Maryland wraps up 2026 Open Enrollment Period up 3.4% y/y thanks to backfilling ~60% of lost federal tax credits (updated)

Originally posted 1/17/26

The Maryland Health Benefit Exchange has their own Open Enrollment dashboard which, while not providing nearly as much data as New Mexico's, at least breaks out the top-line data. With the 2026 Open Enrollment Period (OEP) now over in the Old Line State, here's what their final numbers look like (barring any last-minute clerical corrections):

- Total Renewals: 236,338

- New Enrollees: 47,815

- Total Enrollments: 255,612

- Disenrollments (already subtracted from renewals)

- 67.4% are subsidized; 32.6% are unsubsidized

They also break out total enrollment by county, which isn't terribly relevant to me.

Final 2025 OEP enrollment in Maryland was 247,243, so this represents a 3.4% QHP selection increase vs. last year, in spite of the enhanced federal tax credits expiring...

...for a fairly obvious reason: Like New Mexico, Maryland is backfilling a huge chunk of those lost tax credits (although not all of them the way New Mexico is):

However, the state has created a new subsidy program for all ages for those who are under 400% of the federal poverty level to help offset the expiration of the enhanced federal subsidies. The state subsidy program will replace 100% of the enhanced federal subsidies for those under 200% of federal poverty level and will replace 50% of the enhanced federal subsidies for those between 200% and 400% of the federal poverty level. Those over 400% of the poverty level will not receive a state subsidy, and will be most impacted by the loss of federal enhanced APTC, unless Congress takes immediate action.

In 2025, around 42% of Maryland ACA enrollees (roughly 104.4K people) earned less than 200% FPL, and another 32% earned 200 - 400% FPL (around 79.6K people).

It's worth noting that over 25,000 of the < 200% crowd actually earned less than 100% FPL last year; just about all of these were likely documented immigrants who have lived in the United States for less than 5 years, which the ACA made eligible for federal tax credits until the OBBA bill was passed by Republicans lasts summer.

I don't know the average dollar amount each of these populations received in enhanced tax credits, but this basically means around 60% of the lost subsidies (give or take) are being covered by the state.

UPDATE 1/24/26: The Maryland Health Benefit Exchange has posted a press release with more details:

MARYLAND LEADS NATION IN 2026 HEALTH PLAN ENROLLMENT: STATE PREMIUM ASSISTANCE SOFTENS BLOW OF LOSS OF FEDERAL SUBSIDIES

- Initial numbers show an increase in enrollment, however consumers “buying-down” to cheaper plans leave families vulnerable to medical costs.

BALTIMORE (Jan. 23, 2026) – A total of 255,612 enrolled during the open enrollment period that began Nov. 1, 2025 and ended Thursday. This enrollment through Maryland Health Connection is up 3% from last year. Maryland families and lawmakers alike value health insurance as a pillar of stability.

For Maryland’s 250,000+ individual marketplace enrollees, health insurance is a must-have that is becoming harder to afford. Families are currently balancing two competing values: protection vs. price. Maryland lawmakers made premium assistance available when Federal tax credits expired to protect individuals and families from skyrocketing prices.

At the end of 2025, the federal government let the Affordable Care Act (ACA) enhanced premium tax credits expire. Across the nation, marketplace premiums had a median increase of 18%. As Congress debated whether or not to extend the tax credits, Maryland acted. Governor Moore and the Maryland General Assembly created Maryland Premium Assistance which replaced some or all of the expired federal financial help for those under 400% of the federal poverty level, with those under 200% of FPL receiving the most help. And this year again Maryland provided extra financial help to young adults.

Enrollments by young adults aged 18-37 grew 7% from last year. More than 74% of them were eligible for a subsidy that Maryland created for young adults in 2022 to encourage their enrollment in health insurance. Their participation helps lower rates for everyone.

The Maryland Premium Assistance helped many families who, without it, would have had to make the difficult choice between food and health care costs. There are those whose income is high enough that they don't qualify for this premium assistance. Individuals who earn $62,600 a year were hit hard. So were retirees who aren’t yet 65 and don’t yet qualify for Medicare. Older adults were faced with choosing between steep costs and or choosing a less generous plan. This year, 5,743 people chose a bronze plan, when last year they had a gold plan.

Maryland Health Connection directed a portion of its marketing efforts to Black and Hispanic communities that historically have lacked health insurance. Enrollment by Black consumers grew 4% for 2026. And enrollment by Hispanic consumers grew 2%.

The Maryland Premium Assistance was a crucial state-level safety net. By comparison the Federal Facilitated Marketplace, Healthcare.gov, saw a 9.2% decline in enrollment as of the end of December according to CMS.gov.

This year’s enrollment numbers show that despite rising insurance prices, Marylanders still want the peace of mind that comes with having health insurance,” said Maryland Health Benefit Exchange Executive Director Michele Eberle. “Our priority is to make coverage affordable and accessible. The Maryland Premium Assistance program prevented significant hikes for low and middle income families.”

A clearer picture of the Maryland marketplace will be more apparent in coming months. The expiration of the credits is expected to result in lapsed policies as consumers are unable to pay the first month’s premium. Cancelled policies also contribute to increasing the cost of coverage in the pool.

Recipients of the Deferred Action for Childhood Arrivals (DACA) which were allowed to enroll through the marketplace for the first time last year were no longer eligible as of September due to the One Big Beautiful Bill Act.

In addition, there are about 18,000 lawfully present immigrants who earn under 100% of the federal poverty level that as of Jan. 1 were no longer eligible for Advanced Premium Tax Credits. Many of them terminated coverage, but not yet all.

Overall, new enrollments were down 12%. Dental plan enrollments rose 9%. Enrollment in vision plans increased 42% from roughly 850 last year to 1,209.

“Health insurance is essential to the well-being of our families and the strength of our communities," said Health Secretary Dr. Meena Seshamani, who chairs the Maryland HealthBenefit Exchange Board of Trustees. “Our focus is on meeting people where they are and making sure Marylanders can access the care and coverage they need to live healthy, productive lives.”

Even after open enrollment, opportunities for people to enroll who lack coverage will continue. Marylanders who check a box on their state income tax returns that they need health insurance will be able to enroll in a program offered through the Office of the Comptroller of Maryland. Anyone who loses a job and files for unemployment insurance can also check a box during that application process with the Maryland Department of Labor to request help with health coverage. Marylanders who have certain life events, such as losing employer coverage, getting married or divorced, or turning 26 and aging off a parent’s plan, may also be eligible to enroll now.

People who are eligible for health coverage through Medicaid can enroll any time of the year.

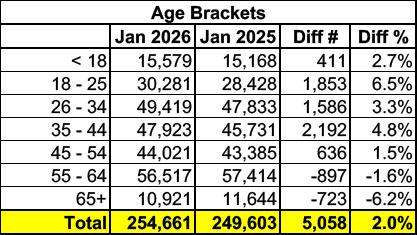

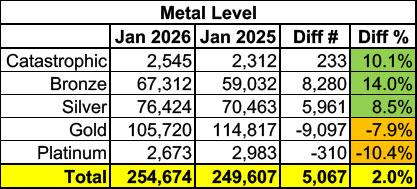

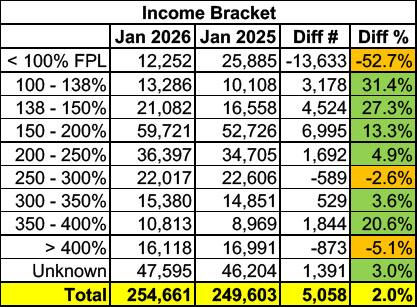

UPDATE 2/04/26: This isn't technically a final report (that likely won't come out for another month or so), but since the Maryland exchange is one of a handful which publishes monthly enrollment reports, I figured I'd compare their January 2026 report against the one from January 2025.

Again, these numbers will look slightly different when the official 2026 OEP Public Use Files are (hopefully) released later this spring, but it should serve as a good guide for the moment:

Like California and Minnesota, there's a clear case of enrollees "buying down" (i.e., downgrading to a lower metal level in order to avoid or at least mitigate the massive premium hikes). In Maryland's case, Silver plan enrollment actually increased...but that's clearly due primarily to the fact that MD residents were heavily enrolled in Gold plans last year. Bronze plan enrollment increased the most, of course.

Here's where the fact that Maryland backfilled a huge chunk of the lost federal subsidies made its biggest impact: The only income bracket to see a dramatic drop in enrollment are those who earn less than 100% of the Federal Poverty Level...which basically means the < 5 year resident immigrants I mentioned above.