I haven't seen this level of gaslighting against the ACA in years.

Note: I decided that while the original headline accurately reflected my feelings about this WSJ Op-Ed, it was a bit over the top, so I've changed it to something less crude.

For years, the Patient Protection & Affordable Care Act, generally shorthanded as the ACA or, more colloquially known as "Obamacare," was the top policy target of Republicans and other conservatives.

It seemed as though not a day went by without some right-wing opinion piece being published attacking the ACA for one thing or another. Once in awhile these attacks had some validity, but the vast majority were either completely baseless or grossly exaggerated.

And yet, after the dust settled on the infamous 2017 ACA "repeal/replace" debacle, it seemed as though the GOP had pretty much tired of their relentless assault on the healthcare law. They had failed to repeal it even with control of the White House, Senate, House of Representatives and Supreme Court, and ended up settling for zeroing out of the federal Individual Mandate Penalty as a consolation prize.

While there have been various lawsuits filed against the ACA since then (most notably the idiotic "Texas Fold'em" lawsuit and the still-pending Braidwood v. Becerra case, it felt for awhile as if Republicans had finally, if grudgingly, accepted that the ACA is here to stay.

This is why I was surprised and a bit bemused to see this Op-Ed piece published in the Wall Street Journal a few days ago:

ObamaCare Turns Out to Be Affordable Only for the Healthy

It was supposed to help those with pre-existing conditions, but they pay dearly for bad options.

Hoo boy.

The Op-Ed was written by John Goodman (not the actor, thankfully; the founder of the John Goodman Institute, a conservative think tank) and Beverly Gossage, a Republican Kansas state senator. It was originally brought to my attention via a tweet (no, I'm not gonna call it an "X" thank you very much) by Republican Tennessee U.S. Senator Marsha Blackburn, in which she refers to the ACA (pardon me..."Obamacare") as an "utter disaster" for people with pre-existing conditions.

OK, hold on tight because I'm going in.

If you are sick, things are different. Consider a hypothetical middle-aged couple in Dallas earning $70,000 a year. Suppose they have two children, both of whom have serious birth defects. Although this family will pay no premium for a Blue Cross bronze plan in the ObamaCare exchange, they will face a $9,100 deductible for each child. Their total out-of-pocket exposure is $18,200 a year.

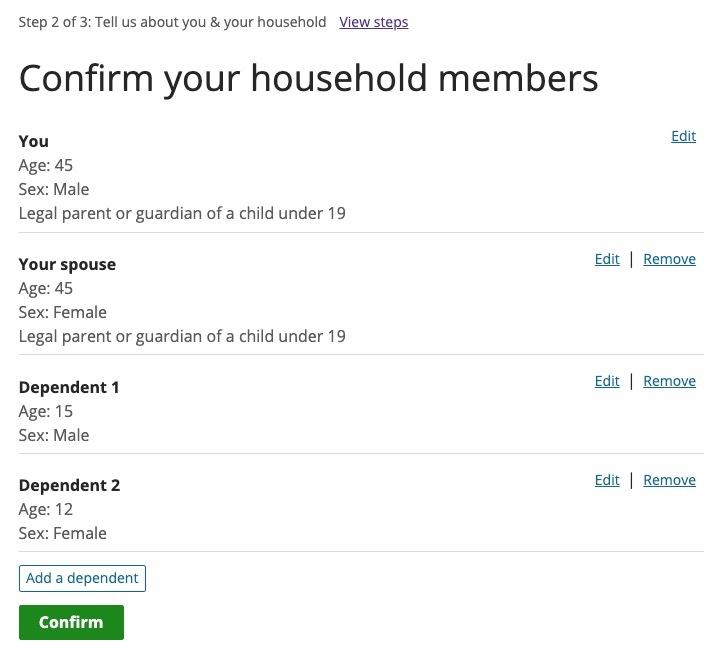

Stop right there. "Middle-aged" is generally considered to be somewhere between 40 - 55 years old, so let's go with 45. They have two children under 19 on their plan (the Op-Ed later refers to the same children being eligible for CHIP under a different scenario); let's figure the kids are, say, 15 and 12.

NOTE: See update at bottom of this post; it turns out they used 35/35/9/7 as the ages. These change the costs of the various plans below slightly, but not by much either way.

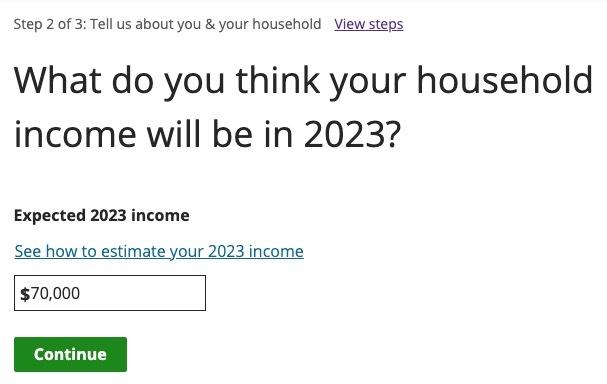

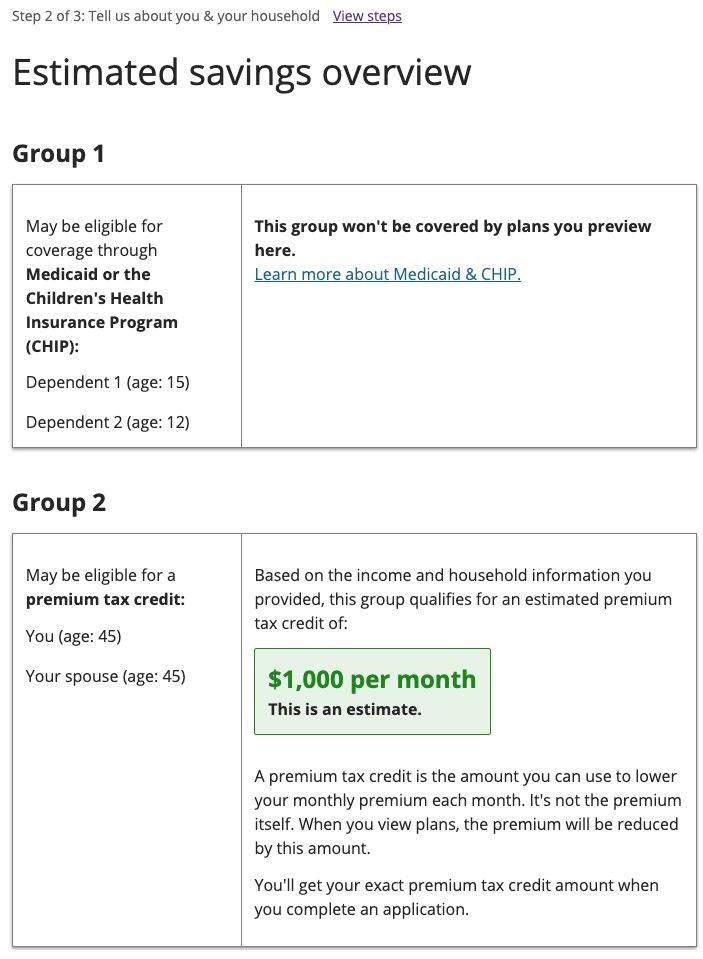

I plugged this hypothetical family into HealthCare.Gov to see what options they have, using a Dallas County, TX zip code (I suppose it's conceivable they meant a different Dallas, but that's...unlikely).

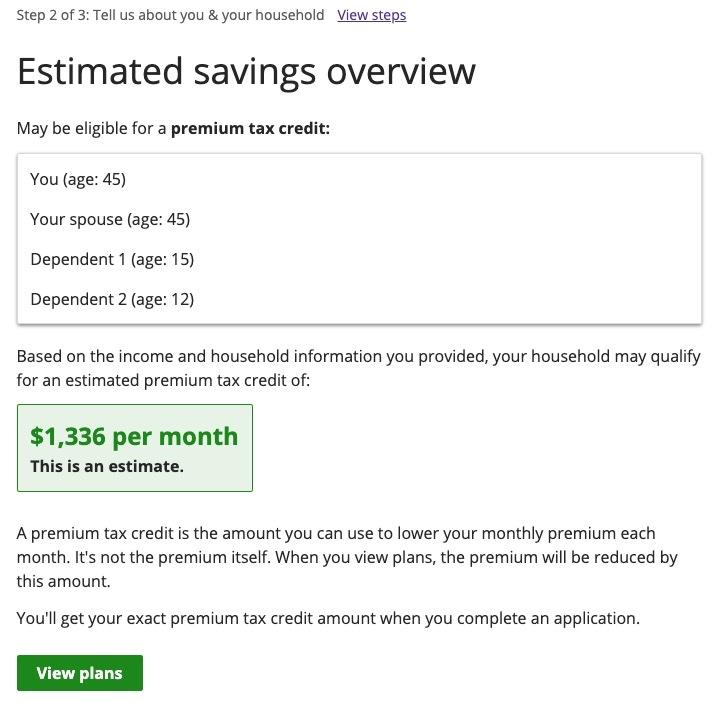

At $70,000/year, this family is earning 233% of the Federal Poverty Level, and is eligible for $1,336/month in federal tax credits to reduce their monthly premiums.

Now let's look at the plans available to them. There's 123 of them total (wow!), but the Op-Ed specifies Blue Cross Blue Shield, which is reasonable; this reduces the number of options to 23.

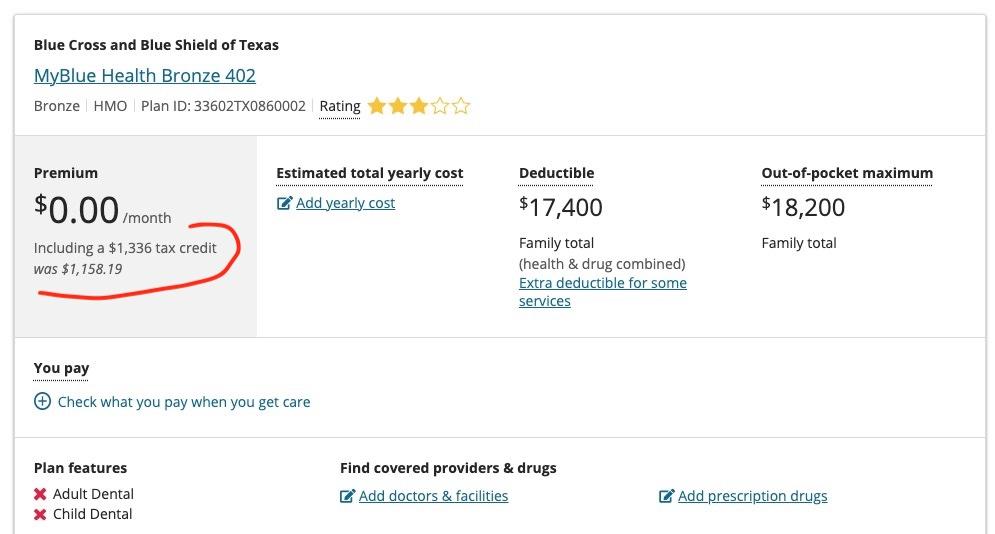

Goodman & Gossage then speculate that this family would choose a Bronze plan even though their children both have (their phrasing) "serious birth defects." There are 11 Bronze BCBSTX plans available, one of which would indeed cost them nothing in premiums.

Here's where Goodman & Gossage's claims start to fall apart. For starters, the Bronze BCBS plan would only cost $1,158/mo at full price, which means they'd be leaving an additional $178/month in tax credits on the table. That's $2,134/year in additional premium savings they'd be giving up.

Second, this plan does not have "a $9,100 deductible for each child." The deductible is $7,400 per individual, and the total deductible for all four of them is $17,400 (healthcare & drugs combined). It's true that this is a lot of money, but "$9,100/child" makes it sound like it would be $36,400 for the family, when it's less than half that.

Goodman & Gossage seem to be conflating this with the $18,200 maximum out of pocket cap (MOOP) for in-network care which isn't the same thing. The MOOP includes the deductibles, along with other OOP costs like co-pays & coinsurance.

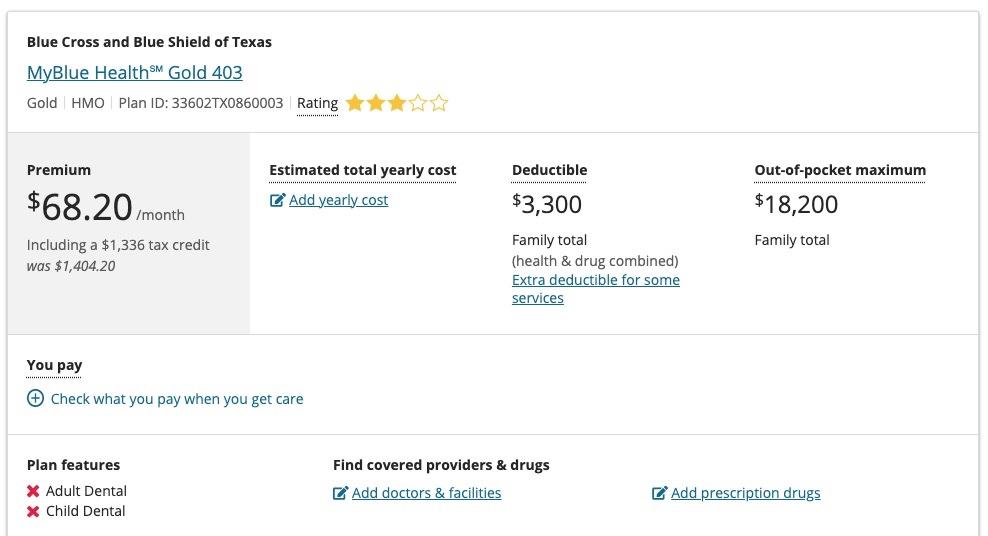

The thing is, this Bronze plan would be a terrible choice for them anyway. They'd be much better off choosing the Gold BCBSTX plan:

For the Gold plan, they'd have to pay $68/month ($818/year), but the deductible for the entire family would only be $3,300/year.

Now, the $18,200 MOOP could certainly still be an issue if they rack up a lot of co-pays & coinsurance, but here's the thing:

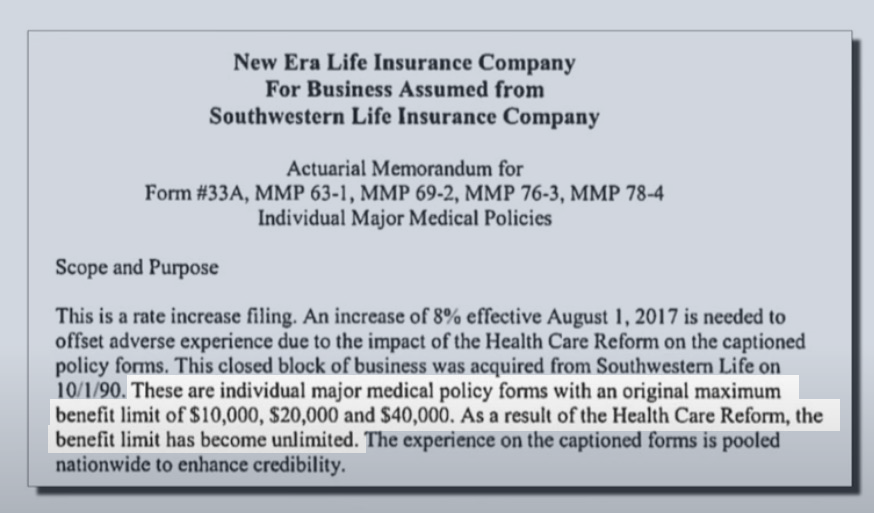

Before the Affordable Care Act, many individual market healthcare policies didn't include the deductible as part of their MOOP, and some didn't have ANY maximum out of pocket cap at all!

According to an archived study published by HealthPocket in 2013:

...Blue Cross Blue Shield insurers in Texas, Kansas, and Illinois excluded deductibles from out-of-pocket limits...38% of the plans did not include the plan’s deductible within their out-of-pocket limit, concealing the full amount a beneficiary could pay annually if the Summary of Benefits wasn’t read carefully.

For some carriers, every plan they offered within a state excluded the deductible from the out-of-pocket limit. For example, well-known Blue Cross Blue Shield organizations in Texas, Kansas, and Illinois were numbered among the insurance companies engaging in this practice.

Nationally...4% of plans examined had no limits on how much a consumer could pay annually in out-of-pocket spending for healthcare. When there is no annual out-of-pocket limit, a severe medical episode could result in catastrophic expenses even with health insurance coverage. Lab tests, hospitalization, surgery, medication, and rehabilitation could lead to expenses could result in expenses above $100,000 with out-of-pocket expenses on some plans representing 30% or more of these costs.

Yes, that's right: Blue Cross Blue Shield of Texas, the very insurance carrier Goodman & Gossage chose to use for their example, is also one of the very carriers which would likely have an actual MOOP nearly double what it is today without the ACA in place.

But you know what those same pre-ACA policies did often have? Annual and Lifetime Limits on claims, known as the "Maximum BENEFIT Limit." That means that many individual market healthcare policies put a hard cap on how much they would pay in medical claims:

However, lifetime limits were still very common in both the individual and employer health insurance markets before the ACA. In 2009, before the ACA, 59 percent of workers with employer-provided health insurance were in a plan with a lifetime limit on how much it would cover, according to the Kaiser Family Foundation / Health Research & Educational Trust Employer Health Benefits Survey. 27 percent of those had a lifetime limit between $1 million and $2 million, while the other 73 percent had a lifetime limit greater than $2 million.

At the same time, 89 percent of health plans in the individual market included a lifetime limit, averaging roughly $5 million, per a 2009 survey conducted by America’s Health Insurance Plans (AHIP).

$5 million may sound like a lot of money, and it is...but anyone who's ever had a premature infant or undergone chemotherapy sessions knows how quickly that can rack up. There were cases of preemies who maxed out their lifetime limits before they even came home from the hospital.

Also, that was just the average. Some policies had absurdly low caps, like this one:

The Op-Ed goes on to criticize the narrow networks of many ACA plans. This is the one legitimate criticism it has. But then it says something rather interesting:

...As a result, ObamaCare looks like Medicaid with a high deductible.

You know what looks like Medicaid without a high deductible? Medicaid.

Which neither Kansas (home to Sen. Gossage), Texas (the state used in the Goodman/Gossage example) nor Tennessee (the home state of Sen. Blackburn) have chosen to expand over the past decade.

But I digress.

...Suppose our Dallas family earned only $60,000. According to Healthcare.gov, their children could qualify for CHIP, (the Children’s Health Insurance Program) or Medicaid, and they wouldn’t be allowed into a subsidized private exchange plan.

Once again, Goodman & Gossage seem to be making a pretty strong case for Texas, Tennnessee & Kansas to expand Medicaid, since it doesn't have those terribly high deductibles which they claim this family is subject to under ACA plans (even though they actually aren't, as I showed above).

Note: These particular parents still wouldn't be eligible for Medicaid if TX expanded it under the ACA, but my point is that over 1.4 MILLION other low-income Texans would be. ACA expansion extends eligibility up to 138% FPL.

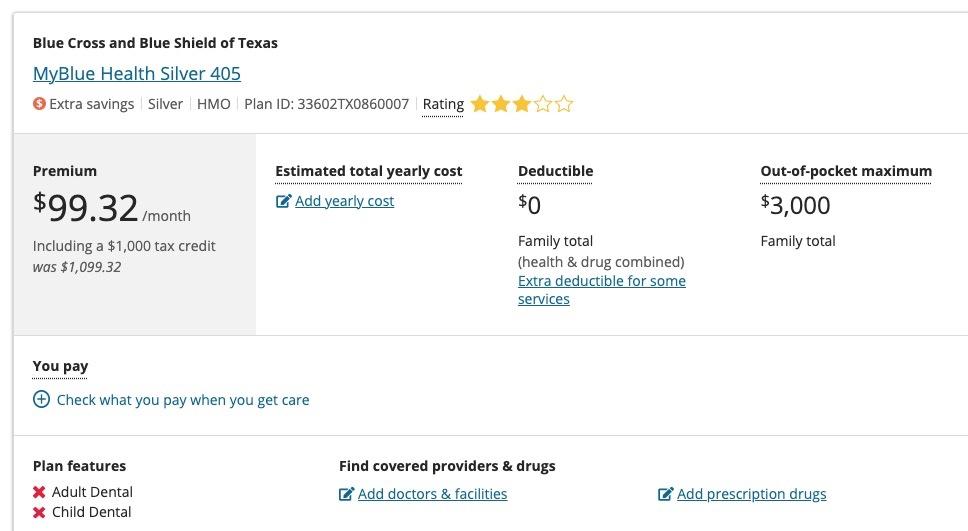

Their second example (dropping the income from $70K to $60K, or 200% FPL) is rather confusing and still just plain wrong:

Given their lower income, the best exchange plan the family would qualify for would now be the Blue Cross silver plan, which carries zero premium. This means that if the parents stay healthy, they would have no out-of-pocket medical expenses.

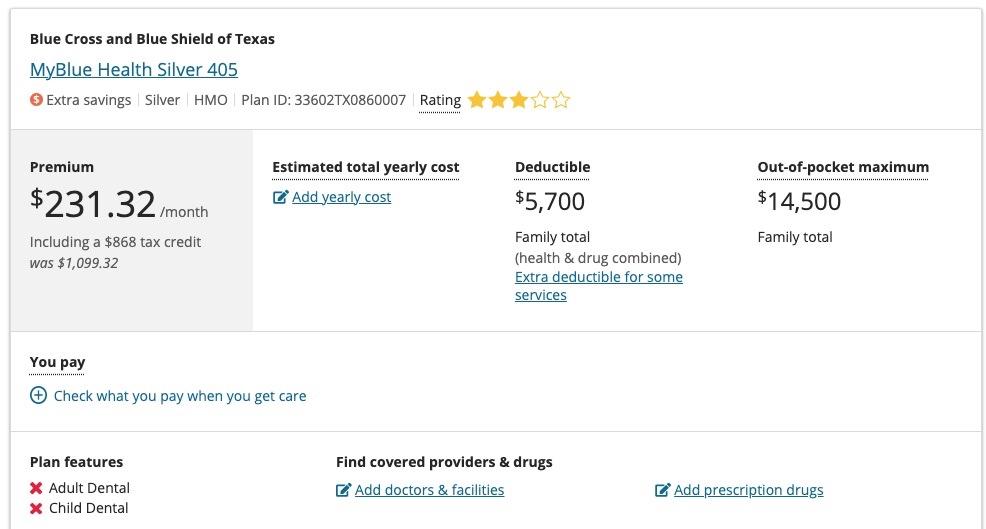

He's correct about the children now being eligible for CHIP or Medicaid instead, but the parents would now only be eligible for $868/month in tax credits (since there's only 2 of them on the ACA policy instead of all 4). However, I'm not sure which silver plan he's claiming would be zero premium; the least-expensive Silver plan via HC.gov now shows up as costing $231/mo (although with a $5,700 family deductible & $14,500 MOOP, not $18,200).

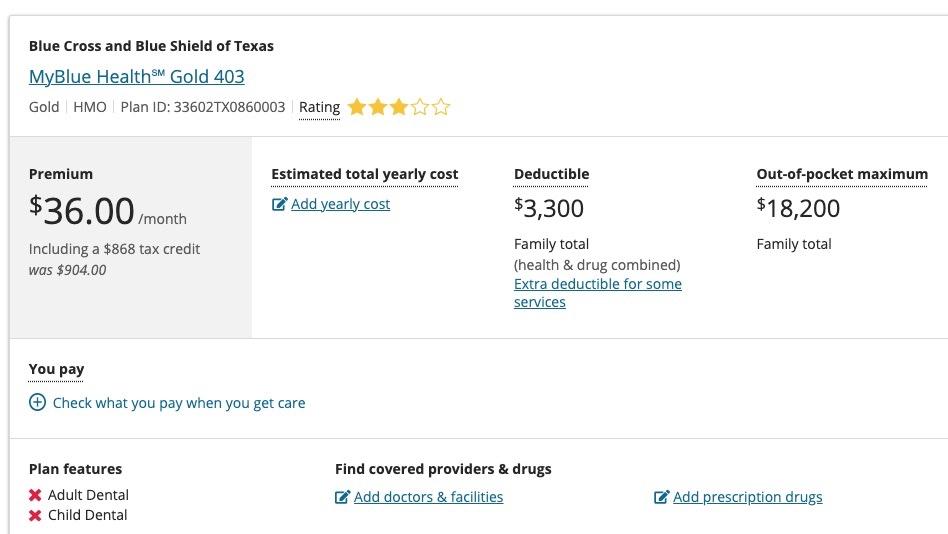

In fact, even at $60,000/year with their kids enrolled in CHIP/Medicaid, the couple would still be much better off on that same Gold plan--they'd only pay $36/month in premiums ($432/year) while the deductible would be even lower ($3,300 for both of them). The MOOP would be higher ($18,200 again), but remember, the children with 'serious birth defects' are no longer on the plan, so the couple is far less likely to come close to hitting that ceiling.

Here's where Goodman & Gossage completely go off the deep end:

But things quickly change if they rose to $70,000 household income again. The penalty would be an $18,200 increase in maximum medical costs—a marginal tax rate of 182%.

This is nonsense. Here's what would happen if they had picked the BCBSTX MyBlue Health Gold 403 plan and their income went up $10,000 in the middle of the year:

- Their children would no longer be eligible for CHIP/Medicaid, so they'd be added to the Gold plan instead

- Their APTC (advance premium tax credits) would increase from $868/mo to $1,336/mo

- Their premium would increase from $36/mo for the 2 parents to $68/mo for all four family members

- The family deductible for all four would remain at $3,300

- The MOOP would remain at $18,200

In other words, they'd end up paying $32 more per month in premiums, and...that's pretty much it (although yes, they'd be more likely to hit that $18.2K MOOP with the kids back on the policy). Fortunately, they'd also have an extra $10,000 in income to help cover that as well.

Of course, another solution to this problem would be for Texas to increase their CHIP eligibility level from 201% FPL to, say, 250% FPL ($75K for a family of 4). Great idea, Mr. Goodman & Ms. Gossage!

Here's where the chutzpah really goes off the rails:

Even with the children on CHIP, the parents could have serious medical problems of their own and an accompanying implicit tax on income. At an income, say, of $30,000, the best option is a silver plan with a small premium combined with a small deductible.

$30,000/year for a family of 4 living in Texas is exactly 100% of the Federal Poverty Level.

In most states, at that income, the entire family would be eligible for Medicaid...because those other states expanded Medicaid under the Affordable Care Act.

In Texas (and Tennessee, and Kansas), they aren't...because those states haven't done so.

Having said that, at $30,000/year (100% FPL), the children would be eligible for Medicaid, while the parents would receive $1,000/mo in APTC subsidies (ACA subsidy eligibility begins at 100% FPL, so they'd just make the cut).

The Op-Ed claims that in this scenario, "the best option is a silver plan with a small premium combined with a small deductible" but that's incorrect as well. The lowest-priced Silver BCBSTX plan has a $99 premium with NO deductible at all (and a $3,000 MOOP).

Near the end, we get to the most revolting part of the gaslighting:

Most people with serious health problems who have to buy their own coverage would have been much better off in the pre-ObamaCare health system.

HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA HA!!!

Sorry about that.

In Texas there was a risk pool for people who delayed buying a plan until they really needed one. Premiums were higher than what others were paying, but less than ObamaCare premiums today. A typical offering was a standard Blue Cross plan, with reasonable deductibles and networks that covered almost all doctors and medical facilities.

This is a reference to the pre-ACA "high-risk pools" which many states (including Texas) used to have. Here's some fun traits of these "high-risk pools:"

Pre-existing condition exclusions – Nearly all state high-risk pools excluded coverage of pre-existing conditions for medically eligible enrollees, usually for 6-12 months. This made coverage less attractive for people who needed coverage specifically for their pre-existing conditions.

(Yes, that's right...even the high-risk pools, designed specifically for those with pre-existing conditions...denied those with pre-existing conditions from enrolling for up to a year. Tough luck if you've been diagnosed with a type of cancer which will kill you in less than a year without treatment).

And this, my friends, is the reason why every other argument made in the Op-Ed is academic... because prior to the ACA, the children of this hypothetical couple with "serious birth defects" as Goodman & Gossage put it, would almost certainly NOT BE ELIGIBLE FOR INDIVIDUAL MARKET HEALTHCARE COVERAGE AT *ANY* PRICE.

Lifetime and annual limits – Thirty-three pools imposed lifetime dollar limits on covered services, most ranging from $1 million to $2 million. In addition, six pools imposed annual dollar limits on all covered services while 13 others imposed annual dollar limits on specific benefits such as prescription drugs, mental health treatment, or rehabilitation.

...A small number of states capped or closed enrollment to limit program costs, though enrollment caps were not allowed for HIPAA-eligible individuals. Limiting enrollment, directly or indirectly, was a key strategy to limit the cost of high-risk pools to states. By design, all state high-risk pools experienced net losses – that is, expenses greater than premium revenue.

Finally, we get to the heart of the matter--and frankly, given how relatively quiet the landscape on attacking the ACA has been recently, this is also the most likely reason this Op-Ed was written in the first place:

In the last two sessions of Congress, Democrats had an opportunity to reverse some of the worst aspects of ObamaCare. Instead, they added $30 billion of “enhanced subsidies,” which will make health insurance cheaper for healthy people making as much as several hundred thousand dollars a year.

I'm sure it's not coincidental that the WSJ published this Op-Ed just a day before House Ways & Means Ranking Member Rep. Richard Neal called for the enhanced subsidies introduced by the American Rescue Plan and extended temporarily by the Inflation Reduction Act to be made permanent.

Oh yeah...and regarding that parting shot claiming that the enhanced subsidies would make insurance cheaper for "healthy people" making "several hundred thousand dollars a year..." that's theoretically possible thanks to the ARP/IRA subsidies finally removing the long-hated "Subsidy Cliff," but the vast majority of those making "several hundred thousand dollars a year" have healthcare coverage via their employer.

In fact, only 3.8% of HealthCare.Gov exchange enrollees earn more than 500% FPL ($73,000/yr for a single adult; $150,000/yr for a family of four). I can't imagine that more than a few thousand of them at most earn "several hundred thousand dollars a year." Even then, they'd have to be in their late 50's or early 60's in order for the premiums to be high enough to make them eligible for subsidies...and even then, there's only a handful of counties in the country where the Silver Benchmark Plan premium would be high enough for that particular subset of theoretical enrollees to have this scenario conceivably apply to.

However, I'll tell you what, Mr. Goodman & Ms. Gossage: If you really want the Subsidy Cliff brought back at a higher threshold (say, 1,500% FPL or so) to be absolutely certain that a hypothetical 64-yr old couple, with 25-yr old triplets, living in Kay County, Oklahoma, earning $880,000/year doesn't receive $0.79/month in subsidies...we can talk.

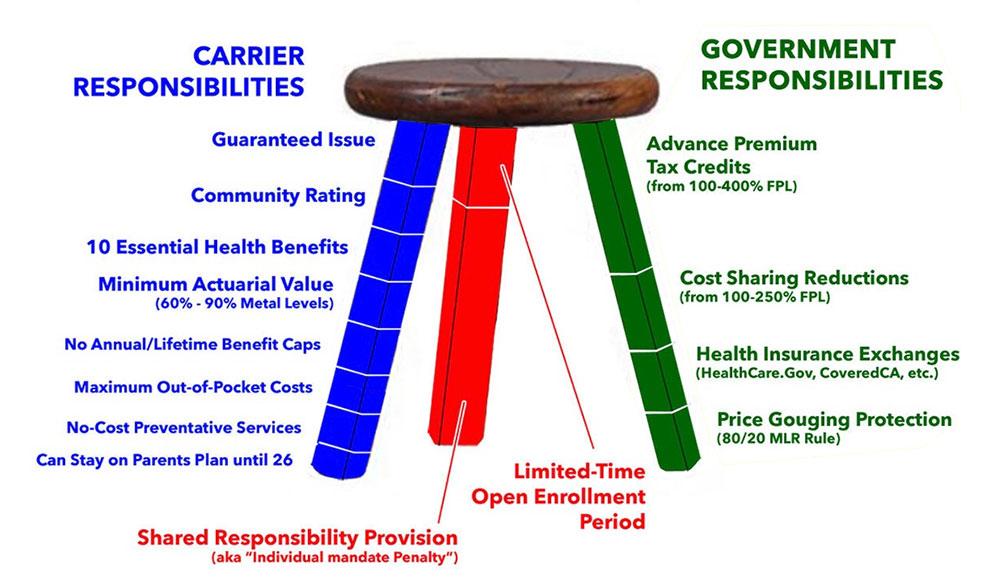

Look, the bottom line is this: The "3-Legged Stool" graphic below depicts how the ACA originally intended the individual market to look. Over the years there have been numerous changes to the Red Leg (zeroing out of the individual mandate penalty) and the Green Leg (upgrading/expanding the APTC subsidies & replacement of CSR reimbursements with "Silver Loading" in many states). Some of these changes have been positive, some negative. But the Blue Leg--the "Patient Protection" part of the law--has (for the most part) remained pretty much intact.

I'll give Mr. Goodman & Ms. Gossage two nods, however: The networks for many ACA plans (the stool seat itself) are indeed too narrow, and the MOOP is still too high for most enrollees (though, again, still far lower than it would be without the ACA being in place)...but the solution to both of those is to strengthen the ACA, not to weaken it.

As an aside, this is an explainer video I put together several years back; it's outdated of course, but the first 9 minutes or so give a pretty good overview of how things used to work on the individual market and how the ACA changed that:

UPDATE: It turns out that Goodman & Gossage defined "middle-aged" literally: They made the parents 35 years old each (since the average mortality rate in the U.S. is 73), while the children are 7 and 9 years old. This changes some of the numbers above but not by much:

At $70K/yr:

- The Bronze plan is still $0/month, $17.4K deductible, $18.2K MOOP

- Instead of "wasting" $178/month of APTC subsidies, they'd only be "wasting" $132/month

- The Gold plan would cost a bit more $86/mo instead of $68/mo, but otherwise would be the same ($3.3K deductible, $18.2K MOOP)

At $60K/yr:

- The Silver plan would cost $15/mo *less* ($216/mo) but otherwise would be the same

- The Gold plan would cost $15/mo *more* ($51/mo) but otherwise would be the same

At $30K/yr:

- The Silver plan would cost $84/mo vs. $99/mo (otherwise identical)

None of this alters any of the other points one way or the other, however.