IMPORTANT: *Official* avg. 2026 premium hikes will likely be lower than KFF's 114% estimate for three critical reasons...

Last week I issued a warning that once the 2026 ACA Open Enrollment Period ends in a few weeks, the Trump Regime is likely to crow about total enrollment "only" dropping by perhaps a million people compared to a year ago (while also blaming all of that loss on "fraudulent enrollees" etc etc) even though enrollment will actually likely drop by several times as many over the next few months.

As I explained, the reason for this is that around half of the ~22 million enrollees as of last fall likely allowed themselves to be passively auto-renewed into the same plans, meaning that they'll be counted as having "selected" a plan for 2026 even if many of them immediately cancel it as soon as they see the shocking rate hikes. Others will stick it out for a few months before not being able to afford their coverage any longer & dropping out of the market altogether.

My point was to keep this in mind if/when you start seeing Republican talking points claiming that Democrats, healthcare advocates, the Congressional Budget Office etc. have all been "exaggerating" the negative impact of the rate hikes on healthcare coverage.

Today, I want to warn about a related GOP talking point I expect to start popping up in another two weeks or so: That the 114% average net premium increase projected by nonprofit healthcare policy research & analysis organization KFF will turn out to be "vastly overstated" etc etc because the actual average net premium increase for 2026 ACA exchange enrollees will "only" turn out to be considerably lower--say, 50%, 60% or 70%, for instance.

First, it's important to keep in mind that even if that turns out to technically be accurate, annual premium increases in that type of range would still be batshit insane. Hell, double digit year over year price increases as low as 10% tend to give most people conniptions.

Having said that, yes, it's possible that the official net average premium hikes for 2026 ACA exchange enrollees could very well end up being a lot less than the 114% projected by KFF last fall...which still won't reduce the financial devastation caused by the enhanced tax credits expiring one iota.

When KFF ran that analysis last fall, the only way they could do it was to make several assumptions, including the following:

- That 100% of current enrollees (roughly 22.6 million as of September) would re-enroll into a 2026 exchange plan, and...

- ...that all 22.6 million of them would be re-enrolled into the same exchange plan they had in 2025.

BOTH of these assumptions are bound to prove false for completely understandable reasons (and I'm in no way criticizing KFF for making them, because there was no other way to run a projection like this at the time).

The reasons should be obvious if you think about it for even a moment:

- 1. Millions of existing enrollees downgraded their plans to try & avoid at least some of the net premium hikes

There's already hard evidence of this from Get Covered NJ, the New Jersey exchange, which just a few days ago reported:

With the reduction in federal financial support due to Congress not continuing the enhanced premium tax credits, more New Jerseyans are currently ‘buying down’ from silver plans to bronze plans that have higher out-of-pocket costs.

The Marketplace plans offered through Get Covered New Jersey are categorized into three types (or “metal levels”): Bronze, Silver, and Gold. There has been an increase in consumers actively selecting the lowest metal level plans, from 16% of active shoppers selecting Bronze plans for plan year 2025 to 27% of active shoppers selecting Bronze plans for plan year 2026 as of the first six weeks of Open Enrollment. Active silver plan selections have fallen to 72% from 83% in plan year 2025. Nearly half (48%) of enrollees receiving financial help in Open Enrollment 2025 paid $10 a month or less for coverage, which has fallen to 8% for the 2026 Open Enrollment Period as of December 12.

Hell, my own family did exactly this: We were forced to downgrade from a Silver PPO plan to a Bronze HMO plan in order to keep our premiums from increasing a whopping $17,000...but the trade-off for that is that our deductible just went up 150% (which we're virtually guaranteed to max out), meaning we're still very likely going to see our total healthcare costs skyrocket by over $15,000 this year.

The thing is, that extra $15,000 isn't gonna show up in the Center for Medicare & Medicaid Service's (CMS) "average net premium" calculation, since technically our premiums didn't go up at all.

Millions of other enrollees will still see their net premiums go up even if they downgrade their policies...it's just that it might be, say, a 40% increase instead of 200% or whatever.

- 2. Many others (potentially several million) were just priced out of the market altogether.

While many people will be able to cling to ACA coverage by downgrading to a worse plan with higher out-of-pocket expenses, even that won't be a viable option for many others. Consider the example I wrote about of a 63-yr old couple earning $85K/yr living in Atlanta, Georgia:

$85,000 a year for two people is 416% FPL in 2025 and 402% in 2026...just barely over the dreaded "Subsidy Cliff" threshold which, as you're about to see, is about to come roaring back with a vengeance.

This year they're paying just $602/month (8.5% of their gross income) for the benchmark Anthem Silver Blue Value HMO...but if the tax credit formula reverts back to the pre-2021 level, they'll have to start paying full price in January...and the lowest-priced Silver plan available from Anthem next year is clocking in at a whopping $3,456/month at full price.

That's a stunning 5.7 times as much as they're paying today, and would amount to nearly half of their gross income.

What about shopping around?

Obviously they'd be insane to stick with this, so to tide them over until they qualify for Medicare they'll likely shop around for a lower-cost plan.

Unfortunately, in this case, the least-expensive plan (a Bronze HMO which more than doubles the deductible from $9,000 to $21,200) would still cost $2,386/month...or over 1/3 of their income in premiums alone.

How about the Trump Regime's new opening of the floodgates on Catastrophic plan eligibility?

Well, the exchanges are currently programmed not to even let you see Catastrophic plans unless you're under 30 years old, so I started by changing their ages to 29. IF they were that young, they could get a catastrophic plan from either Kaiser Permanante for $853/month or stick with Anthem BCBS for $957/month...either of which would still cost 42% - 59% more than they're paying now.

HOWEVER, they're not 29 years old. They'll both be 64 next year, and assuming the Age Band multiplier for Catastrophic plans is the same as it is for other individual market plans in Georgia, you'd have to multiply those prices by 2.68, which would put the cost of a Catastrophic plan for this couple at $2,286 or $2,565/month...basically the same as a Bronze plan anyway.

As I concluded:

...in most cases they'll just be trading off lower premiums (which will still usually be higher than they're paying now) for higher deductibles, co-pays and coinsurance...and in at least one case (the older couple in Atlanta), they're pretty much priced completely out of the individual market altogether...right when they're at an age where they absolutely can't afford NOT to have comprehensive health insurance.

I noted my own family as real-world example of downgrading plans; here's a real-world example of a family being priced completely out of the market entirely:

My wife and I are partners. We share finances but split responsibilities. One of the things she handles is our health insurance. That means the monthly premium. The phone calls. The disputes. The endless back-and-forth when the same charge magically shows up twice.

From bad to worse: Our premium just jumped from $1,700 to $3,000 a month. For two healthy adults and a daughter in college. Could we technically scrape the funds together? Sure. But let’s call it what it is: a shakedown. 2/6

So my wife did the only rational thing left. Today, she canceled our policy. As of January 1, we’re uninsured. This isn’t a reckless decision. It’s a calculated one.

To review:

- You have 3 ACA enrollees (my wife, son and I) who downgraded our coverage. In our case our premiums will technically go up 0% instead of 74%.

- You have 3 more ACA enrollees (Mr. Webb & his family) who dropped out altogether. In their case, they won't be counted as increasing at all since they won't be counted as part of the numerator or denominator.

Now multiply these 6 people by several million more, and you can easily see how the official "average net premium increase" could be much less than the 114% KFF estimated...even though both families are still financially screwed as a result of the subsidy expiration in slightly different ways.

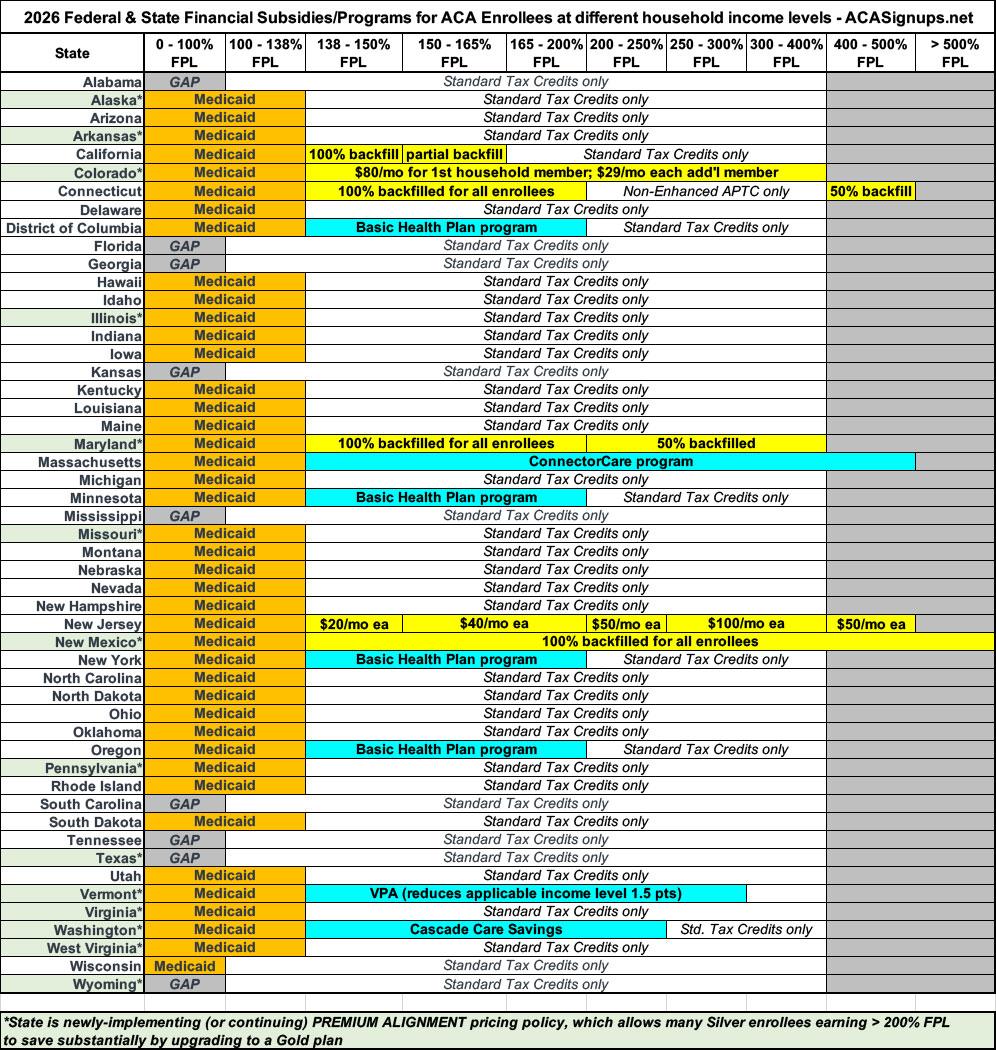

- 3. SUPPLEMENTAL STATE SUBSIDIES & PREMIUM ALIGNMENT.

As I've written about several times before, while most of the ~22.6 million current enrollees in most states are pretty much screwed, there are exceptions thanks to a bunch of states either expanding (or newly-implementing) their own supplemental state-based financial subsidy programs or implementing Premium Alignment policies to make Gold plans less expensive (in some cases considerably less expensive) than Silver plans. In a few cases they're doing both!

I can't really make any hard number projections about the latter, since Premium Alignment requires Silver plan enrollees to actively choose to upgrade to a Gold plan (there's no way of knowing how many will do so), but I can provide some rough numbers for the state subsidy impact:

- In CALIFORNIA, there's around 266,000 enrollees who earn less than 150% FPL who not only didn't have any rate hike, theirs actually went down 17% thanks to the state subsidy program backfilling lost federal tax credits (another unknown number--perhaps 100K or so?--who earn 150 - 165% received nominal state subsidies as well).

- In COLORADO, there's around 180,000 enrollees who earn between 100 - 400% FPL who are receiving anywhere from $29 - $80/month in state subsidies on top of whatever "standard" federal subsidies they're still eligible for. The exact impact on net premium hikes is unknown due to how the program is structured, but it should mean a 0% net increase for tens of thousands of them and a far lower rate hike than they'd otherwise be hit with for the rest of them.

- In CONNECTICUT, AccessHealth CT just announced that they'll be backfilling 100% of the lost tax credits for around 50,000 enrollees and backfilling 50% of it for another ~11,000 or so.

- In MARYLAND, a similar program will backfill 100% of lost tax credits for perhaps 79,000 enrollees and 50% of it for another ~79,000.

- NEW JERSEY is continuing their existing state subsidy program, but I don't think it's actually being expanded, so I don't know if that will have any obvious impact relative to last year.

- NEW MEXICO is the only state which has somehow managed to full backfill 100% of lost federal tax credits for 100% of their enrollees...and then some (their 2026 enrollment is actually up 20% y/y so far!) This means another 70,000 enrollees who should see close to a 0% net premium hike this year.

There are several other states which also have their own state-based subsidies this year (or special programs like Basic Health Plans in DC/MN/NY/OR, ConnectorCare in Massachusetts and the VT Premium Savings program in Vermont), but like New Jersey, most of these are just continuing their existing programs, so I don't think there will be much net premium change impact relative to 2025.

Regardless, that's at least 465,000 enrollees who won't see their net premiums increase one dime thanks to their states backfilling the lost tax credits, plus another 370,000 or so who will have at least half of the lost credits covered by the state.

However, KFF states in their methodology that "state-funded subsidies might offset some increases of premiums but are not accounted for in the estimation."

When you add these into the mix, it will once again, bring down the OFFICIAL average net premium increases nationally...even as the budgets of these states are further strained by their efforts to mitigate the damage.

I should note that KFF also had to make several other assumptions about the 2026 ACA exchange population, such as...

- They had to assume that no enrollees below 100% FPL will receive any federal tax credits due to policy changes made by CMS and/or included in the Big Ugly Bill.

- They assumed that avg. gross premiums would be 18% higher in 2026 vs. 2025 (actual avg. gross premiums are closer to 26% higher)

- They had to assume no changes in family composition, income relative to the Federal Poverty Level, or geography (that is, no one moved)

Obviously millions of Americans move every year, and of course family composition changes as people give birth, turn 26 (or turn 65 & move to Medicare), get or lose employer-sponsored insurance, etc; and of course millions of people's household incomes change year to year as well. However, there's no way for KFF to account for any of that so those are factors which are unknowns here.

In any event, keep all three of the highlighted points above in mind if & when you start hearing Republican House & Senate members flapping their gums ont he Sunday talk shows about how "Democrats vastly overstated the premium increases" bla bla bla.

As an aside, I've put together the following handy visual aid which breaks out the different types of state-based subsidy programs & special ACA-based healthcare programs as well as the 14 states with some level of Premium Alignment policies in place, by income bracket. I know it's still a bit confusing but hopefully this will provide some guidance on which states are doing what to help mitigate the carnage: