2025 Rate Changes

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they had enrolled in ACA-compliant individual market policies as of early this year;

- What their average projected premium rate increase (or decrease) is for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

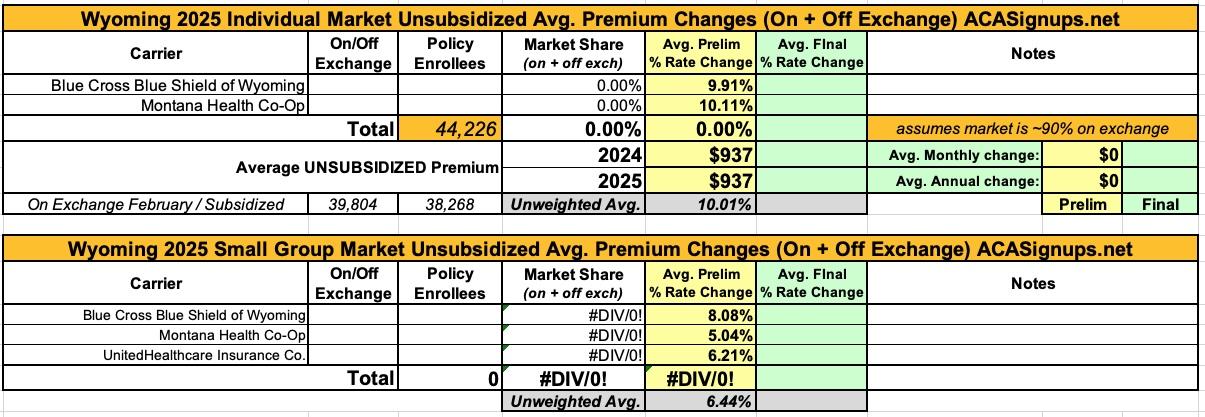

Unfortunately, there are 16 states where, due to the carriers and/or the state insurance departments heavily redacting the rate filing documentation, I've been unable to fill in the actual number of people enrolled by some or all of the insurance carriers within that state's individual market. This means that in those states the average premium rate changes listed (shown in grey) are unweighted averages, not weighted.

This can make a big difference.

- Let's say you have 2 carriers in a state, one raising rates by 10% and the other raising them by 1%. The unweighted average increase would be 5.5%.

- However, what if it turns out that the first carrier has 90% of the market share while the second only has 10%? That would mean a weighted average increase 9.1%.

- The unweighted average is the best I can do for these states without knowing the market share breakout, however.

In some of these states I've been able to acquire the actual effectuated enrollment for some carriers on the individual market but not all of them. In those states, combined with an educated guess as to the total market size, I've been able to run partially-weighted averages:

- Let's suppose there are 4 carriers offering individual market policies in a state, but I only have the actual enrollment for the first two (30,000 and 120,000 respectively).

- Let's say the average rate changes for each carrier are +12%, +4%, +1% and -3%

- An unweighted average would be +3.5%, completely ignore the enrollment numbers.

- Let's further say that according to the official CMS report, that state had 170,000 people enrolled in on-exchange policies as of February.

- If I assume 85% of their enrollees did so on exchange, that would put the total market at 200,000 people. It would also mean the other 2 carriers with unknown enrollment numbers had 50,000 between them. I'd then assume 25,000 apiece in order to run a semi-weighted average.

- This would give a semi-weighted average of +3.95%, rounded up to +4.0%.

The problem with doing this is that I'm making two big assumptions: First, that on-exchange enrollees make up 85% of the total; second, that the "missing" enrollees are evenly spread across the other two carriers. However, it's still more accurate than just running a completely unweighted average.

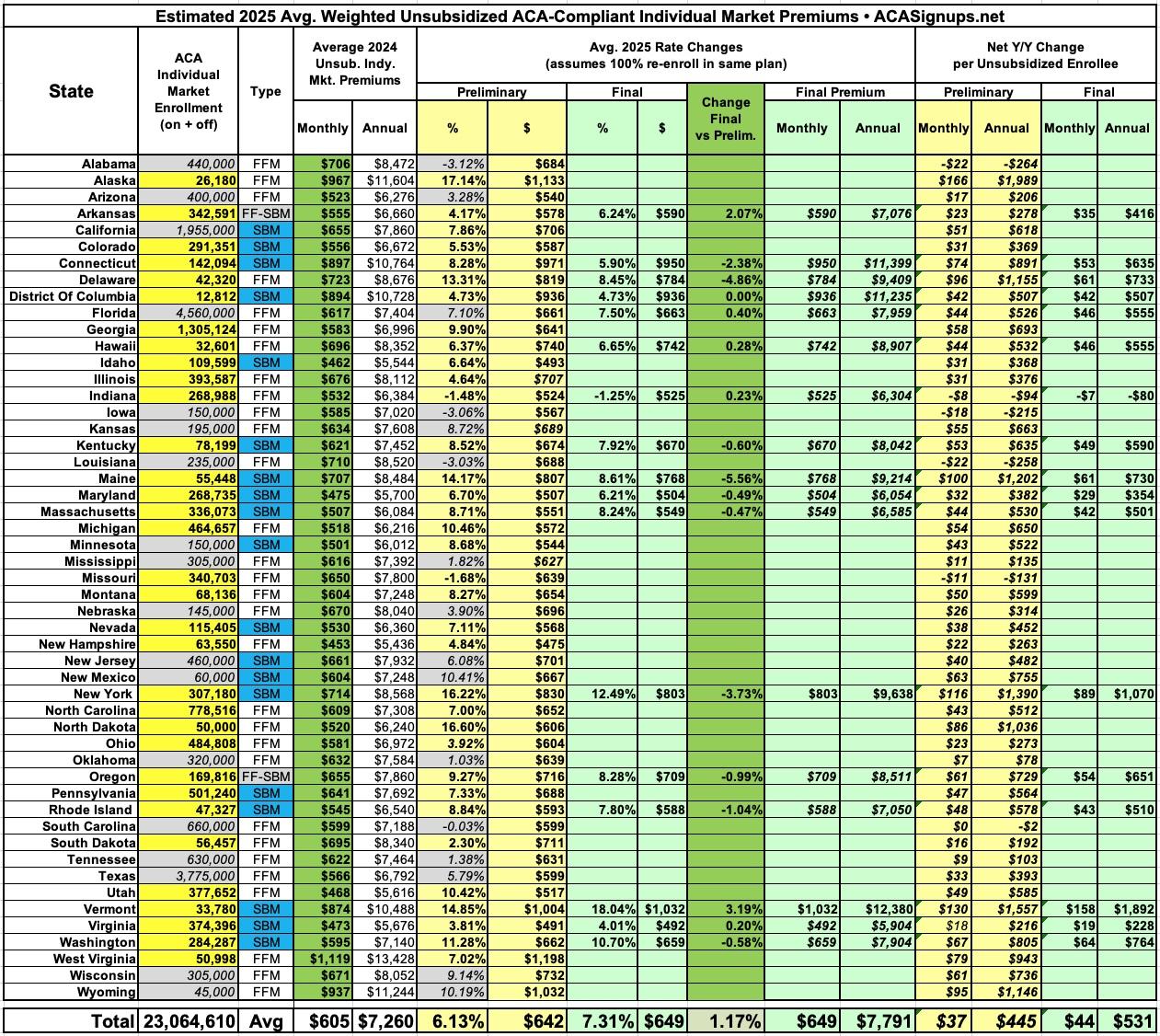

As of September 24th, I have the preliminary (requested) 2025 statewide average rate changes for all 50 states plus the District of Columbia, giving a national average requested rate increase of 6.13%. Again, it's important to remember that this includes 16 states where I've had to use either unweighted or partially-weighted averages.

I've also been able to run the numbers for the final, approved rate changes in 17 states (all of which happen to be fully weighted). Across those 17 states only, the final average premium increase for unsubsidized individual market enrollees is 7.3%. This will shift higher or lower as each of the remaining states has their 2025 rate changes finalized.

Pages

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.