KFF: Entire individual market now 93%+ ACA-compliant & 86% on-exchange

Over at KFF (previously the Kaiser Family Foundation), researchers/analysts Jared Ortaliza, Krutika Amin & Cynthia Cox have put together a new analysis of the overall individual (aka non-group) U.S. health insurance market as of early 2023. While ACA exchange-based enrollment is publicly available (for both subsidized & unsubsidized enrollees) and is the primary focus of this website, off-exchange enrollment is always somewhat fuzzier for several reasons:

- Off-exchange enrollment is more difficult to come by in most states since it's often protected as a trade secret

- Individual market enrollment also includes enrollment in "grandfathered" & "transitional" plans (ie, major medical policies which people were enrolled in prior to ACA regulations going into effect starting in 2014)

- Individual market enrollment also inexplicably sometimes includes so-called "short-term, limited duration" plans which still don't include many ACA coverage & consumer protection requirements to this day.

Getting hard enrollment numbers on all three of these types of policies can be difficult to come by, although enrollment in grandfathered & transitional plans has been shrinking every year since 2014. This is by design since no one has been allowed to enroll in them since then; as existing enrollees either age into Medicare, fall on hard times & move to Medicaid, move to a different state or simply pass away, grandfathered/transitional plan enrollment has quickly dwindled.

In any event, here's what KFF has come up with:

With Marketplace enrollment at a record high in early 2023, the upcoming open enrollment period could be among the busiest yet. In addition to Marketplace enrollees renewing coverage, uninsured people and those buying individual coverage off-Marketplace – as well as those losing Medicaid coverage as the pandemic-era continuous enrollment provision unwinds – may want to check if they are eligible for expanded subsidies under the Inflation Reduction Act.

As I noted yesterday, over 178,000 people who lost Medicaid/CHIP coverage via the ongoing Unwinding process had already enrolled in ACA exchange policies as of the end of May, just two months into it. This is actually more like 200,000 people when you include people who shifted over to BHP programs in Minnesota and New York.

Just to illustrate the point, adding 200K to the ~17.57 million who were enrolled in ACA exchange coverage as of February (16.36M QHPs & 1.22M BHPs) alone would increase total enrollment by 1.1%.

While most of the data in the KFF analysis is as of early 2023, unfortunately some of it was only available through 2022. The main takeaway, as indicated by the KFF headline, is simple:

...as Marketplace enrollment has reached record highs with enhanced premium assistance, fewer people are buying coverage off-Marketplace, but the overall individual market is nonetheless growing.

The eventual goal in my view is for the individual health insurance market to be fully ACA-compliant and 100% on-exchange (although the latter will likely never happen for reasons I'll get into below).

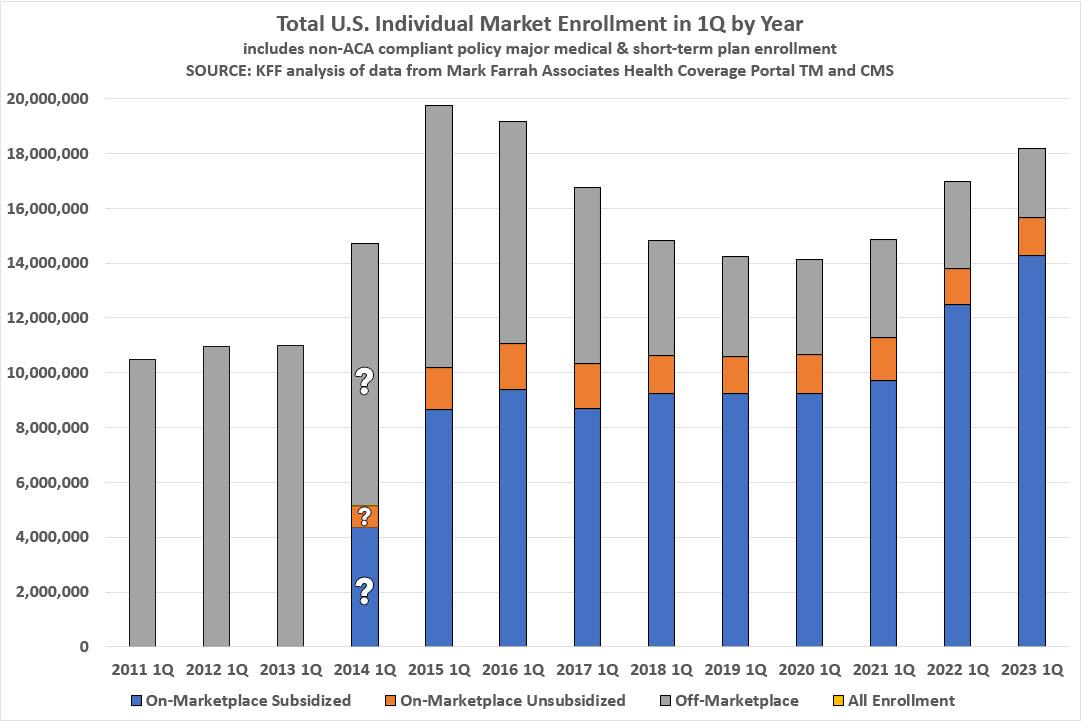

... As of early 2023, an estimated 18.2 million people have individual market coverage, the highest since 2016 (Figure 1). The individual health insurance market grew rapidly in the early years of ACA implementation, reaching nearly 20 million people in early 2015, nearly double the approximately 11 million signed up before the ACA. However, these enrollment gains were partially offset by subsequent declines driven by steep premium increases, particularly among people not receiving subsidies. By early 2020, the individual market had declined to about 14 million enrollees.

During this period of decreasing individual market enrollment, subsidized enrollment increased from 2017-2019 which correspond with the Trump Administration ending federal cost-sharing reduction (CSR) payments, which led to insurers “silver loading” premiums for CSRs and increased premium subsidies for some.

Silver Loading is, as I've long argued, a classic case of a blind squirrel finding a nut. To be clear, Donald Trump was not attempting to improve the ACA individual market when he cut off CSR reimbursements in October 2017; he was very clear and open that he was attempting to destroy (or at least seriously cripple) the ACA at the time.

Fortunately, health insurance actuaries who were far smarter than him at various insurance think tanks & carriers understood the implications and dynamics of this happening and turned lemons into lemonade by instituting Silver Loading as a rate pricing strategy which resulted in many enrollees in many states seeing dramatically lower net premiums thanks to (ironically) increased federal subsidies.

Unfortunately, Silver Loading is still only utilized in a scattershot fashion even six years later--some states have fully embraced and codified it, one still refuses to allow it, and others yet are somewhere in between.

Below is how they break it out over the years. I've modified KFF's chart a bit; they had 2011 - 2013 in a different color to note that there was no "marketplace" for people to enroll through but I decided it's more representative to use the "off-marketplace" color for those years.

For 2014, only the total individual market size was knowable; the exact proportions of subsidized, unsubsidized and off-exchange was much messier for several reasons, including how chaotic the first ACA Open Enrollment Period was and the fact that upwards of ~40% or more of ACA exchange enrollees didn't even start their policy coverage until April or May of that year:

It's also important to note that the off-exchange section includes all three categories described above (ACA-compliant, grandfathered/transitional and short-term plans).

KFF also notes that 91% of all ACA exchange enrollees are now subsidized, which is still 79% of the total individual market even with off-exchange and non-compliant enrollees included. This is partly due to Silver Loading but mostly due to the dramatically enhanced federal subsidies provided by the American Rescue Plan & Inflation Reduction Act, which reduced the income threshold for eligibility and eliminated the "Subsidy Cliff" which cut off eligibility entirely at 400% of the Federal Poverty Level. More recently, the Biden Administration's elimination of the so-called "Family Glitch" (well, mostly) have also expanded subsidy eligibility to millions more Americans as well.

As for the non-ACA compliant enrollment data, again, that's harder to come by. According to KFF:

Using federal risk adjustment data and data compiled by Mark Farrah Associates, we estimate 1.2 million people were in non-ACA-compliant plans in mid-2022, compared to 5.7 million in mid-2015 (Figure 3). Although we don’t yet have complete 2023 data, it’s likely ACA-compliant enrollment (both on- and off-Marketplace) is currently at a record high and that non-compliant enrollment is at a record low.

KFF estimates total off-exchange enrollment to be around 2.5 million as of a year ago, of which ~1.2 million were in non-compliant plans. This means that the breakout as of summer 2022 was roughly:

- 1.7 million off-exchange ACA compliant

- 1.2 million off-exchange grandfathered, transitional & short-term

It's a shame that these last three are still mixed together, but as I said, that's not easy data to parse. I should note that 1.2 million for all three is much lower than the 2.6 million I "spitball" estimated back in February. I pegged it at perhaps 2M short-term, 300K grandfathered & 300K transitional...and that was as of this year, while KFF's 1.2 million as as of last year, and two of the three categories have dropped further yet since then. Huh.

KFF also points out that short-term plan enrollment is set to drop further yet via the Biden Administration's new rule to limit short-term, limited duration plans to actually be short-term and of limited duration.

The share of individual market enrollment in ACA compliant plans has increased to 93% in mid-2022 compared to 71% in mid-2015. These data are only available through mid-2022, and non-compliant enrollment may have fallen even further in 2023.

If you assume that the 1.2 million has dropped to, say, an even 1 million over the past year, that would bump ACA compliant enrollment up to around 95%.

Earlier I noted that the eventual goal would be for 100% of the individual market to be a) fully ACA compliant and b) on-exchange. The former may eventually happen (grandfathered & transitional enrollment will dwindle away to nothing at all over time, and I personally don't think short-term plans should even be counted as part of the individual market anyway), but the latter likely won't without legislative changes, for several reasons:

First, as I've written about before, undocumented immigrants are not legally allowed to enroll in individual market policies via the ACA exchanges in most states even without subsidies. This is one of the dumbest provisions of the legislative text of the law; I can understand not allowing undocumented immigrants to receive federal subsidies via the exchanges, but not allowing them to even enroll in a plan on-exchange is the height of stupidity in my view.

The good news is that a few states have recently made it legal for them to do so (Washington State has already; California is in the process, and Colorado has done sort of an end-run around this rule by launching a separate website for undocumented folks), but in most states, the only way for undocumented immigrants to enroll in individual market plans is to do so off-exchange.

Second, there's a new & growing market which I was surprised not to see mentioned in the KFF analysis: ICHRA (Individual Coverage Health Reimbursement Arrangement) enrollment, which has apparently grown from just a few hundred thousand people nationally a year or two ago to around 500,000 today. ICHRA enrollees can enroll on-exchange, and most apparently do (around 70% so far, as I understand it), but that still leaves perhaps ~150K or so who have done so off-exchange.

Between ICHRA and undocumented enrollees, I'd imagine there will still always be a small off-exchange ACA market no matter what. I'd prefer to see tweaks to the law to remove any incentive for the former to go off-exchange and to open the exchanges up to the latter, but until that happens, it'll be there.

There's also one other point the KFF analysis only mentions in passing: The enhanced/expanded subsidies of the ARP/IRA are currently scheduled to expire at the end of 2025. If they aren't extended further (hopefully permanently), many of the gains made over the past few years will evaporate.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.