Schrodinger's Open Enrollment Period: 2025 OEP starts out down 34% & up 11% at the same time!

Earlier this afternoon, the Centers for Medicare & Medicaid Services (CMS) published the first 2025 Open Enrollment Period "National Snapshot" report...and I admit my initial takeaway was PANIC OMG HAIR ON FIRE!!

Over 496,000 New Consumers Selected Affordable Health Coverage in ACA Marketplace

The Centers for Medicare & Medicaid Services (CMS) is committed to creating a robust Marketplace Open Enrollment process for consumers so they can effortlessly purchase high-quality, affordable health care coverage. CMS reports that 496,000 consumers who do not currently have health care coverage through the individual-market Marketplace have signed up for plan year 2025 coverage.

OMG! Last year nearly 920,000 new enrollees had signed up as of the first snapshot report...over 85% more!

During last year’s record-setting Open Enrollment Period, 21.4 million people signed up for coverage, driving the uninsured rate to a historic low, where it remains today. Consumers who have coverage now will see their coverage renewed for 2025 if they take no action during the current Open Enrollment Period. At the same time, existing consumers are encouraged to return to the Marketplace and actively renew their coverage. Over 2.5 million existing consumers have already returned to the Marketplace to select a plan for 2025. Building on the historic success of last year, we are on track for a record high number of plan selections for this year’s Open Enrollment.

OMG! Last year nearly 3.7 million existing consumers had actively re-enrolled...over 45% more!

But wait...what's that last bit?

we are on track for a record high number of plan selections for this year’s Open Enrollment.

Huh? How could that be? From the initial numbers, it looks like the 2025 OEP is off to an ugly 34% drop in enrollments, even falling below the 2023 initial snapshot total of 3.35 million!

So what's going on here? A lot.

First of all, let's look at the footnotes:

[1] These metrics reflect available data through November 16, 2024, for Federally Facilitated Marketplace (FFM) states and through November 9, 2024, for State-based Marketplace (SBM) plans.

Why is this important? Because last year's first snapshot report included enrollments through Nov. 18th for FFM states and through Nov. 11th for SBM states...two more days for each state.

Those two missing days may not sound like much, but for the first report they make a big difference: That's 11% less time for FFM states and 18% less for SBM states.

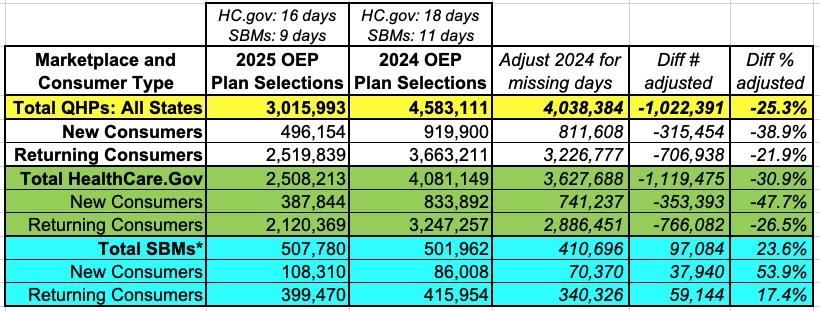

Here's what it looks like when I adjust for each:

When I adjust for the missing 2 days, that 34.2% enrollment drop is actually more like a 25% drop...still dramatic, but 1/4 is a lot less than 1/3.

Next, we have to adjust for another major change from last year: Georgia, which transitioned from being hosted via the Federally Facilitated Marketplace (FFM, or HealthCare.Gov) over to its own full State-Based Marketplace (SBM), Georgia Access.

This is important for several reasons. The 2024 data above includes Georgia as an FFM state...but the 2025 data has it rightly listed as an SBM state. The problem is that unlike every other state which has to be adjusted from either 18 to 16 days or from 11 to 9 days...Georgia has to be adjusted from 18 days to 9 days!

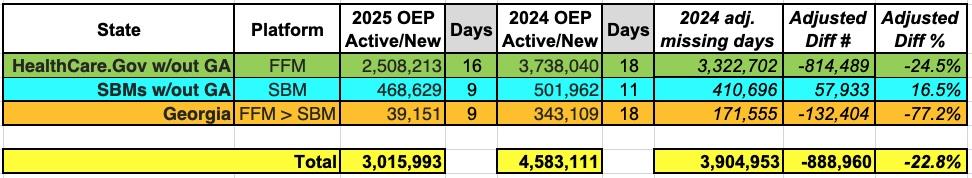

Here's what that looks like:

Our 25.3% drop has been reduced a bit more down to 22.8% behind the same point for every state during the 2024 OEP.

But there's still one more important factor...and for that we have to go beyond the main press release into the actual state-by-state snapshot report itself.

When I plug in the actual numbers for each individual state and adjust each of them for the missing days, it looks like the table below:

Overall this paints the same picture: Enrollment is more than 10% higher in some states (ID, KY, VA, NM, NJ, CO, RI, VT, MD, MA, CT, WA & NY)...but down dramatically ini many other states (AR, WV, AL, FL, AZ, OR, TX, KS, DC, ME, IN, LA, MO, OH, SC, OK, TN, NC, MS & GA). Hell, 2025 enrollment appears to be down a staggering 77% in Georgia!

So what else is missing? AUTO-RENEWALS.

If you keep reading, you'll see that most (not all) of the state-based exchange front-load their auto-renewals of existing enrollees (the rest, as well as HC.gov itself, wait until after the initial Dec. 15th deadline before reporting their auto-renewals).

And when you compare 2025 SBM front-loaded auto-renewals to the same data from last year, there's a pretty big change:

Across the 15 SBM states which front-load auto-renewals, they reported over 2.74 million...over 300,000 (or 12.4%) more than last year. But even that is dwarfed by Georgia, which reported a whopping 1.29 million auto-renewals on their brand-new SBM platform, which means that total SBM auto-renewals broke 4.0 million, up nearly 1.6 million (65%) vs. the same point last year.

This also means that when you include all 2025 Qualified Health Plan (QHP) selections, whether new enrollees, active re-enrollees or auto-reenrollees, the grand total comes to around 7.05 million...or 11.1% higher than the same point last year!

Now, that does NOT mean that total 2025 OEP enrollment will end up being 11% higher than last year. It may run even, or it may actually end up falling well short after all. Remember, some of those being reported as auto-renewals by the SBMs may change over time, since some current enrollees will either actively go back into their accounts and terminate it, or they may simply do nothing at all but fail to pay their January premium...at which point they'll be terminated as well.

In addition, if you look only at 2025 FFM states (that is, not including Georgia in either year), active + new enrollments are still down 24.5% after adjusting for the 2 missing days.

But again, there could be a number of reasons for that--including the possibility that more people may simply have decided to passively auto-renew this year than last. If so, then the remaining auto-renewals (from the 31 FFM states as well as the 4 remaining SBM states) may end up being dramatically higher than last year, thus making up some or even all of the difference.

The larger point is to look beyond the headlines and dig into the actual data before jumping to any conclusions.

Y'know...sort of like the day after Election Day when lots of people were freaking out about Kamala Harris supposedly receiving 15 million fewer votes than President Biden did 4 years ago, and that supposedly "20 million votes were missing!" When in fact, as of this writing, she's only down around 6.8 million from Biden's 2020 tally, and total POTUS ballots are only down around 4.5 million from 2020. When the dust settles on the remaining ballots, the Harris/Biden gap will likely only be around 6.2 million, while total 2024 turnout will likely end up only 3.4 million behind 2020.

UPDATE 11/25/24:

There's two other potentially important factors to consider this year:

1. First, via Jonathan Cohn, CMS apparently deliberately delayed & modified their marketing campaign strategy for HealthCare.Gov this year to avoid overlapping with the Presidential campaign. This may mean a significant delay in when a lot of people choose to sign up.

2. Keep in mind that several million people who lost their Medicaid coverage via the "Unwinding" process over the past year or so shifted over to exchange coverage instead. My guess is that this population is more likely than others to allow themselves to be passively auto-renewed for 2025 coverage. That assumption is supported somewhat by the auto-renewal data available so far (over 300K more auto-renewals across the 15 states which front-loaded them both years); if auto-renewals across the remaining 3 dozen states are higher as well, that would further support this hypothesis.

In any event, that's where things stand at the moment. Stay tuned...