2026 Final Gross Rate Changes - Wyoming: +25.9% (updated)

Originally posted 8/11/25

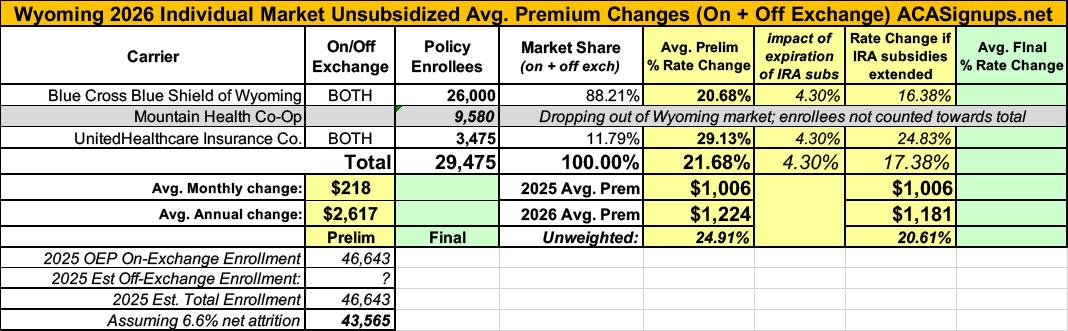

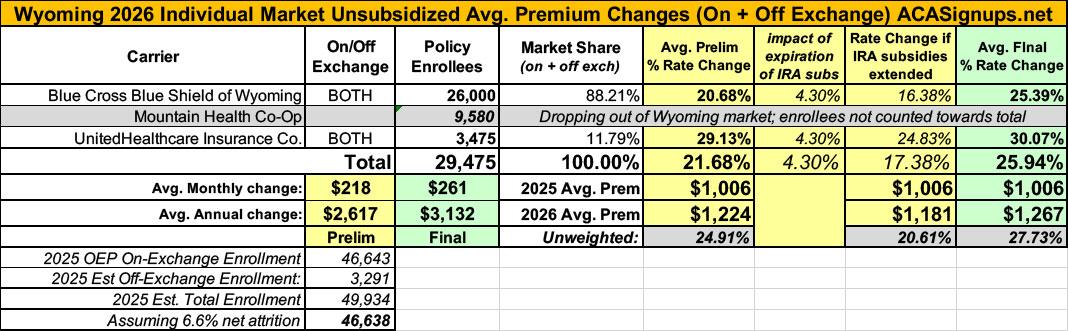

Overall preliminary rate changes via the SERFF database, Wyoming Insurance Dept. and/or the federal Rate Review database.

Blue Cross Blue Shield of WY

Blue Cross Blue Shield of Wyoming (BCBSWY) has offered comprehensive and fully insured coverage to members in the Individual ACA market since 2014. BCBSWY is filing a rate increase for 2026 products. All plans will be offered statewide; plans with be offered either on or off the Federally Facilitated Marketplace in Wyoming.

The products associated with this filing will cover a wide range of benefits, including all Essential Health Benefits (EHBs) required under the ACA. Some plans will have access to pediatric dental benefits. Stand-alone pediatric dental plans are available to satisfy the EHB requirements. All plans will utilize a PPO network. BCBSWY will offer plans at the bronze, silver, and gold metallic levels. Cost share reduction plans will be offered for those eligible. Services will be subject to deductibles, copays, and coinsurance; member cost-sharing will be limited to out-of-pocket maximums (OOPMs). A range of cost-sharing options will be provided to consumers, including deductible options ranging from $0 to $10,600, member coinsurance options ranging from 0% to 50%, and OOPM options ranging from $1,450 to $10,600 for single coverage. Some plans will feature copays for physician services and prescription drug fills.

The average rate change for individuals renewing in 2026 is 18.0%, with the minimum and maximum rate changes equal to 12.7% and 21.2%, respectively. The proposed rate changes vary by plan due to changes in the paid to allowed ratios underlying the actuarial value and cost sharing components of the Plan Adjusted Index Rates. The paid to allowed ratios for all plans were updated to reflect the benefits to be offered in 2026 and the anticipated claim costs associated with the projected 2026 BCBSWY Individual ACA population.

The primary drivers of the average rate change are summarized below:

- Higher than expected claims net of risk adjustment in the experience period

- One year of claims trend relative to 2025;

- An increase in the claims trend assumption due to an increase in observed historical claims trend;

- The expectation that the enhanced premium tax credits (originally implemented under the America Rescue Plan Act and subsequently extended under the Inflation Reduction Act) will expire at the end of 2025

The rate change is estimated to impact approximately 26,000 members.

Mountain Health Co-Op

Mountain Health Cooperative (MHC) has 9,580 insureds enrolled who will be affected by 2026 Individual Market rate changes if they continue their coverage. Before federal subsidies, the average change in premium for these individuals will be 31.96%. The requested rate change varies by product with the smallest average change of 31.1% for Peak PPO Bronze Standard and the largest average change of 32.5% for Peak PPO Silver.

Most Significant Factors

The rate change described above is driven by the following changes in rating from 2025 to 2026.

- Morbidity/Experience Adjustment: 15%

- Risk Adjustment: 3%

- Health Cost Trend: 9%

Morbidity refers to the relative difference in utilization of healthcare services between one population and another for reasons unrelated to plan design or management of care. This is often times referred to as the risk of the population or risk pool. Based on the anticipated change in the single risk pool for 2026 the morbidity increased 4%.

UnitedHealthcare Insurance Co

UHIC is filing 2026 rates for individual products. The proposed rate change is 29.13% and will affect 3,475 individuals. The rate changes vary between 26.72% and 30.94%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

...There are many different healthcare cost trends that contribute to increases in the overall U.S. healthcare spending each year. These trend factors affect health insurance premiums, which can mean a premium rate increase to cover costs. Some of the key healthcare cost trends that have affected this year’s rate actions include:

- Increasing cost of medical services: Annual increases in reimbursement rates to healthcare providers, such as hospitals, doctors, and pharmaceutical companies.

- Increased utilization: The number of office visits and other services continues to grow. In addition, total healthcare spending will vary by the intensity of care and use of different types of health services. The price of care can be affected using expensive procedures such as surgery versus simply monitoring or providing medications.

- Higher costs from deductible leveraging: Healthcare costs continue to rise every year. If deductibles and copayments remain the same, a higher percentage of healthcare costs need to be covered by health insurance premiums each year.

- Impact of new technology: Improvements to medical technology and clinical practice often result in the use of more expensive services, leading to increased healthcare spending and utilization.

- Expiration of enhanced premium tax credits: Expanded and enhanced federal premium tax credits for consumers will expire at the end of 2025. As a result, post-tax credit premiums will increase for calendar year 2026.

- Changes in market morbidity: Premiums reflect the expected increase in the average cost per member due to healthier members leaving the market if enhanced ATPCs are allowed to expire.

The total enrollment for all three carriers adds up to just over 39,000 people, which is actually down 16.3% from 2025 OEP enrollment of 46,643, assuming the carriers aren't disregarding enrollees in some policies being terminated.

In any event, this gives a weighted average increase of 24.2% across the Wyoming market.

HOWEVER, it's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

UPDATE 8/14/25: As explained in more detail here, Mountain Health Co-Op just announced they're dropping out of the Wyoming market entirely after all, meaning their ~9,600 enrollees will have to choose one of the other carriers. This also means the weighted average rate increase drops by several points to 21.7%. I've updated the table below to reflect this:

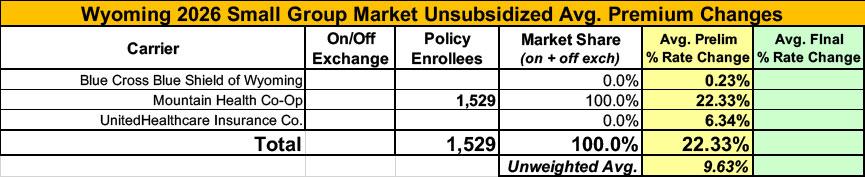

Meanwhile, I have no enrollment data at all for two of the three small group carriers; the unweighted average 2026 rate hike there is 9.6%.

UPDATE 11/02/25: Just hours before Open Enrollment went live, the final, approved 2026 filing decisions for Wyoming carriers were uploaded to the federal rate review database. Unfortunately, BCBSWY's were bumped up another 4 points or so, and since they hold the lion's share of the market, that means the weighted average increase went up to 25.9%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.