District of Columbia: *Final* Avg. Unsubsidized 2025 #ACA Rate Change: +4.7%; CVS/Aetna drops out of sm. group market (updated)

Originally posted 8/27/24

via the District of Columbia Dept. of Insurance, Securities & Banking (DISB):

Thursday, May 23, 2024

(yes, I know...I missed this last spring...)

(Washington)– The District of Columbia Department of Insurance, Securities and Banking (DISB) has received 193 proposed health insurance plan rates for annual review in advance of open enrollment for plan year 2025. The proposed rates were submitted for DC Health Link, the District of Columbia’s health insurance marketplace, from CareFirst BlueCross BlueShield, Kaiser and United Healthcare.

The proposed rates are for individuals, families and small businesses for the 2025 plan year. Overall, the number of plans submitted for 2025 is down by 22 from those submitted for 2024. The number of small group plans decreased from 188 to 166 while the number of individual plans remained at 27.

“As part of the Bowser Administration’s vision to protect and support residents and small business owners, DISB reviews rates to address unjustified premium hikes and foster transparency and accountability in the health insurance market” said DISB Commissioner Karima Woods. “The Department is committed to ensuring that coverage remains accessible and sustainable for everyone and will decide on final rates after a public hearing in September. Reviewing proposed health insurance rates is crucial to ensure affordability and fairness for consumers.”

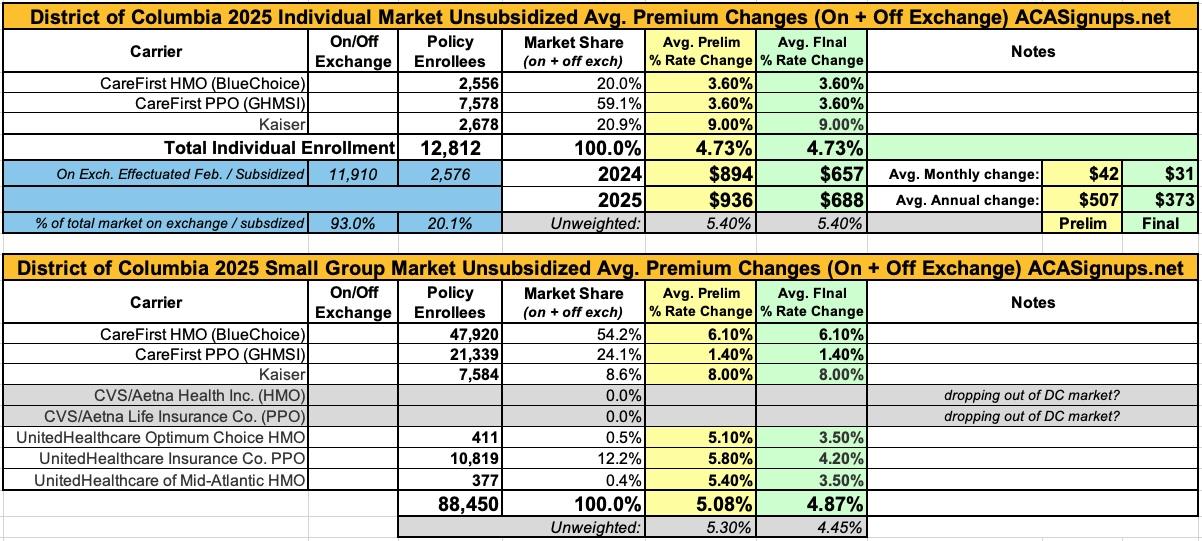

In the individual market, CareFirst proposed an average increase of 3.6% for both health maintenance organization (HMO) plans. Kaiser proposed an average increase of 9%. For small group plans, CareFirst filed average rate increases of 6.1% for HMO plans and 1.4% for the insurance plans. Kaiser proposed an average increase of 8%. Finally, United Healthcare proposed an average increase of 5.1%; 5.4% for its two HMOs and 5.8% for its insurance plans.

The most noteworthy thing here is that CVS/Aetna Health appears to have pulled completely out of the DC small group market.

UPDATE 9/19/24: Via the DISB:

(WASHINGTON, DC) – Today, the DC Department of Insurance, Securities and Banking (DISB) announced the 2025 approved individual and small business health insurance rates. The overall rate increases are the smallest in recent years with individual rates increasing by 4.7% and small business rates increasing by 4.9%.

DC Health Link open enrollment for individuals and families starts November 1, 2024, and runs through January 31, 2025. Visit DCHealthLink.com or call (855) 532-5465 for help enrolling.

“Through the leadership of Mayor Bowser, DISB is committed to ensuring that the rates are set fairly, and the coverage is non-discriminatory,” said Commissioner Karima Woods of DISB. “During a thorough review of 171 small group plans and 27 individual plans, we made sure that these rates met the District’s exacting standards and will provide accessible, affordable and non-

discriminatory health insurance for all DC residents.”The Department reviewed 198 proposed health plan rates for 2025 from CareFirst BlueCross BlueShield, Kaiser Permanente and United Healthcare. CVS/Aetna is withdrawing from the small business market for 2025. The new rates were approved after the Department considered input from insurers, government and non-profit organizations, and testimonies provided by consumers and actuaries during an August 20 public hearing. At the hearing, actuaries presented their findings and members of the public had an opportunity to share their stories and discuss the proposed 2025 rates. As a result of the Department’s rate review, and input provided at the hearing, DISB required decreases that will save District residents almost $1.5 million.

The Department is grateful to consumer health advocates, health insurers, the DC Health Benefit Exchange Authority, actuaries, and the public for their input during the rate review process. For more information about the approved 2025 health insurance plan rates, visit disb.dc.gov/2025rates.

None of the individual market requested rates were changed, but small group market rates were shaved down a bit.

It's worth noting that only 20% of DC's indy market enrollees are subsidized because DC residents are eligible for Medicaid up to 210% of the Federal Poverty Level, so those who do enroll are less likely to be eligible for exchange subsidies.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.