DRAMA! House to vote on clean subsidy extension this week, while Senate GOP scrambles to slap together something acceptable...

When last we checked in on the U.S. House of Representatives before Christmas, there was much High Drama after four supposedly "moderate" (aka "extremely vulnerable") Republicans gave up on trying to convince GOP Speaker Mike "Renfield" Johnson to do the sane thing and simply allow one of several reasonable compromise bills to extend the enhanced ACA tax credits to get a vote in the lower chamber.

When that didn't happen, Brian Fitzpatrick, Robe Bresnahan & Ryan Mackenzie of Pennsylvania, along with Mike Lawler of New York, said "screw this" and signed onto the discharge petition signed by all 213 House Democrats to force a vote on a clean 3-year extension.

Of course, those same four Republicans also proceeded to join nearly all of their GOP colleagues (except Thomas Massie of Kentucky) in voting for a different bill which, if passed in the Senate as well, would seriously harm around 5.7 million middle-class ACA enrollees to the point of ~300,000 of them losing coverage entirely, while also expanding a type of junk plans historically rife with fraud.

So...any praise you might have for them for breaking with Johnson on the discharge petition should be taken with a rather large grain of salt.

In any event, it's 2026, the House is back in session, and they're finally scheduled to actually hold the vote on that "clean" 3-year extension of the enhanced tax credits sometime today or tomorrow (Thursday the 8th).

I'm going to assume it will end up narrowly passing the House; it would be pretty stupid for those four to sign the discharge petition without actually voting for the bill, and Republicans are currently down 2 members anyway with Marjorie Taylor Greene (GA) having resigned and Doug LaMalfa (CA) dying yesterday morning.

My guess is that up to a dozen of the other vulnerable GOP House members will also vote for the bill once it breaks a simple majority, but we'll see.

UPDATE 7:00pm: Sure enough...

Sahil Kapur @sahilkapur.bsky.social

221-205, House passes the “motion to discharge” the Jeffries 3-year ACA funding extension. NINE (!) Republicans join unanimous Democrats in voting to advance it. This tees up a final House vote tomorrow; it’s poised to sail through.

Assuming it passes the House, the ball would then be kicked back over to the Senate, where it would be up to GOP Senate Majority Leader John Thune to decide whether to have the Senate re-vote on the bill (remember, they just did so on the exact same 3-year clean extension less than two months ago, with it falling 9 votes shy of the 60-vote majority needed to reach cloture).

So, what's going on over there?

Well, here's the latest I've seen as of this writing, via Peter Sullivan & Stef Kight of Axios:

Bipartisan ACA items of discussion per Moreno to @StefWKight:

- 2 yr extension

- Income cap 700% FPL

- $5 premium not $0

- Patient option to get enhanced $ in HSA instead of toward premium

- Possible CSR funding in yr 2

- Hyde big problem still, unclear where leaders come down

Once again: The enhanced tax credit formula made two major changes to the original formula:

- First, it made the subsidy sliding scale table much more generous across the board, including $0 net premiums for enrollees who earn up to 150% of the Federal Poverty Level (FPL), or around $23,500/yr for a single adult (~$48,000/yr for a family of four).

(FWIW, 45% of all ACA exchange enrollees earned less than 150% FPL last year.)

- Second, it removed the so-called "Subsidy Cliff" which cut off ANY financial help for enrollees who earn more than 400% FPL ($62,600/yr if single; $128,600 for a family of four).

The proposal being tossed around the Senate would bring the Subsidy Cliff back, but would kick it up the income scale to 700% FPL, which is just under $110K/yr for a single adult or $225K/yr for a family of four.

As I've explained before, while I'd prefer to leave the tax credit formula as it was until a week ago, I could live with them being cut off at a reasonable threshold...but 700% FPL is still simply too low in most parts of the country.

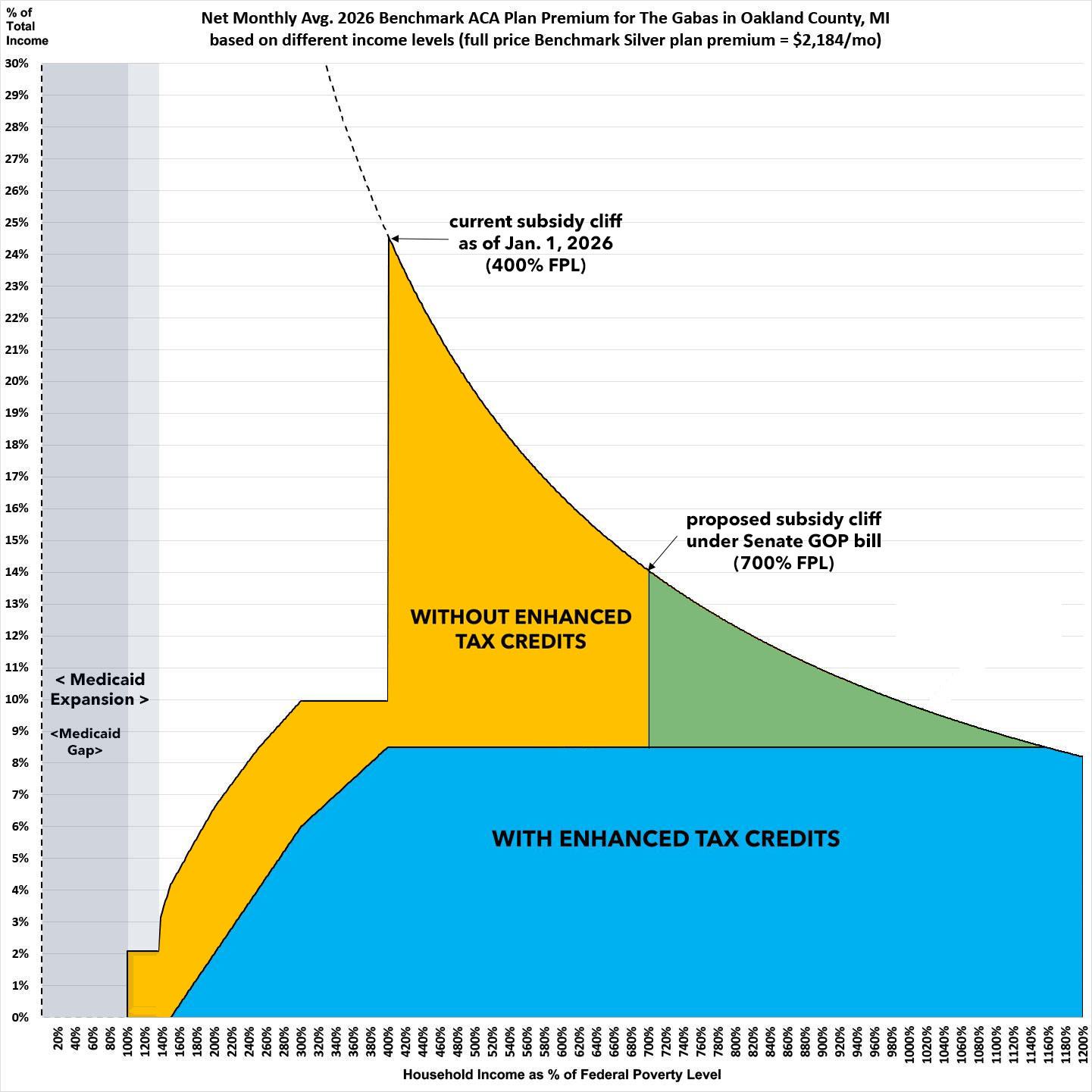

Here's a visual example of what this would look like for my own family (2 middle-aged adults with 1 college-age kid) here in Oakland County, Michigan.

- Dotted line = Unsubsidized benchmark Silver plan premium as a percent of total household income

- Blue section = NET premium as % of total income after subsidies with enhanced tax credits

- Orange section = Net premium as % of total income after subsidies without enhanced tax credits (which cut off at 400% FPL)

- Green section = Net premium as % of total income after subsidies under proposed Senate GOP bill (cuts off at 700% FPL)

700% FPL would be barely acceptable here in Oakland County (though we'd still have to pay up to 14% of our gross income in premiums alone if we earned even $1 more than 700% FPL), but there are other parts of the country where it would still be ugly for many middle-class families.

Here's what it would look like for a family of four living in Cabell County, West Virginia, for example:

In their case, they'd still be paying more than 20% of their gross income in premiums alone if they earn just a hair over $225,000/year. Again, I'd be fine with the Cliff being brought back at, say, 900% - 1000% FPL, but 700% is still too low.

If you think, "OK, but cry me a river--they earn over $225,000/year, they can afford it!"...how about if I keep the location the same (Cabell County, West Virginia) but change the enrollees to a 64-year old couple?

That's right: A 64-yr old couple living in Cabell County, West Virginia would still have to pay a jaw-dropping 43% of their gross income in premiums alone if they earn even $1 over 700% FPL, which is $148,050 for two people.

However...if that was the only condition, I could accept it. It's the other three (or potentially four) conditions which are more problematic:

- $5 premium not $0

As I explained when writing about the Fitzpatrick bill:

Republicans seem to be obsessed with the idea that a minimum premium is necessary to combat fraud as well as to ensure that "everyone has skin in the game" which is a talking point they've been fixated on for decades.

Again, I don't like it and there's ample evidence that it would cause legitimate enrollment to drop by up to a million people (nearly all of whom would be very low income)...but if it has to be included, making it $1/month would accomplish the same "anti-fraud" goal.

- Possible CSR funding in yr 2

This is the part of the bill passed by House Republicans last month which would, again, financially harm up to 5.7 million middle-class enrollees while causing up to 300,000 of them to lose coverage entirely, by ending Silver Loading (which comprises the bulk of the pricing advantage offered by Premium Alignment in over a dozen states...including Texas, Arkansas and Wyoming, I should note!).

- Patient option to get enhanced $ in HSA instead of toward premium

Oh Dear God. As I explained in my write-up about the "Cassidy/Crapo" bill pushed by Senate Republicans last fall, Health Savings Accounts are a perfectly valid way for wealthy and upper-middle class people to help get a nice little tax break, but they're practically useless for low-income enrollees, since they do nothing to actually help you afford the premiums in the first place.

The end result of both this and the elimination of Silver Loading will be to cause millions more Americans to enroll in bare-bones Bronze plans which have massive deductibles & other out-of-pocket expenses...by design.

For that matter, just setting this up would be a logistical, regulatory and security nightmare, since it would presumably require enrollees to either hook their bank accounts up into HealthCare.Gov's back end (!!!) or to establish a new, separate HSA account, coordinated with the insurance carriers. I can't fathom any way of actually establishing something like that in less than a year or more; presumably it wouldn't be ramped up until 2027 at the earliest, more likely 2028.

- Hyde big problem still

ONE MORE TIME: UNDER THE ACA, FEDERAL SUBSIDIES ARE ALREADY PROHIBITED FROM BEING USED TO PAY FOR ABORTIONS.

Here's an idea of how absurdly the ACA already bends over backwards to ensure this:

The ACA allows the coverage of abortion services through the marketplaces but includes a number of restrictions and requirements that insurers must follow before covering non-Hyde abortions. Many, though not all, of these restrictions are outlined in Section 1303 of the ACA, which includes specific rules related to the coverage of abortion services by QHPs and has been the subject of previous litigation. In particular, Section 1303:

- Prohibits insurers from using any portion of premium tax credits or cost-sharing reduction payments to pay for non-Hyde abortion services;

- Requires insurers to inform consumers in their summary of benefits and coverage that the QHP they are considering includes coverage of non-Hyde abortion services; and

- Requires insurers that cover non-Hyde abortions to determine the cost of and then separately collect and segregate funds for non-Hyde abortion services.

Section 1303 further specifies that individuals who purchase insurance that covers abortions must pay at least one dollar into a separate account specifically designated for abortion. These segregated accounts are designed to help ensure that the accounts are 1) funded solely by the enrollee’s premium (rather than by the premium tax credit) and 2) used exclusively to fund non-Hyde abortion services. Section 1303 also allows states to ban the coverage of abortions by QHPs sold through the marketplaces: to date, twenty-six states have done so. In an additional six states, no marketplace plans offered coverage for abortion during the 2016 plan year. Two states—California and New York—require health plans to cover abortions, subject to an exception for multistate plans, at least one of which in each state must offer insurance without abortion coverage.

The actual wording of Section 1303 clarifies that the "separate account" payment has to be at least $1.00 per month per enrollee.

(sigh) In any event, the other big factor here is that the Continuing Resolution which 8 Senate Democrats voted for in order to end the federal government shutdown earlier this fall is only scheduled to keep the government open through the end of January, which means we could be right back where we were at the end of September a few weeks from now...

Stay tuned.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.