Breaking: CMS posts semifinal 2026 Open Enrollment report: 23.0M QHPs, down "only" 1.3M...

Late this afternoon, the Centers for Medicare & Medicaid Services (CMS) published an updated 2026 Open Enrollment Period snapshot report:

Marketplace 2026 Open Enrollment Period (OEP) Report: National Snapshot

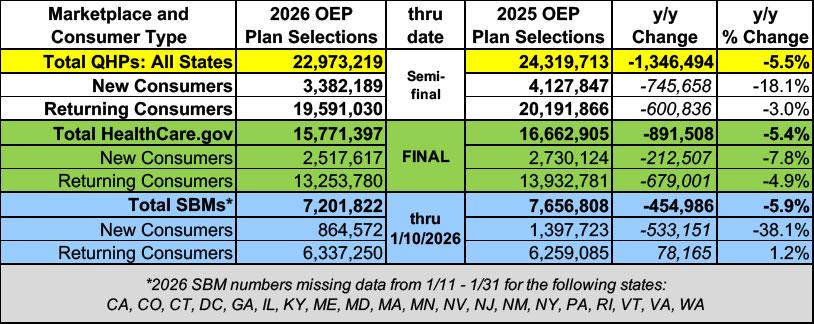

The Centers for Medicare & Medicaid Services (CMS) reports that 23.0 million consumers have signed up for 2026 individual market health insurance coverage through the Marketplaces since the start of the 2026 Marketplace Open Enrollment Period (OEP) on November 1, 2025.

This includes 15.8 million Marketplace plan selections in the 30 states using the HealthCare.gov platform for the 2026 plan year and 7.2 million plan selections in the 20 states and the District of Columbia with state-based Exchanges (SBEs) that are using their own eligibility and enrollment platforms.[1]

Total nationwide plan selections include 3.4 million consumers who are new to the Marketplaces for 2026, and 19.6 million consumers who had active 2025 coverage and selected a plan for 2026 coverage or were automatically re-enrolled. Open Enrollment on HealthCare.gov ran through January 15, 2026. State-based Exchange enrollment deadlines vary.

Before I continue, it's important to note the "as of" dates:

-

For the 30 states hosted via HealthCare.Gov: January 15th (final deadline)

-

For the 21 states operating their own state-based exchanges: January 10th (except Idaho, which ended their OEP on December 15th)

This is important because it means there's still anywhere between 5 - 21 days of enrollment data missing for some states (in fact, there's 9 states where 2026 OEP is still going on for 2-3 more days).

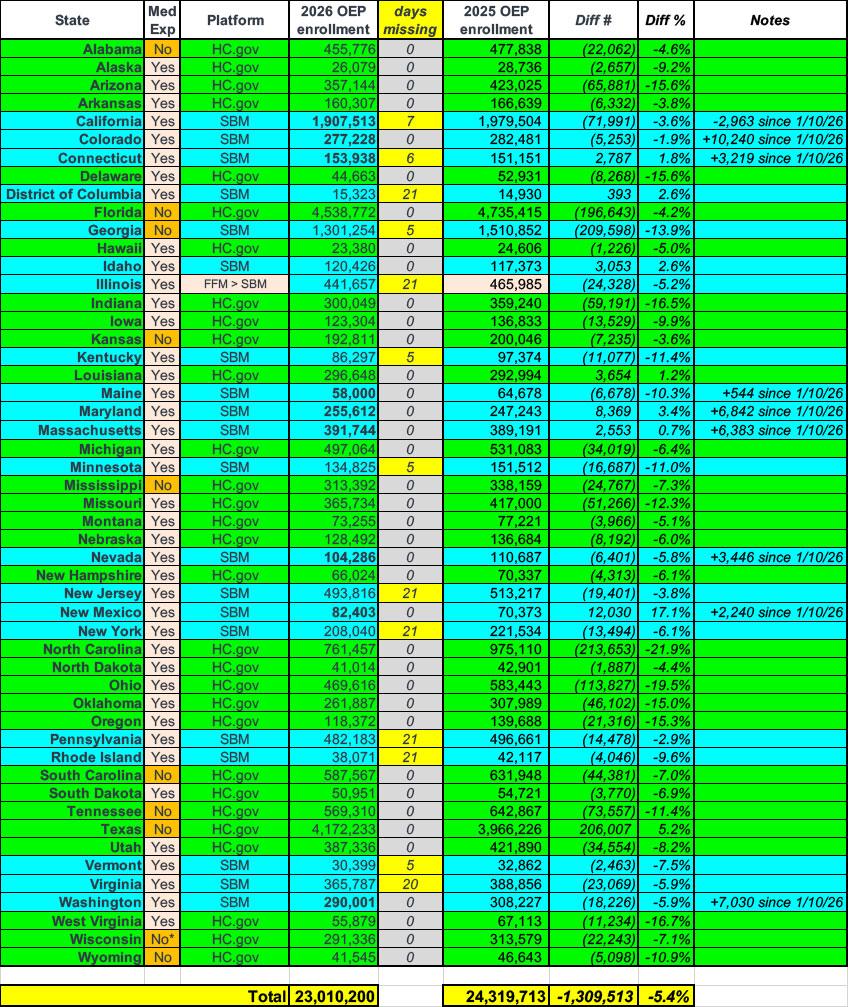

I've plugged in the semi-final 2026 OEP totals and compared them against the final 2025 OEP numbers. Note that since ILLINOIS transitioned from the federal exchange (HC.gov) to a state-based marketplace (SBM) this year, I shifted the final 2025 OEP enrollment data over to the SBM category accordingly:

Overall Qualified Health Plan (QHP) plan selections are down 5.5% year over year. New enrollment is down 18%, while there are 3% fewer returning enrollees.

The overall drop isn't too different between federal & state-based exchanges (5.4% & 5.9% respectively), but there's a huge difference in the new vs. renewing enrollee breakout:

- HC.gov states saw new enrollment drop 7.8% & renewals drop 4.9%

- SBM states saw new enrollment drop a whopping 38% (again, this is a bit misleading due to some SBM data still missing)...but renewals increased by 1.2%

The total of the state by state breakout below is around 37,000 higher than the 2026 summary total above due to my having more recent enrollment data for 9 of the SBM states (CA, CO, CT, ME, MD, MA, NV, NM & WA). I've included columns to note how many days of enrollment data are still missing for 13 of the SBM states:

The extra data from those states brings the shortfall down slightly to 5.4% year over year (1.35M). Based on last year, I wouldn't expect the final tally to increase by more than perhaps another 40,000 people, which would bring the grand total to ~23.05 million or so.

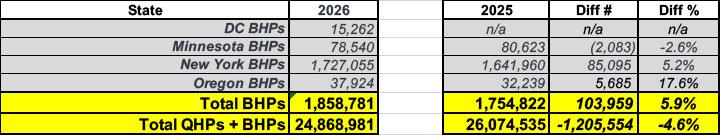

In addition, there's around 1.86 million Americans enrolled in Basic Health Plan (BHP) programs in the District of Columbia (new this year), Minnesota, New York and Oregon. This is up 5.9% year over year (some of which is due to DC newly launching their program).

BHP enrollment is expected to plummet by around 450,000 people this July, however, due to New York being forced to offer their Essential Plan program to far fewer people.

If you combine the BHPs w/the QHPs, enrollment is down around 1.2 million or 4.6% vs. January 2025.

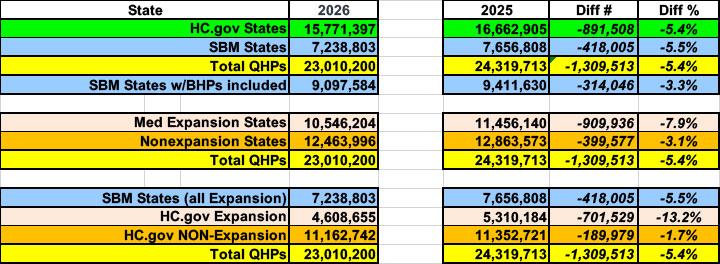

I've also broken out the year over year totals in other ways, including federal vs. state-based exchanges (again, not much difference overall) & Medicaid expansion vs. Non-Expansion (expansion states have dropped by a higher percentage, interestingly):

AGAIN, while the official net year over year drop in plan selections during Open Enrollment "only" ended up being around 1.3 million (which is still a lot of people losing healthcare coverage!), it's important to remember that up to 10 MILLION of the ~19.6 million enrollees who re-enrolled this year did so via passively autorenewing, which means millions of them received massive sticker shock when they received their January invoice.

As I noted a few days ago, at least a half-dozen of the state-based exchanges released press releases warning that they're already seeing much higher cancelations & terminations by enrollees than they usually do, and that they expect this trend to continue throughout the year as people are no longer able to keep up with the dramatically higher premium payments.

Here's what I said two weeks ago in my rebuttal of that reckless editorial by the Wall St. Journal:

I have no idea what the actual monthly average will be for 2026 (and neither does the Wall St. Journal), but here's what it will look like assuming an additional 200K, 400K or 600K enrollees are added over the final weeks of the Open Enrollment Period (which ended on Thursday in most states and will end by January 31st in the rest) and assuming the monthly effectuation pattern ends up mirroring any of the earlier pre-enhanced tax credit years:

In short, if it ends up mirroring 2016 or 2017, actual enrollment will end up being lower than the CBO projected, while if it ends up mirroring 2018 - 2020 it will likely be higher than the CBO projected, but potentially not by much.

Well, it looks like plan selections are gonna end up being just a hair over 23.0 million in the end...which means average monthly effectuated enrollment for 2026 will likely end up somewhere between 18.2 - 20.8 million people...or anywhere from 1.6 - 4.2 million lower than it was last year.

Having said all of that, some points of interest at the state level:

- New Mexico is up a whopping 17.1% year over year, thanks to the state backfilling 100% of all lost federal tax credits for all enrollees!

- 7 other states (TX, MD, DC, ID, CT, LA & MA) are also up year over year, although not nearly as dramatically. Connecticut, Maryland & Massachusetts all offer state-based subsidies (if not nearly as generous or widespread as New Mexico).

- The big surprise here is TEXAS, which is up 5.2%. While TX does have an very robust Premium Alignment initiative which definitely helps mitigate the expired tax credits, they've already had this program in place for the several years now, so I assumed that most of the enrollment benefits were already baked into the mix. Apparently not: According to CMS, over 200,000 more people enrolled in the Lonestar State this year. Huh.

It'll be interesting to see what the net attrition pattern looks like for Texas as opposed to other states over the course of the year, although that data won't be available until July for the first quarter and not until 2027 for the rest of the year.

- At the opposite end of the spectrum, North Carolina has seen enrollment plummet a whopping 22%. Other states which dropped by more than 15% include Ohio, West Virginia, Indiana, Delaware, Arizona, Oregon & Oklahoma.

- The 8 states offering supplemental subsidies have seen enrollment drop by 2% on average, although half of these are still missing enrollment data; states without extra subsidies have seen a 6% drop overall.

- The 14 states with Premium Alignment pricing in effect are up 0.9%, while those without it are down 7.9%.

In terms of raw number losses, North Carolina, Georgia & Florida lead the way with each losing ~200,000 enrollees apiece. Again, this is in sharp contrast to Texas, which again gained over 200,000 enrollees.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.