Exclusive: Full-price 2026 ACA premium rate hikes to average 23.4% (semi-final)

IMPORTANT: See here for methodology & state-by-state analysis

Every year, I spend months painstakingly tracking every insurance carrier rate filing (nearly 400 for 2025!) for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

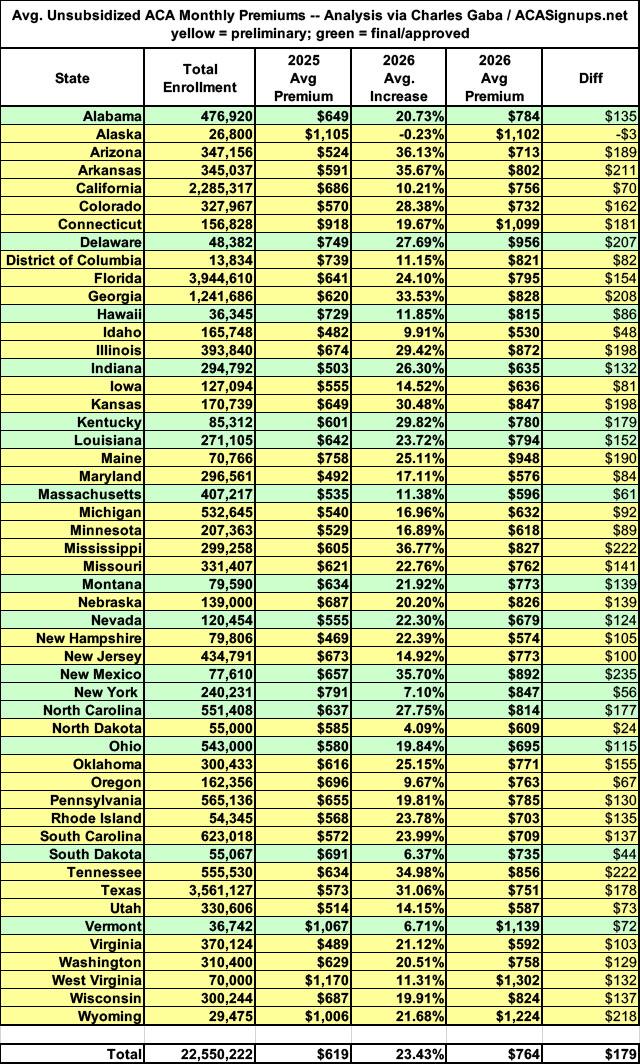

As of September 2nd, I've managed to fill in preliminary weighted average 2026 rate filings for all 50 states +DC as well as the final/approved rate filings for 15 states.

While it will move up or down slightly as more states finalize their 2026 filings, as of this writing, the weighted average rate increase for unsubsidized enrollees is 23.4% nationally.

This is the 2nd highest year-over-year gross rate hike since the ACA overhauled the individual market starting in 2014.

And yes, a significant chunk of this is due specifically to three factors:

- Congressional Republicans allowing the improved premium tax credits to expire at the end of December 2025;

- The Trump Administration's so-called "Affordability & Integrity Rule" changing the Premium Adjustment Percentage Index (PAPI) formula, which is what determines the underlying ACA tax credit formula; and

- The Trump Administration's tariffs on pharmaceuticals and medical supplies, which have been cited by numerous insurance carriers and state insurance regulators alike as being a significant factor.

At the state level, the rate changes range from a slight decrease in Alaska (-0.2%) to a whopping 36.8% avg. rate increase in Mississippi.

In raw dollars, it ranges from a $3/mo reduction in Alaska to an additional $235/month in New Mexico, with a national average of an extra $179/mo per person.

However, Alaska's full-price premiums already average $1,102/month to begin with, while New Mexico announced that they're backfilling 100% of the federal subsidies which will be lost when the IRA upgrade expires at the end of this year for the ~85% of their enrollees who earn less than 4x the poverty level, along with their own state-based supplemental subsidies.

In Alaska's case, the 0.2% rate reduction will be meaningless for the vast majority of enrollees losing tax credits, while in New Mexico 85% of enrollees should be held harmless from those losses. (It'll still be devastating for the remaining 15%, however.)

Again, it's important to stress that these average rate hikes will vary for individual enrollees, but more importantly, the increases below are only relevant for enrollees who aren't currently receiving federal subsidies.

Nationally, that's just 8% of ACA exchange enrollees (~1.8 million people or so), although there's also another 1-2 million off-exchange enrollees who pay full price as well.

For most of the 92% of on-exchange enrollees who currently receive federal subsidies, however (nearly 21 million Americans as of today), a ~23% rate hike will seem like a pleasant dream by comparison.

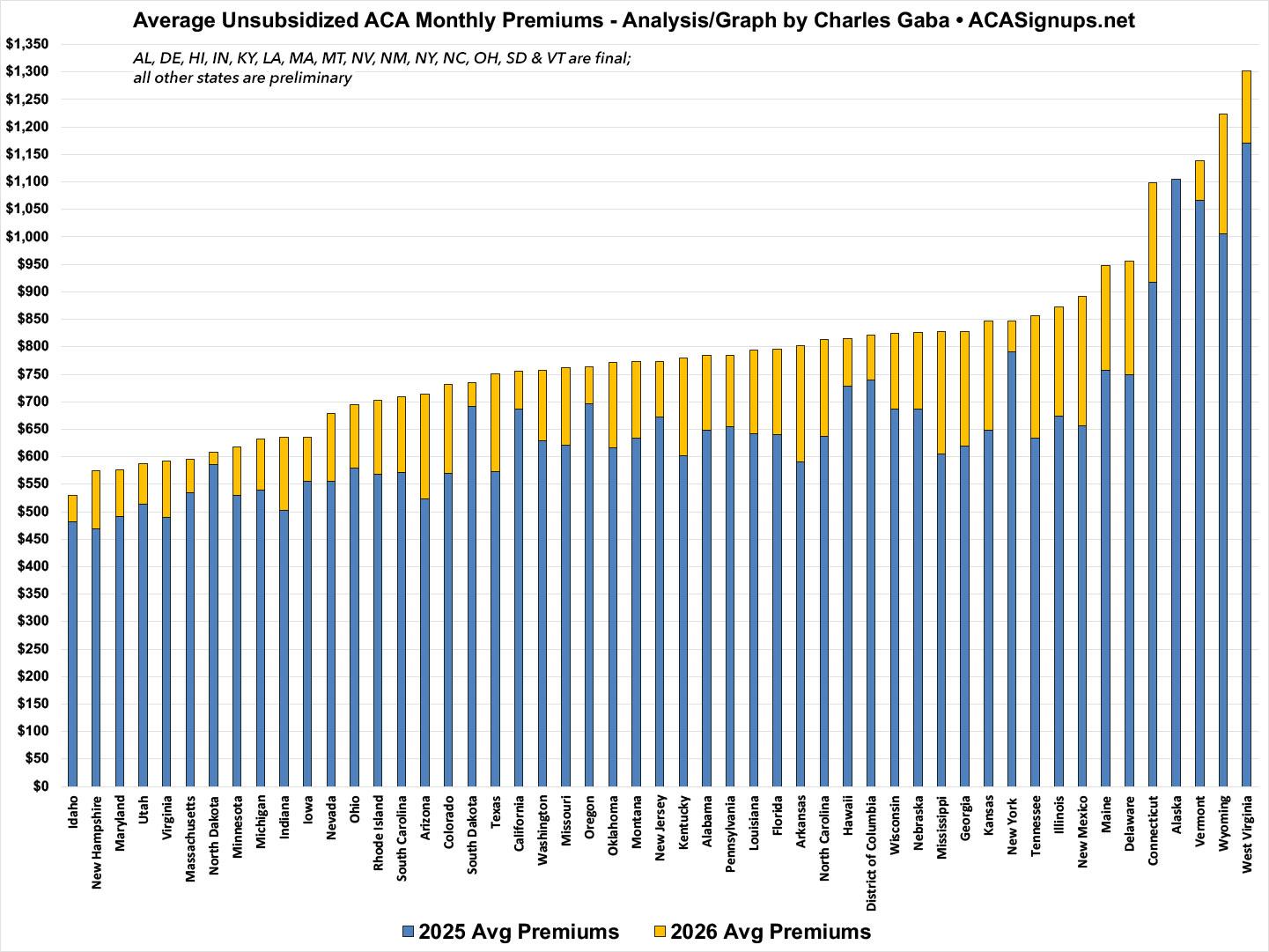

Assuming the preliminary averages for the remaining states are approved as is, Idaho will have the lowest average premiums next year ($530/month) while West Virginia, which already has the highest average premiums nationally, will keep that dubious honor as their average individual market premiums jump to over $1,300/month.

It's worth noting that both the lowest and highest averages can be found in deep red states...while some of the lowest and highest can also be found in deep blue states (Maryland will be 3rd lowest, Vermont 3rd highest).

In any event, here's what it looks like visually, sorted from lowest to highest average 2026 monthly premium:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.