How full of shit is this Hill Op Ed? Let me count the ways.

Someone alerted me to a new column over at The HIll written by Dean Clancy, a "Senior Health Policy Fellow at Americans for Prosperity."

It's been awhile since I've done one of these, but let's go through his entire post point by point, shall we?

Ronald Reagan once quipped that “nothing lasts longer than a temporary government program.”

He could have been talking about the effort to extend — for a second time — former President Joe Biden’s Affordable Care Act-enhanced tax credits, a set of extremely generous federal health insurance subsidies intended to help Americans get through the COVID-19 crisis.

Stop right there: The "extremely generous" subsidies which he refers to are actually far less generous for higher-income enrollees than employer-sponsored insurance tax exclusions.

As Gideon Lukens, Senior Fellow and Director of Health Policy Research at the Center on Budget & Policy Priorities noted last year:

New Treasury data: Premium tax credits for ACA marketplace coverage provide the greatest benefit for people who need the most help. The tax exclusion for employer health coverage does the opposite.

Premium tax credits: 44% of enrollees had incomes below 200% of the poverty level, with an average benefit of $6,420. 14% of enrollees had incomes above 500% of the poverty level, with an average benefit of $1,570.

Tax exclusion for employer coverage: 11% of enrollees had incomes below 200% poverty, with average benefit of $1,650. 49% of enrollees had incomes above 500% of poverty, with average benefit of $2,540.

The improvements to premium tax credits made them much more progressive.

I'll take this one step further: According to this same study from the U.S. Treasury Dept. itself, only 6% of ACA exchange enrollees earned more than 800% FPL, and they only averaged $730/year in APTC assistance, while 25% of Americans with employer-sponsored health insurance earn more than 800% FPL, and averaged $2,580/yr in ESI tax benefits.

That's 40x as many higher-income people with employer coverage receiving 3.5x as much in federal subsidies than the nominal number of higher-income ACA enrollees. The above data is from 2022 so the dollar amounts are higher in both categories, but there's little reason to think the ratios have shifted much.

(FWIW, 800% FPL will be around $125,000/yr for a single adult, $169,000/yr for a couple or $257,000/yr for a family of four next year.)

That crisis ended two years ago. Biden’s extra help, enacted by a Democratic-majority Congress in 2021 and extended in 2022, is scheduled to expire at the end of this year.

...Like other pandemic measures, it’s time for these temporary handouts to end.

It's true that the improved ACA tax credits were originally passed as part of a COVID pandemic response bill, but Democrats had been rightly trying to get them upgraded for years prior to that (here's H.R. 1868 from 2019, for instance, which includes the same APTC rate table).

Just because it happened to be included as part of an emergency bill doesn't mean that the need wasn't already there before and since the pandemic period itself. If your basement was already leaking before a torrential storm hit your area, the storm may have made the leak worse but it still needed to be repaired either way.

Fort that matter, there's plenty of legislation which started under unusual or extreme circumstances but which was later made permanent...such as employer-sponsored insurance itself, which Republicans insist is the only "proper" way for Americans to receive health insurance!

Here's a summary of the history of ESI:

...In fact, the system is largely a result of one event, World War II, and the wage freezes and tax policy that emerged because of it. Unfortunately, what made sense then may not make as much right now.

...In 1942, with so many eligible workers diverted to military service, the nation was facing a severe labor shortage. Economists feared that businesses would keep raising salaries to compete for workers, and that inflation would spiral out of control as the country came out of the Depression. To prevent this, President Roosevelt signed Executive Order 9250, establishing the Office of Economic Stabilization.

This froze wages. Businesses were not allowed to raise pay to attract workers.

Businesses were smart, though, and instead they began to use benefits to compete. Specifically, to offer more, and more generous, health care insurance.

KFF picks up the history from there:

...In 1954, ESI exclusion was enacted in the tax code.

I should note that World War II had been over for 9 years at this point, and The United States had both a Republican President (Eisenhower) and Senate at the time.

This is confirmed here by that left-wing rag known as the U.S. Chamber of Commerce:

...When the program began, it was designed to help retain and attract workers in the aftermath of World War II. Employers were incentivized to provide health insurance benefits to employees, and many did.

...Furthermore, since the addition of section 106 to the Internal Revenue Code in 1954, employees have been allowed to exclude the value of employer-provided health insurance coverage from their taxable income.

Getting back to Clancy's post at The Hill...

...The Biden tax credits make health insurance 100 percent free of charge for everyone with an income below 150 percent of the federal poverty line. Remarkably, they also eliminate the program’s income cap, so that now, sliding-scale subsidies are available to everyone above the poverty line as well — even millionaires.

The main reason for dropping premiums down to 0% for those below 150% FPL was to provide at least some relief to the millions of low-income Americans living in states which have refused to expand Medicaid under the ACA.

Remember, even a $0-premium ACA plan with full CSR assistance still includes a deductible & other out of pocket expenses (typically around $1,600 for the household). The enhanced tax credits only address half the problem (around 1.3 million Americans who earn 100 - 138% FPL), but that's still a hell of a lot better than nothing.

As for the "even millionaires" claim, this is a massive exaggeration. Under the current tax credit structure, the only way someone earning $1 million per year would be if the unsubsidized premiums for the benchmark Silver plan where they live cost more than $85,000/year for one person or $170,000/year for two.

The most extreme hypothetical example I've been able to come up with in 2026 would be a 64-yr old couple living in one of 4 specific counties in West Virginia (Cabell, Mason, Putnam or Wayne...which have a combined population of 211,000 people), which is the most expensive rating area in the state (which has the highest gross ACA premiums in the country).

Even then, the benchmark Silver plan would still only reach a peak of $63,100/yr, which is admittedly an insanely high amount to pay for health insurance premiums but still falls far short of that threshold (for what it's worth, in that hypothetical case, this older WV couple would receive a nominal $1 per month in APTC if their income was as high as around $742,300/year).

Of course, seeing how the median household income in these counties is around half the national average (it ranges from $27K - $58K/year vs over $80K nationally), I find it extremely difficult to believe that there's a whole lot of couples earning over half a million dollars in that area, much less doing so while being self-employed.

It's also worth following Clancy's logic here: He's perfectly fine with a million people who earn more than $500K/yr receiving thousands of dollars in tax deductions (see above) via employer-sponsored coverage, but is blowing a gasket at the thought of a tiny percent of them receiving as little as $1/month in tax credits via ACA plans.

And by the way, all that extra money goes directly to health insurance companies, who obviously don’t need the money.

Ah, as opposed to the billions of dollars which Trump & Republicans are giving to the pharmaceutical industry by attempting to gut the IRA's requirement that Medicare Part D drug prices be negotiated. Got it.

Perhaps such lavish help was needed during the endless COVID-19 lockdowns, when unemployment was rising. But five years later, the case for another extension is untenable. The pandemic is over and people are back to work.

That’s not stopping Democrats and the health insurance lobby from claiming the world will end without another extension. They are running millions of dollars’ worth of political ads, claiming hard-working families will have to pay significantly more out of pocket for their health insurance next year or could even lose coverage altogether.

It’s a huge exaggeration.

Yes, the federal subsidies will indeed shrink back to their pre-COVID levels. But they will still be very generous. No one will have to pay more than 9.78 percent of their income for health insurance, and most will pay less. The poorest will pay only 2 percent.

- "No one" is a flat-out lie, as the "pre-COVID level" means that anyone earning more than 400% FPL would have to pay full price, often as much as 25%, 30% or an even higher percent of their income. I mean, just a paragraph or so earlier Clancy complains that the current structure provides subsidies too far up the income scale.

- The 9.78% cap is also incorrect (the cut-off for those who earn between 300-400% FPL is actually 9.96%)

- The claim that "the poorest" will pay "only 2%" is wrong in two different ways:

- The actual minimum percentage for those earning 100 - 133% FPL is 2.1%, not 2.0%

- Technically speaking "the poorest" would be the ~1.4 million Americans who earn less than 100% FPL who live in GOP-run states which haven't expanded Medicaid.

It's also important to keep in mind that "only" a "small percent" of your income can still be a huge expense for low-income people.

Drew Altman of KFF noted this morning that...

...a 40-year-old in Amarillo, Texas earning $23,000 per year [147% FPL] could see their premium rise from $0 to $920 annually. [4.0% of their income]

While they would still receive financial help, the added expense could strain already tight household budgets for people living just above the poverty level. In this case, the premium increase would be the equivalent of about a quarter (22%) of their typical annual food budget, or about a third (34%) of the average utility and fuel budget for individuals with similar incomes. They could switch to a bronze plan to keep their $0 monthly premium, but that would likely leave them with a deductible that is about $7,000 higher than their current plan (for someone with a $23,000 income, that’s pretty useless coverage).

If the same 40-yr old only earned 137% FPL ($21,440), they'd still go from paying nothing to $450 in premiums next year, which would still be around 11% of their food budget or 16% of their utility/fuel budget, which could still mean having to choose between being able to get medical treatment or having their electricity turned off.

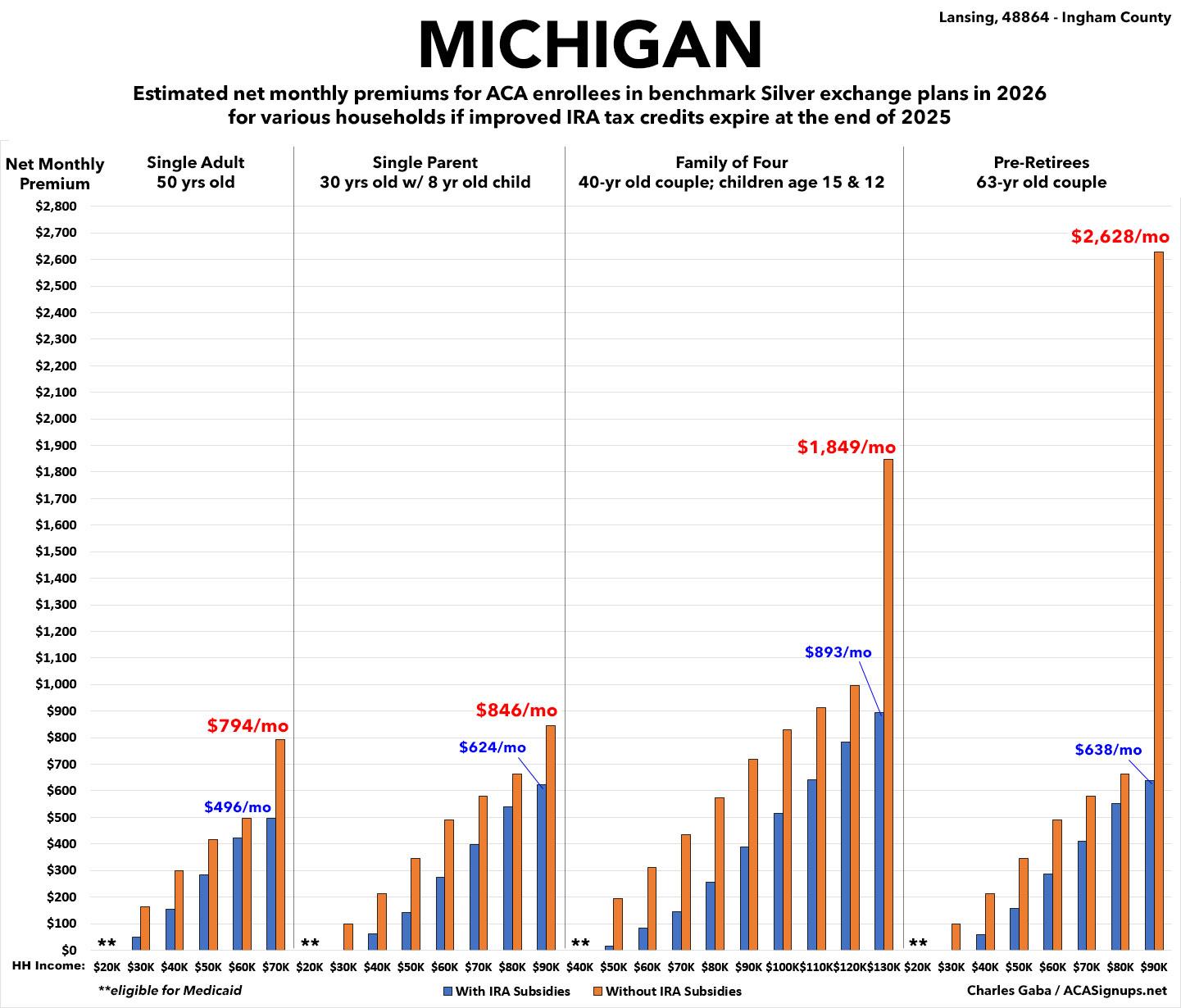

As for claiming that it's an "exaggeration" that "families will have to pay significantly more for their health insurance" or "could even lose coverage altogether," he might want to take a gander at how much net premiums are expected to increase for current ACA enrollees. Seriously, pick a state, any state. Here's my home state of Michigan, for example:

And if some people do leave the rolls, there are other generous subsidies available, including Medicaid and workplace coverage, which are tax-exempt.

Holy Fucking Shit.

No, Dean, Medicaid subsidies aren't available for those priced out of ACA coverage in the 10 states which haven't expanded their Medicaid program...and even in the other 40 states +DC which have, the GOP's Big Ugly Bill is gonna gut Medicaid expansion there as well.

(Plus, as Andrew Sprung points out, anyone who's legally eligible for even $1 in ACA subsidies isn't eligible for Medicaid expansion by definition anyway, and vice versa)

As for workplace coverage (presumably for those who earn more than 138% FPL who get priced out of coverage), not only is this logical nonsense for someone claiming to want to "save taxpayer dollars" (as noted above, ESI-based tax subsidies cost taxpayers even more than ACA tax credits do), but it's also only true if you work for a company which employs more than 50 full-time workers.

If you work for a small employer or are self-employed, YOU HAVE NO OTHER AFFORDABLE OPTIONS FOR COMPREHENSIVE MEDICAL COVERAGE, PERIOD.

Biden’s tax credits caused total enrollment in the Affordable Care Act premium tax credit program to more than double, from 11.4 million people in 2020 to 24.3 million in 2025. But it turns out at least half the enrolled population, 12 million people, are “phantom” enrollees who never saw a doctor even once in 2024.

For someone who claims to be a "Senior Health Fellow" Mr. Clancy doesn't seem to understand how health insurance risk pools work. Setting aside the "fraud" issue which he goes into next, let's take this at face value and assume that 12 million ACA enrollees never filed a single claim last year.

As my colleague David Anderson put it:

I pay my premium and I don’t intend to submit claims. My premiums help pay claims from people who have bad luck. This is insurance 101 — there are a lot of no claim people paying in without getting a dollar back.

...Some people have very high demand (think someone with cancer who really values getting chemo). Some people have very low demand (think generic 24 year old men). Demand is a function of underlying health, risk tolerance, social determinants of health and income. When premiums are high and administrative barriers are substantial, we would expect a higher proportion of total buyers to have relatively high demand when compared to situations when premiums are low and enrollment is easier.

We should almost always expect really sick individuals to enroll, but the marginal...will vary due to policy changes. In 2019 about a quarter of all ACA enrollees generated absolutely no claims in a year. This was a fairly morbid year and a fairly small market in terms of total enrollment.

...The people who aren’t signing up in 2019 are likely to be the “Young Invincibles” or least “Invincibles” who are systemically pretty low risk to using care.

Now let’s fast forward to 2022. [w/the enhanced subsidies in place]

...Who faces new incentives to move from not buying to buying?

Well the class of folks who were willing to buy in 2019 are also likely willing to buy in 2022.

...Now what else is happening with much lower prices?

Lots of people who were previously not buying ACA coverage are now buying ACA coverage.

So, you have several million additional Young/Not So Young Invincibles signing up and...not using the insurance, presumably because they're Young & Healthy. That's...a good thing (unless they actually need to use it).

In other words, Clancy is basically admitting that a huge chunk of ACA enrollees are exactly the type of healthy enrollees who you WANT to enroll in the risk pool in order to shoulder the cost of enrollees who are sick/injured & expensive to treat.

HAVING MILLIONS OF EXTREMELY HEALTHY ENROLLEES IN A SINGLE INSURANCE RISK POOL IS A GOOD THING.

This is why, when my wife went back to school a few years ago & we both moved onto her student plan coverage, we discovered that our premiums via the University Plan were far lower than they would have been on an unsusidized exchange plan...because there were ~20,000 students averaging just 23 years old...plus our middle-aged asses.

In addition, under the ACA, insurance carriers are required to maintain an 80% Medical Loss Ratio. That means that they have to spend at least 80% of their premium revenue on actual medical claims (on a 3-yr revolving cycle). If their gross margins come in higher than 20%, they have to pay back the difference to the policyholders (and in fact have done so to the tune of well over $12 billion over the past decade).

In other words, the insurance carriers can't simply pocket the money for the 12 million supposedly "phantom enrollees" unless they've been managing to pull the wool over not only the federal government but every insurance dept. regulator in all 50 states every year for the past five years straight by pretending that their gross profit margins are much lower than they actually are.

But...let's go back to the original claim, that millions of ACA enrollees "never filed a claim" last year. This is based on an analysis done by Brian Blase of the Paragon Institute. However, there's some major problems with the underlying data released from the Centers for Medicare & Medicaid Services (CMS).

Matt Fiedler is a Senior Fellow at the Center on Health Policy at the Brookings Institute. He addressed this last month:

To start, it’s common for insured people to have no claims in a year; not everyone needs care. Is the 35% figure for individual market enrollees unreasonably high, as claimed?

Using the MEPS, I estimate that about 15% of non-elderly people with 12 months of group coverage in 2022 had no medical spending, even though no one thinks phantom enrollees exist in the group market.

And, as others have noted, there’s good reason to expect the individual market rate to be *much* higher: individual market enrollees are typically enrolled for only part of the plan year. Fewer months enrolled mechanically means fewer chances to incur claims.

Concretely, other CMS data show Marketplace enrollment spells averaged only ~8 months in the FFM states in 2024. That’s enough to explain much of the difference between CMS’ estimate of the individual market no-claims rate and my 15% group market estimate.

Also, as another colleague who prefers to remain nameless put it:

The short version is that the EWOC “total enrollees” counts enrollees multiple times if they change plans. It is impossible to say how many EWOCs there are in a state, but Paragon/WSJ’s numbers are inaccurate and really a measure of enrollee/plan combinations that double-counts anyone who changed plans during the year.

In other words, if you enroll in a Blue Cross plan for 6 months but then move out of state and switch to, say, a Molina plan for the other 6 months of the year and don't happen to visit the doctor once the entire year, guess what? They're counting that as 2 enrollees "not filing a claim all year" instead of one.

Of course there are plenty of other problems with Paragon’s analysis, but this one basically means the numbers they’re publishing are wrong and the phenomena driving the trends they identify may have very little to do with fraud.

Getting back to Fiedler's thread:

Here’s the math. Suppose enrollees have a 14.6% chance of generating a claim each month. I’ve chosen this percentage so that if a person was enrolled for 12 months, they’d have a 15% (= [1-0.146]^12) chance of having no claims, matching my group market estimate.

Now suppose that the exact same enrollees were enrolled for only 8 months (the FFM average). In that case, we’d expect 28% (= [1-0.146]^8]) to incur no claims.

There are lots of ways one could refine this calculation, but refinements could actually make the effect of enrollment duration differences larger. What’s clear is that duration matters *a lot*. Plus there could be other big differences between the individual & group markets.

Bottom line: it’s unsurprising that the individual market has a sizeable no-claims rate, especially given its relatively short enrollment durations. Given that, these data do not provide persuasive evidence that “phantom” enrollments are widespread.

Some have also highlighted the fact that the share of enrollees without claims rose substantially from 2020 to 2024. But that’s exactly what we’d expect in a period where enhanced subsidies attracted many (real) new enrollees into the market.

Prior research has found that subsidy expansions tend to pull in enrollees who use less care—and are thus less likely to incur claims—than those already in the market. For particularly high-quality evidence on this point, see here

There’s also another serious flaw...even if there were lots of phantom enrollees, health insurers wouldn’t “get the benefit,” and it wouldn’t impose the claimed large costs on the federal government.

In particular, the “tens of billions” cost estimate they both cite appears to be derived by assuming that the presence of phantom enrollees would result in additional federal subsidy payments and no other changes. That assumption is indefensible.

To see why, suppose there were a surge of phantom enrollees into the market. Total claims spending in the market would remain the same, but *per enrollee* claims spending would fall. Premiums would follow, and, by design, Marketplace subsidies follow premiums.

So the gov’t would pay for more enrollees but pay less for each one. On net, federal costs would likely rise only slightly, and mainly because there would be a modest cost shift from unsubsidized enrollees (whose premiums fall) to the gov’t, not because insurers got a windfall.

Next, Clancy raises one of the few semi-legitimate concerns in his propaganda piece:

Many of them are not even aware they’re on the rolls. Most probably have other health insurance.

How could that happen? Many may have been signed up for Biden’s tax credits without their knowledge by unscrupulous insurance brokers looking to make a quick buck. Fraud across the program is rampant.

The broker fraud issue is, unfortunately, a real one, which was first reported on by Julie Appleby at KFF about a year and a half ago. Basically, unscrupulous brokers have been quietly either enrolling people into ACA policies without their knowledge or switching existing enrollees from one plan to another one without their knowledge or consent (in order to pocket the commission).

However, CMS has since instituted measures to crack down on this issue, and if this continues to be a problem there's a variety of other measures they could institute ranging from mandating 2 Factor Authentication to requiring a nominal $1/month premium for all enrollees regardless of income/subsidy eligibility level to ensure that the policyholders know they've been enrolled in an exchange plan.

Another stunning fact: 6.4 million people are on the rolls unlawfully. Research by the Paragon Health Institute finds that in 29 states, there are more people signed up for free health insurance than actually exist and are eligible in the state. In Florida, the most egregious example, it is estimated that five times the eligible population is signed up. In second-place Texas, it is calculated to be twice the eligible population.

First of all, this isn't a "fact," it's pure conjecture.

The basis of this seemingly jaw-dropping claim is the same "Enrollees without Claims" spreadsheet from CMS putting the "Total Number of Enrollees" at ~33.5 million nationally in 2024 even though only ~21.4 million signed up during the Open Enrollment Period. Except that, again, "Total Number of Enrollees" includes anyone who was enrolled in any exchange plan for even one month of the year.

To use my own family as an example again: Last year we were still on my wife's university plan through the end of August. In September we switched to an ACA plan for the remaining four months of the year. That increased Michigan's "Total Number of Enrollees" for 2024 by 3 who weren't counted as part of the OEP number. Furthermore, we "weren't eligible" to enroll (due to having other coverage)...right up until we were.

As Fiedler notes, the average enrollment is just 8 months in a given year...which means that there are millions of enrollees who only stick around for as little as 2-3 months. This could easily result in the "total enrollees" being several times the number of "eligible people" in a given state.

But wait, there's more! Another colleague of mine, Andrew Sprung of Xpostfactoid, addressed these claims by Brian Blase & the Paragon Institute earlier this year (although Sprung uses an earlier version of Blase's claims in his rebuttal):

Here are [Blase's] core claims:

In nine states (Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, Tennessee, Texas, and Utah), the number of sign-ups reporting income between 100 percent and 150 percent FPL exceed the number of potential enrollees. The problem is particularly acute in Florida, where we estimate there are four times as many enrollees reporting income in that range as meet legal requirements.

[Blase's later piece ups these to 29 states & 5x the eligible population in Florida specifically]

The problem of fraudulent exchange enrollment is much more severe in states that have not adopted the ACA’s Medicaid expansion as well as in states that use the federal exchange (HealthCare.gov). In states that use HealthCare.gov, 8.7 million sign-ups reported enrollment between 100 percent and 150 percent FPL compared to only 5.1 million people likely eligible for such coverage, or 1.7 sign-ups for every eligible person….

...Blase’s core conclusions — that benefits generous enough to induce the uninsured to access them should be scaled back, and that efforts to streamline enrollment should be broadly rejected — are unwarranted, as argued below. His use of the term “fraud” is overbroad.

After conceding some of Blase's points regarding legitimate concerns about enrollment security, Sprung addresses the heart of the matter:

Blase’s estimates of how many subsidy-eligible people are in the 100-150% (and 100-200%) FPL income brackets are based on survey data, namely the Census Bureau’s American Community Survey, in which respondents report their insurance status and incomes. That self-reported data is always inexact and always shows results different from enrollment data.

I have noted myself that enrollment growth from 2022-2024 in the 100-138% FPL bracket in nonexpansion states (a cohort that would be Medicaid-eligible in expansion states) exceeds KFF’s 2022 estimates of the uninsured in that income bracket.

But KFF estimates of how many would enroll in Medicaid in a given nonexpansion state were the state to enact the expansion (as 16 states have done since 2014), also based on the ACS, consistently underestimate enrollment after the expansions happened. In fact Blase has written prior analyses complaining about allegedly ineligible expansion-group Medicaid enrollees as well (see also a rebuttal from the Center for Budget and Policy Priorities).

Put more simply: Many people honestly don't have the slightest clue what type of "insurance coverage" they have. I've had countless people refer to Medicare as Medicaid or vice-versa. Millions of people don't know that "Obamacare" and "the Affordable Care Act" are the same thing. Millions who are enrolled in Medicaid think they're enrolled in private insurance since, after all, ~80% of Medicaid enrollment is privately administered. Many people don't know they're on an ACA plan because "the card says it's from Blue Cross" and so on.

Blase seems to be mostly obsessed with the "discrepancy" over how many enrollees are within the lower-end income brackets (under 100% FPL, 100 - 150% FPL), which Sprung roundly slams the lid on:

Blase cites Treasury estimates from tax data of ACA premium subsidy recipients in Plan Year 2020 broken out by income as evidence of widespread “fraud,” i.e. self-serving mis-estimates of income on the application.

...yes, there is a wide discrepancy between tax data and enrollment data, and the IRS data shows a large subsidized enrollment cohort whose tax returns claim income below the ACA’s 100% FPL threshold for subsidy eligibility.

But that discrepancy does not necessarily indicate widespread deliberate income exaggeration by low-income enrollees. ACA subsidy data is not the only context in which income data derived from tax returns diverges widely from self-reported income data. According to the IRS tables, in 2019 26% of all U.S. families had income under 100% FPL. According to the Census Bureau’s Current Population Survey, about 10% of the population had income under 100% FPL in 2019.

That’s partly due to a difference between households and individuals — in the tax data, a higher proportion of households have no children in the 100% FPL bracket than in all brackets combined. But tax data always shows a higher proportion of the population in low income brackets than the CPS and other survey data. That’s chiefly because the surveys define a household as everyone living under one roof, whereas tax data splits some of those households — and, accordingly, their income.

Another key factor is that the CPS instructs respondents to include various sources of income that are excluded from the tax data. A 2012 paper from the Treasury’s Office of Tax Analysis by Ithai Lurie and James Pearce (preliminary, apparently never finished) shows that in 2007, the CPS placed 12.5% of the population below poverty, compared to 19.3% indicated by the tax data. At 100-138% FPL, the difference was 6.8% in the CPS vs. 8.1% in the tax data.

Sprung's analysis goes on for quite awhile covering a variety of additional points, but the bottom line is that Blase/Paragon's entire argument appears to be based on highly questionable underlying data: Both the numerators AND denominators are terribly flawed.

This does not mean that there's no fraud at all--again, the "unscrupulous broker" issue is a real one, and there's always going to be some scammers involved in any program that impacts millions of people--but the claims that "6.4 million people are on the rolls unlawfully" or that there's "more people enrolled than actually exist or are eligible" seem to be largely based on (to put it in Blase's terminology) "Phantom Data."

Going back to Clancy's Hill piece again...

...Extending the Affordable Care Act enhanced tax credits would perpetuate an unconscionable level of fraud and waste — and cost taxpayers nearly $40 billion a year.

Actually, the most recent CBO projection is that it would cost around $35 billion per year ($349.8 billion over a decade). Still a lot of money, I agree, but he's still overstating it by 12.6%.

Of course the same CBO projection also finds that doing so would increase the number of Americans with health insurance by 3.8 million people by 2035, which would be an objectively good thing.

...A decade of ObamaCare-induced premium inflation has squeezed the middle class. In place of Biden’s inflationary Covid credits, why not make every dollar we spend on our health care tax-free?

OK, but tax exemptions don't do much good for the nearly half of Americans who don't earn enough to pay federal income taxes in the first place, Dean (you may remember Mitt Romney made a whole campaign issue about "47% of Americans not paying taxes" an eternity ago). That doesn't mean they don't have major expenses, of course...healthcare being among them.

Republicans took a great first step in that direction in their recently enacted working family tax cuts bill, which expanded access to tax-advantaged Health Savings Accounts to an additional 7 million Americans. But even with that change, only about 20 percent of Americans are eligible for a Health Savings Accounts. Why not go further and make them available to all Americans?

Health Savings Accounts are a perfectly fine idea, and can be helpful to many people when it comes to tax savings. I have nothing against them; in fact, my wife and I have one ourselves. HOWEVER, an HSA requires you to be able to set aside hundreds or thousands of dollars for the account in the first place...which, of course, if you're low or moderate income, you likely don't have.

And let’s stop the insurance-company rip-offs like surprise bills and outrageously high claim-denial rates, which have grown under ObamaCare, too often denying access to needed care.

I actually agree with both of these ideas! Thankfully, the No Surprises Act was passed and signed into law back in December 2020 (at the tail end of Trump's first term in office) as part of another COVID-19 emergency relief bill (but wait, I thought Mr. Clancy was opposed to passing legislation as part of an emergency package unless it was only germane to the emergency at hand???)

Granted, it took over another year for the NSA to actually be implemented (this happened during the Biden Administration), and it still leaves out ambulance transporation (an admittedly major gap), so if Clancy wants to expand it to include those as well, I'm all for it, although that would probably mean higher premiums all around.

As for tackling high claim-denial rates, I'd be happy to discuss that with him as well.

So, there you have it: In a mere 843 words, Dean Clancy managed to spout 20 gross exaggerations, disingenuous nonsense and flat-out lies, which I admit is pretty impressive...plus tacking on two legitimately good ideas at the tail end.

UPDATE: It looks like AFP isn't the only right-wing organization to pick up the nonsense Blase/Paragon ball and run with it; apparently nearly 3 dozen others have sent a letter to Donald Trump using the exact same garbage talking points to attack the enhanced tax credits as well.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.