Texas: Average unsubsidized 2023 #ACA rate increases drop from 8.8% to 4.9% "thanks" to Bright & Friday leaving...

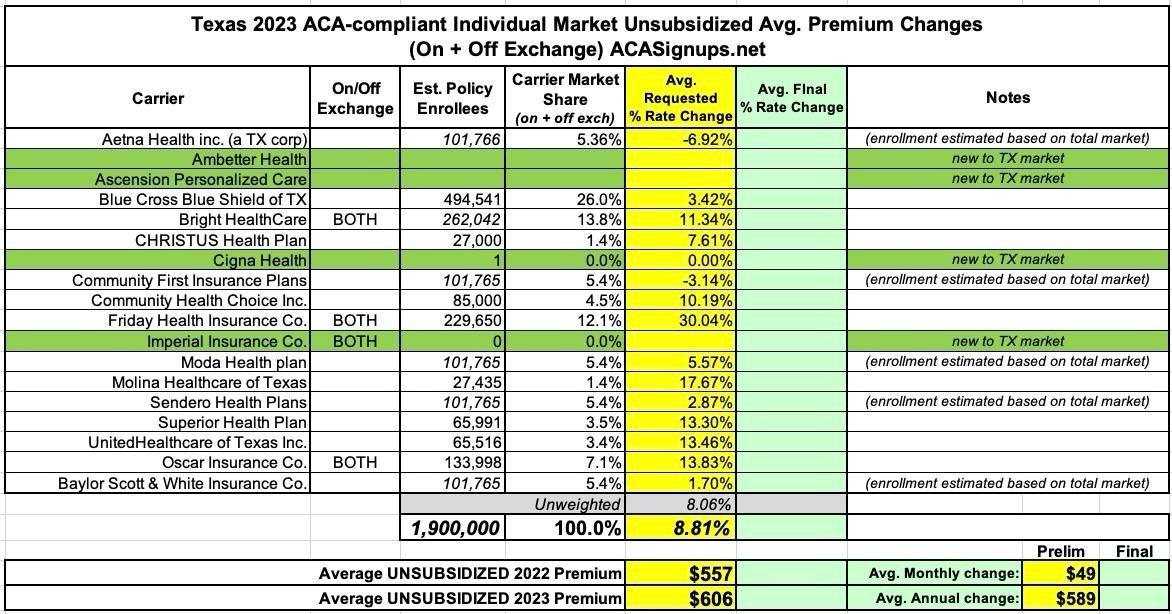

Back in August I was able to post estimated preliminary average 2023 rate changes for Texas' individual market. I emphasize "estimated" because the state insurance dept. website isn't helpful and even the filings found in the SERFF database only include actual enrollment data for about half of the dozen or so insurance carriers offering policies on the TX indy market. For the remaining carriers I had to use my best guesstimate of what the market share of each was in order to come up with a weighted average increase, which turned out to be +8.8% for unsubsidized enrollees.

Since then, I'm afraid I still haven't had any luck in doing so, and the federal Rate Review database hasn't been updated with final/approved rate filings yet either (even with the 2023 Open Enrollment Period launching in just 5 days). As a result, I have to stick with that +8.8% statewide estimate until further notice on either enrollment data, approved filings or both.

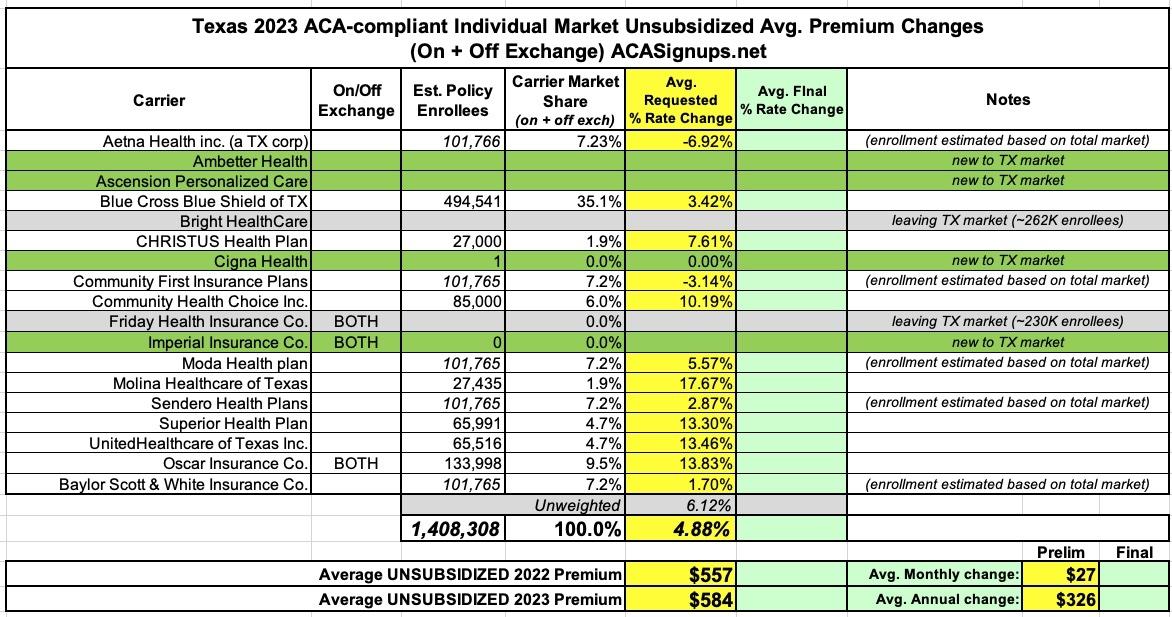

Regardless of how far off I am with that estimate, the fact that both Bright HealthCare and Friday Health Plans announced at the last minute that they're both dropping out of the state will have a huge impact on the final weighted average rate impact for two reasons:

- First, because assuming my enrollment estimate for Bright is accurate, the two currently hold over 25% of the entire current ACA individual market, meaning their leaving will skew the weighted average dramatically;

- Second, because as you can see below, the preliminary rate hikes requested by both Bright and Friday before they bailed also happened to be higher than the statewide average (Bright asked for +11.3% while Friday wanted to jack up their premiums by a whopping 30%).

Of course, those high rate hikes--especially for Friday--also provided some evidence of how much trouble these carriers were in, leading them to pull out in the first place, but the point is that if you remove those two from the equation, you're left with an estimated average rate increase of just 4.9% for unsubsidized enrollees across the remaining 12 current carriers...again, assuming my market share estimates for all of them are fairly close:

Whether this is a good or bad thing depends entirely on your point of view, of course. Certainly the ~490,000 or so Bright/Friday enrollees who now have to find another carrier (or have one auto-selected for them) aren't likely to be too happy about it, and it doesn't actually mean that unsubsidized premiums for the other 12 carriers are dropping; it's just a matter of how much they're going up on a percentage basis relative to the prior statewide weighted average.

Of course, the vast majority of enrollees are going to be heavily subsidized via premium tax credits (and many will receive CSR assistance as well) anyway, which is the basis of a followup blog entry about Texas' 2023 Open Enrollment Period situation which I'll be posting tomorrow...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.