Connecticut: *Final* avg. Unsubsidized 2025 #ACA Rate Change: +5.9%; sm. group market continues to shrink (updated)

Originally posted 6/12/24

via the Connecticut Insurance Dept:

CONNECTICUT INSURANCE DEPARTMENT RELEASES HEALTH INSURANCE RATE REQUEST FILINGS FOR 2025

The Connecticut Insurance Department (CID) has received eight rate filings from seven health insurers for plans that will be available on the individual and small group market, both on and off the state-sponsored exchange, Access Health CT. As part of our regulatory responsibilities, we will conduct a thorough examination of these filings to ensure that the requested rates comply with Connecticut’s insurance laws and regulations.

The review process will examine each submission, requiring insurers to provide detailed justifications and evidence supporting the requested rates. Our comprehensive rate reviews demonstrate our ongoing commitment to transparency and accountability. By using tools like cost benchmarking and other industry best practices, we aim to maintain a competitive insurance market.

The 30-day public comment period for all filings starts today, June 7. The public can share comments online or submit them by mail to the Connecticut Insurance Department at P.O. Box 816, Hartford, CT 06142-0816.

The Department will hold a public informational session on requested rates. The date and time for the session will be shared as it becomes available. Open enrollment for the 2025 health insurance coverage year begins November 1, 2024.

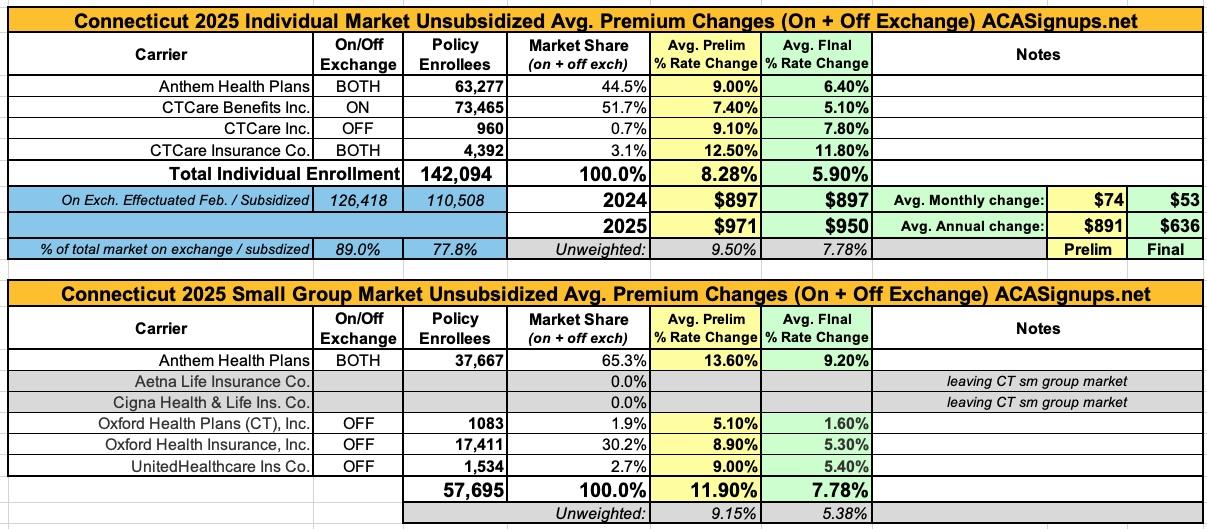

The Connecticut Insurance Department has posted the initial proposed health insurance rate filings for the 2025 individual and small group markets. There are 8 filings made by 7 health insurers for plans that currently cover approximately 200,000 people (142,000 individual and 58,000 small group).

Anthem has filed rates for both individual and small group plans that will be marketed through Access Health CT, the state-sponsored health insurance exchange. ConnectiCare Benefits Inc. (CBI) and ConnectiCare Insurance Company, Inc. have filed rates for the individual market on the exchange.

Aetna Life Insurance Company and Cigna Health and Life Insurance Company have decided to leave the CT Small Employer market and will no longer offer new business small group health plans. They will only renew existing plans through the end of their appropriate plan years.

It's worth noting that CTCare (all three divisions) had dropped out of the state's small group market last year...and Harvard Pilgrim (HPHC) dropped out of it the year before that.

Connecticut's small group market has already dropped from 106,000 in 2021 to 93,000 in 2022 to 76,000 enrollees last year to 58,000 this year. with Aetna and Cinga both bailing as well I wouldn't be surprised if it continues to shrink further.

This isn't necessarily a bad thing overall, however; it may simply reflect more companies taking advantage of ICHRAs, for instance, in which employees of small businesses are enrolled in individual market ACA plans instead of small group plans.

The 2025 rate proposals for the individual and small group market are on average lower than last year:

- The proposed average individual rate request is an 8.3 percent increase, compared to 12.4 percent in 2024, and ranges from 7.4 percent to 12.5 percent.

- The proposed average small group rate request is an 11.9 percent increase, compared to 14.8 percent in 2024, and ranges from 5.1 percent to 13.6 percent.

In general, carriers have attributed the proposed increases to:

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs and the increased demand for medical services.

- Experience: Experience adjustment necessary to reflect deteriorating experience from the prior rating period to the current rating period.

- Medicaid Unwinding: The impact to the current commercial market due to Medicaid unwinding.

- COVID-19: Adjustment needed to reflect COVID-19 expenses in 2025 at a higher level than previously assumed.

UPDATE 9/19/24: The Connecticut Insurance Dept. has posted the final/approved 2025 rate changes:

On September 6, 2024, the Connecticut Insurance Department issued its final rulings on 8 health insurance rate filings for the 2025 individual and small group markets. The filings were made by 7 health insurers for plans that currently cover about 200,000 people.

The average rate increase requested in the individual market was reduced by 29% from the requested 8.3%, resulting in an average increase of 5.9%.

The average rate increase requested in the small group market was reduced 35% from a requested average of 11.9%, resulting in an average increase of 7.8%.

Here's what it looks like: