Good: Court puts hold on a batch of Trump Admin ACA rules! Bad: ...but not one of the worst ones

Back in March I wrote about a proposed rule (really a set of rules) put out by the Trump Regime's Centers for Medicare & Medicaid Services (CMS) which, if implemented, would make major changes to how the Affordable Care Act is administered. This rule was finalized in June, with some provisions kicking in immediately, most starting January 1st and others over the next couple of eyars.

This set of regulatory changes is completely separate from the impending expiration of the improved premium tax credits which I've written so much about; these have to do with the specifics of how the ACA is actually implemented going forward.

A very simple example of this is the length of the annual Open Enrollment Period, which has ranged from as long as 6 months during the very first OEP in 2013-2014 to as short as just 75 days during most of the first Trump Administration.

The HHS Secretary (via CMS Administrator Dr. Mehmet Oz) has considerable leeway when it comes to some of the nuts & bolts of administering the ACA, and there have been tweaks to how it's implemented every year under the Obama, Trump, Biden and (again) Trump Administrations.

However, there are limits to this leeway, and I'm thankful that at least some of the worse "tweaks" which were proposed by the Trump CMS this year--officially (and ironically) called the "2025 Marketplace Integrity & Affordability Final Rule"--have had the rug pulled out from under them...at least for the moment, anyway.

Before I get to the lawsuit, however, here's here's the major provisions:

1. Immediate Effect: APTC/CSR/BHP enrollment eligibility for DACA recipients RESCINDED

CMS is finalizing amendments to the definition of “lawfully present” to exclude DACA recipients, returning to the interpretation adopted in the 2012 Interim Final Rule (77 FR 52614). This change will make DACA recipients ineligible to enroll in a Qualified Health Plan (QHP) through the Marketplace, for premium tax credits, APTC, and cost-sharing reductions (CSRs), and for Basic Health Programs (BHPs) in states that elect to operate a BHP, reversing the 2024 DACA Rule. This policy aligns with statutory requirements and ensures that subsidies are reserved for eligible individuals.

This screws over up to 580,000 DACA recipients (although more realistically only around 100,000 of them were likely to be eligible for various reasons) for...absolutely no good reason whatsoever, other than Trump/MAGA hating immigrants...even those who have lived here virtually their entire lives.

2. December 31, 2025: Gender-Affirming Care can no longer be considered an Essential Health Benefit

CMS is finalizing that, effective beginning in plan year 2026, issuers subject to EHB requirements (that is, non-grandfathered individual and small group market plans) may not cover specified sex-trait modification procedures, as an EHB. In the final rule, CMS is also adding a definition of the term “specified sex-trait modification procedure” in response to comments and specifying that certain services would not qualify as a “specified sex-trait modification procedure” under this definition.

This policy will not prohibit issuers of coverage subject to EHB requirements from voluntarily covering specified sex-trait modification procedures, nor will it prohibit states from requiring coverage of such services, subject to the rules related to state-mandated benefits at 45 CFR § 155.170. This policy will align EHB with the benefits covered by typical employer-sponsored plans, as required by the applicable statute.

It doesn't mean that insurance carriers can't cover gender-affirming services, but it does mean those services can't have APTC subsidies applied towards them if they're included in the policy...which not only means that a lot more transgender folks will have to pay more for such services, it also means carriers will be less likely to choose to include them as part of their policies at all.

3. January 1, 2026: Elimination of Special Enrollment Period for enrollees earning less than 150% FPL

People in states that use Federally-Facilitated Marketplaces (FFM) and make no more than 150% of the federal poverty level can apply for a year-round SEP to sign up for coverage. Some state-based exchanges also offer SEPs that are based on the relationship of people's income to the poverty line.

Nearly half of all ACA exchange enrollees on the federal exchange earned less than 150% FPL this year.

The CMS rule eliminates the < 150% FPL Special Enrollment Period.

4. January 1, 2026: PAPI formula change to make subsidies less generous & increase out of pocket costs

CMS is finalizing updates to the methodology for calculating the premium adjustment percentage to establish a premium growth measure that captures premium changes in both the individual and employer-sponsored insurance markets for the 2026 plan year and beyond. CMS is also finalizing the plan year 2026 maximum annual limitation on cost sharing, reduced maximum annual limitations on cost sharing, and required contribution percentage using the finalized premium adjustment percentage methodology.

Maximum out of Pocket (MOOP) is the maximum amount that any ACA plan enrollee has to pay in deductibles, co-pays or coinsurance combined for in-network care over the course of the year.

The 2025 Maximum Out of Pocket cap: $9,200 for an individual or $18,400 for the household

- Under the old rule: 2026 MOOP would be $10,150 / $20,300 (10.3% higher)

- Under the new rule: 2026 MOOP would be $10,600 / $21,200 (15.2% higher)

In other words, under the old formula the MOOP would increase by $950 or $1,900 next year, which would be bad enough...but under the new formula, it's gonna go up by an additional $450 person / $900 per household.

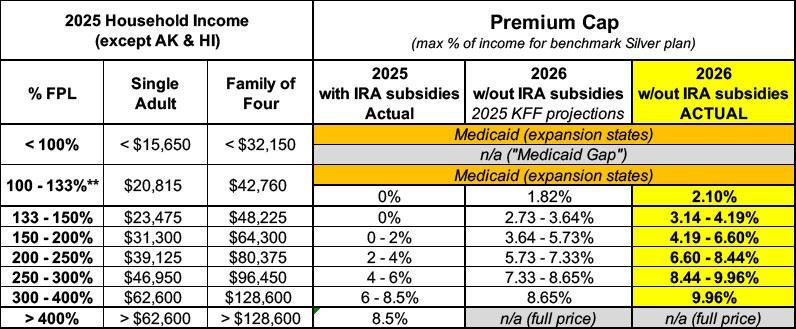

Even worse, as I wrote about separately the "revised" PAPI formula means that the premium tax credit formula is going to be stingier than the the NON-enhanced, PRE-2021 version was. Below is a table which lays out what percent of household income enrollees have to pay for the benchmark Silver plan under the current (enhanced subsidy) thresholds, the pre-2021 thresholds under the current PAPI formula, and the 2026 thresholds under the revised PAPI formula:

What this means is that instead of a single adult earning $30,000/year having to pay around 1.9% of their income under the current level or even around 5.6% of their income with just the subsidies expiring, they'll actually have to pay more like 6.5%. Thats over triple what they have to pay today.

5. January 1, 2026: Widening de minimus thresholds

CMS is finalizing widening the de minimis ranges to +2/-4 percentage points for all individual and small group market plans subject to the AV requirements under the EHB package, other than for expanded bronze plans, for which CMS is finalizing a de minimis range of +5/-4 percentage points. CMS is also finalizing removing from the conditions of QHP certification the de minimis range of +2/0 percentage points for individual market silver QHPs and specifying a de minimis range of +1/-1 percentage points for income-based silver CSR plan variations.

This is basically blurring the lines between Bronze, Silver, Gold and Platinum-level ACA plans, making the distinctions vaguer, more confusing to enrollees and completely defeating the point of having separate "Metal Levels" in the first place. It also means that the benchmark Silver plan, which is the one used to calculate APTC subsidies, will likely be lower-priced but also less comprehensive...which means that ACA subsidies will be less generous for all enrollees.

6. January 1, 2026: $5/mo subsidy penalty for $0 auto-renewals until verification

CMS is finalizing modifications to the annual eligibility redetermination process by requiring Marketplaces on the Federal platform to ensure that consumers who are automatically re-enrolled with no premium responsibility following application of APTC and without affirming or updating their eligibility information, are automatically re-enrolled with a $5 monthly premium beginning in plan year 2026.

Once consumers confirm or update their information, the $5 monthly bill will be eliminated if they continue to be eligible for a $0 premium after application of APTC. As with all enrollees, they may receive a refund or reduction on the taxes they owe (or may owe) when they file and reconcile their APTC on their federal income tax return.

...This policy will sunset at the end of the 2026 plan year.

Normally, if an existing ACA enrollee takes no action whatsoever (ie, they never contact their ACA exchange by phone or by logging into their account) during OEP, the exchange will either automatically re-enroll them into their existing plan for another year or they'll "map" the enrollee to the closest equivalent plan in the event that their current one is being discontinued by the insurance carrier.

This rule states that in cases where the enrollee is fully subsidized (ie, 100% of their premiums are covered by APTC subsidies), they'd have those subsidies reduced by $5/month...which means they'd go from paying nothing to $5/month in premiums.

During the 2024 OEP, 42% of federal exchange enrollees (6.8 million people) were enrolled in $0-premium policies. I don't have that number for 2025 yet, but I'm assuming it's higher since total enrollment is 13% higher.

Assuming that extrapolated across every state, that'd be up to over 10 million ACA exchange enrollees who could potentially be hit with a $5/month hike in their monthly premium. They'd be charged the $5/mo until they actively confirmed that they wanted to remain enrolled in that policy or that their income had changed.

$5/mo may not sound like much but it's a pretty big deal to low-income folks and will no doubt cause a lot of confusion. I should also note that if the point was truly to eliminate fraud and make sure enrollees were aware of being auto-renewed, they could have made the reduction $1.00 or even $0.01 instead of $5.00 for the same effect.

7. November 1, 2026: Shortened Open Enrollment Period

CMS is finalizing changes to the annual OEP beginning with the OEP for plan year 2027. This adjustment will apply to both on- and off-Marketplace individual market coverage. The final rule allows all Exchanges flexibility to set their own OEPs within set parameters for timing and duration. Each OEP must start no later than November 1 and end no later than December 31, and the OEP may not exceed 9 calendar weeks. Finally, all enrollments pursuant to Open Enrollment Period must begin on January 1.

Currently, the annual Open Enrollment Period runs 76 days, from November 1st to January 15th. This would shorten it considerably. While it's being implemented for the 2027 calendar year, that means the policy still goes into effect before the midterms...2 days before, to be precise, on November 1, 2026.

8. December 31, 2025: Discontinuation of Bronze plan enrollees eligible for $0-premiums CSR Silver plans being auto-reenrolled into them

CMS is finalizing the repeal of a regulation that allows Marketplaces to automatically re-enroll CSR-eligible bronze QHP enrollees in a silver QHP if the silver QHP is in the same product, has the same provider network, and has a lower or equivalent net premium as the bronze plan into which the enrollee would otherwise have been re-enrolled.

State Marketplaces may continue seeking approval from the Secretary to design and conduct their own annual eligibility redetermination process.

Normally the exchange will re-enroll people into the same policy if it's still available, but a couple years back the Biden Admin realized that there's a lot of people who are leaving thousands of dollars in potential savings on the table by selecting Bronze plans instead of a high-CSR Silver plan with the exact same provider network even when they're eligible for a far better value without paying a dime more.

To benefit enrollees, HealthCare.gov started shifting people in that specific situation over to Silver plans instead in order to provide them with greater savings on deductibles, co-pays & coinsurance fees. The Musk/Trump Administration is pulling the plug on this improvement.

----------

OK, back to the lawsut: Last week a federal judge ruled against the Trump Administration on a bunch of (but not all of) these provisions...at least for now:

via Rebecca Pifer of Healthcare Dive:

The CMS rule finalized in June significantly shrunk sign-up windows and heightened eligibility verification for ACA plans. Regulators said the changes were necessary to crack down on fraud and abuse in the ACA exchanges, a key priority for conservatives. However, health policy experts and patient advocates slammed the rule as overly aggressive, and said it appeared aimed at shrinking the size of the exchanges, not targeting fraud.

In early July, nonprofit Democracy Forward filed a lawsuit challenging the rule on behalf of three cities — Chicago, Baltimore and Columbus —, the physician advocacy organization Doctors For America and small business lobbying group Main Street Alliance.

Side note: I'm proud to say I was on the Doctors for America Board of Directors for several years but my term ended before this lawsuit was filed.

The suit argues that the Trump administration violated the Administrative Procedures Act in issuing the rule, and that they would shoulder higher costs and see their members lose coverage if it goes into effect.

On Friday, Maryland Judge Brendan Hurson granted the plaintiffs’ request for a preliminary injunction while the case advances, determining that they are likely to succeed in the suit.

So far, so good...

Hurson stayed seven of the rule’s most consequential provisions, including the creation of a $5 premium penalty for individuals who automatically reenroll in coverage and a policy disqualifying people who fail to reconcile tax credits with their income from receiving subsidies.

The judge also paused the elimination of guaranteed coverage for people who are overdue to pay their premiums; the imposition of higher income verification standards if exchanges find inconsistencies in tax data; and a policy requiring stricter eligibility checks ahead of a special enrollment period.

Changes to a formula used to sort ACA plans into different coverage tiers were also put on pause.

All of this is great to hear. HOWEVER...

Hurson allowed changes to CMS’ methodology for calculating premium adjustments and the elimination of a 60-day window for ACA enrollees to resolve inconsistencies in their income data to continue.

Ouch. As I explained above, that's one of the biggest ones, at least for the 2026 Open Enrollment Period, although some of the provisions which were struck down will be more consequential a couple of years down the road. Furthermore...

...Still, Hurson’s decision represents a short-term relief, not a total stay of execution for the reforms. The Trump administration could appeal the judge’s decision to a friendlier court. Red states could also elect to implement the changes for their own exchanges. And, the GOP’s tax and policy megabill signed into law in July includes similar policies restricting the ACA, including effectively ending autorenewals and requiring enrollees to update income information more frequently or risk losing coverage.

Here's a summary of the 7 provisions which Judge Hurson did put a hold on...

- $5/mo fee for $0 prem enrollees

- De Minimus change

- No effectuation until past-due premiums paid

- SEP pre-enrollment verification

- Failure to reconcile

- Income Verification if Data Shows Income < 100% FPL

- Income Verification if Tax Data Unavailable

...and the two which he didn't:

- PAPI change (weaker subsidies, higher out-of-pocket costs)

- Recission of 60-Day Extension

Stay tuned...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.