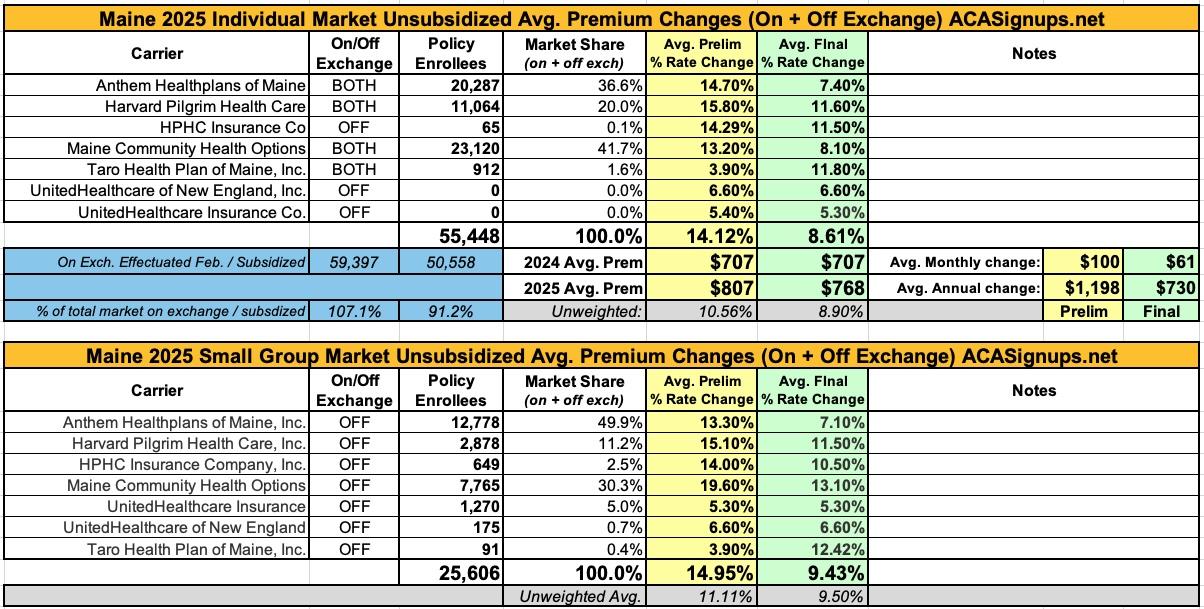

Maine: *Final* avg. unsubsidized 2025 #ACA rate changes: +8.6%

Originally posted 6/17/24

Each year insurers that sell Individual and Small Group plans in Maine's pooled risk market must submit their proposed forms and rates to the Bureau of Insurance, using the System for Electronic Rate and Form Filing (SERFF). Details of the filings submitted to the state since June 10, 2010 can be viewed in the system.

To see details of a filing, click on the Search Public Filings button below and paste or type in the relevant SERFF Tracking Number listed in the table (no need to complete the rest of the form).

There's a couple of noteworthy items going on here:

The rate summary for the 2025 Maine individual market only lists 4 carriers (Anthem, Harvard Pilgrim, Maine CHO and Taro Health Plan), but the actual SERFF filings list three others: HPHC, UnitedHealthcare of NE and UnitedHealthcare Insurance Co...except all three of these offer off-exchange policies only and they only list 86 enrollees across all three. Also, Maine's individual market seems to have shrunk significantly since the same point a year ago, from 68.2K to 58.8K...down 9,400 people, or nearly 14%. I already knew about some of this, as around 1,300 exchange enrollees were moved over to Medicaid instead this year, but that doesn't account for the rest.

Secondly, while all seven carriers are listed in the small group market summary, the total size of Maine's small group market appears to have shrunk even more dramatically year over year: From over 46,000 in 2023 to just 28,100 this year....around a 40% drop. I have no idea what would account for that.

UPDATE 9/20/24: The Maine Insurance Bureau has posted the final/approved rates for 2025 for both the individual and small group markets:

Bureau successfully worked to lower initially proposed rates by insurers and reduce geographic disparity among northern and southern Maine

Maine Bureau of Insurance Superintendent Bob Carey announced approval of the 2025 health insurance rates for Maine’s individual and small group market. The new rates will take effect on or after January 1, 2025. Over the past two months, the Bureau has worked with health insurers to lower their initially proposed rates. As a result, the approved rate increases were reduced from an initial rate increase of 14.2% to an approved rate increase of 8.6% for individuals, and from 14.5% to 9.4% for small employers (those with 50 or fewer employees).

“The Bureau works hard to minimize increases in the cost of health insurance by scrutinizing annual health insurance rate filings and only approving rate changes that reflect medical trends and the projected cost of health care. However, the underlying drivers of health care costs continue to push rates higher. These cost drivers include higher prices for hospitals and health care providers, accelerating prescription drug costs, and increased utilization of services,” Carey noted. “We will continue to do all we can in our regulatory capacity to protect the interests of Maine’s insurance consumers.”

For individuals, health plans with the largest membership saw the greatest rate reductions compared to their initial rate filing. Anthem Health Plans of Maine’s initial rate request of 14.7% was reduced to 7.4%; Maine Community Health options initial request of 13.2% was reduced to 8.1%; and Harvard Pilgrim Health Care’s initial request of 15.8% was lowered to 11.6%.

In the small group market, Anthem’s initial rate increase was lowered from 13.3% to 7.1%; and Maine Community Health Options was reduced from 19.6% to 13.1%.

The Bureau was able to approve lower rates in part due to Maine’s reinsurance program, which leverages state and federal funds to reduce premiums. The Maine Guaranteed Access Reinsurance Association (MGARA), a nonprofit entity that administers the state’s reinsurance program, uses public funds to lower premiums for individual and small group health plans. MGARA received a larger than expected amount of federal pass-through funds for 2024, after the carriers filed their initial rate requests. These additional funds allowed the MGARA board to reset the reinsurance program’s parameters to provide more funding for 2025. The carriers subsequently refiled rate requests that fully reflected the MGARA reinsurance program’s updated reinsurance parameters.

In addition to lowering the overall rate of increase, the Bureau directed carriers to adjust their geographic rating factors to reduce the disparity in rates between southern and northern Maine. This will mean individuals and small groups in Aroostook, Hancock and Washington County will see very modest or no premium increases in 2025 compared to other parts of the state.

“I urge individuals and small employers to shop around for coverage,” Carey recommended. “For individual purchasers, CoverMe.gov is a great resource that allows Maine residents to compare plans and rates, and to see if they may be eligible for federal premium subsidies. Small employers should talk to their insurance broker about their health plan options.”

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.