My expectations: 13.5 - 14.0 million QHP selections for OE4 (UPDATE: So does HHS)

Unfortunately, due to an ongoing side project of mine, I haven't had a chance to write up a full analysis/projection for OE4 as I usually do around this time.

However, I've been informed that the HHS Dept. plans on issuing their 2017 Open Enrollment projections in the near future, so I'm throwing this out there quickly:

I expect somewhere between 13.5 - 14.0 million people are likely to select QHPs via the ACA exchanges during the 2017 Open Enrollment Period (which runs from 11/01/16 - 1/31/17).

As always, it's important to remember that QHP selections are not the same as effectuated policies...there's usually around 10% or so of enrollees who never bother paying their first premium and thus are never actually enrolled, and of course there's attrition after that as people drop their policies after 1, 2, 3 months or more for various reasons (many replaced by new enrollees via SEPs and so forth).

UPDATE: Oh for heaven's sake. Turns out HHS is projecting 13.8 million...but no one will ever believe that my own expectations were around the same range because they announced it half an hour ago and I didn't notice.

(sigh) OK, believe me or don't. So be it.

Anyway, here's the bigger story, courtesy of a whole mess of reporters:

HHS is setting an Obamacare enrollment goal of 13.8 million, 1.1 million people more than last year.

— Paige W. Cunningham (@pw_cunningham) October 19, 2016

BREAKING: HHS projects 13.8 million Obamacare signups next year, up 1 million from 2017

— Jason Millman (@JasonMillman) October 19, 2016

But of that 13.8 million enrollees, 9.2 million are expected to be returning customers.

— Paige W. Cunningham (@pw_cunningham) October 19, 2016

HHS expects 13.8 million in Obamacare, calls for public option https://t.co/IMd5d7j5Qn via @DCExaminer

— Pradheep Shanker MD (@Neoavatara) October 19, 2016

Anyway, here's the official ASPE report, dammit:

Plan Selections

- By the end of open enrollment for 2017, we expect 13.8 million people to have selected a plan, an increase of 1.1 million people or nearly 9 percent over the 12.7 million plan selections at the end of 2016 Open Enrollment.

- Of these 13.8 million people, we estimate that individuals may enroll from three primary groups:

- 9.2 million individuals are estimated to be re-enrollees with 2016 Marketplace coverage,

- 3.5 million are estimated to be uninsured individuals, and

- 1.1 million are estimated to be individuals with 2016 off-Marketplace nongroup coverage.

That 9.2 million re-enrollee estimate is exactly the same as my own projection of the number who will likely still be enrolled in effectuated 2016 policies as of the end of December.

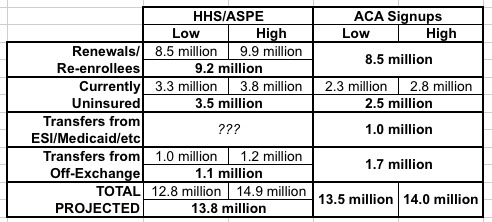

However, not 100% of people still enrolled on 12/31/16 will renew/re-enroll. ASPE thinks there will be around 10.0 million still effectuated at the end of 2016, of which 9.2 million will renew (92%). I expect renewals/re-enrollments to be more around 8.5 million.

HHS also expects around 3.5 million uninsured people to sign up this year. That sounds about right to me.

As for the 1.1 million shifting from off-exchange policies, remember that there's around 7 million people enrolled in ACA-compliant off-exchange policies (paying full price), of whom up to 2.5 million are likely eligible for APTC assistance if they were to shift to on-exchange policies. It sounds like HHS expects quite a few of these folks to make the move.

However, unike renewals, where I expect around 700,000 fewer enrollees than HHS does, I actually expect more enrollees to shift over from the off-exchange individual market. HHS estimates around 5.1 million off-exchange enrollees; I estimate the number to be higher, around 7 million or so (plus perhaps 1-2 millions still enrolled in grandfathered/transitional plans). Since I estimate 2-3 million more off-exchange enrollees, I also expect a higher number to shift onto exchange policies.

In other words, HHS and I get to roughly the same total exchange-based QHP selection total, the breakout of enrollees is just a bit different:

UPDATE: As Larwit1512 and I noted in the comments below, there's another enrollment source which the ASPE report didn't really address...people transferring into exchange QHPs from other types of existing coverage (that is, large group, small group, moving off of Medicaid, getting out of the military, etc). With the economy improving over the past few years and wages finally starting to go up, the odds are some number of people who have been just below the 138% Medicaid expansion threshold are seeing their incomes drift above that line, which should mean that they get bounced off of Medicaid and onto heavily-subsidized exchange policies. I've updated the table below to reflect this; I doubt this will actually change the total enrollment numbers much, so I'm carving about 1 million people out of the "currently uninsured" category.

Average Monthly Effectuated Enrollment

- We estimate that 11.4 million individuals will effectuate their enrollment on an average monthly basis over the course of 2017. This does not include individuals enrolled in coverage through New York and Minnesota’s Basic Health Programs, which currently enroll about 650,000 people.

This actually sounds ambitious to me. In 2015 the full-year average effectuation figure was roughly 9.4 million people (based on 11.7 million QHP selections during open enrollment, or 80%). I expect 2016 to average around 10.1 million (out of 12.7 million, or 79.5%). If they do hit 13.8 million during OE4, 80% would mean around 11.0 million on average per month.

To hit 11.4 million average out of 13.8 million OE4 QHP selections, they'd have to hit an 82.6% rate. This means they're expecting the crackdown on SEPs, the increased Shared Responsibilty penalty, improvements in data matching and so forth to result in a higher retention rate. Obviously I hope they're correct about this.

Addressable Market

- More than 8 in 10 (84 percent) of the QHP-eligible uninsured have family incomes between 100/138% and 400% of the Federal Poverty Level (FPL).

- More than one-third (40 percent) of the QHP-eligible uninsured individuals are between the ages of 18 and 34.

- We estimate that between 2011 and 2016, the number of people buying insurance in the individual market has grown by approximately 65 percent from 11 million to 18 million. Of the estimated 18 million 2016 individual market consumers, we estimate two-thirds (66 percent) are potentially eligible for tax credits.