Get Covered NJ reports 186K active enrollees thru 12/12; residents still have until MIDNIGHT TONIGHT for coverage starting tomorrow

via the New Jersey Dept. of Banking & Insurance:

TRENTON — With a critical deadline approaching to enroll in 2026 health coverage through Get Covered New Jersey, Department of Banking and Insurance Commissioner Justin Zimmerman is encouraging residents in need of health insurance to enroll by December 31st for coverage that is effective on January 1st .

Open Enrollment at Get Covered New Jersey, the state’s Official Health Insurance Marketplace, runs from November 1, 2025, through January 31, 2026, but consumers must enroll in a plan by December 31, 2025, for coverage beginning January 1, 2026. Those who enroll by January 31, 2026, will have coverage beginning on February 1, 2026.

“As we approach the end of the year, we are encouraging residents who need coverage to explore their options now. As consumers navigate federal changes to financial assistance, we want them to know that Get Covered New Jersey is here to help them find the plan that best meets their needs,” said Commissioner Zimmerman. “With the busy holiday season upon us, we are reminding residents to enroll by December 31st to secure coverage for the start of the New Year.”

This Open Enrollment Period, 480,993 residents are signed up for 2026 health coverage through Get Covered New Jersey, including 186,336 new or existing consumers who actively selected a plan and 294,657 who were automatically renewed as of December 12. New consumers to the marketplace are down compared to last year, with 29,033 enrolled at a similar time last year compared to 26,573 new consumers enrolled in 2026. Total plan selections are up 7% compared to a similar timeframe last year, propelled by record high enrollment in 2025.

As I warned yesterday, those higher numbers can be very misleading, since a significant portion of those 294K auto-renewed enrollees may end up having to drop their coverage almost as soon as they receive their January invoice, and others will likely stick it out for just a few months before having to do so.

On the other hand, I'm happy to report that it looks like a lot more New Jersey residents have been taking my advice to actively shop around & select a plan for 2026 instead of letting themselves be passively auto-renewed. Unfortunately, I can't run an apples-to-apples comparison vs. last year since this report runs through December 12th while last year's snapshot reports were only published through either December 5th or January 2nd, but over twice as many NJ residents had already actively selected plans as of Dec. 12th this year as those who had done so as of Jan. 2nd last year.

Part of this is due to the pool of current enrollees being 29% higher to begin with this year, but that's still encouraging.

With the reduction in federal financial support due to Congress not continuing the enhanced premium tax credits, more New Jerseyans are currently ‘buying down’ from silver plans to bronze plans that have higher out-of-pocket costs.

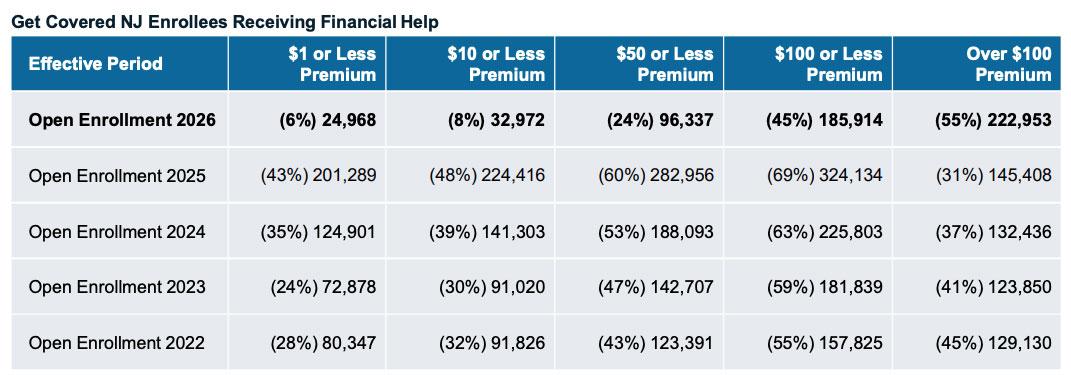

The Marketplace plans offered through Get Covered New Jersey are categorized into three types (or “metal levels”): Bronze, Silver, and Gold. There has been an increase in consumers actively selecting the lowest metal level plans, from 16% of active shoppers selecting Bronze plans for plan year 2025 to 27% of active shoppers selecting Bronze plans for plan year 2026 as of the first six weeks of Open Enrollment. Active silver plan selections have fallen to 72% from 83% in plan year 2025. Nearly half (48%) of enrollees receiving financial help in Open Enrollment 2025 paid $10 a month or less for coverage, which has fallen to 8% for the 2026 Open Enrollment Period as of December 12.

New Jersey has improved access and affordability

Since the creation of the marketplace in 2020, New Jersey has worked to improve affordability for those enrolling in coverage through Get Covered New Jersey by providing state subsidies, called New Jersey Health Plan Savings, to help offset the cost of health insurance for hundreds of thousands of eligible enrollees. The state is estimated to provide $215 million for New Jersey Health Plan Savings in 2026 providing greater affordability in the market. New Jersey Health Plan Savings are available to consumers earning up to 600% of the Federal Poverty Level.

Establishing Get Covered New Jersey, the state’s own health insurance marketplace, has meant greater flexibility and control for New Jersey to meet the needs of its residents. In addition to providing state subsidies, the state expanded the Open Enrollment Period to three months, from the six-week window available under the federal administration in 2019. It also expanded plan options by increasing the number of health carriers offering plans from three in 2020 to the current five. The five insurance companies offering 2026 plans through the marketplace are: Ambetter from WellCare of New Jersey, AmeriHealth, Horizon Blue Cross Blue Shield of New Jersey, Oscar, and UnitedHealthcare.

For the upcoming plan year, consumers will again benefit from legislation that limits prescription drug costs by capping copays for certain medications. All Get Covered New Jersey health plans will cap the out-of-pocket cost of insulin at $35 per month, as well as cap out-of-pocket costs for EpiPens and asthma inhalers at $25 and $50, respectively, for a month’s supply.

Open Enrollment is the only time of year residents can enroll in a plan, unless they have a major life event, such as marriage, pregnancy, or a move that qualifies them for a Special Enrollment Period. At the end of the last Open Enrollment Period on January 31, 2025, a total of 513,217 residents overall had signed up for 2025 health coverage through Get Covered New Jersey.

Get Covered New Jersey is Here to Assist Consumers

The Department continues to partner with Navigators, community-based organizations who provide free enrollment assistance, in a robust outreach effort in pop-up events in malls and supermarkets throughout New Jersey. The Department is investing $5 million in 30 Navigators, up from $400,000 in federal funding provided for just one Navigator under the federal government in 2019. Certified brokers are also available to assist consumers.

“Get Covered New Jersey is here to help consumers navigate federal changes and is meeting people where they are in their communities to help them enroll and find financial assistance to stay covered and healthy,” said Commissioner Zimmerman. “This year, we again have free expert help available across the state to assist consumers, with certified Navigators and Brokers available in every county, and ongoing events to assist consumers in-person.”

Remaining December and January pop-up events include:

- Cherry Hill Mall, Cherry Hill: December 30; January 17

- Deptford Mall, Deptford Township: January 30

- Freehold Raceway Mall, Freehold: December 29; January 23, 25

- Menlo Park Mall, Edison: December 31; January 20, 31

- Newport Centre, Jersey City: December 29; January 11, 21

- Ocean County Mall, Toms River: January 24, 29

- Quaker Bridge Mall, Lawrence Township: December 30; January 24, 29

- Rockaway Townsquare, Rockaway: January 18, 22

- Willowbrook Mall, Wayne: December 31; January 17, 28, 31

- ShopRite, Absecon: January 14, 25, 27

- ShopRite, Garwood: January 15, 18

- ShopRite, West Orange: January 16, 30

Follow @GetCoveredNJ on Facebook or X for more information on mall outreach events.

Thirty Navigator organizations are assisting residents in-person and remotely, and perform year-round outreach and education for coverage, including before and during the Open Enrollment Period. Navigator grantees provide local assistance in various languages at locations across the state. Find free local assistance on the Get Covered New Jersey website. Consumers can also use Get Covered New Jersey’s shop and compare tool to evaluate plans and pricing.

In New Jersey, there remains a requirement to have health coverage. Residents who do not qualify for an exemption from the Shared Responsibility Payment will pay a penalty at tax time.

The Department also reminds consumers to avoid short-term limited duration plans, which are prohibited in New Jersey and do not cover the basic services consumers would expect from insurance and that are required in the state. All health plans offered through GetCovered.NJ.gov cover preventive services, emergency services, prescription drugs, prenatal and pediatric care, and more. No one can be denied coverage due to a pre-existing condition.

Get Covered New Jersey’s Week 6 Open Enrollment Snapshot may be found here.

Here's the hard numbers from the Week 6 snapshot report (thru 12/12/25):

- New enrollees: 26,573

- Active renewals: 159,763

- Auto-renewals: 294,657

- Total enrollees: 480,993

Financial Assistance:

- 51% are receiving APTC, CSR & state subsidies

- 28% are receiving APTC & state subsidies

- 6% are receiving state subsidies only (400 - 600% FPL)

- 15% are paying full price

Metal Levels:

- 19.3% have enrolled in Bronze plans

- 79.4% have enrolled in Silver plans

- 1.1% have enrolled in Gold plans

- 0.2% have enrolled in Catastrophic plans

(I'm assuming Platinum plans aren't available in New Jersey)

And here's the key table: A breakout of net premiums for enrollees in 2026 vs. 2025:

In 2025, 43% of New Jersey enrollees paid no more than $1/month in premiums. In 2026 this is down to 6%.

In 2025, nearly half (48%) of NJ enrollees paid less than $10/month in premiums. This had dropped to just 8%.

Over 55% of NJ enrollees will have to pay over $100/month in 2026...which, based on the table above, includes a significant number of people who have been paying less than $10/month.