House GOP will hold vote on healthcare package w/subsidy extension after all, but DANGER WILL ROBINSON...

With the Senate failing to pass either the Democrats bill to simply extend the enhanced tax credits by 3 more years or the Republicans bill to make everything worse yesterday, all eyes turn to the House, where something like a dozen different bills, some with bipartisan support, some not, have been thrown against the wall to see if anything might stick.

Now, it looks like one of them might actually get a floor vote next week...but only as an amendment to another healthcare bill package being pushed by GOP House leadership, which of course raises all sorts of red flags.

via Laura Weiss of Punchbowl News on Thursday:

NEWS: Speaker JOHNSON & House GOP leaders are leaning toward giving mods a FLOOR VOTE on a bill extending enhanced ACA subsidies next week

Vote would be on FITZPATRICK bill as an amendment toOP leadership's health package JOHNSON told huddle of mods on the floor earlier he'd support amendment vote & could do it WITHOUT adding abortion funding restrictions.

But speaker cautioned he'll need buy-in from other parts of the conference.

Without including Hyde Amendment restrictions??? Hmmmmm...

via Sahil Kapur of NBC News on Friday:

Speaker Johnson is eying a vote on a health care package *next week*, per House Republican leadership aides.

Underlying bill will include policies like codifying AHPs, approving CSRs, PBM transparency. (NO Crapo-Cassidy.) Plus an amendment on extending ACA funds; no details yet.

GOP Rep. Mark Harris also said something about "Choice Plans" being part of the package on FOX Business this morning. There was also a mention of "Choice Accounts" on that slide from Johnson's powerpoint a few days ago.

And sure enough, as of Friday evening, Politico has the latest including the text of the bill itself:

House GOP leadership will permit a floor vote to extend enhanced Obamacare subsidies — an olive branch to moderate members who have been clamoring for a chance to go on record in support of an extension.

Republican leaders unveiled text of their health care package Friday evening, which they plan to put on the floor next week.

“The process” for considering that package “will allow” a vote on an amendment to prevent the subsidies from lapsing Dec. 31, according to a House Republican leadership aide granted anonymity to share the unannounced plans.

...Instead, according to House Republican leadership aides, Republicans are preparing to roll out a health care framework that would allow businesses that fund their own health plans to purchase “stop-loss” policies — which would protect businesses from going bankrupt from just a few unexpectedly expensive insurance claims.

So, it looks like it'll include the following:

- Codifying Association Health Plans

- Appropriating CSR reimbursement payments

- Pharmacy Benefit Manager (PBM) reform

- Codifying CHOICE Plans

- Stop-Loss Group Insurance

- The Fitzpatrick bill which I did a brief writeup on a few days back

Let's go through these one by one.

Codifying Association Health Plans:

From my colleague Louise Norris:

Associations can offer group health insurance plans known as association health plans, or AHPs. The idea behind an AHP is to let small businesses in the same industry join together to offer what essentially amounts to large group coverage, rather than each small business having to obtain its own small group plan.

This is an attractive idea for some small businesses (primarily those with healthy employees), because the ACA places far fewer regulations on large group plans. While small group plans have to cover the essential health benefits and cannot base premiums on the group's medical history, those rules do not apply to large groups.

In 2018, the Trump administration finalized new rules to expand access to AHPs. The new rules called for allowing sole proprietors to join AHPs, allowing associations to be formed primarily for the purpose of providing AHP health coverage (as opposed to a primary business purpose), and allowing associations to be formed either based on a commonality of business interest (as was already allowed) or based on sharing a common geographic location.

Sounds harmless enough, right? Well...keep reading. From a Robert Pear NY Times article about them during the Trump 1.0 era:

But these health plans, created for small businesses, have a darker side: They have a long history of fraud and abuse that have left employers and employees with hundreds of millions of dollars in unpaid medical bills.

The problems are described in dozens of court cases and enforcement actions taken over more than a decade by federal and state officials who regulate the type of plans Mr. Trump is encouraging, known as association health plans.

In many cases, the Labor Department said, it has targeted “unscrupulous promoters who sell the promise of inexpensive health benefit insurance, but default on their obligations.” In several cases, it has found that people managing these health plans diverted premiums to their personal use.

The department filed suit this year against an association health plan for 300 small employers in Washington State, asserting that its officers had mismanaged the plan’s assets and charged employers more than $3 million in excessive “administrative fees.”

...But Mila Kofman, a former insurance superintendent in Maine who has done extensive research on association health plans, said they also often falsely claimed to be exempt from state insurance laws, as a way to explain how they could offer premiums lower than those charged by licensed insurance companies.

...But history shows the risks of an expansion of association health plans. If a plan becomes insolvent, the impact on consumers can be devastating.

...when they went to the doctor, they found out all of a sudden that their insurance company, their perceived insurance company, was in receivership and that they had no coverage.”

HARD PASS. Next?

Appropriating CSR Reimbursement Payments:

This is about the dozenth time I've had to explain this, but it's necessary to understand what's going on here:

- The ACA includes two types of financial subsidies for individual market enrollees through the ACA exchanges. One program is called Advance Premium Tax Credits (APTC), which reduces monthly premiums for low- and moderate-income. This is what the entire "enhanced tax credit" brouhaha is about to begin with.

- The other type of subsidies are called Cost Sharing Reductions (CSR). These reduce deductibles, co-pays and other out-of-pocket expenses for low-income enrollees (households earning up to 250% FPL, although they become far less generous over 200% FPL).

- The way the CSR program works is a bit unusual. Unlike premiums, which are a set, known dollar amount for every enrollee each month, the CSR program involves deductibles & co-pays, which can vary greatly from month to month.

- Therefore, instead of subsidizing the enrollees directly, it was designed so that the insurance carriers are contractually required to cover the given portion of the enrollee's deductibles, co-pays etc. up front, and then submit their CSR expenses to the federal government on a monthly basis to be reimbursed.

- In 2014, House Republicans sued the Obama Administration in order to stop CSR reimbursement payments. They actually won the case, but it was appealed by the Obama Admin...and the appeal spilled over into the Trump 1.0 Administration in 2017.

- In late 2017, the Trump 1.0 Admin dropped the appeal, which immediately cut off CSR reimbursement payments. Trump did this as part of a failed attempt to sabotage the ACA.

- HOWEVER, insurance carriers, state-based ACA exchanges and state insurance commissioners put their heads together and switched to a contingency plan which was first laid out in an issue brief by the HHS Dept's. Assistant Secretary for Planning & Evaluation (ASPE) in 2015 to make up for their CSR losses and which was further discussed by analysts at the Urban Institute in 2019: SILVER LOADING.

- The carriers basically calculated how much they expected to have to shell out in CSR payments the following year...and then added that amount to their gross/unsubsidized premiums for the following year instead.

You can read the rest of my explainer here, but the end result of Silver Loading has been the following:

- GROSS premiums for SILVER plans went up dramatically. HOWEVER...

- NET premiums for BRONZE, GOLD (and even PLATINUM) plans dropped dramatically as well, AND...

- Premium SUBSIDIES (tax credits) also increased significantly...and since those can be applied towards non-Silver plans...

- MILLIONS OF SUBSIDIZED ENROLLEES found themselves able to get GOLD plans for the same or even lower cost than SILVER plans, and many could even get BRONZE plans for dirt cheap or no premium cost at all.

If this sounds a lot like Premium Alignment, that's no coincidence--Silver Loading of CSR costs actually comprises the bulk of Premium Alignment impact.

The bottom line is that Silver Loading ended up making lemons into lemonade: Over 5.7 million moderate-income enrollees who earn over 200% FPL and are enrolled in Bronze, Gold or Premium plans are greatly benefiting from this pricing strategy right now via dramatically lower premiums.

Meanwhile, the only ones who are harmed by it via higher premiums are around 300,000 unsubsidized enrollees who happen to have selected Silver plans...and the only reason many of them would be unsubsidized to begin with, ironically, if the enhanced tax credits actually expire less than three weeks from today.

So, what would appropriating the CSR payments actually do?

Well, for starters, it would revert back to the pre-2018 CSR reimbursement system, which would ironically be the exact opposite of what House Republicans were trying to do in the first place over a decade ago.

More importantly, however, it would reduce gross Silver premiums by around 11% or so (according to GOP claims)...but it would also reduce premium tax credits while also making Bronze, Gold & Platinum plans cost far more.

Oh, and keep in mind that the ~11% gross premium drop for Silver plans would be relative to the 26% average gross premium increase for 2026. Gross premiums would still be ~12% higher than they are in 2025.

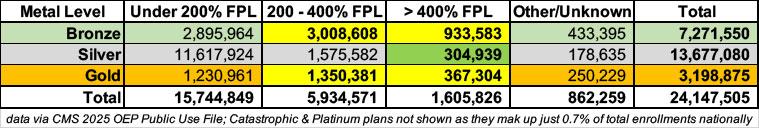

Here's a breakout of current ACA exchange enrollment by metal level and income bracket...

...and here's the same table with the enrollees currently helped by Silver Loading (in yellow) vs. those who would be "harmed" by it (in green). And again, the only reason they'd be harmed at all is if the enhanced subsidies end, since that would cut everyone earning over 400% FPL from any subsidies at all:

In other words, funding CSR reimbursement payments would slightly help a few hundred thousand middle-class enrollees (who only need the help because of the enhanced tax credits expiring to begin with) while significantly harming over 5.7 million lower-income enrollees in the process.

UPDATE: Not sure how I missed this as it's at the very end of the bill, but sure enough, there is abortion-related language in it...although I don't think that's the type of Hyde language that Politico was referring to.

It's worth noting, however, that if this section were to come to pass, it would have an absurdly ironic outcome which I don't think Republicans have thought through...

HARD PASS. Next?

Pharmacy Benefit Manager (PBM) reform:

The PBM section takes up a whopping 85 pages of the 110 page bill, and get insanely complicated, but I assume it's similar to the PBM reforms included in the bipartisan "Common Ground" bill I wrote about on Wednesday.

As I said then: I don't really know enough about it to comment too much, but here's a snippet from a recent article in Healthcare Dive which gives a basic idea of the problem:

PBMs sit in between drug companies, payers and pharmacies in the drug supply chain, and wield significant power over what drugs patients receive and at what cost.

The middlemen have become a target for legislators and regulators in Washington looking to make drugs more affordable. In particular, policymakers have taken aim at the “Big Three” PBMs — Express Scripts, CVS Caremark and Optum Rx — that jointly control about 80% of U.S. prescriptions and are all owned by major insurers.

Pharmaceutical companies — which have a vested interest in keeping PBMs in the public spotlight to avoid reform themselves — along with independent pharmacies and some health policy experts argue that vertical consolidation incentivizes PBMs to drive up the cost of medicines and steer patients to in-house pharmacies. PBMs deny this, arguing that they’re the only actor in the U.S. drug supply chain actually incentivized to negotiate lower prices, since they prove their value to employer and payer clients through the savings they’re able to wrangle from drugmakers.

Still, there’s broad bipartisan support for curbing PBMs in Congress, which has given rise to a number of proposals over the past few years, including breaking up PBM conglomerates entirely. Congress got close to passing a package of more moderate reforms last December, slotting them into an annual appropriations bill. However, the PBM language and other healthcare policies were scrubbed before the bill was passed after being criticized by Musk.

Of course Elon Musk would have his fingers in this pie as well.

Again: I don't know if the PBM provisions of the House GOP package are good or bad, but it's sincerely possible that this will actually be a positive thing. I'm giving this a "neutral until I know more about the details" grade.

Codifying CHOICE Plans:

"CHOICE Plans" are a rebranding of an existing program with a far more unfortunate name: ICHRAs.

ICHRAs (it stands for Individual Coverage Health Reimbursement Arrangement) allow employers the option of having their employees buy health insurance via the ACA individual market instead of via a group (employer-sponsored) plan. The employer then still covers a portion of the employee's premiums just as they would if they enrolled via group coverage instead (this is basically the same role that ACA tax credits serve for most exchange enrollees).

I've written about ICHRAs a few times over the years; I was suspicious of it at first since it was developed by the Trump 1.0 Admin, but eventually decided that it seems to be one of the few good healthcare ideas to come out of that period.

So what's going on with them now? Well, ICHRAs have never actually been codified into law--they were created via Executive Order by Trump 1.0, and the Biden Administration never rescinded them (again, presumably because Biden's HHS/CMS folks came to the same conclusion I did).

Republicans have actually tried to codify ICHRAs into law a couple of times...most recently last summer as part of the so-called "One Big Beautiful Bill." However, it never made the cut in the final version which the GOP passed.

So, what's the deal now? Here's a good explainer (as always) from Louise Norris, who's awesome:

...The budget bill also calls for ICHRAs to be rebranded as Custom Health Option and Individual Care Expense (CHOICE) Arrangements.

As an aside, I admit that changing the acronym from "ICHRA" to "CHOICE" is a wise move. "ICHRA" makes it sound like a diseased fish.

Section 110203 of the House budget bill creates a nonrefundable tax credit that would be available to small employers (those with fewer than 50 full-time equivalent employees) during the first two years they offer a CHOICE Arrangement to their employees. The tax credit would be $100 per employee per month for the first year and $50 per employee per month in the second year. Both amounts would be adjusted for inflation in years after 2026.

OK, so Republicans are pushing legislation which would dole out more tax credits!

Oh, the irony! But...ok, what else?

...Under current rules, an ICHRA can be used to reimburse employees for individual-market coverage purchased through the ACA Marketplace / exchange or outside the exchange. If the employer’s ICHRA contribution is not enough to cover the full premium, the employee is responsible for covering the remaining premium.

Employers that utilize Section 125 cafeteria plans can allow employees the option to use a pre-tax salary reduction to pay the employee’s share of the premiums, but only if the plan is purchased outside the Marketplace (meaning the plan is purchased directly from an insurer, with or without the assistance of an agent or broker, without utilizing the health insurance Marketplace).

Section 110202 of the House budget bill would change that. It would allow employees to utilize pre-tax salary reductions (if offered by the employer) for the employee’s share of an individual-market plan, even if the plan is obtained in the Marketplace.

OK, so Republicans are pushing legislation which would encourage more people to enroll on-exchange!

Oh, the irony! But...ok, what else?

...Under current rules, an employer can offer both an ICHRA and a traditional group plan, but only if they’re offered to different employee classes. In other words, no employee can be offered a choice between a traditional group plan and an ICHRA.

Section 110201(a)(2)(C) of the House budget bill would relax this rule for small employers. If all of the employees in a class are offered a fully insured small-group health plan, those employees could also be offered the option to be reimbursed for individual-market coverage with a CHOICE Arrangement instead.

It’s unclear whether small employers would utilize this option however, as doing so would require the administrative burden of offering both a CHOICE Arrangement and a small-group health plan.

I'll be perfectly honest: I don't know that I have much of a problem with this in and of itself. There's probably some downsides to it that I'm not thinking of (and the specifics in the House GOP bill may be different from what they were last summer); the devil is always in the details, but at face value it sounds like this would result in ACA exchange enrollment increasing.

The small group health insurance market has been gradually shrinking over the years, but has generally hovered around 9 - 10 million people. If ICHRAs (pardon me, CHOICE plans) eventually result in all 10 million being absorbed into the ACA exchange market, that would be a good thing in my view (assuming the ACA plans themselves aren't weakened, of course).

It would make it more durable politically (~33 million people vs. ~24 million) while also making it more stable risk pool-wise.

I'm giving this one a possible thumbs up, depending on the details.

Stop-Loss Policies:

From the Healthcare Administrator's Association:

Stop-loss insurance (also known as excess insurance) is a product that provides protection against catastrophic or unpredictable losses. It is purchased by employers who have decided to self-fund their employee benefit plans, but do not want to assume 100% of the liability for losses arising from the plans. Under a stop-loss policy, the insurance company becomes liable for losses that exceed certain limits called deductibles. There are two types of self-funded insurance:

- Specific Stop-Loss is the form of excess risk coverage that provides protection for the employer against a high claim on any one individual. This is protection against abnormal severity of a single claim rather than abnormal frequency of claims in total. Specific stop-loss is also known as individual stop-loss.

- Aggregate Stop-Loss provides a ceiling on the dollar amount of eligible expenses that an employer would pay, in total, during a contract period. The carrier reimburses the employer after the end of the contract period for aggregate claims.

A number of variations are available for each of these two products.

Generally, all but the largest employers will want to protect their plan with both specific and aggregate stop-loss coverage. Occasionally, circumstances may be such that specific stop-loss by itself will fulfill the employer’s need for protection.

As my colleague Dave Anderson says, this is basically a form of reinsurance, and it's been available for years.

So what is the House GOP bill changing?

Well, judging by the text of the bill (the Stop-Loss section is only about a page long), they basically want to remove stop-loss insurance from being defined as health insurance altogether so it can't be regulated by states:

SEC. 102. CERTAIN MEDICAL STOP-LOSS INSURANCE OBTAINED BY CERTAIN PLAN SPONSORS OF GROUP HEALTH PLANS NOT INCLUDED UNDER THE DEFINITION OF HEALTH INSURANCE COVERAGE

(a) IN GENERAL.—Section 733(b)(1) of the Employee Retirement Income Security Act of 1974 (29 U.S.C. 1191b(b)(1)) is amended by adding at the end the following sentence: ‘‘Such term shall not include a stop loss policy obtained by a self-insured group health plan or a plan sponsor of a group health plan that self-insures the health risks of its plan participants to reimburse the plan or sponsor for losses that the plan or sponsor incurs in providing health or medical benefits to such plan participants in excess of a predetermined level set forth in the stop-loss policy obtained by such plan or sponsor.’’.

(b) EFFECT ON OTHER LAWS.—Section 514(b) of the Employee Retirement Income Security Act of 1974 (29 U.S.C. 1144(b)) is amended by adding at the end the following: ‘‘(10) The provisions of this title (including part 7 relating to group health plans) shall preempt State laws insofar as they may now or hereafter prevent an employee benefit plan that is a group health plan from insuring against the risk of excess or unexpected health plan claims losses.’’.

HARD PASS. Next?

The Fitzpatrick Bill:

Finally, we come to the Fitzpatrick Bill, as in PA GOP Rep. Brian Fitzpatrick. I did a short write-up about it the other evening:

A bipartisan group of House members is introducing a bill to extend the enhanced Obamacare subsidies for two years with new income limits and anti-fraud measures.

The tax credit formula table changes are confusingly worded, but it basically boils down to:

- A $5/month minimum premium even if the main formula would normally make you eligible for $0/mo premiums

Republicans seem to be obsessed with the idea that a minimum premium is necessary to combat fraud as well as to ensure that "everyone has skin in the game" which is a talking point they've been fixated on for decades. Again, I don't like it and there's ample evidence that it would cause legitimate enrollment to drop by up to a million people (nearly all of whom would be very low income)...but if it has to be included, making it even $1/month would accomplish the same "anti-fraud" goal.

I don't like the minimum premium thing at all, but it may be a necessary evil, at least for now.

- The rest of the formula would stay at the currently-enhanced levels up to 600% FPL: Good.

- From 600 - 700% FPL the sliding scale would increase from 8.5% to 9.25% of income: Not ideal, but...OK.

- 700% FPL would become the new Subsidy Cliff (roughly $110K/yr for one person or $225K/yr for a family of four

700% is obviously a lot better than 400%, but it's still too low: I'd be fine if it was 1000% or higher, and even the 935% FPL cut-off in the HOPE Act would work...but 700% is just too low IMHO.

I should also note that the confusingly-worded section (in order to work in the $5 minimum premium) may have been phrased in such a way that only enrollees who earn less than 200% FPL would have a $5 minimum. This would be batshit insane, of course, but I could also be wrong about it.

Beyond that, it would include similar measures to crack down on broker/agent fraud as the ones included in the HOPE Act, which is fine (and which would also pretty much make the "minimum premium" talking point moot).

It would also bump out the final deadline for the 2026 Open Enrollment Period through March 1st, which is also fine (why 3/01 instead of 2/28 I have no idea).

The Fitzpatrick bill includes a bunch of PBM reform stuff which I assume would mirror the changes in the "Common Ground" bill and which I discussed a bit above.

It's the last section which is the most confusing, however:

Section 7: Qualified Exchange Enrollees Eligible to Establish Health Savings Accounts

This section establishes an option for enrollees in a qualified health plan, who select the lowest cost bronze plan available, or if previously enrolled in the Marketplace select a plan that is lower in monthly premium payments than the previous year, to establish and contribute to an HSA. 50% of the credit for the eligible enrollees will be deposited into a Health Savings Account, and this account can be used to pay for health insurance premiums as well as other defined health care costs.

Traditional HSA funds can't be used to pay premiums, and in fact it would be kind of pointless to convert your premium tax credits (which help pay your premiums) into HSA funds which you then use to...pay your premiums.

But here's where it gets even weirder and more pointless:

- Let's say you enroll in a policy which costs $1,500 at full price, and you're eligible for $1,000 in tax credits/month.

- If you take the full amount as tax credits, you only pay $500/mo in premiums.

- If you take 50% of it as an HSA deposit, you have $500 in your HSA account...but you have to pay $500 more in premiums ($1,000/mo).

So...you've saved nothing.

For that matter, if you chose to take the full amount as tax credits, you could just put the other $500 into an HSA yourself anyway.

This is effectively taking money out of your left pocket and putting it into your right pocket. It's not really harmful, it's just pointless and confusing.

The question is...who would actually benefit from this? And the answer is...just about no one.

There are some people who are eligible for more tax credits than the full price of their premiums (this is how you get people with $0 net premiums even if they earn more than 150% FPL). In those cases, they don't get the difference. So if their premium is $950 and they're eligible for $1,000 in tax credits, they only get $950 of it.

However, there doesn't appear to be any provision which would allow the "extra" $50 to be put into the HSA, so there's no benefit there either.

Furthermore, according to Norris, the legislative text specifically reduces how much you can put into the HSA on your own (in other words, you still can't go beyond the maximum $8,750 limit for a family HSA)...so there's no benefit there either.

There's basically almost no one this would benefit--even wealthy people, believe it or not! What it would be is confusing as hell and incredibly complicated to set up logistically, legally, financially etc.

The larger problem with this, however, is that it would be one more method of pushing people into the last-comprehensive Bronze plans available...as opposed to encouraging them to enroll in highly comprehensive plans, especially high CSR Silver plans for enrollees under 200% FPL.

So...my take on the HSA section isn't so much "Hell No!" as it is "Why???"

In the end, my final take on the different provisions above boil down to:

- Codifying Association Health Plans: HELL NO.

- Appropriating CSR reimbursement payments: HELL NO.

- Pharmacy Benefit Manager (PBM) Reform: Depends on details.

- Codifying CHOICE Plans: Probably OK but depends on details.

- Stop-Loss Deregulation? HELL NO.

- Fitzpatrick Bill: $5/mo minimum: I hate it, but possible necessary evil

- Fitzpatrick Bill: 700% FPL Subsidy Cliff: TOO LOW, but possible necessary evil

- Fitzpatrick BIll: Broker/Agent Fraud Crackdown: THIS IS FINE.

- Fitzpatrick Bill: 50% HSA for Bronze enrollees: WTAF???

Obviously there could be other terrible things included in the specific text (I haven't read through all of it yet and the PBM section in particular is way above my pay grade), but of the provisions above, I see three which sound fine, two which I don't like but would probably swallow if I had to, three MAJOR poison pills and one which just doesn't make any sense at all.

We'll see what happens...