Ways & Means Ranking Member urges Congress to make upgraded ACA tax credits permanent

Over at Inside Health Policy, Amy Lotven confirms that House Democrats haven't forgotten about the pending expiration of the upgraded federal subsidies provided by the American Rescue Plan and extended via the Inflation Reduction Act last summer:

While the Census found the percentage of Americans without insurance fell, even as a supplemental poverty measure increased following the end of pandemic-era assistance, ranking House Ways & Means Committee Democrat Richard Neal (MA) is highlighting the need to extend the enhanced Affordable Care Act credits that are set to expire at the end of 2025.

...Neal blamed the increase in child poverty on Republicans who refused to extend the expanded Child Tax Credits effective during the pandemic, while noting that the “investments in making health coverage more affordable and accessible continue to pay off as the uninsured rate fell to a near-record low.”

“In the Inflation Reduction Act, Ways and Means Democrats fought to extend critical tax credits to lower premiums, saving 13 million people an average of $800 per year. Making this support permanent would give families more breathing room and make it even easier to find the health coverage that best fits their needs,” Neal said, referring to the enhanced Affordable Care Act credits that are set to expire as of Jan. 1, 2026. The policy, first enacted under the American Rescue Plan, increases the subsidies available for people earning up to 400% of poverty, limiting the premium contribution for any earning more than 400% of poverty to no more than 8.5% of income.

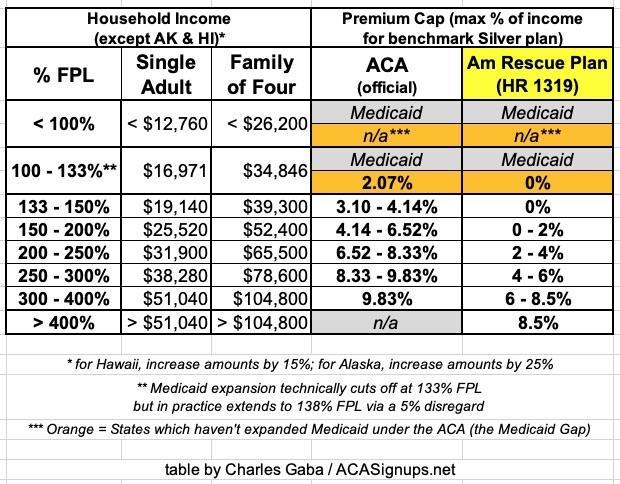

The enhanced ACA subsidies of the ARP/IRA consist of two parts:

- First, it made the premium subsidy formula much more generous to those already eligible for them

- Second, it finally removed the hard 400% FPL household income eligibility threshold cut-off included in the original formula

Here again is what the two subsidy formulas look like side by side:

Here's a couple of visual reminders of what the difference looks like in real world terms.

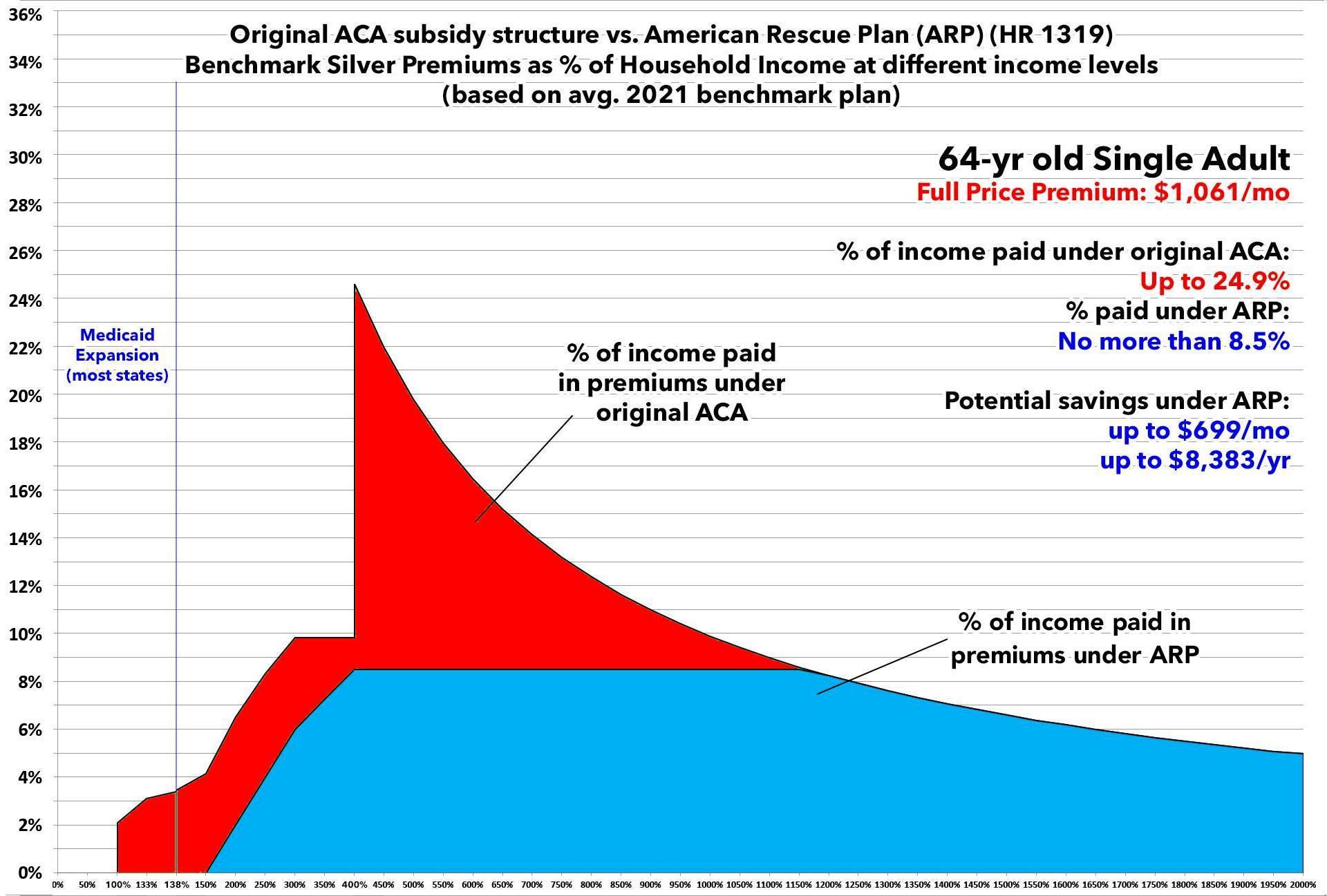

First, a 64-year old single adult just one year away from becoming eligible for Medicare:

With the enhanced ARP/IRA subsidies, a Silver ACA exchange healthcare policy is free if they earn up to 150% FPL (nearly $22,000/year as of 2023); after that their net premiums increase on a sliding scale until they reach 8.5% of their income at 400% FPL (just over $58,000/year). After that, however, they still never have to pay more than 8.5% of their household income for the Silver benchmark plan.

Without the enhanced subsidies, the ACA would revert back to the old formula, where they'd have to pay ~4% of their income even at 150% FPL, rising up to around ~9.8% at 400% FPL...and if they earn even a dollar over that, they have to pay full price...which, on average, would end up being as much as a stunning 25% of their income.

In short, the enhanced ARP/IRA subsidies are saving them as much as ~$8,400 per year in premiums, which they'd have to start paying again if those enhanced subsidies are allowed to expire.

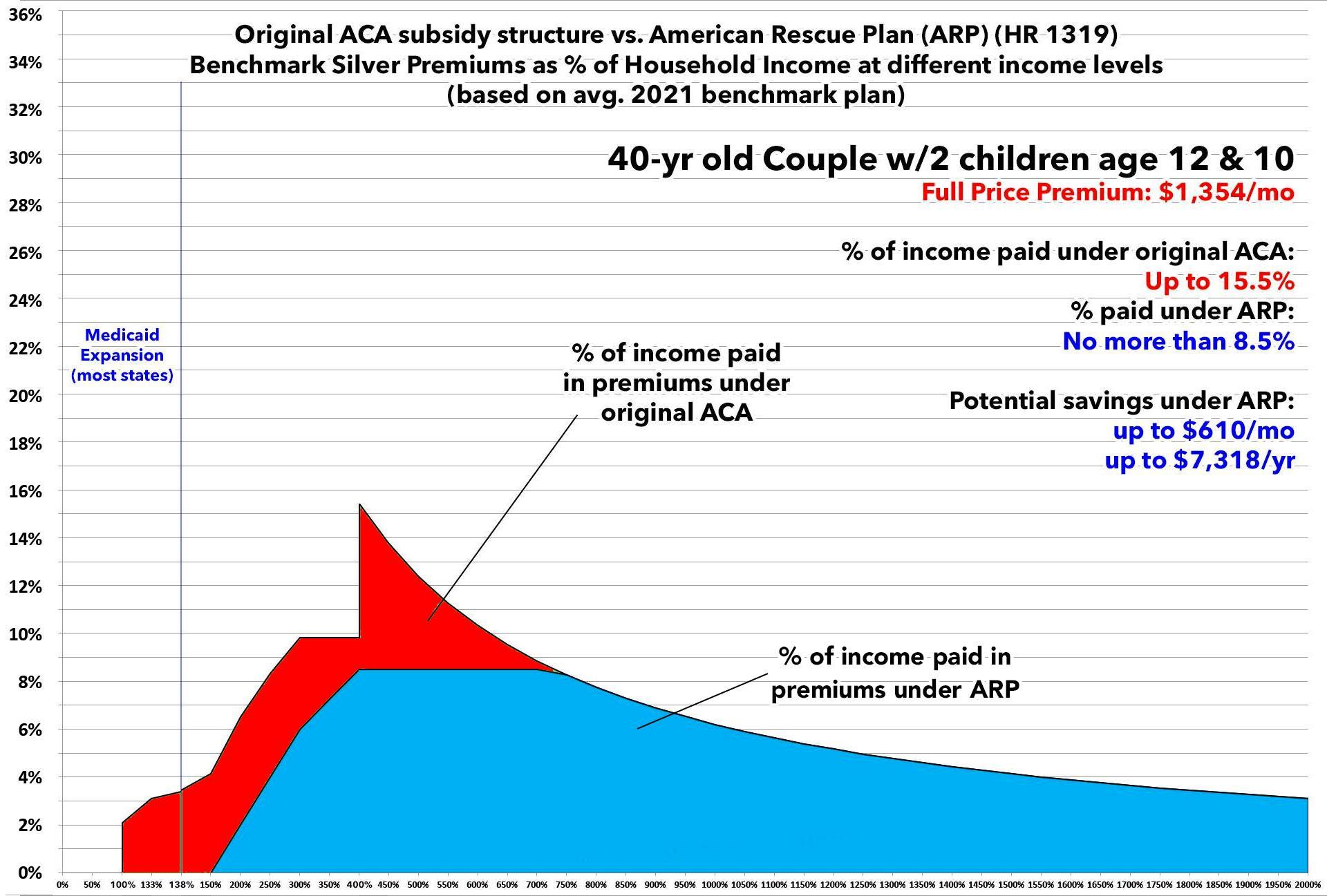

Next, a 40-yr old couple with two children:

With the enhanced ARP/IRA subsidies, a Silver ACA exchange healthcare policy is free if they earn up to 150% FPL ($45,000/year as of 2023); after that their net premiums increase on a sliding scale until they reach 8.5% of their income at 400% FPL ($120,000/year). After that, however, they still never have to pay more than 8.5% of their household income for the Silver benchmark plan.

Without the enhanced subsidies, the ACA would revert back to the old formula, where they'd have to pay ~4% of their income even at 150% FPL, rising up to around ~9.8% at 400% FPL...and if they earn even a dollar over that, they have to pay full price...which, on average, would end up being as much as over 15% of their income.

In short, the enhanced ARP/IRA subsidies are saving them as much as ~$7,300 per year in premiums, which they'd have to start paying again if those enhanced subsidies are allowed to expire.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.