Reading Sheep Entrails: What half-baked "reform" are Republicans offering to resolve the tax credit crisis?

A haruspex was a person trained to practice a form of divination called haruspicy in the religion of ancient Rome, the inspection of the entrails of sacrificed animals, especially the livers of sacrificed sheep and poultry.

I realize I'm a little late to the party on this, but nine days ago, Donald Trump posted one of his online rants in response to the then-ongoing government shutdown standoff in the U.S. Senate, which was primarily focused on the imminent expiration of enhanced ACA tax credits:

"I am recommending to Senate Republicans that the Hundreds of Billions of Dollars currently being sent to money sucking Insurance Companies in order to save the bad Healthcare provided by ObamaCare, BE SENT DIRECTLY TO THE PEOPLE SO THAT THEY CAN PURCHASE THEIR OWN, MUCH BETTER, HEALTHCARE, and have money left over. In other words, take from the BIG, BAD Insurance Companies, give it to the people, and terminate, per Dollar spent, the worst Healthcare anywhere in the World, ObamaCare. Unrelated, we must still terminate the Filibuster!"

Now, Trump being Trump, what he actually meant by this rant is pretty difficult to decipher. He could have meant any number of things, several of which could overlap with or contract each other.

Is he again calling for the ACA to be repealed? Hard to say.

Is he calling for all ACA tax credits to be eliminated? Who can tell?

Is he just referring to the enhanced tax credits (around 20% of the total this year)? Beats me.

Regardless, Congressional Republicans being Congressional Republicans, they immediately set to following their Lord & Master's lead...or at least what they interpreted as being his lead.

GOP Congressman Tom Emmer of Minnesota and GOP Senator Roger Marshall of Kansas are calling for a return to the days of High Risk Pools, which were chronically & deliberately underfunded & abject failures across the board.

Meanwhile, GOP Senator Bill Cassidy of Louisiana seems to have taken the lead on trying to come up with something in line with what Trump (seems to be) demanding:

Sen. Bill Cassidy (R-LA) says he aims to craft bipartisan legislation to give subsidies directly to Obamacare exchange enrollees rather than to insurance companies — a plan that would flesh out President Donald Trump's suggestions for resolving the demands from Democrats that led to the longest total government shutdown in U.S. history.

Cassidy, chairman of the Senate's health committee, told the Washington Examiner that his proposal is meant to defray the rising premium costs for Affordable Care Act enrollees after the extended premium tax credits expire at the end of the year.

...Cassidy’s proposal would utilize the current funding for enhanced premium tax credits to fund flexible spending accounts for Obamacare enrollees who are eligible for subsidies. FSAs are limited, tax-free accounts meant to help beneficiaries cover the costs of copays, deductibles, and other health expenses.

The basic idea behind Cassidy's logic seems to be the following:

- Republicans refuse to simply extend the enhanced tax credits as is (Cassidy claims this would cost $26 billion next year; the CBO projects it as being $23.4 billion).

- Therefore, most ACA enrollees who aren't priced out of ACA exchange coverage altogether are likely to downgrade to a worse plan with higher deductibles/co-pays in order to reduce their premium hikes.

- Therefore, they want to instead take the $26 billion which otherwise would go towards cutting down the premiums and instead put it towards paying for those high deductibles/co-pays.

Now, if you look at this proposal in the most positive light and with the most optimistic assumptions about Cassidy being an honest negotiating partner (hah!), it could be a little bit like swapping out enhanced Advance Premium Tax Credits (APTC) for enhanced Cost Sharing Reduction (CSR) assistance.

Right now, APTC is available on a sliding income scale, starting with enrollees paying $0/mo in premiums for the benchmark Silver plan if they earn less than 150% FPL and rising to no more than 8.5% of their income in premiums for the benchmark plan if they earn 400% FPL or higher.

If the enhanced tax credits expire, this would revert back to them paying 2.1% of their income in premiums at 100% FPL - 138% FPL, rising to nearly 10% of their income at 300% FPL, and jumping to full price starting at 400% FPL or higher.

CSR assistance, meanwhile, is also available on a sliding income scale, starting with enrollees having maximum out of pocket (MOOP) caps of no more than perhaps $800 - $2,000/year if they earn less than 150% FPL; perhaps $2,000 - $3,500/year if they earn 150 - 200% FPL; and perhaps $5,000 - $8,000 if they earn 200 - 250% FPL.

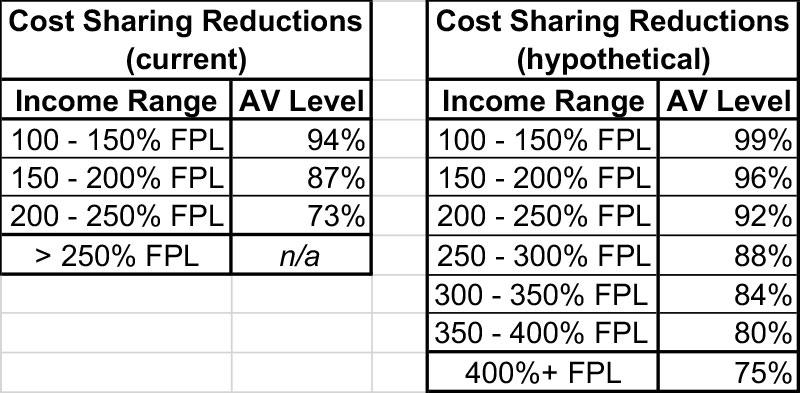

In actuarial terms, this translates into a Silver plan--which normally only covers 70% of average aggregate healthcare claims--covering either 94% of them under 150% FPL; 87% of them between 150 - 200% FPL; and 73% of them between 200 - 250% FPL.

In other words, up to 200% FPL, Silver plans are effectively turned into Platinum plans; from 200 - 250% FPL they're just a slightly stronger Silver plan.

IN THEORY, something like what Cassidy is proposing might be workable, but only if some MAJOR ASSUMPTIONS are included:

- First, the non-enhanced tax credits would have to remain in place

(and even those are already about to become less generous than they otherwise would have been due to other administrative fuckery by the Trump Regime).

- Second, the full amount which would otherwise be going towards the enhanced tax credits ($24 - $26 billion in 2026) would have to be utilized.

- Third, each enrollee would have to see the same (or close to the same) level of financial help under this scheme that they would otherwise receive if the enhanced tax credits remained in place.

- Fourth, the funds could only be used in conjunction with an ACA-compliant Qualified Health Plan.

Consider my own family's situation, which I wrote about a couple of weeks ago.

In our case, if we end up earning slightly more than 400% of the Federal Poverty Level (FPL) as we currently expect to, we'll lose out on over $15,000 in APTC assistance.

IF Cassidy's FSA/HSA proposal meant that they knock that same $15,000 off of our out of pocket expenses (and that's a huge assumption), it might work out in our favor if we were enrolled in Bronze High Deductible plan...but only if we actually max that deductible/MOOP out (which, as I explained, we probably would due to an insanely expensive prescription medication my wife requires). We'd still likely pay over $5,000 more in premiums, but this might be offset (or even more so) by the savings on OOP costs.

HOWEVER...if we don't max out that deductible/MOOP...that is, if we only rack up, say, 1/3 of the max or less...we'd have to eat that extra premium cost up front without receiving any actual savings on OOP costs, since we didn't rack them up in the first place.

The bottom line is that some people might benefit...but millions of others would still be screwed, and this all still assumes that every household would receive the same amount of FSA/HSA funding that they would if they just extended the damned enhanced APTC in the first place...which I highly doubt they have in mind.

More likely they would just seed the HSA accounts with a flat amount for each enrollee (again, the CBO projects the enhanced subsidies would cost around $24 billion, and there's around 24 million exchange enrollees, so that'd work out to around $1,000 apiece).

If they did something like this, again, it would be very helpful for some people...but would be almost useless for millions of others. Again: Having your deductible reduced from $6,000 to $5,000 (or even to $1,000!) is certainly not a bad thing....but it doesn't do you much good if you can't afford the premiums to begin with.

In addition, all of this assumes that...

- a) Such a system could actually be set up logistically & technologically in the next 6 weeks (I highly doubt it).

- b) Someone in all ~16 million or ACA households (assuming ~1.5 people per policy) understand how an FSA/HSA account works, how to use it & what the limitations are.

There's also absolutely no way of knowing what sort of impact a last-minute sea change like this would have on the insurance industry. Remember, they spent countless hours & resources number-crunching earlier this year based on one of two assumptions:

- 1. The enhanced tax credits are extended;

- 2. The enhanced tax credtis aren't extended.

Ultimately their final filings were based on and locked in on assumption #2...but throwing a monkey wrench like this into the gears literally weeks before the policies themselves kick in strikes me as actuarial insanity which would have a massive ripple effect in 2027.

There's also a lot of confusion about whether it would be in the form of a Flexible Savings Account (FSA), which is a "use it or lose it" setup, or a Health Savings Account (HSA) where the funds can be rolled over from one year to the next; about what the rules are for each (right now neither one can be used to actually pay premiums, there are strict limits on what the tax free contribution limits are for each, and there's a stiff penalty of 20% for withdrawing money from either one); and so on.

“FSA, you have 15 months to use it, and if not, it reverts back to, in this case, the federal government,” said Cassidy. “I actually think it’s fair too, because we’re trying to help people, but if you don’t need healthcare, then we don't need to give you the money.”

Not all details, including the income levels that would be eligible for the new FSA accounts, have been worked out yet, as Cassidy said he hopes to collaborate with Democrats and other Republicans to come to a solution. But the intention of the policy fits with the president’s goals of directing subsidies away from insurance companies.

Don't forget the confusion--not so much from Cassidy, who is clearly referencing the money being used for deductibles/OOP expenses, not premiums, as from Trump and other Republicans (like CMS Administrator Dr. Oz)--who seem to think that the money would in turn be used to...pay for insurance premiums, which it already is, and which would completely contradict Trump's original rant about "not giving billions of dollars to the insurance companies."

Furthermore, there's no way of telling whether or not Cassidy is talking about restricting the FSA/HSA funds to only be used in conjunction with ACA-compliant insurance policies or whether it could also be used alongside junk plans which can deny coverage for those with pre-existing conditions, don't include essential health benefits, have annual and/or lifetime coverage limits and so forth.

Honestly, the only way I could possibly see something along the lines of what Cassidy has in mind working logistically would be if it was paired with a 1-year extension of the enhanced tax credits, with whatever HSA/FSA cludge they come up with not going into effect until 2027 instead.

Now, one way I could see something like this working which would fall into the same general ballpark as Cassidy's proposal would be to literally expand CSR assistance instead, from the current 150/200/250 levels out to something more like the following (this is pulled completely out of my ass, mind you, and it still wouldn't help those over 400% FPL much):

In summary, my best read of Cassidy's proposal is that it would be cumbersome, confusing and pointless at best, and a complete disaster at worst...especially if they try to ram it through in the next 6 weeks without thinking through the ramifications of such a drastic policy change on such short notice. Remember, there are reasons the ACA took 4 years from being signed into law until the newly-compliant policies went into effect, and it wasn't just to give time to get HealthCare.Gov developed.