Breaking: CMS posts claimed 2026 Open Enrollment: 5.76M QHPs, up ~11% y/y so far

Just before the close of business for the week, the Centers for Medicare & Medicaid Services (CMS) published the first official 2026 Open Enrollment Period snapshot report:

The Centers for Medicare & Medicaid Services (CMS) reports that nearly 950,000 consumers who do not currently have health care coverage through plans in the individual market Marketplace have signed up for coverage in 2026, since the start of the Marketplace Open Enrollment Period (OEP) on November 1, 2025. Existing consumers are also returning to the Marketplace to actively renew their coverage, and anyone who does not actively renew will be automatically re-enrolled for 2026. Over 4.8 million existing consumers have already returned to the Marketplace to select a plan for 2026.

Definitions and details on the data in this report are included in the glossary.

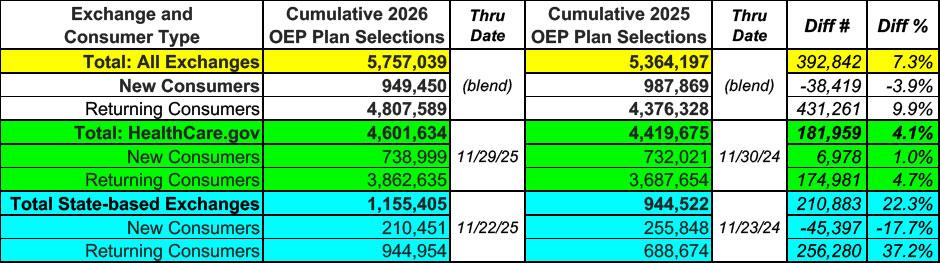

As usual, I'll start out with the top line numbers, compared to the same point last year:

This is actually...pretty damned good, especially considering all of the freaking out surrounding the expiring enhanced tax credits: So far, according to CMS, total active enrollment (which includes both new enrollees as well as current enrollees who have actively selected a plan for 2026) is running over 7% ahead of the same point a year ago.

It's actually slightly better than that, in fact, since there's one fewer day included in this data for both federal exchange states (HealthCare.Gov) as well as state-based exchange states (SBEs).

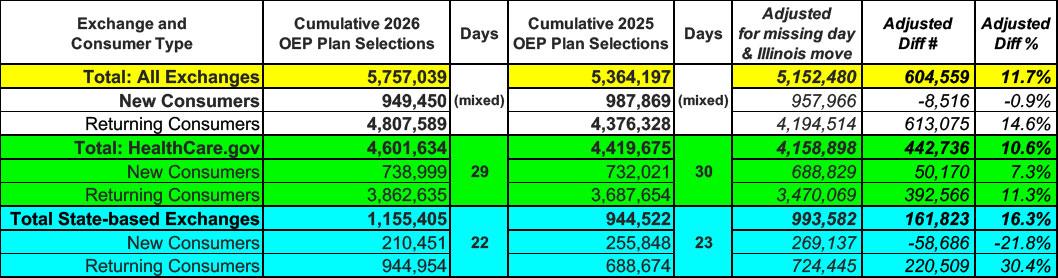

On top of that, there's also another important adjustment: Illinois, which enrolled nearly 466,000 people during the 2025 Open Enrollment Period, moved off of the federal exchange onto their own platform this year, which means you have to adjust for both the HC.gov and SBE data.

When I adjust for the missing day and for Illinois shifting from HC.gov to a state exchange, it looks more like the following:

And there you have it: Total enrollment through the end of November is actually running over 11% ahead of the same point a year ago.

This may sound counterintuitive; after all, there have been a bunch of stories like this one by Amy Lotven of Inside Health Policy from just a few days ago talking about how both enrollees as well as insurance brokers, agents & assisters have been reporting sluggish and delayed enrollment:

Weeks into a chaotic Affordable Care Act open enrollment season, sources tell Inside Health Policy while it's still early to gauge how the loss of the premium tax credits is affecting sign-ups, some “concerning” trends have emerged -- like people shifting to less-generous plans -- and the consumer panic and fear that stakeholders had tried to prevent by pushing the renewal of the expiring tax credits is real and intense.

Consumers are stunned by premiums. Some are asking if it’s a mistake, Audrey Morse Gasteier, executive director of Massachusetts Health Connector, tells IHP. Call center staff report an uptick in the number of consumers threatening self-harm as they process the information about their costs, she says.

...“[People are] generally shocked, concerned, hesitant, or downcast about the new premium costs but often feel complacent and resigned to renewing their plans due to limited alternatives,” a Covered California spokesperson says. “Consumers are asking what other options exist for them, particularly those struggling with affordability, even at the bronze level. Some have mentioned potentially having to cancel their coverage altogether.”

...An exchange official says consumers are waiting to see if Congress extends the EPTCs before deciding whether to enroll, according to reports from Covered California’s broker and navigators. The exchange has also heard people in the 55-65 age range who make more than 400% of the federal poverty level and face significant premium increases without the EPTCs are not yet canceling their insurance but are saying they’ll likely be unable to renew without any financial help.

However, there's a couple of other factors to consider which may explain the increase in early enrollment so far:

- Total 2025 enrollment was 13.4% higher than total 2024 enrollment; assuming a similar rate of net attrition over the course of the year, there should be around 13% more current enrollees who can potentially actively renew/re-enroll for 2026 to begin with. As it happens, re-enrollment is currently up around 14% over the same point a year ago.

- There's been a MASSIVE amount of attention given to the ACA, the exchanges, Open Enrollment, etc etc this year due to the panicky headlines about the impending subsidy expiration and of course the 43-day long federal government shutdown which focused primarily on...the ACA, the exchanges, Open Enrollment and the impending subsidy expiration.

- Finally, it's possible (I hope) that more people are taking my advice strongly urging people NOT to let themselves be passively auto-renewed: SHOP AROUND, SHOP AROUND, SHOP AROUND!

If the latter is the reason why active re-enrollments are up so far (even as new enrollments are down slightly), that's a good thing, because it means that people are actually looking at their options instead of blindly letting themselves be passively rolled over into a plan with dramatically higher premiums.

I'll have a much clearer picture of what's going on after the initial December 15th deadline (in most states) for January coverage passes. That's when any existing enrollees who haven't actively chosen a plan (or terminated their accounts entirely) will be auto-reenrolled and added to what I presume will be the next enrollment report.

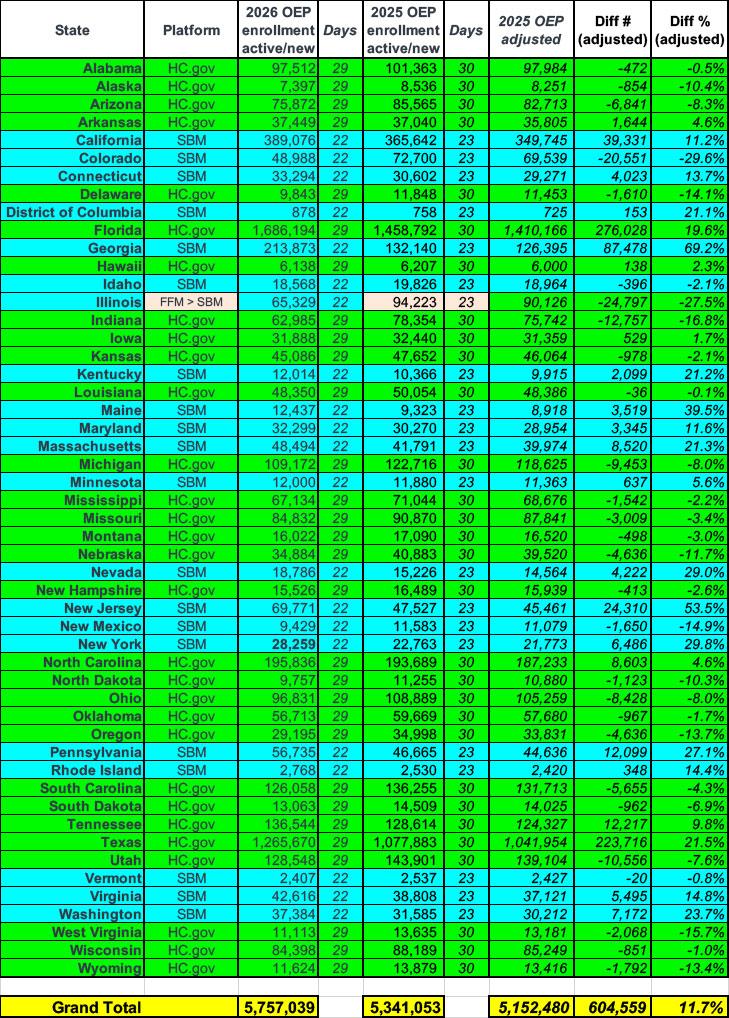

Today's "Snapshot Report" also breaks out the enrollment data so far by state; here's what it looks like compared to the same point last year (along with an adjustment for the missing day):

If we only look at new enrollees plus active re-enrollments, about half the states are running behind last year while the other half are running ahead. If you only include states which are running at least 5% behind or ahead, you get:

- Down 5 - 10%: AZ, MI, OH, SD & UT

- Down 10 - 15%: AK, DE, NE, NM, ND, OR & WY

- Down 15 - 20%: IN, WV

- Down over 20%: Colorado & Illinois

- (Illinois is understandable seeing how they just transitioned from one platform to another)

The states running well ahead of last year so far include:

- Up 5 - 10%: MN, TN

- Up 10 - 15%: CA, CT, MD, RI, VA

- Up 15 - 20%: FL

- Up 20 - 25%: DC, KY, MA, TX, WA

- Up 25 - 30%: NV, NY, PA

- Up over 30%: GA, ME & NJ

In fact, Maine is up nearly 40%, New Jersey up over 53% and Georgia is up an astonishing 67% year over year so far.

There's so many variables still at play that it's still difficult to draw any conclusions from all of this, although it is worth noting that nearly all of the states which are running well ahead of last year are state-based exchanges (so far).

As for the lingering question of whether the Trump CMS (operated by Dr. Oz and ultimately under the control of RFK Jr.) might be cooking the books/etc, I highly doubt that. For one thing, there are 21 state-based ACA exchanges; they would call out any funny business with their enrollment data.

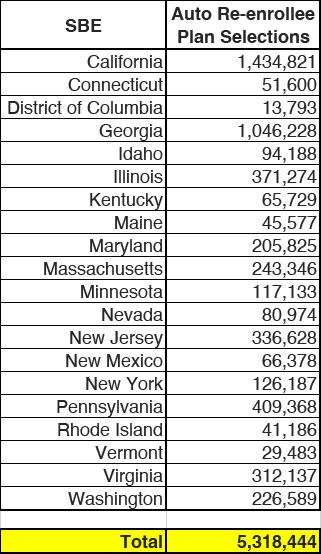

Finally, there's the question of auto-renewals. The following is the pool (for state-based exchanges only) from which current enrollees can actively choose to select a new plan for 2026 (or to terminate coverage altogether). I'll be posting some additional thoughts about these later today or tomorrow:

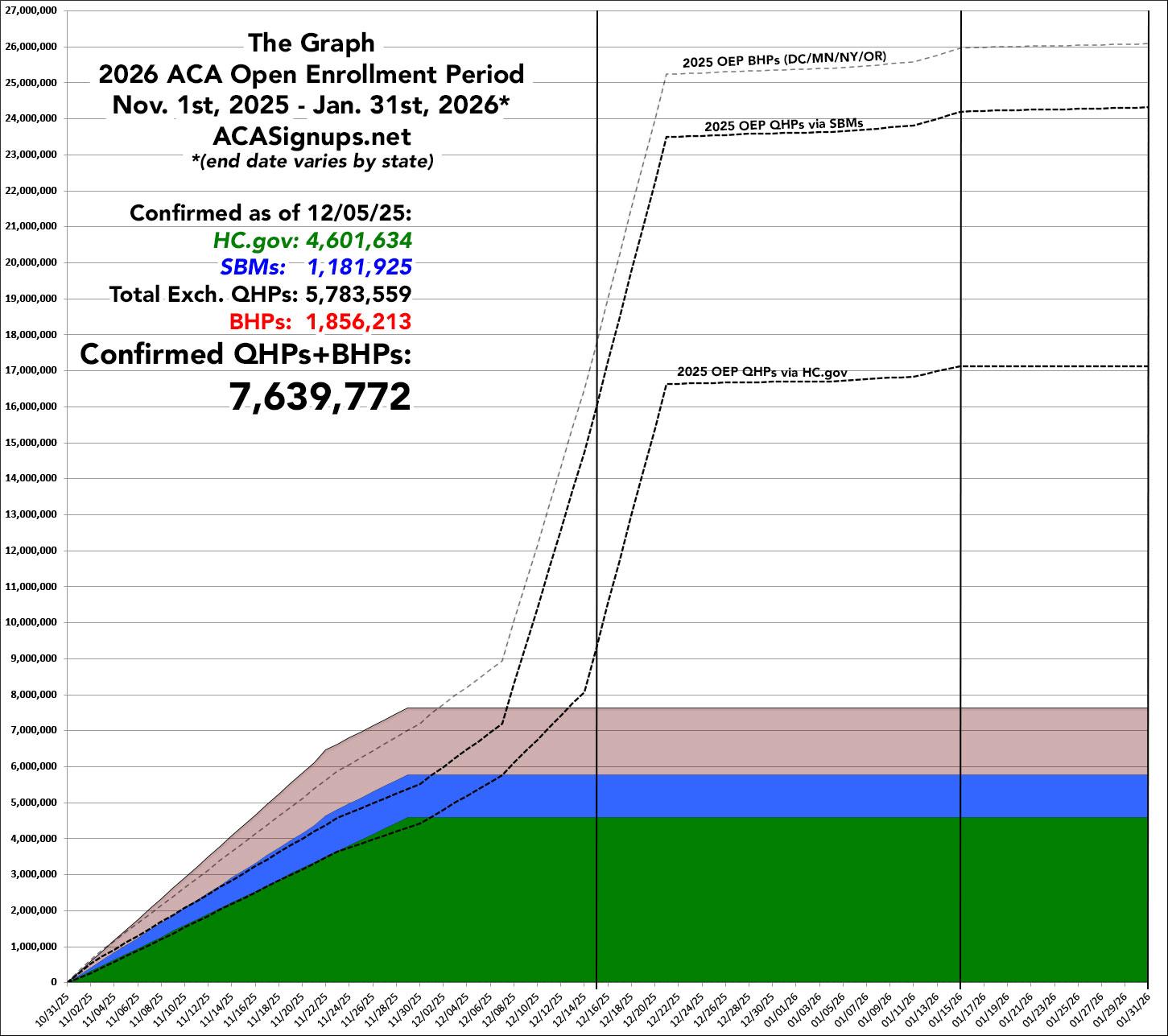

In any event, when I plug today's data dump into The Graph, it looks like so (again, the dotted lines show how the 2025 Open Enrollment Period progressed a year ago):