Prepare Thyself: ACA 2.0 is happening. (Part 1 of 3)

Back in late January, Senator Mark Warner of Virginia announced the introduction of a new-ish bill called the Health Care Improvement Act of 2021. Tell me if any of the major provisions look familiar:

- Capping health care costs on the ACA exchanges

- Establishing a low-cost public health care option

- Authorizing the federal government to negotiate prescription drug prices

- Allowing insurers to offer health care coverage across state boundaries

- Supporting state-run reinsurance programs

- Incentivizing states to expand Medicaid

- Expanding Medicaid eligibility for new moms

- Simplifying enrollment

- Increasing Medicaid funding for states with high levels of unemployment

- Reducing burdens on small businesses

I haven't had a chance to take a deep look into Sen. Warner's bill yet, but most of it seems reasonable (Exceptions: The "sell across state lines" bit is a pointless way of humoring Republicans who've been touting this tired chestnut for decades, and state-run reinsurance would actually be a net negative if the rest of the bill went through.)

There was also some buzz about a month ago, in mid-February, surrounding the re-introduction of "Medicare X", the "ACA 2.0 w/Public Option" bill from U.S. Senators Michael Bennet & Tim Kaine:

The Medicare-X Choice Act would establish and fund the Medicare Exchange plan, which would offer affordable health insurance to families, individuals and small businesses in every county in the U.S. It would expand Medicare’s network of doctors and providers, guarantee essential health benefits that were established in the Affordable Care Act and ensure access to affordable prescription drugs.

...This new version of the Medicare-X bill would provide a larger tax premium subsidy for Americans living below 400% of the federal poverty level and more generous tax credits than previous versions. It would also allow for payment adjustments of up to 150%, compared with 125% in previous versions of the bill.

One of the biggest changes from previous versions of the bill is the additional reimbursement rate meant to help people in rural areas. If passed, the public health care option would initially be available on the individual exchange in areas where health care costs are higher because of less competition, particularly rural communities, including those in Colorado.

I did a write-up of the prior version of Medicare X two years ago. The changes in the new version, as noted above, mostly involve increasing the healthcare provider reimbursement rates in rural areas from 125% of Medicare rates to 150%, plus some other odds & ends. It would fix the "Family Glitch", one of the most important drafting errors in the ACA which prevents several million people from being eligible for ACA subsidies who were supposed to be.

On the other hand, Medicare X would also include $10 billion/year in reinsurance...which, as noted above, would not only be pointless in a world without the Subsidy Cliff but which would actually be counterproductive. Dave Anderson explained why; I'll do a separate write-up on this myself soon.

Medicare X is a reasonable plan (except for the reinsurance provision), but to be perfectly honest, I still have my doubts about whether a real Public Option can make it through the sausage-making process, especially in a 50/50 Filibuster world (frankly, I have doubts even without the filibuster).

The fact that Bennet & Kaine are already upping the provider reimbursement rate from 125% of Medicare to 150% (if only for rural hospitals) before the bill even goes to committee already brings up visions of Washington State's quasi-PO, where they started out trying to only pay hospitals/doctors Medicare rates before bumping it up to 120%, 140% and eventually 160% of what Medicare reimburses providers. The WA legislature is attempting to take another shot at playing hardball with providers for the 2nd year of Cascade Care, but from what I've seen since that bill was introduced it sounds like it, too, is being severely watered down as it goes through the process.

So, while I hope that a strong Public Option is waiting in the wings, It's the rest of "ACA 2.0" which I'm continuing to keep my eye on.

Nearly four years ago, I posted my own Wish List for what I felt should be added or improved to the ACA to bring it to the next level. The original list consisted of 20 different provisions, many of which overlap with both the bills described above. Since then some of them have either already happened, been rendered moot or, as I've since come to realize, would actually work against some of the other bullet items:

- Lock in CSR reimbursements

(rendered moot by Silver Loading...for now) Restore Risk Corridor Funding

(settled via lawsuits)- Fix the Family Glitch

- Fix the Skinny Plan Glitch

"Encourage" the Remaining States to Expand Medicaid

(done via the ARP)- Encourage more states to launch a Basic Health Program

- Kill the Cliff & Up the Subs

(done via the ARP...temporarily) - Silver to Gold (& Up the CSR Cap)

INCREASE the Mandate Penalty

(moot...the federal penalty is gone & ain't coming back)- Require On-Exchange Exclusivity

- Let Undocumented Enroll On-Exchange (at least at full price)

- Tie MA/MCO contracts to Exchange participation

Reinstate Reinsurance

(whoops...never mind!)- Institute an MLR requirement for prescription drugs

- Let Medicare negotiate drug prices

- Fix the Silver Spam problem/Make standardized plans mandatory

Merge rating areas statewide

(up to each state, not feds)Merge the indy & sm. group risk pools

(up to each state, not feds)- Add a Public Option

(see my thoughts above) - Repeal the EMPLOYER mandate

(but only after the others are done first!)

As you can see in the Fact Sheet, as with Sen. Warner's bill, Bennet/Kaine's Medicare X would indeed scratch many of these items off the list, but again, the Public Option part of it is gonna be an incredibly tough sell in the current environment (and again, reinsurance has gone from being a small positive as long as the Subsidy Cliff is around to being a significant negative once the Cliff is killed permanently).

How about a bill which scratches off some of the other items?

Lo and behold, via Amy Lotven of Inside Health Policy:

Senate Dems’ Bill Would Enhance, Fund ACA’s Cost-Sharing Reductions

Senate Democrats led by New Hampshire Sen. Jeanne Shaheen are pushing legislation that would enhance the value of and eligibly for the Affordable Care Act’s cost-sharing reductions (CSRs) and permanently fund the program, thus eliminating the need for the “silver-loading” workaround that insurers crafted after the Trump administration ended direct payments to reimburse their costs for the subsidies in 2017.

The Improving Health Care Affordability Act, introduced March 1, also would also make permanent the ACA premium tax credit enhancements in the soon-to-be-enacted COVID-19 relief bill.

And the Senate Democrats’ bill would lift the actuarial value of the ACA subsides from 70% to 80% by linking the premium tax credits to the gold-level instead of silver-level plans.

...Federal spending would increase by about $350 billion over a decade, [Urban Institute economist Linda] Blumberg estimates.

...Shaheen’s bill also would end the “silver-loading” work-around in a way that does not harm consumers.

...Shaheen’s bill is structured to more efficiently spend federal dollars so that nobody would be worse off under the bill than under the status quo, says Stan Dorn of Families USA, which has endorsed the legislation.

...It also would expand CSRs to everyone earning up to 400% of poverty. For enrollees earning up to 200% FPL, the CSRs would hike the actuarial value of their plan from 87% up to 95%. Enrollees earning 200%-300% of FPL would have plans with a 90% AV and those earning from 300%-400% of FPL would get their plan value boosted to 85% AV.

This bill alone would permanently Kill the Cliff & Up the Subs. It would upgrade the benchmark ACA plan from Silver to Gold and expand/beef up the CSR subsidy formulas so that instead of being weak over 200% FPL and gone over 250%, it would be strong all the way up to 400% FPL.

This basically means that every exchange enrollee earning up to 300% FPL could afford to enroll in what's effectively a Platinum plan, while those earning 300 - 400% FPL could afford a Strong Gold (or weak Platinum?) plan. These are healthcare plans which rival all but the high-end employer-sponsored coverage.

Here's the biggest twist, however: It might not cost a dime in additional federal spending (or at least it'd cost FAR less than you might think).

How is that possible? Because it would be funded, ironically, by scratching off the very first item in the original list above: Formally locking in CSR reimbursement payments!

I'll do a full write-up on this separately as well, but the bottom line is that the Trump Administration cutting off CSR reimbursement payments, which he claimed would "save taxpayer money" actually ended up leading to ACA subsidies increasing dramatically...to the tune of a projected $194 billion over the next 9 years, or $21.5 billion per year. As explained in this 2017 CBO analysis:

- Had CSR reimbursement payments continued to be paid over the next decade, the CBO projected that it would have cost the federal government $118 billion between 2018 - 2026, or around $13 billion per year on average.

- Cutting off CSR reimbursement payments saves the federal government that $118 billion over 9 years. HOWEVER...

- The practice of "Silver Loading" by the carriers make up for that $118 billion is causing federal APTC subsidy costs to increase by a far more than $118 billion...in fact, the CBO projects that it's gonna increase APTC by around $309 billion for those earning between 250 - 400% FPL (that is, people who are eligible for APTC but not for CSR...the 200-250% crowd does qualify for CSR as well but it's pretty weak, so many of them likely go for Gold or Bronze plans regardless).

- There's some additional revenue increases & decreases projected by the CBO as well which I don't entirely understand, but they mostly cancel each other out, so in the end, the bottom line is that the CBO projected that cutting off CSR payments is actually going to COST the federal government a net $194 billion over the next nine years. That's roughly $21.5 billion per year.

- In other words, Donald Trump, in attempting to destroy the ACA, has actually ended up unintentionally causing the ACA's subsidies for lower-income Americans to increase by over $20 billion per year...without the Dems having to pass a law or anything.

On the one hand, hooray for Silver Loading! It's the reason why there's large portions of the country where Gold plans cost less than Silver plans on the ACA exchanges (or more accurately, it's why Silver costs more than Gold). It's also the reason why there's 190 counties where many people were already eligible for a FREE Gold plan even before the American Rescue Plan (ARP) beefed up subsidies for the next 2 years.

On the other hand, Silver Loading, as clever and effective as it can be, is also a scattershot mess at the moment, as well as being inefficient and unevenly utilized. For instance, while most states have embraced Silver Loading as of 2021, there's still a few which refuse to allow it (West Virginia and Indiana, I think?) Even in states which do allow or encourage it, implementation is all over the place--some insurance carriers utilize it fully, some partially and some not at all. Finally, Silver Loading confuses the hell out of the enrollees who can't figure out why the hell a Gold plan covering 80% of their expenses costs less than a Silver plan covering 70%.

I say all this as one of those who helped coin the phrase and hashtag "#SilverLoading" in the first place. I've written about it, promoted it and encouraged it for the past 3+ years because as long as the ACA subsidy formula remained as it was, it was the most effective way of cutting down costs for individual market enrollees earning more than 200% FPL. HOWEVER, as long as we #KillTheCliff and #UpTheSubs permanently and beef up/expand CSR subsidies as well, Silver Loading is no longer necessary.

Formally appropriating CSR funding would reverse the situation, causing Silver Loading to disappear...but in doing so it would free up several hundred billion dollars over the next decade...which in turn would be used to pay for the beefed-up subsidies.

For the most part, this would be basically spending the exact same money on the exact same subsidies for most of the same people...but doing so in a more sane, rational, equitable and easier-to-understand fashion. Again, I dont think it would cover 100% of the cost, but it should cover the vast bulk of it.

Here's the actual text of the bill...it's only six pages long, and that's with the wide margins & double-spacing of legislative text:

SECTION 1. SHORT TITLE.

This Act may be cited as the ‘‘Improving Health Insurance Affordability Act of 2021’’.

SEC. 2. INCREASE IN ELIGIBILITY FOR CREDIT.

(a) IN GENERAL.—Subparagraph (A) of section 36B(c)(1) of the Internal Revenue Code of 1986 is amended by striking ‘‘but does not exceed 400 percent’’.

(b) APPLICABLE PERCENTAGES.—

(1) IN GENERAL.—Subparagraph (A) of section 36B(b)(3) of the Internal Revenue Code of 1986 as follows the table headings is amended to read as follows:

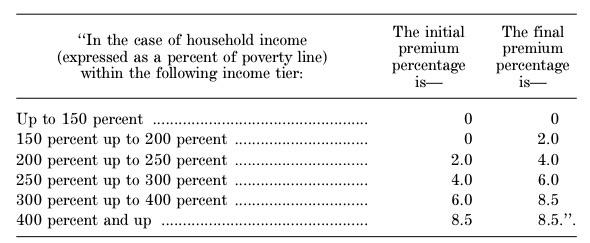

‘‘(A) APPLICABLE PERCENTAGE.—The applicable percentage for any taxable year shall be the percentage such that the applicable percentage for any taxpayer whose household income is within an income tier specified in the following table shall increase, on a sliding scale in a lin1ear manner, from the initial premium percentage to the final premium percentage specified in such table for such income tier:

(2) CONFORMING AMENDMENTS RELATING TO AFFORDABILITY OF COVERAGE.—

(A) Subparagraph (C) of section 36B(c)(2) of such Code is amended by striking clause (iv).

(B) Paragraph (4) of section 36B(c) of such Code is amended by striking subparagraph (F).(c) LIMITATION ON RECAPTURE.—Clause (i) of section 36B(f)(2)(B) of the Internal Revenue Code of 1986 is amended—

(1) by striking ‘‘400 percent’’ and inserting 10 ‘‘800 percent’’;

(2) by striking the period at the end of the last row of the table; and

(3) by adding at the end of the table the following new rows:‘‘At least 400 percent but less than 600 percent ........................... $3,500

At least 600 percent but less than 800 percent ........................... $4,500.’’.(d) PREMIUM COST STANDARD.—

(1) IN GENERAL.—The following provisions of section 36B of the Internal Revenue Code of 1986 are each amended by striking ‘‘silver’’ each place it appears and inserting ‘‘gold’’:

(A) Paragraphs (2)(B)(i), (3)(B), and (3)(C) of subsection (b).

(B) The heading of subparagraph (B) of subsection (b)(3).

(C) Subsection (c)(4)(C)(i)(I).(2) CONFORMING AMENDMENTS TO REDUCED COST-SHARING.—Section 1402(b)(1) of the Patient Protection and Affordable Care Act (42 U.S.C. 5 18071(b)(1)) is amended by striking ‘‘silver’’ and inserting ‘‘gold’’.

(e) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 2021.

SEC. 3. ENHANCEMENTS FOR REDUCED COST-SHARING.

(a) MODIFICATION OF AMOUNT.—

(1) IN GENERAL.—Section 1402(c)(2) of the Patient Protection and Affordable Care Act (42 14 U.S.C. 18071(c)(2)) is amended—

(A) by striking ‘‘150 percent’’ in subparagraph (A) and inserting ‘‘200 percent’’,

(B) by striking ‘‘94 percent’’ in subparagraph (A) and inserting ‘‘95 percent’’,

(C) by striking ‘‘150 percent but not more than 200 percent’’ in subparagraph (B) and inserting ‘‘200 percent but not more than 300 percent’’,

(D) by striking ‘‘87 percent’’ in subparagraph (B) and inserting ‘‘90 percent’’,

(E) by striking ‘‘200 percent’’ in subparagraph (C) and inserting ‘‘300 percent’’,

(F) by striking ‘‘250 percent’’ in subparagraph (C) and inserting ‘‘400 percent’’, and

(G) by striking ‘‘73 percent’’ in subparagraph (C) and inserting ‘‘85 percent’’.(2) CONFORMING AMENDMENT.—Clause (i) of section 1402(c)(1)(B) of such Act (42 U.S.C. 9 18071(c)(1)(B)) is amended to read as follows:

‘‘(i) IN GENERAL.—The Secretary shall ensure the reduction under this paragraph shall not result in an increase in the plan’s share of the total allowed costs of benefits provided under the plan above—

‘‘(I) 95 percent in the case of an eligible insured described in paragraph (2)(A);

‘‘(II) 90 percent in the case of an eligible insured described in paragraph (2)(B); and

‘(III) 85 percent in the case of an eligible insured described in paragraph (2)(C).’’.(3) EFFECTIVE DATE.—The amendments made by this subsection shall apply to plan years beginning after December 31, 2021.

(b) FUNDING.—Section 1402 of the Patient Protection and Affordable Care Act (42 U.S.C. 18071) is amended by adding at the end the following new subsection:

‘‘(g) FUNDING.—Out of any funds in the Treasury not otherwise appropriated, there are appropriated to the Secretary such sums as may be necessary for payments under this section.’’.

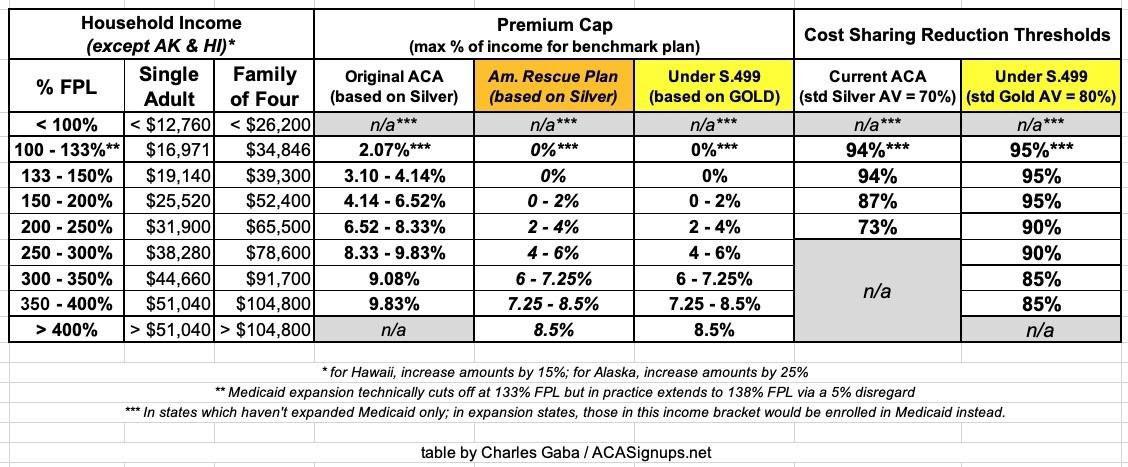

Here's a table summarizing how S.499 would change both the APTC and CSR subsidy formulas compared to the official ACA and the American Rescue Plan (which is only in place for 2 years):

NOTE: This post is getting kind of long so I've broken Part 2 out into a separate post...