Warning: 2026 ACA net rate hikes w/out IRA subsidies will be even worse than I thought.

(with apologies to “Weird Al” Yankovic)

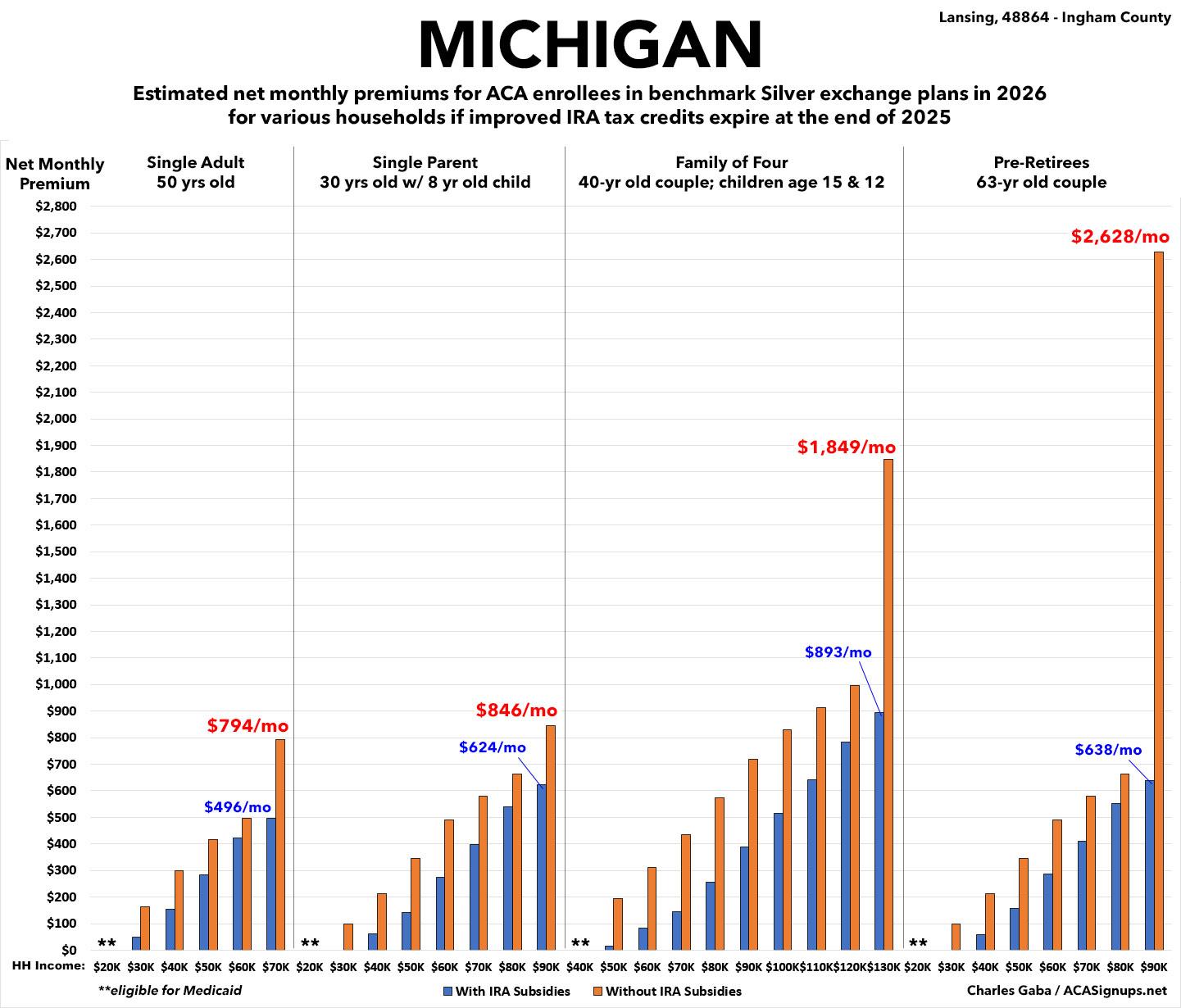

Last winter, I initiated an ambitious project in which I generated graphics to illustrate just how much net ACA premiums are likely to increase starting on January 1st, 2026 (slightly over 5 months from today) assuming the enhanced premium subsidies provided by the Inflation Reduction Act over the past several years are allowed to expire.

This project took several months to complete, as I had to generate both tables and bar graphs for all 50 states (+DC), using 4 different households at multiple income brackets for each. All told, that's over 1,600 different examples.

I made sure to include various caveats for these projections. For instance, each of these examples assumes...

- ...the capital city for each state (premiums may vary widely in other parts of the state)

- ...the 2025 benchmark Silver plan for each year (not everyone chooses the benchmark plan, and the benchmark plan itself can change from year to year)

- ...both the household income and make up remains the same each year (ie, no new children/etc)

- ...enrollees being the same age (they'll actually all be a year older, which bumps up premiums slightly more)

There's one more important caveat which I partially accounted for: The annual increase in full-price premiums for unsubsidized enrollees. The Congressional Budget Office issued an analysis last winter which projected that the IRA subsidies expiring in & of itself would cause an average full-price rate hike of around 4.3% in 2026.

I added that 4.3% to unsubsidized benchmark Silver premiums across the board, but the reality is that a) the actual impact of the IRA subsidies expiring will vary widely from carrier to carrier; b) the rate change to the benchmark plan may not be the same as the statewide average; and most importantly, c) that 4.3% doesn't include rate changes due to other factors.

Those factors include normal stuff (inflation, increased utilization of services, etc), but it can also include changes due to administrative policy changes, such as the so-called "Marketplace Integrity & Affordability Rule" finalized by CMS last month.

There's a lot of wonky stuff included in the CMS rule, some of which impacts 2026 rate changes. The bottom line is that while I did tack on 4.3% to all 51 of my analyses last winter/spring, the actual average premium increase is turning out to be higher so far...a lot higher.

For example, here in Michigan, it's 17% on average.

While this is obviously bad, I was debating whether to bother redoing all of the tables & graphs since the point was already made (premiums will be a lot higher!) and since that 17% hike will mostly only impact those who earn more than 400% of the Federal Poverty Level (FPL) anyway...and they're already pretty much screwed as it is.

In other words, I didn't see the point in telling someone who already knows they're gonna be priced out of the market that they're actually gonna be priced even more out of the market.

HOWEVER, it turns out that there's another change which I need to account for which will directly impact every ACA exchange enrollee who is subsidized...all the way down to those earning just barely over the poverty level.

This change has to do with something called the Premium Adjustment Percentage Index and the Applicable Percentage Table

These get wonky, but in short, these are what determines the formula for how generous ACA premium tax credits are for those eligible for them each year.

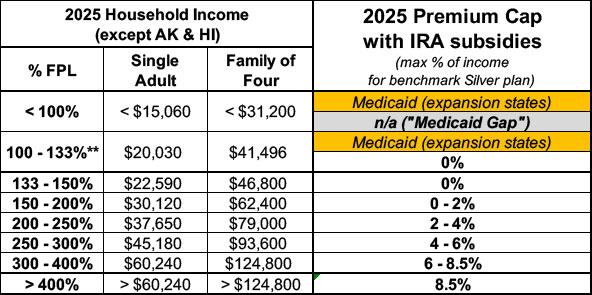

In 2025, with the IRA subsidies in place, here's what the Applicable Percentage Table looks like:

In other words, if you're a single adult who earns $30,000/year (just under 200% FPL), you pay no more than 2% of your income for the benchmark Silver plan. That's $600/year, or no more than $50/month. If you earn $50,000//year (332% FPL), the benchmark plan would cost no more than 6.8% of your income, or around $283/month.

If the IRA subsidies expire, however, there are three things which change: First, that last row for enrollees earning more than 400% FPL goes away--they have to go back to paying full price. This is called the "Subsidy Cliff" and I've talked about it many times before.

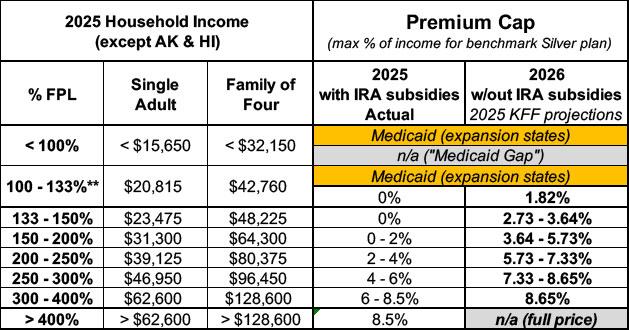

The second change is that the other percentages revert back to the original, pre-2021 levels, which are far less generous. I've also talked about that before, and that's what my existing analyses are based on.

Those analyses are based on the KFF estimates from last fall, which look like this (the annual FPL thresholds also get bumped up slightly each year):

Don't get me wrong, this would be bad enough, and that's what's reflected in all of my tables & bar graphs.

HOWEVER, it turns out that there's a third change which I couldn't account for until now, which is the change in the Premium Adjustment Percentage Index (PAPI) formula .

I discussed this briefly in my recent post about the timeline of healthcare gutting included in the so-called One Big Beautiful Bill (aka the MAGA Murder Bill):

January 1, 2026: PAPI formula change to make MOOP higher ($450/$900/yr) (via CMS rule)

CMS is finalizing updates to the methodology for calculating the premium adjustment percentage to establish a premium growth measure that captures premium changes in both the individual and employer-sponsored insurance markets for the 2026 plan year and beyond. CMS is also finalizing the plan year 2026 maximum annual limitation on cost sharing, reduced maximum annual limitations on cost sharing, and required contribution percentage using the finalized premium adjustment percentage methodology.

When I wrote about this a few weeks ago, I was only focusing on the impact to the Maximum Out of Pocket (MOOP) cap (it's gonna increase ACA enrollee deductibles/co-pays by around $450/year per enrollee).

At the time I didn't get into the last part of the paragraph above: The impact on the required contribution percentage, since I didn't know exactly how bad it would be.

(I should pause to give a shout-out to Andrew Sprung, aka Xpostfactoid, for reminding me of this issue earlier today.)

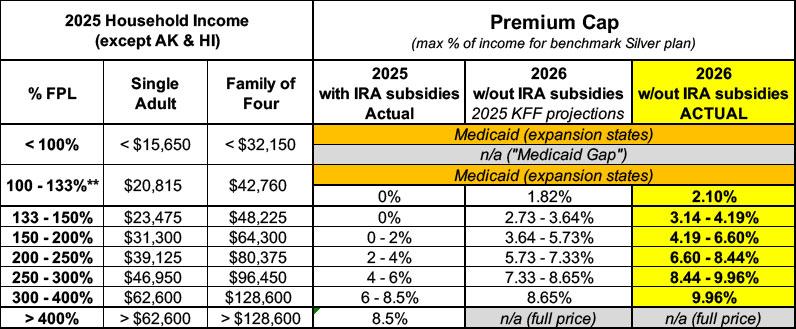

Today I know. Here's the official Revenue Procedure 2025-25 bulletin from the IRS which lays out exactly what the actual revised Applicable Percentage Table will look like:

The Applicable Percentage Table and the Section 36B Required Contribution Percentage indexing adjustments are computed using the methodology described in section 4 of Rev. Proc. 2014-37, 2014-2 C.B. 363, and in guidance issued by the Department of Health and Human Services (HHS).

For 2025 and a number of years prior to 2025, the rate of premium growth was based on per enrollee spending for employer-sponsored insurance as published in the National Health Expenditure Account. However, beginning in calendar year 2026, HHS guidance provides a new premium growth measure that captures increases in individual market premiums in addition to increases in employer-sponsored insurance premiums for purposes of calculating the premium adjustment percentage for the 2026 benefit year and beyond. See HHS Marketplace Integrity and Affordability rule, 90 Fed. Reg. 27074 (June 25, 2025).

The Treasury Department and the IRS adopt the new premium growth measure provided in the 2026 HHS Marketplace Integrity and Affordability rule for purposes of the Applicable Percentage Table and the Section 36B Required Contribution Percentage indexing adjustments.

So, what does this look like in practice? Like this:

Those seemingly tiny percentage increases in the last column may not look like much, but they make a massive difference in how much subsidized ACA exchange enrollees will have to pay.

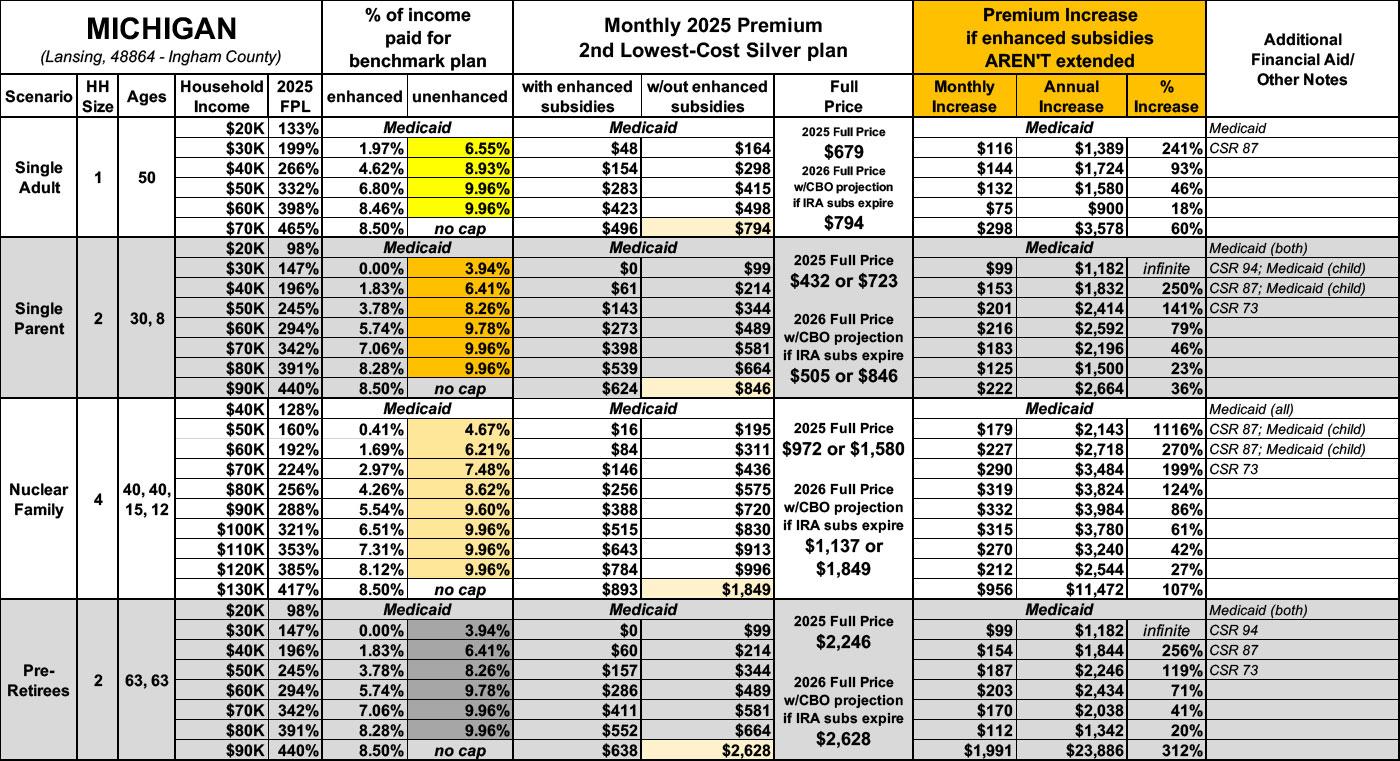

It's gonna take a lot of time to redo all 51 state analyses, but for now, here's what it means for enrollees in Lansing, Michigan:

-

Single 50-yr old: I thought their net premiums would increase by up to 196%, or nearly triple, which would be awful enough.

Instead, their 2026 premiums could go up by as much as 241%, or 3.4x what they pay today.

-

Single parent earning $30K/yr: I thought their net premiums would go from $0/mo to $87/mo.

Instead, their 2026 premiums would increase to $99/month.

-

Family of four earning $60K/yr: I thought their net monthly premiums would triple from $84 to $270.

Instead, their 2026 premiums would increase to $311/month, or 3.7x higher.

-

Older couple earning $90K/yr: I thought their net premiums would increase from $638/mo to $2,380/mo...3.7x higher.

Instead, their 2026 premiums would actually increase to $2,628/mo...4.1x higher.

I should also note that $2,628/mo would be a whopping 35% of this couple's gross annual income for premiums alone.

Here's the revised/updated table looks like for all four households. Remember, this also assumes that the benchmark Silver plan in Lansing, Michigan increases by 17% instead of 4.3%:

Finally, here's what it looks like visually. Not a pretty picture:

P.S. As it happens, my own family is among those who are about to be hit with some of these draconian rate hikes. If you'd like to support my work here at ACA Signups you can do so here, thanks.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.