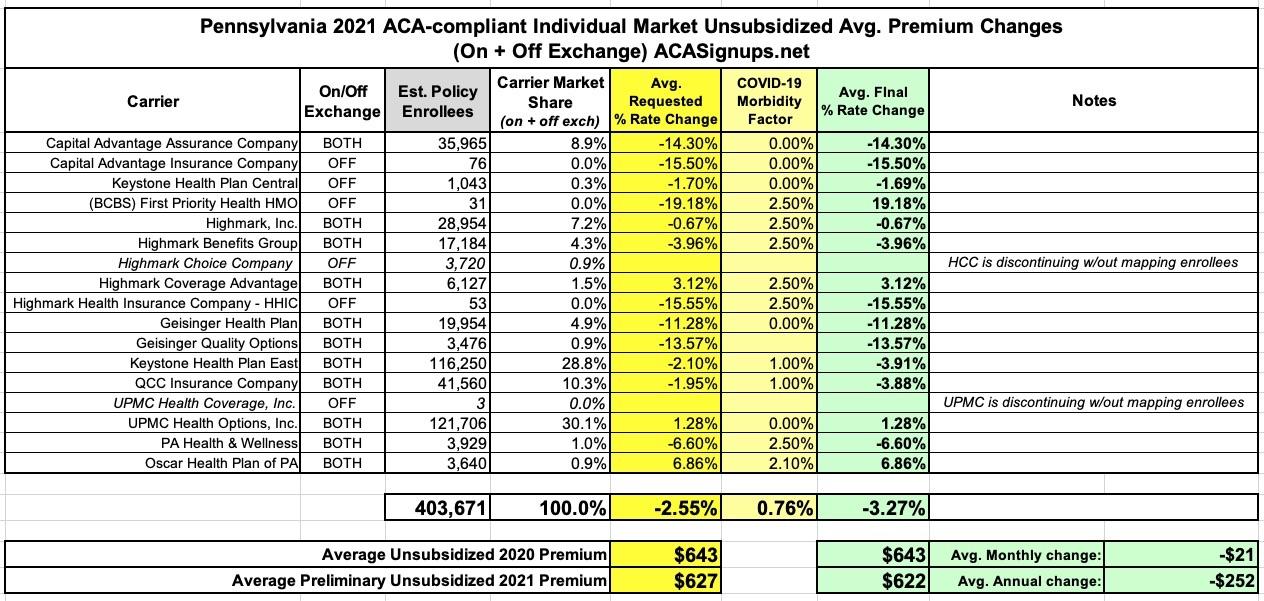

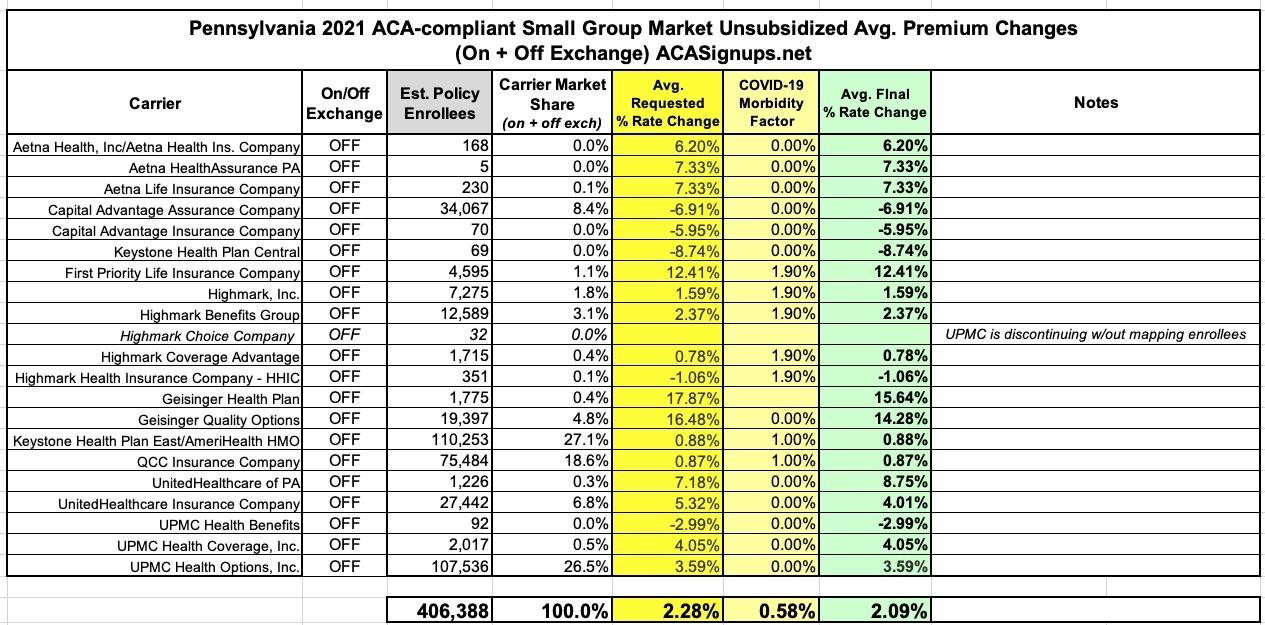

Pennsylvania: *Approved* avg. 2021 #ACA premiums: -3.3% indy market, +2.1% sm. group

Back in early August, the Pennsylvania Insurance Dept. issued the preliminary rate filings for PA's individual and small group market carriers. At the time, the weighted average rate change being requested on the individual market came to a 2.6% reduction in unsubsidized premiums, while the average small group plan was set to increase by 2.3%.

Last week, the PA DOI issued their final decisions for the long list of carriers on each market, and the changes were...minimal, really. In fact, there was no change at all made to most requested rate filings--only two of the 17 indy market carriers saw a change (reductions for each), and only four of the 21 small group carriers did...and even then, the changes aren't terribly dramatic, just a few percentage points in most cases.

Insurance Department Announces Lower ACA Individual Plan Health Insurance Rates, Attributes Them To New State-Based Exchange And Reinsurance Program

Harrisburg, PA – As the Wolf Administration pushes back on federal attempts to dismantle the Affordable Care Act amid a pandemic and the start of flu season, the Department of Insurance today announced Pennsylvania's approved 2021 individual and small group Affordable Care Act (ACA) health insurance rates, highlighting a decrease in individual market rates attributable to the new state-based exchange and reinsurance program.

"This individual plan rate decrease means more affordable plan options for those who seek coverage via the ACA," Insurance Commissioner Jessica Altman said. "Without the affordable coverage that the ACA provides, millions of people would be without health care coverage during a time when health is top-of-mind for every Pennsylvanian and having coverage to maintain good health is even more critical."

All insurers currently offering coverage in Pennsylvania's 67 counties will continue to provide plans in 2021 with a statewide average decrease of 3.3 percent for individual market plans and a 2.1 percent average increase in the small group market. The rates present more options for consumers looking for comprehensive health insurance plans that provide robust benefits.

"The absolute effect of COVID-19 on health care costs has yet to be realized," Commissioner Altman said. "However, as Pennsylvanians maneuver and assess the impact, the Insurance Department has worked diligently to keep rate increases low for consumer in the individual and small group markets. Last year's enactment of Act 42 creating the state exchange and Pennsylvania reinsurance program played a significant role in driving individual market premiums down for 2021 in fact, the reinsurance program is the reason individual market rates are decreasing rather than increasing this year.

"Increased options and lower costs will play a major role in helping consumers shop around for the plan that best suits their needs and these two positive changes are more reasons why the ACA must be protected."

As more Pennsylvanians file for unemployment due to COVID-19, coverage through the ACA may be an affordable alternative to COBRA for many people who have lost employer-sponsored coverage, especially in the event a consumer is eligible for tax subsidies, which can significantly lower the monthly cost of coverage.

Nearly nine out of ten Pennsylvanians who are currently enrolled in the Marketplace receive financial assistance. All of these Pennsylvanians receive assistance to pay for their monthly premium based on their income, and many also receive assistance to lower out-of-pocket costs like co-pays and deductibles.

Last month, Pennsylvania introduced Pennie, the new state-based health insurance marketplace for 2021 coverage. Pennie is available to all Pennsylvanians and aims to improve the accessibility and affordability of individual market health coverage. It is also the only place that connects Pennsylvanians to financial assistance to reduce the cost of coverage and care, previously available on Healthcare.gov.

Pennsylvanians can begin shopping for health and dental coverage through Pennie at the start of Open Enrollment on November 1, 2020. This year, Pennie extended the 2021 Open Enrollment Period from November 1, 2020 through January 15, 2021. Pennsylvanians currently enrolled through HealthCare.gov will be automatically transitioned to Pennie for their 2021 coverage. Pennie's goal is to make it easier for Pennsylvanians to access coverage through education, assistance, and improved customer service.

"Pennsylvanians will be able to shop for and purchase 2021 coverage through Pennie this Open Enrollment Period. Transitioning from HealthCare.gov to Pennie, the new state-based marketplace, gives us the flexibility to serve individuals and families in the way best suited for their needs," says Zachary W. Sherman, Pennie Executive Director. "In service to Pennie's goals of increasing access and affordability, we will generate millions in premiums savings for individual market customers through the Pennsylvania Reinsurance Program. Customers looking to learn more about Pennie and their options for shopping, financial qualification, and purchasing 2021 health coverage can visit pennie.com."

Consumers looking to learn more about health insurance and key Open Enrollment dates should visit the department's website.

Pennsylvanians with insurance questions can contact the Insurance Department Consumer Services Bureau online or at 1-877-881-6388.