Sen. Moreno's "final offer" is either a sick joke or an AI-generated dumpster fire. Take your pick.

Breaking via Burgess Everett of Semafor:

Sen. Bernie Moreno, R-Ohio, made his final pitch to Senate Democrats on a plan to revive expired health care subsidies on Wednesday, according to a copy of the legislation obtained by Semafor.

The Ohio Republican is pitching a one-year extension of the enhanced premium tax credits that expired at the end of last year with an option to use Health Savings Accounts after 2026. it would also bar “individuals not lawfully present” in the US from receiving benefits under the bill.

...The proposal also includes a minimum $5 monthly payment on subsidized plans; extends open enrollment until March 31; imposes penalties on fraud; requires audits of states’ compliance with the Hyde amendment barring taxpayer funding on abortions; includes cost-sharing reduction payments; and caps the subsidies at 700% of the federal poverty level.

Everett includes a link to the legislative text of Moreno's bill. It's only 6 pages long, so I'm going to do something unusual and embed it verbatim here:

SEC 1. SHORT TITLE.

This Act may be cited as the “Consumer Affordability and Responsibility Enhancement Act" or the "CARE Act."

SEC. 2. EXTENSION OF ENHANCED PREMIUM TAX CREDIT FOR 2026.

(a) Extension of Rules To Increase Premium Assistance Amounts.—Clause (iii) of section 36B(b)(3)(A) of the Internal Revenue Code of 1986 is amended— (1) by striking “January 1, 2026” and inserting “January 1, 2027”, and (2) by striking “2025” in the heading and inserting “2026”.

(b) Ineligibility of Individuals Not Lawfully Present. —No credit, payment, contribution, or other assistance shall be allowed or made under this section with respect to any individual who is not a citizen or national of the United States.

(c) Effective Date.—The amendments made by this section shall apply to taxable years beginning after December 31, 2025.

So, one year...which is down from two years in the earlier version. Which was already down from three years in the version passed by the House.

On the one hand, kicking the can down the road by one year would be a gift to Republicans for the midterms since it would take most of the subsidy expiration political backlash off the table from them until just after Election Day.

On the other hand, it would also mean that all of those terrifying headlines & jaw-dropping rate hikes which were all over the place last October would be popping up again this October...starting a few weeks before Election Day. So, y'know...

Beyond that, however, the restriction of any financial assistance to anyone who isn't a "citizen or national of the United States" immediately sets off all sorts of red flags in my head. Here's the legal definition of a "national" of the United States:

(A) a person who is a citizen of the United States, and (B) a person who, while not a citizen, owes permanent allegiance to the United States. This definition is important for understanding various legal rights and responsibilities associated with nationality.

The GOP's Big Ugly Bill already seriously shrank the pool of non-U.S. citizens who are eligible for ACA tax credits last summer:

Under current law, U.S. citizens and lawfully present immigrants are eligible to enroll in ACA Marketplace coverage and receive premium subsidies and cost-sharing reductions. Lawfully present immigrants with incomes under 100% of the federal poverty level (FPL) who do not qualify for Medicaid coverage due to their immigration status also are eligible for ACA Marketplace coverage.

Under H.R. 1, “lawfully present immigrants” has been reduced to LPRs/green card holders, COFA migrants, “certain immigrants from Cuba & Haiti” which means many other groups are screwed including refugees, asylees & those with TPS starting in 2027.

Are Lawful Permanent Residents, green card holders, COFA migrants & "certain immigrants from Cuba & Haiti" still legally considered "nationals of the United States?" Beats me, but if not...

SEC. 3. OPEN ENROLLMENT PERIOD FOR PLAN YEAR 2026.

(a) In General.—With respect to plan year 2026, the annual open enrollment period required to be provided by Exchanges under section 1311(c)(6) of the Patient Protection and Affordable Care Act (42 U.S.C. 18031(c)(6)) shall begin on November 1, 2025, and end on March 31, 2026.

I mean, yes, the enhanced tax credits are extended for another year or more, of course it would also be appropriate to bump out the enrollment deadline by another month or so. This makes sense.

However...

(b) Adjustments to Premiums.—The Administrator of the Centers for Medicare & Medicaid Services, in consultation with the National Association of Insurance Commissioners, shall develop a process by which issuers of qualified health plans offered on a Federal Exchange in any State in which the State insurance commissioner determines an adjustment to premiums for such plans for plan year 2026 is necessary to ensure that premium rates for such plans remain actuarially justified, may, during the 45-day period beginning on the date of enactment of this Act, adjust the premiums for such plans for plan year 2026.

You've got to be kidding me.

If I'm reading this correctly (and I might not be), Moreno seems to think that insurance carriers can modify the list pricing of their policies for the current calendar year *in the middle of that same calendar year*.

This is like telling a mechanic he has to perform a front end alignment on a car while the car is driving.

The only saving grace of this is that it says the insurance carriers "may" adjust their premiums mid-year instead of requiring them to do so. I can't imagine they're gonna get a lot of takers.

SEC. 4. MODIFICATION OF INCOME ELIGIBILITY LIMIT.

(a) In General.—Section 36B(c)(1)(A) of the Internal Revenue Code of 1986 is amended by inserting “(700 percent in the case of taxable years beginning before January 1, 2029)” after “400 percent”.

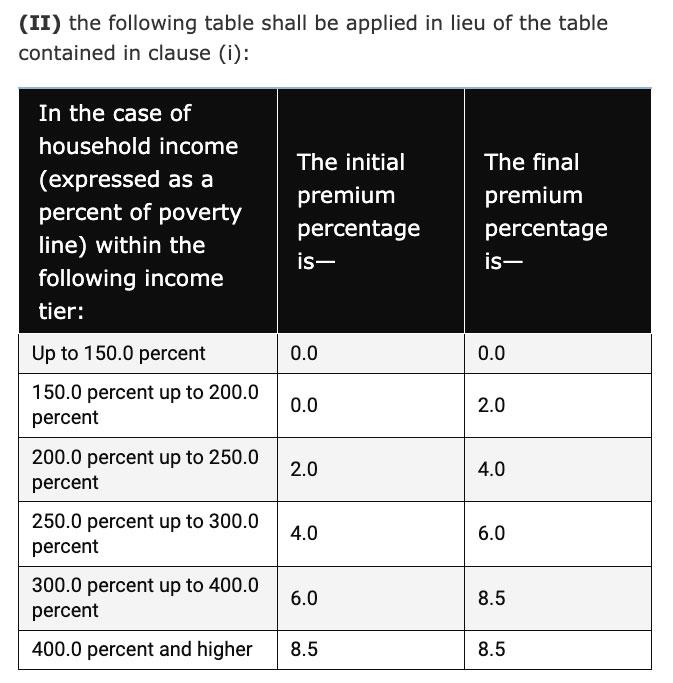

(b) Conforming Amendments.— (1) Section 36B(c)(1) of such Code is amended by striking subparagraph (E). (2) The last row of the table in section 36B(b)(3)(A)(iii)(II) of such Code is amended by striking “400.0 percent and higher” and inserting “250.0 percent up to 700.0 percent”.

(c) Effective Date.—The amendments made by this section shall apply to taxable years beginning after December 31, 2025.

Ummmmm...OK, so they're bumping the Subsidy Cliff up from 400% FPL to 700% FPL for three years only; that much I understand.

Except...earlier it specifies that the subsidy bump would only be for one year, not three...so???

More concerningly, what's this about changing the last row of the table from "400%+" to "250% - 700%?"

Here's the table this refers to:

Maybe I'm misunderstanding something, but it sure as hell looks to me like that section of the bill would significantly weaken the tax credits for enrollees who earn between 250 - 400% FPL, by changing "4 - 6%" and "6 - 8.5%" of income to "8.5% of income."

If so, this is a MASSIVE klaxon alarm, as it would actually make the subsidy formula even less generous than it is right now without the enhanced tax credits in place!

If I'm misreading it, of course, I'll issue a mea culpa and will strike this section of my analysis.

SEC. 5. MINIMUM MONTHLY PREMIUM CONTRIBUTION.

(a) Minimum Monthly Premium Contribution.— (1) IN GENERAL.—Section 36B(b)(2)(A) of the Internal Revenue Code of 1986 is amended by inserting “, reduced by $5” after “1311 of the Patient Protection and Affordable Care Act”. (2) PAYMENT BY ENROLLEES OF PREMIUMS.—Section 1412 of the Patient Protection and Affordable Care Act (42 U.S.C. 18082) is amended by adding at the end the following: “(f) Payment by Enrollees of Premium Minimum.— “(1) IN GENERAL.—In the case of an individual with respect to whom the Secretary makes an advance determination under section 1411 of eligibility for a premium tax credit under section 36B of the Internal Revenue Code of 1986, the health insurance issuer of the qualified health plan in which such individual is enrolling shall require such individual to pay the minimum premium contribution— “(A) $5 on a monthly basis, at the time of payment of the premium due for each coverage month of the individual for the plan year, or “(B) $60 in full for the plan year, at the time of payment of the premium due for the first coverage month of the individual for the plan year.”.

(b) APPLICABILITY.—The amendments made by this section shall apply with respect to plan years beginning on or after January 1, 2026, and before January 1, 2029.

This is the same $5/month minimum premium which Republicans have become absolutely obsessed with mandating for some reason.

The main red flag here beyond it being included at all is that the way it's phrased "shall require such individual to pay" sure as hell seems to mean that states wouldn't even be allowed to cover the $5/mo premium for the enrollees (ie, via state-based subsidies) even if they wanted to.

Oddly, the $5/mo minimum payment would only be required for 3 years, not permanently.

SEC. 6. CIVIL PENALTIES FOR KNOWING AND WILLFUL FRAUDULENT EXCHANGE ENROLLMENT.

(a) In General.—Section 1312(e) of the Patient Protection and Affordable Care Act (42 U.S.C. 18032(e)) is amended— (1) by redesignating paragraphs (1) and (2) as subparagraphs (A) and (B), respectively, and adjusting the margins accordingly; (2) by striking “The Secretary” and inserting the following: “(1) IN GENERAL.—The Secretary”; and (3) by adding at the end the following: “(2) FRAUDULENT ENROLLMENT BY AGENTS AND BROKERS.— “(A) IN GENERAL.—No agent or broker authorized to assist with enrollment in a qualified health plan through an Exchange may knowingly and willfully engage in fraudulent enrollment conduct, including any of the following: “(i) Enrolling, or attempting to enroll, an individual in a qualified health plan through an Exchange without the individual’s knowledge and affirmative consent. “(ii) Submitting, or causing to be submitted, materially false information for purposes of enrolling an individual in coverage or securing eligibility for enrollment, advance payments of the premium tax credit, or cost-sharing reductions. “(iii) Fabricating, falsifying, or deliberately misrepresenting information relating to income, household size, residency, citizenship, or immigration status, where such information is material to eligibility or enrollment. “(iv) Enrolling, or attempting to enroll, an individual in a health plan through an Exchange if the agent or broker knows, at the time of enrollment, that the individual is not seeking health insurance coverage.

“(B) CIVIL MONETARY PENALTY.—Any person who violates subparagraph (A) shall be subject to a civil monetary penalty of not more than $100,000 for each individual with respect to whom such violation occurs.

“(C) ENFORCEMENT.— “(i) ADMINISTRATIVE AUTHORITY.—The provisions of section 1128A of the Social Security Act, other than subsection (a) and (b) and the first sentence of subsection (c)(1) of such section shall apply to civil monetary penalties under this paragraph in the same manner as such provisions apply to a penalty or proceeding under section 1128A of the Social Security Act. “(ii) CERTIFICATION ACTIONS.—In addition to any penalty imposed under this paragraph, the Secretary may suspend, revoke, or permanently bar a person from certification to participate in Exchange enrollment activities. “(iii) REFERRAL.—Nothing in this section shall be construed to limit the authority of the Secretary to refer conduct to the Attorney General for appropriate civil or criminal enforcement under other provisions of law. “

(D) RULES OF CONSTRUCTION.—Nothing in this paragraph shall be construed to— “(i) impose liability for negligent, reckless, or unintentional conduct; “(ii) create a private right of action; or “(iii) limit any other authority of the Secretary or the Attorney General under Federal law.”.

I'm not a lawyer so I can't say whether this section is legally reasonable or not, but assuming it is, it would basically seriously beef up the penalty for brokers/agents committing fraud, either by enrolling people into policies without their knowledge/consent or switching them from one plan to another without their knowledge/consent.

Is $100,000 too strict of a penalty? Beats me, but generally speaking I support cracking down on broker fraud, which has been a real issue with the ACA exchanges the past few years. This (along with the 3/31 Open Enrollment Period extension) is the only positive provision I see so far.

SEC. 7. FUNDING COST SHARING REDUCTION PAYMENTS.

Section 1402 of the Patient Protection and Affordable Care Act (42 U.S.C. 18071) is amended by adding at the end the following new subsections:

“(h) Funding.—There are appropriated out of any monies in the Treasury not otherwise appropriated such sums as may be necessary for purposes of making payments under this section for plan years beginning on or after January 1, 2027, and before January 1, 2029.

(i) Ineligibility of Individuals Not Lawfully Present.—No credit, payment, contribution, or other assistance shall be allowed or made under this section with respect to any individual who is not a citizen or national of the United States.”

I've already explained many times before why doing this would eliminate Silver Loading, which would in turn mean significantly increasing net premiums for millions of enrollees (while only reducing them for a few hundred thousand at most). So again, this is another major red flag.

However, it's very interesting (and outright weird) that this would only fund CSR reimbursement payments for two years instead of permanently.

I can't fathom why they would only do it for 2 years (I don't want them to do it at all, but from a Republican perspective you'd think they would try to make it permanent...very strange).

SEC. 8. PREMIUM TAX CREDIT FOR HOUSEHOLDS WITH INCOME ABOVE 150 PERCENT AND NOT MORE THAN 700 PERCENT OF POVERTY.

(a) In General.—The Internal Revenue Code of 1986 is amended— (1) APPLICABLE PERCENTAGE FOR CERTAIN TAXPAYERS WITH HOUSEHOLD INCOME ABOVE 150 PERCENT OF POVERTY.—Section 36B(b)(3)(A) is amended by adding at the end the following new clauses:

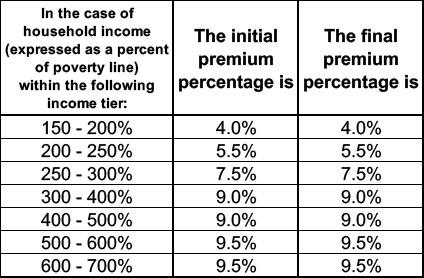

“(iv) TEMPORARY PERCENTAGES FOR 2027.— “In the case of a taxable year beginning after December 31, 2026, and before January 1, 2028.— (I) clause (ii) shall not apply for purposes of adjusting premium percentages under this subparagraph, and (II) the following table shall be applied in lieu of the table contained in clause (i):

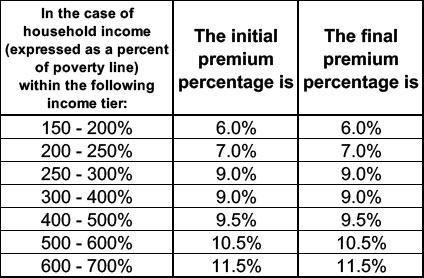

“(iv) TEMPORARY PERCENTAGES FOR 2028.— “In the case of a taxable year beginning after December 31, 2027, and before January 1, 2029.

(I) clause (ii) shall not apply for purposes of adjusting premium percentages under this subparagraph, and (II) the following table shall be applied in lieu of the table contained in clause (i):

(b) Coordination with Termination of Enhanced Credit.—For taxable years beginning after December 31, 2026, section 36B shall be applied without regard to the amendments made by section 9661 of the American Rescue Plan Act of 2021 (Public Law 117–2) and section 12001(a) of the Inflation Reduction Act of 2022 (Public Law 117–169), except as otherwise provided by this section and other amendments made by this Act.

(c) Ineligibility of Individuals Not Lawfully Present.—No credit, payment, contribution, or other assistance shall be allowed or made under this section with respect to any individual who is not a citizen or national of the United States.

WHAT THE HELL IS THIS???

Keep in mind that I pasted the legislative text verbatim from the original. Aside from formatting the 2 tables above to be more readable, this is exactly how it's worded in Moreno's original.

I think the "Temporary percentages for 2028" bit above is supposed to appear before the 2nd table. If so, that would mean that the first table applies to 2027 while the second one applies to 2028.

However, that's not the way it's actually worded in the document...and this is supposed to be official federal Congressional legislative text. As written, it's basically either gibberish or the 2nd table would supercede the first one, I'd imagine.

If it does mean that these tables would be used for 2027 & 2028 respectively, that means that the enhanced subsidies would actually be partially in place for three years (becoming gradually less generous each year), not one...which would be a good thing if it's the case...except that...

...The tables also make no sense because the initial and final premium percentages in both tables are identical.

This means that if you earn anywhere between 150-200% FPL, for instance, you would pay exactly 4% of your income in premiums (6% in 2028?), but the moment you go even $1 over 200% FPL, you would immediately jump to having to pay 5.5% (7% in 2028?).

THIS IS UTTER NONSENSE, not to mention, once again, being even less generous than the NON-enhanced tax credits are right now for many enrollees!

Right now those earning 150 - 200% FPL have to pay between 4.19 - 6.6% of their income. These tables would mean ALL of them would have to pay 6% of their income in 2028.

This is a complete crock.

SEC. 9. ELECTION TO PAY ADVANCE PAYMENTS OF THE PREMIUM TAX CREDIT TO EXCHANGE PLAN HSAS.

(a) Establishment of Exchange Plan HSAs.— (1) IN GENERAL.—Section 223 of the Internal Revenue Code of 1986 is amended by adding at the end the following new subsection: “(i) Exchange Plan HSAs.—For purposes of this section—

“(1) IN GENERAL.—In the case of an Exchange plan HSA, this section shall be applied as provided in paragraphs (3) through (4).

“(2) EXCHANGE PLAN HSA.—The term ‘Exchange plan HSA’ means a health savings account which is designated as an Exchange plan HSA upon the establishment of such account.

“(3) NO ROLLOVERS PERMITTED.—Except in the case of a contribution from one Exchange plan HSA to another Exchange plan HSA, subsection (f)(5) shall not apply.

“(4) RESTRICTION ON USE OF AMOUNTS.—For purposes of subsection (d)(2)(A), amounts paid for an abortion shall not be treated as paid for medical care.

(5) NO WITHDRAWALS AS CASH. — Any amount contributed to an Exchange plan HSA pursuant to this Act shall not be withdrawn for any purpose other than paying the qualified medical expenses of the account beneficiary.”.

(2) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 2026.

Right out of the gate, this would not actually be a Health Savings Account under the current definition, since HSAs allow you to roll any unused funds from one year to the next.

(b) Election for Payment of Premium Tax Credit to Exchange Plan HSAs.—

(1) IN GENERAL.—The Secretary of Health and Human Services shall establish a program under which, for plan years 2027 and 2028, an eligible individual who is enrolled in a bronze level qualified health plan through an Exchange shall have 100 percent of the payment amount for such plan year paid to an Exchange plan HSA of such eligible individual.

This is something which Republicans have become obsessed with since last fall: The idea, again, is that instead of providing financial assistance to cut your premiums down to size, they'd instead put the money into a Health Savings Account to cut down on your deductibles, co-pays & other out-of-pocket expenses...but only if you enroll in the least comprehensive plans on the market which have the highest deductibles & out of pocket costs (Bronze plans). In other words, it'd be a race to the bottom.

And of course even then this wouldn't necessarily be that helpful: Consider the example I gave last fall of a 63-yr old couple living in Atlanta, Georgia who earn $85,000/year.

WITH the enhanced premium subsidies in place, they only had to pay $602/month last year for a plan with a $9,000 deductible & $18,400 maximum out of pocket cap.

WITHOUT the enhanced subsidy in place, this year they have to pay a whopping $2,386/month even for the least-expensive Bronze HMO. This would include a whopping $21,200 deductible...and even if that was mostly (or even completely) wiped out, it wouldn't do them any good if they still can't afford to pay over 1/3 of their gross income in premiums to begin with.

(2) PAYMENT.—In the case of an eligible individual making an election under this subsection—

(A) the Secretary of Health and Human Services shall notify the Secretary of the Treasury of such election and the Exchange plan HSA into which the eligible individual has elected to receive a payment under this subsection, and

(B) notwithstanding section 1412(c) of the Patient Protection and Affordable Care Act, the Secretary of the Treasury shall make such advance payment of the premium tax credit to the Exchange plan HSA so indicated, and no portion of such advance payment shall be made to the issuer of the bronze level qualified health plan for such plan year.

Don't be surprised if the "Exchange Plan HSA" funds somehow end up being deposited into a "Trump HSA," by the way.

(3) PAYMENT AMOUNT – the amount of each payment under this section for any individual for an eligible month is an amount equal to—

(A) the premium assistance amount determined under section 36B(b)(2) of such Code for such month with respect to the taxpayer, over (ii) the premium assistance amount which would be determined under section 36B(b)(2) of such Code for such month with respect to the taxpayer if section 36B(b)(3)(A)(iii) of such Code did not apply;

OK, this gets wonky and confusing, but I think it means that only the enhanced portion of the premium tax credits would be converted into HSA funds, not the main APTC assistance.

In other words, if an enrollee is eligible for, say, $10,000/yr in APTC and would be eligible for another $4,000/yr in enhanced subsidies, only the $4,000 would be converted into HSA funds.

I think that's what the "X amount OVER Y amount if the other section didn't apply" bit means...but I could be wrong.

(4) TAX TREATMENT OF CONTRIBUTIONS.—For purposes of the Internal Revenue Code of 1986, any contribution to an Exchange plan HSA under this subsection shall not be includible in the gross income of the eligible individual and no deduction shall be allowed under section 223 with respect to such contribution.

I think this means that you could add your own HSA funds as well, which in turn would be tax deductible? Granted, not many people at lower income levels have enough cash on hand to put it away in an HSA or other tax shelter in the first place.

(5) ELIGIBLE INDIVIDUAL.—For purposes of this section, the term “eligible individual” means an individual who is eligible to make contributions to a health savings account for the month for which such election applies and who has established an Exchange plan HSA.

(6) BRONZE LEVEL QUALIFIED HEALTH PLAN.—The term “bronze level qualified health plan” has the meaning given such term in section 1302(d) of the Patient Protection and Affordable Care Act.

(7) EXCHANGE PLAN HSA.—The term “Exchange plan HSA” has the meaning given such term under section 223(i) of the Internal Revenue Code of 1986.

c) Ineligibility of Individuals Not Lawfully Present.—No credit, payment, contribution, or other assistance shall be allowed or made under this section with respect to any individual who is not a citizen or national of the United States.

Once again, they're really sticking it to anyone who isn't a U.S. citizen or "national..." and again, this may mean that green card holders/etc wouldn't be eligible.

SEC. 10. AUDITS ON ISSUERS OF QUALIFIED HEALTH PLANS REQUIRED TO SEGREGATE FUNDS; ENFORCEMENT.

(a) GAO Audits.— (1) IN GENERAL.—The Comptroller General of the United States, as the head of the Government Accountability Office, shall conduct an annual audit of the allocation accounts described in paragraph (2)(C)(ii) of section 1303(b) of the Patient Protection and Affordable Care Act (42 U.S.C. 18023(b)) of qualified health plans to determine whether the issuers of such qualified health plans have complied with the segregation requirements of such section 1303(b).

(2) PRIVACY PROTECTION.—An audit under paragraph (1)—

(A) may not include individual patient or medical provider information; and (B) may only review disaggregated data.

(b) Enforcement.— (1) IN GENERAL.—If an issuer of a qualified health plan has failed to comply with the segregation requirements of section 1303(b) of the Patient Protection and Affordable Care Act (42 U.S.C. 18023(b)) with respect to an allocation account described in paragraph (2)(C)(ii) of such section 1303(b), the issuer shall be subject to a civil monetary penalty in an amount of $500,000 for each year in which the issuer was determined to be in such noncompliance.

So after all the fuss & bother Republicans were making over cracking down with stricter Hyde Amendment/abortion restriction language, in the end they're settling on...auditing insurance carriers once a year to make sure they're complying with the existing abortion restrictions, and fining the carriers $500K per year if they fail the audit?

Really?

(2) APPEALS.—An issuer of a qualified health plan may appeal a civil monetary penalty under paragraph (1). (c) Sunset.—The authorities under subsections (a) and (b) shall terminate on December 31, 2027.

This bit is interesting as well...they're literally saying the Hyde audits would only be a thing for two years. Huh.

(d) Use of Amounts.—Each year, the Secretary of the Treasury shall transfer to the Administrator of the Centers for Medicare & Medicaid Services an amount equal to the amount collected as civil penalties under subsection (b) during the previous year. The Administrator of the Centers for Medicare & Medicaid Services shall use such amounts so transferred to carry out any maternal mortality initiative of the Center for Medicare & Medicaid Services.

(e) Savings Clause.—Nothing in this Act shall— (1) affect the implementation of section 1303 of the Patient Protection and Affordable Care Act (42 U.S.C. 18023); or (2) authorize the use of protected health information.

In the end, aside from the Hyde/abortion language section, this is an even worse version of the bill than the one Moreno & Co. were tossing around 2-3 weeks ago.

Before I issue my final verdict, a reminder that my own family would stand to receive over $15,000 in premium tax credits this year if this bill were to pass.

Conclusion: It's a confusing, nonsensical mess of a bill designed to be refused.

Which is exactly what Senate Democrats should do: Say not just no, but hell no.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.