secretly either enrolling people into ACA exchange plans without the enrollee's knowledge or permission, or switching them from one plan to another without their knowledge/permission, in order to pocket the commission.

There are various ways this has been taking place, and there have been a variety of measures taken by both HelathCare.Gov and state-based ACA exchanges to crack down on this issue, but one reason the instances have grown over the past few years is because the eAPTC also mean millions more Americans have become eligible for $0-premium plans.

While this is a good thing in terms of administrative burden and affordability for very low-income enrollees, it does make it easier for brokers to commit fraud as well, since if the enrollee never actually receives an invoice (even for just $1 or so), they're far less likely to find out that they're even enrolled in an insurance policy (at least until they file their taxes the following year and have to reconcile their income vs. the APTC via IRA form 8962, that is).

One of the measures the Trump Administration is imposing on enrollees next year is a $5/month mandatory premium for current $0-premium enrollees who auto-renew their policies. This is supposedly being put into place to root out fraud, but a) the way it's being done has had a hold on it for being unconstitutional; and b) making it $5 is unnecessary if the sole point of the measure is to make sure enrollees know that they're enrolled early on.

One possible thing I could see Dems agreeing to would be to add a $1/month minimum net premium regardless of how much in APTC enrollees are otherwise eligible for. I'm not saying I'd be thrilled with this, but I could see that winning over support.

A second potential negotiation point would be at the upper end of the spectrum. The pre-2021 Subsidy Cliff kicked in at 400% of the Federal Poverty Level (FPL), which is $62,600/year for a single adult or $128,600 for a family of four. As I make crystal clear in my "Subsidy Expiration by State" project, this will go back to being absolutely devastating for families earning more than that.

The current sliding scale looks like the following:

- 100 - 150% FPL: 0% of income paid for benchmark Silver plan

- 150 - 200% FPL: 0 - 2% of income

- 200 - 250% FPL: 2 - 4% of income

- 250 - 300% FPL: 4 - 6% of income

- 300 - 400% FPL: 6 - 8.5% of income

- > 400% FPL: 8.5% of income

Here's what the sliding scale is currently scheduled to look like starting January 1st, after the enhanced thresholds expire and the Trump Administration's tinkering with the PAPI formula go into effect:

- 100 - 133% FPL: 2.1% of income

- 133 - 150% FPL: 3.14 - 4.19% of income

- 150 - 200% FPL: 4.19 - 6.6% of income

- 200 - 250% FPL: 6.6 - 8.44% of income

- 250 - 300% FPL: 8.44 - 9.96% of income

- 300 - 400% FPL: 9.96% of income

- > 400% FPL: n/a (full price)

One criticism of the elimination of the "Subsidy Cliff" is that it's theoretically possible that a family earning up to, say, $500,000 or more could still qualify for tax credits. This is true (especially in states with insanely high gross premiums like Alaska, West Virginia and Wyoming), but it's also disingenuous since:

- a) the amount of eAPTC those households qualify for is pretty nominal (literally $5month or less in some cases);

- b) those instances are extremely rare since you'd almost certainly have to be older than 55 or so for the benchmark plan to cost that much of your income, and almost everyone 55+ with that high of an income likely has employer benefits anyway; and

- c) people who have a corporate job which pays half a million dollars or more are likely receiving far more in tax credits via the Employer Sponsored Insurance Tax Exclusion anyway.

HOWEVER, if Republicans really want to be absolutely certain that there's no possibility whatsoever of Bill Gates or Elon Musk sponging $5/month in ACA tax credits, fine: Bring back the "Subsidy Cliff" at a much higher income threshold.

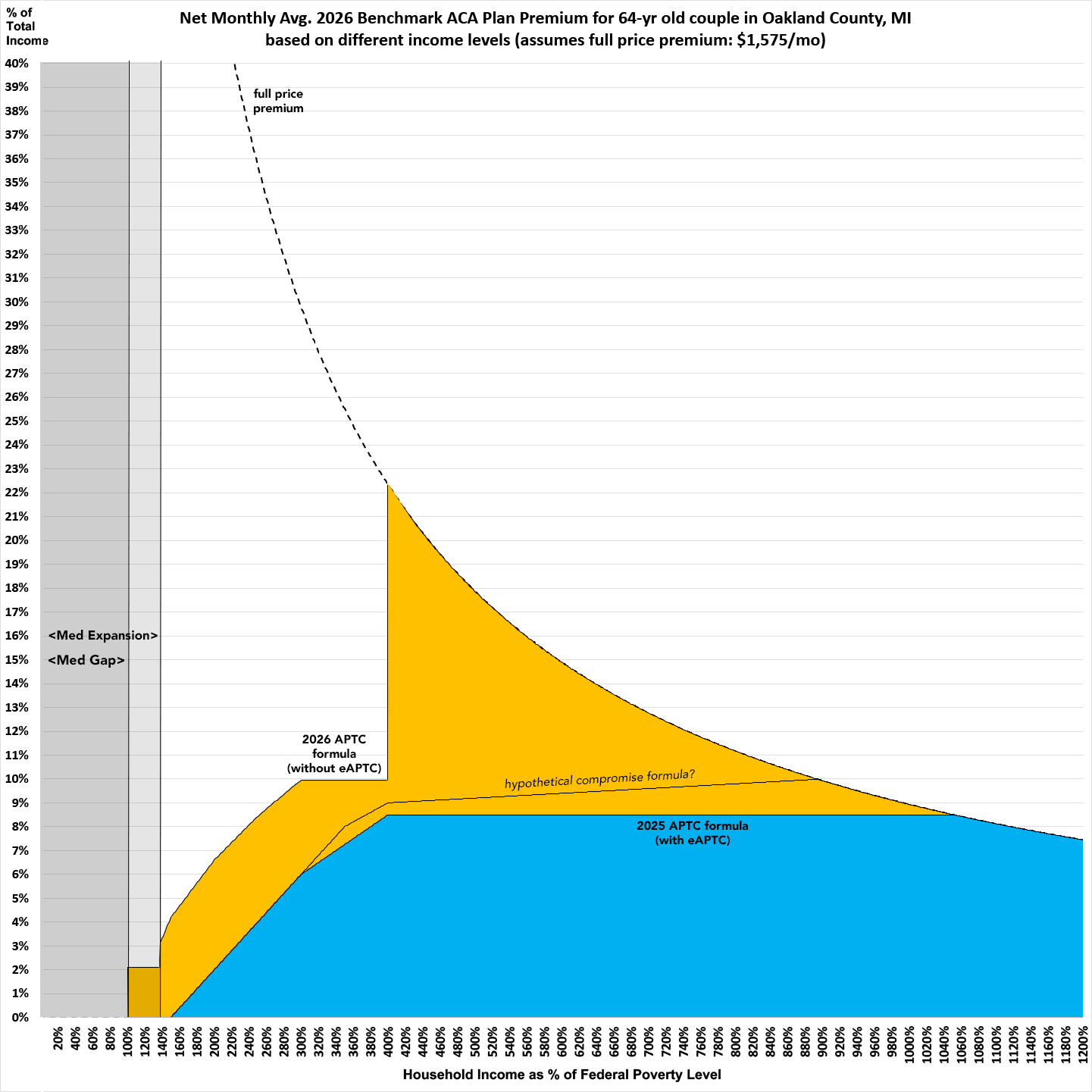

Below is what these look like visually...this is based on a 64-yr old couple in Oakland County, Michigan enrolled in the 2025 benchmark Silver plan; the actual 2026 plan will likely cost around 17% more at full price.

You see that orange area below? That's where legitimate negotiations could take place.

- While I'd prefer that the Subsidy Cliff not return at all, I could see negotiating to bring it back at a much higher income threshold...say, 1,200% FPL.

- While I'd prefer to keep the high-end 8.5% of income cap locked where it is, I could see compromising at a max of 9% at 400% FPL, or perhaps adding a tier at 10% around 800% FPL or whatever.

There's a number of other wonky, in-the-weeds technical tweaks you guys could debate, of course, but the larger point is that as long as it's made permanent, there is some wiggle room between the two...assuming an honest debate is on the table which, let's be honest, seems unlikely these days.

But if Trump is allowed to continue to ignore Congress and the Constitution whenever he feels like it, none of this will matter by the time the midterms come around anyway. Take a stand.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.