It's not the ~5M who've actively re-enrolled I'm most worried about; it's the ~17M who haven't yet.

In yesterday's write-up about CMS posting the first official, state-by-state data breakout for the ongoing 2026 ACA Open Enrollment Period, I noted several possible reasons why so far enrollment is running a solid 11% ahead of the same point a year ago even with widespread knowledge of the enhanced federal tax credits expiring just 25 days from now:

- Total 2025 enrollment was 13.4% higher than total 2024 enrollment; assuming a similar rate of net attrition over the course of the year, there should be around 13% more current enrollees who can potentially actively renew/re-enroll for 2026 to begin with. As it happens, re-enrollment is currently up around 14% over the same point a year ago.

- There's been a MASSIVE amount of attention given to the ACA, the exchanges, Open Enrollment, etc etc this year due to the panicky headlines about the impending subsidy expiration and of course the 43-day long federal government shutdown which focused primarily on...the ACA, the exchanges, Open Enrollment and the impending subsidy expiration.

- Finally, it's possible (I hope) that more people are taking my advice strongly urging people NOT to let themselves be passively auto-renewed: SHOP AROUND, SHOP AROUND, SHOP AROUND!

I'll add a couple more possibilities to these, both of which relate more to new enrollment, which is running behind last year but only slightly (it's only down around 1% so far):

- Layoffs: Over 200,000 federal employees were fired by Elon Musk's DOGE minions earlier this year; I don't know how FEHB rules work for laid-off federal employees but it's likely that at least a chunk of them are among the new exchange enrollees this fall. And of course unemployment in general has been crawling back up again over the past year, meaning more people potentially looking to ACA coverage for the time being.

- ICHRAs: Individual Coverage Health Reimbursement Arrangements, or ICHRAs, are one of the only good ideas to come out of the first Trump Administration. This article has a fairly good summary of how they work, but basically, employees of small businesses can enroll in an ACA individual market plan instead of a small group plan...but instead of receiving federal tax credits, their employer still covers a chunk of their premiums.

Via the same article, the HRA Council claims that around 450,000 employees & their dependents were offered ICHRAs in 2025, up from 300,000 in 2024. I don't know how many actually take up these offers, and most of them probably enroll in off-exchange plans, but they likely account for some portion of the unsubsidized enrollment on exchange as well.

In any event, I closed out the post by noting that the CMS report also mentioned the current number of "Auto Re-enrollee Plan Selections" as they call them. Basically, those are the rest of the current enrollees who haven't yet actively selected a policy for 2026, nor have they actively terminated their coverage as of the end of 2025.

As I've noted many times before: If you're a current ACA enrollee and you take no action whatsoever by the end of the initial December deadline for January 1st coverage (December 15th in most states), in most cases you'll be automatically re-enrolled into the same plan you have today for the following year.

I said "in most cases" because in some cases the plan you're currently enrolled in may not be available any longer. Perhaps your carrier discontinues it; perhaps they decide not to offer coverage in your part of the state (or pull up stakes and leave the state entirely, as Aetna and some others are doing).

If that happens, the ACA exchange (either HealthCare.Gov or your state-based exchange) is supposed to "map" you to the next closest plan available. If Blue Cross drops your Silver PPO, they're supposed to put you in another Blue Cross Silver PPO; if no PPOs are available, you might be placed in an HMO. If Blue Cross pulls out entirely, you'll be mapped to a similar Silver plan from another carrier, and so on.

Either way, the point is that if you take no action whatsoever--you don't log into your account & actively select the specific plan you want for 2026--one will be chosen for you...and there's no guarantee that it will make sense for your purposes...or (vitally important with the looming subsidy expiration) that you'll be able to afford it.

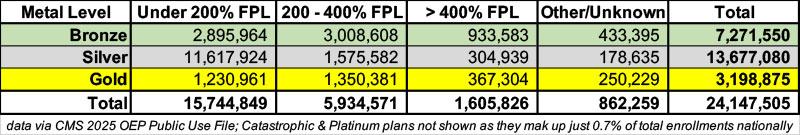

Last year over 12.3 million ACA exchange enrollees received CSR assistance, which (aside from a tiny number of Native American/Alaska Natives) means, by definition, that they earn less than 250% FPL and are enrolled in Silver plans. Of those, I estimate around 9.6 million earn less than 150% FPL, based on data from the 2025 OEP Public Use File. This means that they're currently receiving 94% AV Silver CSR (aka "Secret Platinum) coverage, which is a good thing...and assuming their incomes remain under 150% FPL next year, in just about every case they should stick with it.

Another ~2.0 million enrollees are receiving 87% AV CSR coverage, which means they earn between 150 - 200% FPL...and again, in most cases they'll probably be better off staying with a Silver plan even with their subsidies becoming far less generous next year.

HOWEVER, the same data shows that nearly 13.7 million enrollees have chosen Silver plans overall. This means that there's around 1.9 million who almost certainly shouldn't be enrolled in Silver plans next year...because they're gonna get hit with the subsidy-expiration premium hikes without at least getting the generous deductible/copay assistance offered by high-AV CSR assistance.

In many cases--particularly in the 14 states with Premium Alignment policies in place for 2026--they'd be far better off enrolling in either a Bronze plan (which would have high deductibles but be dirt cheap) or a Gold plan (which would actually cost the same or less than Silver even though they have lower deductibles/co-pays).

On the flip side, there's another 1.7 million enrollees who earn less than 150% FPL enrolled in Bronze plans who should be enrolled in a Silver plan this year since they're missing out on the generous CSR assistance...and 1.1 million more Bronze enrollees earning 150 - 200% FPL who would probably be better off with Silver.

Finally, there's a good 1.6 million enrollees who earn more than 400% FPL who are about to see their premiums skyrocket due to being cut off from any federal subsidies whatsoever.

For them, Silver is probably the worst place to be in most cases, and their best bet would likely be to either go for a Bronze plan with an HSA (in order to force their MAGI income below the 400% FPL threshold) or, if that isn't feasible and they live in one of the 14 Premium Alignment states, to switch to Gold to at least save some money.

In a few cases they may even be better off switching to a "mirrored" off-exchange Silver plan, but that starts getting deeper into the weeds.

The larger point of all of this is that, ONCE AGAIN, while it's never a good idea to passively let yourself be auto-renewed without at least checking around first, for 2026 it's even MORE important that current enrollees NOT do so.

This is why, while it's heartening to hear that over 4.8 million current enrollees have actively selected a plan for next year (hopefully taking all of this advice to heart when doing so)...it's those who don't do so who I'm most concerned about.

Those who actively shop around and select a plan will still end up being screwed on either premiums, deductibles/co-pays, networks or all of the above in most cases...but at least they'll know what they're about to face.

Those who don't do so--who are oblivious to everything going on and let themselves just be passively auto-renewed without understanding the consequences of doing so--are going to be hit with a January 2026 premium invoice which could very well cause a heart attack which they'll no longer be able to afford to have treatment for.

So, how many people are we talking about?

Well, CMS reported that there were around 22.8 million effectuated ACA exchange enrollees nationally as of August. I'm assuming that this has dropped slightly to perhaps 22.5 million or so (?).

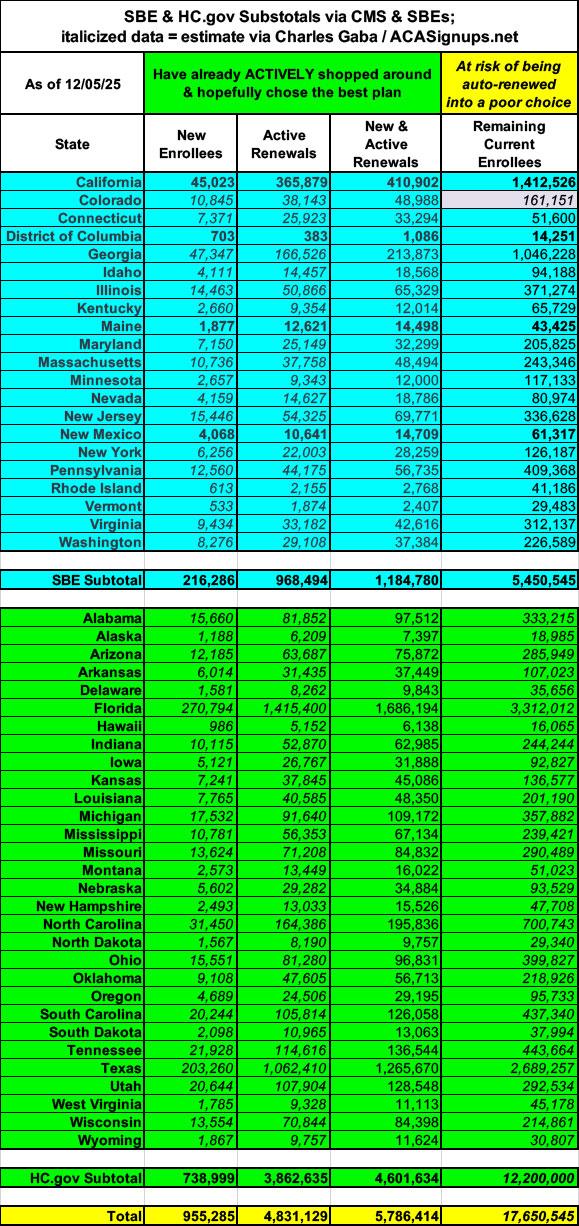

Yesterday's CMS report lists a total of 5.32 million "Auto re-enrollee plan selections" across 20 of the 21 SBE states...the missing one is Colorado, which had previously reported 210,000 total enrollees (including new, active & passive re-enrollees). That puts the remaining total for SBEs at around 5.5 million.

4.83 million active renewals + 5.45 million remaining in the SBEs means there could be up to 12.2 million current enrollees who haven't selected 2026 coverage as of yet in the 30 HealthCare.Gov states.

Combined, that means there's still as many as 17.6 MILLION remaining current enrollees nationally who haven't yet enrolled. In the table below I've done my best to estimate how many this likely is in every state (the blue SBE states come directly from the CMS report; the italicized green HC.gov states are my best estimates):

Of course, the enrollment data reported by CMS yesterday is already outdated: It's missing a week's worth of data for HC.gov states and 2 weeks worth for SBM states. And of course there's still at least 9 more days for those ~17M people to actively select plans (which I'm sure millions will be scrambling to do soon).

However, last year over 10.8 million people let themselves be passively re-enrolled...nearly 54% of total re-enrollments. If that were to happen this year, that'd be around 12 MILLION current ACA exchange enrollees who will be in for a very rude awakening right around...oh Christmastime.

DO. NOT. LET. YOURSELF. BE. PASSIVELY. AUTORENEWED.

As an aside, I should also note that the timing of all of this will be interesting. Assuming new enrollment continues to only lag slightly behind last year, there could be up to ~4 million new enrollees for 2026, which means total plan selections could potentially hit ~25 million...which would actually break last year's record of 24.3 million.

If this happens (or anything close to it), you can expect the following scenario to play out:

- 1. Sometime on December 23rd (just before DC shuts down for the holiday break), Trump & CMS will crow about how he "managed Obamacare better than Obama & Biden!" even though it's "still terrible & needs to be replaced with a much better plan" which he'll be announcing "very soon, probably within two weeks!"

- 2. Congressional Republicans will pounce on the high enrollment to mock Democrats for "needlessly scaremongering" everyone about people losing coverage etc etc, and how this "proves" that the enhanced tax credits "were never needed in the first place!"

- 3. Both Congressional Republicans & Trump will, of course, use the above as another excuse not to extend the enhanced tax credits.

- 4. Sometime between Christmas & New Year's Eve, millions of people who let themselves be auto-renewed will receive their January premium invoices...often for double, triple, quadruple or more than what they've been paying this year.

- 5. After they finish freaking the fuck out, some of them will use the extra time left in the Open Enrollment Period (most states will have until January 15th) to switch to a different plan starting in February. They'll still owe the January payment, mind you, and the plan they switch to will likely still cost somewhat more and/or have higher out of pocket costs than they do now. Oh, yeah...and the deductible & out of pocket cap will be reset for 11 months instead of 12, so anything they pay towards that in January won't be counted.

- 6. Others will be forced to drop coverage altogether. This is when the bulk of the "several million losing coverage" that the CBO projected will likely happen. Some may be able to cover the absurdly higher premiums for 3-4 months before having to drop coverage entirely, which will dilute the impact in the media.

- 7. Meanwhile, all of this will be playing out against the backdrop of the Continuing Resolution which Democrats agreed to last month expiring and the federal government facing another shutdown scenario at the end of January...once again, tied primarily to the enhanced tax credits being reinstated.

The point is that Trump & Congressional Republicans will get their victory lap & "Much Ado About Nothing" talking points out there before #4 - 7 above happen. Watch for it.