Wyoming: Mountain Health Co-Op pulling the plug for 2026 just weeks after filings go live

It was just a couple of weeks ago that the official (if preliminary) 2026 ACA individual market rate filings for Wyoming insurance carriers went live on the federal rate review website.

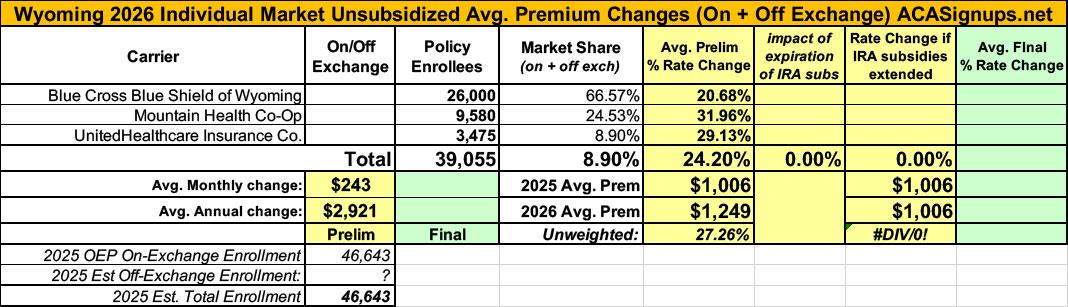

I published a writeup about these just 3 days ago; unlike some states, Wyoming was pretty easy to break out as they only have three carriers on the indy market, all of which also made their current enrollment data easy to find.

The landscape isn't pretty: BCBS is seeking average rate increases of 20.7%; UHC wants 29.1%, and Mountain Health Co-Op, which has around 9,600 enrollees, was asking for a whopping 32% average premium hike.

Keep in mind that Wyoming already has among the most expensive individual market policies in the country, with premiums averaging over $1,000/month.

Well, just moments ago I received a heads up that Mountain Health Co-Op (which also operates in Montana and Idaho) has made a last-minute change and is pulling out of the so-called "Equality State" at the end of this year:

Critical Update for Wyoming Members — All Plans Terminate December 31, 2025

Your Health Coverage with us in Wyoming is ending on December 31, 2025.

Key Details & Questions

Mountain Health Co-Op will no longer offer health plans in Wyoming. The last day of your current Mountain Health CO-OP Marketplace coverage is December 31, 2025. Take action during Open Enrollment or you may not have coverage in 2026.

It's worth noting that this appears to be breaking news--there's no formal press release listed on the main Mountain Health website, nor is there any reference to it elsewhere on the site. I also haven't seen any news stories via a simple Google search as of this writing.

What does this mean?

- You will need to sign up with a new company for a new health plan during Open Enrollment.

- Your health coverage with us will end on December 31, 2025. Until then you’ll be able to use your health plan as normal.

How will I get insured for 2026?

- Wyoming members will be eligible for a special enrollment window.

- There are three windows of enrollment to understand.

- Your health coverage will be affected depending on which window you sign up during.

- Remember, your coverage ends December 31, 2025.

Zero interruption

- Standard Open Enrollment November 1 – December 15, 2025

- Pick a new plan during the standard Open Enrollment period for uninterrupted coverage that begins on January 1 (the day after ours ends).

- You will need to sign up on or before December 15 for uninterrupted coverage.

31 Day Coverage Gap

- Extended Enrollment Until January 15, 2026

- Extended Open Enrollment closes January 15, 2026

- So, if you sign up anytime after December 15, then the earliest your health coverage could begin is February 1, 2026.

- This means you could have a 31 day coverage gap.

Largest Coverage Gap

- Special Enrollment Until March 1, 2026

- You will qualify for a Special Enrollment period between January 1 – March 1, 2026.

- If you don’t enroll by December 15, 2025, you may have a gap in coverage beginning on January 1, 2026.

What else should I do for 2026 enrollment?

- Make sure your Marketplace information is correct.

- Double check your Marketplace application details and update any personal information that has changed.

- Keeping details updated means you get the best possible financial benefits.

- You may qualify for more financial help in 2026 than you’re getting now.

- This could be a lower monthly premium or reduced out-of-pocket costs, differences in deductibles, copayments, and coinsurance.

- Plus, you’ll avoid owing money when you file taxes since your tax credit will be accurate.

How do I choose another plan?

- Visit healthcare.gov to view other Wyoming Plans

- Or call 800-318-2596 to learn more about the Wyoming Marketplace and see if you qualify for lower costs.

- Compare plans to find a plan that best meets your needs and budget, possibly even saving you money.

Note — If you received financial help in 2025 to lower your monthly premium, you’ll have to “reconcile” using IRS Form 8962 when you file your federal taxes. This means you’ll compare the amount of premium tax credit you got in advance during 2025 with the amount you actually qualify for based on your final 2025 household income and eligibility information. If the amounts are different, it may change the amount you owe or receive when you file taxes.

For more information about the premium tax credit, visit: The Premium Tax Credit Basics

Get help choosing.

- Use an Agent: Reach out to your local health insurance agent.

- Find in-person help from a navigator at Enroll Wyoming at enrollwyo.org or by calling 307-996-4797

- Help understanding your existing coverage: Call Mountain Health CO-OP at 800-299-6080 or send a message via the Member portal.

How long do I or my doctor have to submit claims for payment?

- One year from date of service.

- All valid claims will be honored for one year from the date of service.

- View Claims Form

Is the CO-OP going out of business?

- No. The CO-OP will remain offering insurance in Montana and Idaho.

- We chose to leave the state due to the soaring costs of health care in Wyoming and the resulting significant losses to the company.

- The CO-OP will continue focusing its efforts in our primary foundation states.

I received a notice in the mail that my provider is moving to Aetna on September 1, 2025. Is this still happening?

No. The CO-OP’s contracts with providers are staying the same until December 31, 2025. Your in-network providers will remain in-network until coverage completes.

Mountain Health is one of the few remaining Health Insurance Co-Operatives originally established by the ACA back in 2010. These were sort of a consolation prize thrown in after the much-ballyhooed "Public Option" failed to be included with the legislation. The ACA co-ops seemed to thrive for the first couple of years, but they were crippled and were pretty much designed to fail from the start. As of today I there's only three of them left: Mountain Health, Maine's Community Health Options and Wisconsin's Common Ground, although the latter was bought out by CareSource earlier this year.

So...what does this mean for Wyoming enrollees?

Well, as noted above, they're gonna have to scramble to get new coverage via one of the 2 remaining carriers or elsewhere.

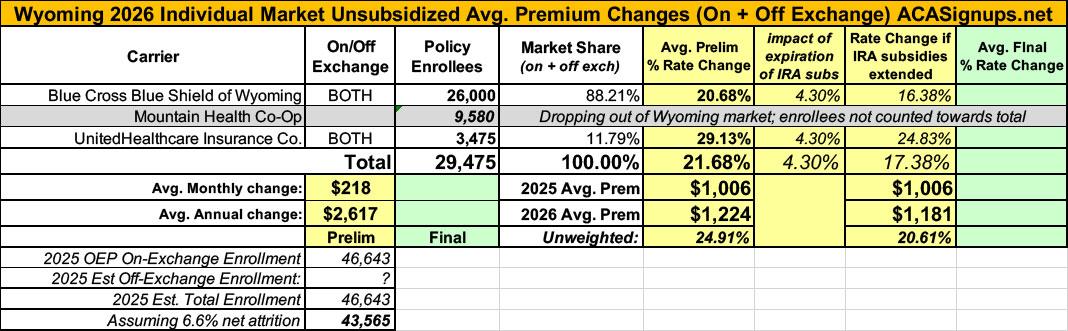

Ironically, this actually reduces the average rate increase for the remaining Wyoming market, since Mountain Health was the highest of the three. Here's what it looks like now...the weighted average has dropped from 24.2% to 21.7%.

That's small comfort to the 9,600 Mountain Health enrollees, however...or to the rest of the Wyoming population, which has just lost 1/3 of their options for individual market coverage.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.