Updated: California bill would complete a major chunk of Biden's ACA 2.0 vision at the state level...w/one concern

Yesterday I did a write-up about Covered California's 2022 Open Enrollment Period Executive Summary, which included a bunch of important data and demographic breakouts about how the largest state-based ACA exchange performed over the 2022 OEP.

However, I deliberately left out a section because I wanted to discuss it separately. If you scroll down to pages 31 & 32, you'll see a summary of two important pieces of ACA-related legislation which have been introduced in the California state legislature.

One of these is SB 967, introduced by CA State Senator Robert Hertzberg, which would do the following:

- The Franchise Tax Board to include a checkbox for a taxpayer to indicate on their individual income tax return that they are interested in no-cost or low-cost health care coverage and authorize the board to share information from their tax return with the California Health Benefit Exchange for taxable years beginning on and after January 1, 2023.

- The Exchange to annually conduct outreach and enrollment efforts to individuals who indicate on their tax returns that they are interested in no-cost or low-cost health care coverage.

In other words, this would add California to the growing list of states with a "Tax Time Special Enrollment Period," spearheaded by Maryland a couple of years ago. As summarized above, it would simply allow uninsured Californians a second chance to enroll in either a no- or low-cost ACA plan or Medicaid (Medi-Cal) if eligible by checking a box on their state tax return.

This is a great idea and I'm glad it's taking off so quickly, but it's the second pending bill which really caught my eye:

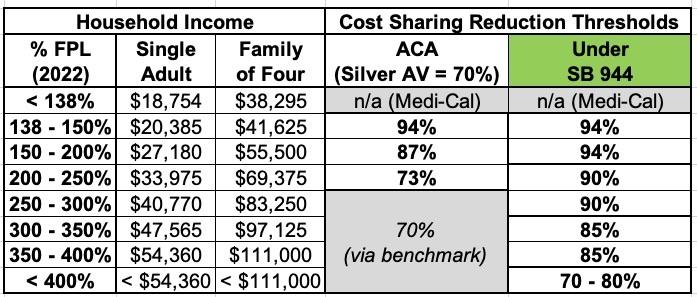

AB 1787* (Wood) and SB 944 (Pan) would require Covered California to offer cost sharing assistance based on FPL with the actuarial values (AV) outlined below:

- Below 200% FPL: AV of at least 94 percent.

- Between 200 and 300% FPL, AV of at least 90 percent, scaled to income.

- Between 301 and 400% FPL, AV of at least 85 percent, scaled to income.

- Above 400% FPL, may offer AV of as much as 80 percent, depending on available funding.

Requires adoption of standard benefit designs consistent with these provisions.

*Note: This is a typo in the actual CoveredCA report...the bill number is AB 1878, not 1787!

As a reminder, the Actuarial Value (AV) refers to the percent of the (aggregate) average plan enrollees total in-network medical expenses which are paid for by a given health insurance policy. The higher the AV, the lower the deductible, co-pays & coinsurance the enrollee has to pay.

ACA plans have AVs of roughly 60% (Bronze), 70% (Silver), 80% (Gold) or 90% (Platinum), but the ACA's Cost Sharing Reduction (CSR) subsidies turn Silver plans for lower-income enrollees into what amount to "Platinum Plus" plans (94% or 87% AV if you earn less than 200% of the Federal Poverty Level) or "Silver Plus" plans if you earn 200 - 250% FPL.

If passed, this bill would be huge for California ACA enrollees. It's essentially a state-based version of U.S. Senator Jeanne Shaheen's S.499, which I talked about last spring (well, half of it, anyway):

...It also would expand CSRs to everyone earning up to 400% of poverty. For enrollees earning up to 200% FPL, the CSRs would hike the actuarial value of their plan from 87% up to 95%. Enrollees earning 200%-300% of FPL would have plans with a 90% AV and those earning from 300%-400% of FPL would get their plan value boosted to 85% AV.

Here's a summary of the ACA's Cost Sharing Reduction subsidy table and how it would change for California enrollees under SB 944:

This bill would reduce deductibles, co-pays & coinsurance costs for California ACA enrollees dramatically. To give you an idea of how dramatic, here's what the benchmark Silver plan would look like for a 50-year old single adult here in Oakland County, Michigan:

- Ambetter Balanced Care 31:

- At 70% AV (no CSR): $5,460 deductible, $6,450 out of pocket maximum

- At 94% AV: $625 deductible, $625 out of pocket maximum

- At 87% AV: $1,700 deductible, $1,700 out of pocket maximum

I don't know the exact savings at 90% or 85% AV, but the bottom line is this individual would save up to ~$4,000/year or so.

For a family of four, I believe the deductible/out of pocket maximums would be double each of the above, so they'd save up to ~$8,000/year, give or take.

Overall, this would be fantastic and I'm rooting for it to become law in not just California, but nationally.

There is, however, one well-intentioned part of the bill which my brilliant colleague David Anderson notes could, ironically, cause issues for the chronically sick:

The affordability assistance provided by the Exchange shall reduce cost sharing, including copays, coinsurance, and maximum out-of-pocket costs, and shall eliminate deductibles for all benefits (MY EMPHASIS)

Cost-sharing is still a part of these plan designs. There are lots of different ways to build a 94% AV plan. These cost-sharing decisions have distributional consequences. A 94% AV plan for a single individual in 2022 in California has a $75 deductible and an $800 maximum out of pocket. A deductible only plan that is also 94% AV can have a $500 deductible and a $500 maximum out of pocket. A 30% coinsurance for everything plan that has a 94% AV has no deductible and an $850 maximum out of pocket. If we make PCP, outpatient mental health and generic drug no cost-sharing, the maximum out of pocket increases to $1,000.

In other words, even a 94% AV plan still has to slice up that other 6% one way or another between deductibles, co-pays & coinsurance. If you legally eliminate deductibles, it forces the other two (co-pays & coinsurance) to be higher to make up the difference.

In short, this bill should be passed but without the "eliminate deductibles" line included.

UPDATE: I've been contacted by Anthony Wright and Beth Capell of Health Access California, who have provided me with some important context for the "eliminate deductibles" provision within the proposed bill. In particular, they note that:

...We have been part of the negotiation over benefit design at Covered California, and are fully aware of the straightjacket of the AV calculator-if you lower the deductible, you raise cost sharing in inequitable ways. But what we are talking about is a subsidy, which creates a different dynamic. In the modeling process, we learned that eliminating the deductible was also relatively cheap given other options. Why?

- Deductibles for silver apply only to inpatient care (hospital/SNF), not even ER visits.

- Almost every consumer who hits this (peculiar) deductible hits their MOOP because staying overnight in the hospital means that 20% of the cost will make the consumer hit the deductible.

Again, MOOP = Maximium Out of Pocket cost limit. The point here is that in the vast majority of cases, the enrollee would max out their co-pays & coinsurance regardless of whether there's a deductible or not anyway, rendering a distinct "deductible" as kind of moot anyway.

...Because the deductible for the silver products only applies to inpatient hospital care (and SNF), not even ER visits, only a small fraction of people (2%-3% by Covered CA's data) ever hit the deductible--and as (Anthony) said, almost everyone who stays overnight in a hospital hits their MOOP.

The gold and platinum products in Covered CA have no deductibles. Since SB944 and AB1878 improve silver cost sharing to AV levels comparable to or better than gold or platinum, deductibles would be eliminated with or without the amendment you suggest.

Both deductibles and coinsurance are less common in California employer coverage than in other states: just under half of CA workers with employer coverage have zero deductibles, compared to 83% nationally.

This is the other critical factor I hadn't thought about: Existing California law when it comes to deductibles is already quite different from most other states as it stands, which means eliminating deductibles altogether should have far less downside than it would in other states.

The truth is, I've never been a fan of deductibles, and in fact I argued for doing exactly this at the federal level less than three years ago in my analysis of the proposed "Medicare for America" universal coverage bill. As I said at the time:

The "no deductibles" part is the first important change since December. Originally they were going to cap deductibles at $350/individual or $500/household, but they thought better of this and decided to simplify the cost sharing provision. I applaud this...while I'm not opposed to reasonable premiums and co-pays, I hate deductibles and based on my interactions, they confuse the hell out of people even when they aren't sky-high. Good riddance to deductibles, I say!

Of course the Medicare for America bill also had a lot of other provisions which made eliminating deductibles a viable option. In my original post above, I had completely forgotten that California already has some of those other provisions in effect today.

With that in mind, "elimination of deductibles" makes a lot more sense for California specifically. I'm still not 100% sure it's the right move but the points made by Wright and Capell definitely make me feel more at ease about it.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.