Two new polls confirm it: Out of the shutdown gate, Americans STRONGLY support extending the enhanced ACA tax credits (updated)

A Washington Post poll conducted on Oct. 1, the first day of the shutdown, found that 47% of U.S. adults blame Trump and Republicans in Congress, while 30% blame Democrats and 23% said they're not sure.

The survey found that independents blamed Trump and Republicans over Democrats by a wide margin of 50% to 22%. And one-third of Republicans were either unsure who to blame (25%) or blamed their party (8%).

While I'm glad to see that far more people are rightly blaming Trump & Congressional Republicans, it's the other section of the survey which I find more noteworthy:

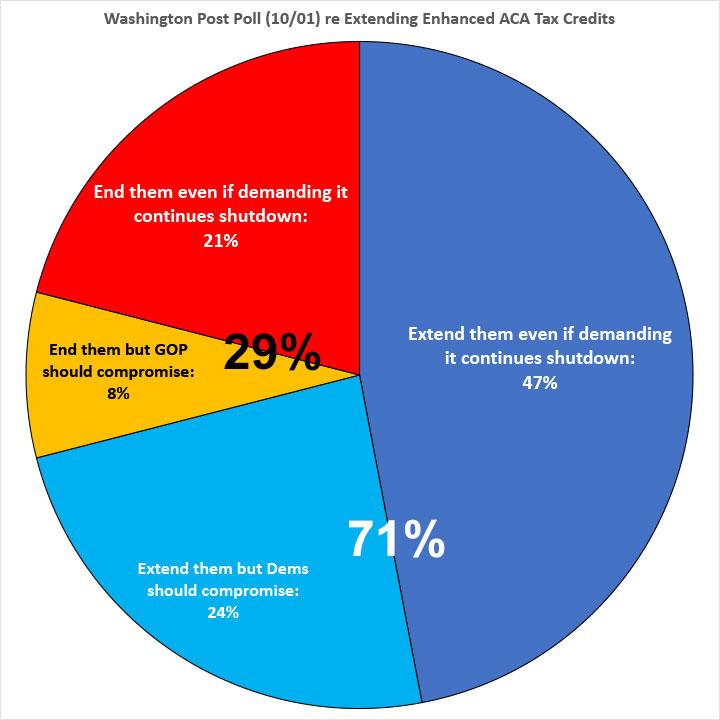

Federal subsidies that reduce the cost of Affordable Care Act health insurance plans are scheduled to end at the end of this year. Should these subsidies...

- Be Extended: 71%

- End as Scheduled: 29%

That's right: Americans support extending the enhanced federal tax credits by more than a 2:1 margin, which I find pleasantly surprising given that only around 7% of the total population is enrolled in an ACA exchange plan.

But wait, there's more:

(Among those who said subsidies should be extended) Do you think Democrats in Congress should...?

- Demand the extension of federal health insurance subsidies even if it continues the government shutdown: 66%

- Compromise to end the shutdown: 34%

(Among those who said subsidies should end) Do you think Trump and Republicans in Congress should...?

- Demand that federal health insurance subsidies end as scheduled even if it continues the government shutdown: 72%

- Compromise to end the shutdown: 28%

Here's what the overall breakout looks like: A strong plurality of respondents (47%) support extending the enhanced tax credits even if demanding that continues the government shutdown, while only 21% insist on letting the enhanced credits expire on December 31st even if that demand continues the shutdown.

About 1/3 (32%) think that one side or the other should compromise on the tax credit extension in order to end the shutdown,

Granted, "compromise" could mean any number of things ranging from how long they're extended to how robust they should be (kept exactly as they are now? Made slightly/somewhat less generous at various points along the income range?). The vast majority of the public doesn't really know the details of how the tax credits are structures, though, so there's no way of gleaning what specifics they'd be "comfortable" with...but the bottom line is that Americans firmly stand with Democrats on the issue.

We'll have to see how opinion shifts over time as the real world impact of the shutdown starts to actually hit people, of course.

UPDATE 10/3/25: Thanks to bobododo for alerting me to another poll conducted by KFF last week (but not published until today) which confirms these findings:

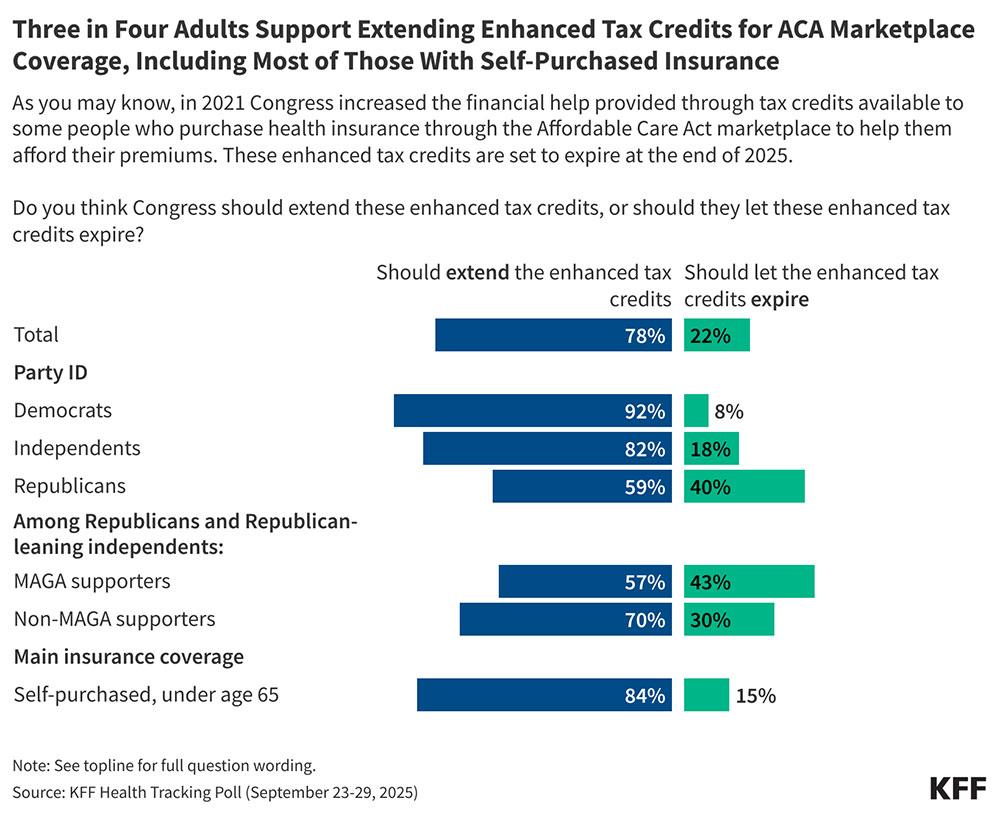

More than three-quarters (78%) of the public say they want Congress to extend the enhanced tax credits available to people with low and moderate incomes to make the health coverage purchased through the Affordable Care Act’s Marketplace more affordable, a new KFF Health Tracking Poll finds. That’s more than three times the share (22%) who say they want Congress to let the tax credits expire.

Most Republicans (59%) and “Make American Great Again” supporters (57%) favor extending the enhanced tax credits, which otherwise would expire at the end of the year and require Marketplace customers to pay much more in premiums to retain coverage. Larger majorities of Democrats (92%) and independents (82%) also support extending the enhanced tax credits, as do most people who buy their own health insurance, most of whom purchase through the Marketplace (84%).

The KFF poll was taken a week before the actual federal government shutdown started, which is an important factor to consider (there's a big difference between something theoretically happening and something which has actually already happened). Even so, this strongly underscores the support for extending the tax credits among the public...even among die-hard MAGA Republicans.

Speaking of the difference between something potentially happening in the future and the same thing actually happening...

The poll suggests that many Marketplace enrollees are going to be surprised by the jump in their premiums if the tax credits aren’t renewed in time for 2026 open enrollment period, which starts Nov. 1.

Among people who buy their own coverage (largely through the Marketplaces), about six in ten (58%) say they have heard just “a little” or “nothing at all” about the expiration of tax credits for eligible people with Marketplace coverage.

Among those who buy their own insurance, about a third (35%) expect their premiums to increase “a lot” next year. A quarter (25%) expect their premiums to rise “some,” another quarter (24%) expect their premiums to increase “a little,” and the rest (15%) don’t expect any increase.

Hoo boy. 40 - 65% of ACA enrollees are in for a big surprise (to be fair, there are some enrollees who actually won't see too much of a rate hike due to either the specifics of their situation or because several states are promising to backfill some or even all of the lost federal tax credits, including California, New Jersey, Colorado, Maryland and especially New Mexico.

When asked if they could afford health coverage if their premiums nearly doubled, seven in 10 (70%) of those who purchase their own insurance say they would not be able to afford the premiums without significantly disrupting their household finances, more than twice the share (30%) who say they could afford the higher premiums.

About four in 10 (42%) Marketplace enrollees say they would go without health insurance coverage if the amount they had to pay for health insurance each month nearly doubled. Similar shares (37%) say they would continue to pay for their current health insurance, while two in 10 (22%) say they would get insurance from another source, like an employer or a spouse’s employer.

The KFF survey is excellent, but I do wish that they had included one more option for this question: Whether they would shop around for a lower-premium ACA plan (ie, downgrading from Gold to Silver, from Silver to Bronze, from PPO to HMO, etc).

Oh yeah...the KFF survey also asks about the blame game...although again, this was asked a week before the shutdown actually happened:

...About four in ten (39%) adults who want to see the tax credits extended say that if Congress does not extend these enhanced tax credits, President Trump deserves most of the blame, while another four in ten (37%) say the same about Republicans in Congress. About two in ten (22%) say that Democrats in Congress deserve most of the blame. Democrats are most likely to place blame on President Trump (56%) followed by Republicans in Congress (42%), while six in ten Republicans (61%) say they would place the blame on Democrats in Congress. Among those who buy their own coverage (nearly half of whom identify as Republican or Republican-leaning), Republicans in Congress and President Trump receive the majority of the blame (42% and 37%, respectively).

It's important to qualify this last finding with the point that this is among those who want them extended, ie, 78% of the total surveyed.

That breaks out as follows:

- 30% of all respondents blame Trump

- 28% of all respondents blame GOP Congress

- 17% of all respondents blame Democrats

- 2% of all respondents aren't sure

- The remaining ~22% don't want them extended anyway

Point being, 58% of all respondents blame Trump/GOP vs. only 17% who would blame Democrats (although the only way Democrats are "responsible" for them expiring is that they didn't make them permanent in the first place...which was only due to the fact that they couldn't get any Republicans (or Joe Manchin) to vote to do so at the time.