2026 Final Gross Rate Changes - Pennsylvania: +21.5% (updated)

Originally posted 8/04/25

10/15/25: Scroll down for FINAL rate filings

via the Pennsylvania Insurance Dept:

Pennsylvanians can submit comments on rate requests and filings through September 2

Harrisburg, PA – The Pennsylvania Insurance Department (PID) today announced that the 2026 rate changes requested by insurance companies currently operating in Pennsylvania’s individual and small group markets are now available. On average, all Pennsylvania health insurers are requesting premium increases in plan year 2026: 19% increase to premiums in the individual market (for people who buy their own insurance), and a 13% increase to premiums in the small group market (for small businesses).

“This year, even more than previous years, Pennsylvanians should consider shopping around to find the best plans to meet their individual needs, at a price that makes sense for their current financial situation,” said Pennsylvania Insurance Commissioner Michael Humphreys. “Pennsylvania is fortunate to have a competitive health insurance marketplace with many plan options to choose from, and Pennie makes it easy to shop for plans that cover specific providers and medications. So, despite the increase in cost, PID is confident consumers will have numerous affordable insurance plans to choose from during Open Enrollment.”

The requested rate increases for Plan Year 2026 as filed by insurers are results of:

- The rising cost of health care;

- The higher use of benefits, including for more expensive outpatient services and medication; and

- The end of the Enhanced Premium Tax Credits (Tax Credits), which are set to expire on December 31, 2025, unless Congress acts to extend them.

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with PID for review and approval before plans can be sold to consumers, serving as an important consumer protection. The proposed rates reflect the expected claims and operational costs for the upcoming year. PID reviews rates to ensure that the rates are not excessive or inadequate – and are not unfairly discriminatory. The premiums consumers are charged will be based on the rates that are approved after review.

Public comment on rate requests and filings will be accepted through September 2, 2025, and can be emailed to ra-in-comment@pa.gov.

Rate filings for 2026 health insurance plans were submitted to PID on May 15, 2025. Proposed rate changes vary by plan and region and are subject to change as the department conducts its review process. Final approved rates will be made public in the fall.

Insurers who are currently selling in the individual market that propose selling plans in 2026 have filed plans requesting an average statewide increase of 19%. The rates are rounded to the nearest tenth and vary by region:

- Ambetter Health of Pennsylvania Inc: Average rate increase request 30.1% (rating areas 1, 2, 3, 4, 5, 6, 7, 8, and 9);

- Capital Advantage Assurance Company: Average rate increase request 26%; (rating areas 6,7 and 9);

- Geisinger Health Plan: Average rate increase request 14.1% (rating areas 2,3,5,6,7 and 9);

- Geisinger Quality Options: Average rate increase request 16.2% (rating areas 2,3,5,6,7 and 9);

- Health Partners Plans “Jefferson Health Plans": Average rate increase request 7.3% (rating areas 3, 6 and 8);

- Highmark Benefits Group Inc.: Average rate increase request 18% (rating areas 3 and 8);

- Highmark Coverage Advantage Inc.: Average rate increase request 14.1% (rating areas 1 and 4);

- Highmark Inc.: Average rate increase request 17.2% (rating areas 1,2,4,5,6,7 and 9);

- Independence Blue Cross (QCC Ins. Co.): Average rate increase request 16.7% (rating area 8);

- Keystone Health Plan Central: Average rate increase request 27.9% (rating areas 6,7 and 9);

- Keystone Health Plan East Inc.: Average rate increase request 23.5% (rating area 8);

- Oscar Health Plan of PA: Average rate increase request 22% (rating Areas 3, 6, 7 and 8);

- Partners Insurance Company Inc.: Average rate increase request -10.1% (rating area 3, 6, and 8);

- UPMC Health Options Inc.: Average rate increase request 11.7% (rating areas 1,2,3,4,5,6,7 and 9); and

- UPMC Health Plan Inc.: Average rate increase request 16.3% (rating areas 1 and 5).

Ambetter is a new plan for Centene in the individual market, transitioning from the previous plan, Pennsylvania Health & Wellness. UPMC Health Plan is a new plan for UPMC in the individual market, transitioning from the previous plan, UPMC Health Coverage.

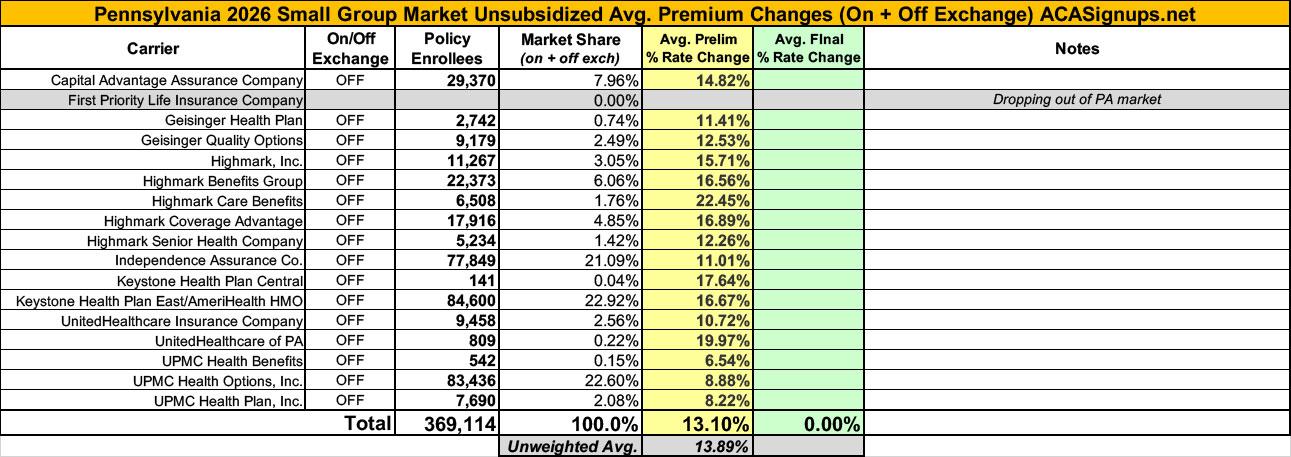

Insurers in Pennsylvania's small group market have filed 2026 plans requesting an average statewide increase of 13%.

- Capital Advantage Assurance Company: Average rate increase request 14.8% (rating areas 6 ,7, and 9);

- Geisinger Health Plan: Average rate increase request 11.4% (rating areas 2, 3, 5, 6, 7, and 9);

- Geisinger Quality Options: Average rate increase request 12.5% (rating areas 2, 3, 5, 6, 7, and 9);

- Highmark Inc.: Average rate increase request 15.7% (rating areas 1, 2, 4, 5, 6, 7, and 9);

- Highmark Benefits Group: Average rate increase request 16.6% (rating areas 6, 7, and 9);

- Highmark Care Benefits: Average rate increase request 22.5% (rating area 3);

- Highmark Coverage Advantage: Average rate increase request 17% (rating areas 1, 2, 4, 5, and 6);

- Highmark Senior Health Company: Average rate increase request 12.3% (rating area 8);

- Independent Assurance Company: Average rate increase request 11% (rating area 8);

- Keystone Health Plan Central: Average rate increase request 17.6% (rating areas 6, 7, and 9);

- Keystone Health Plan East/AmeriHealth HMO Inc.: Average rate increase request 16.7% (rating area 8);

- UnitedHealthcare Insurance Company: Average rate request 10.7% (rating areas 1, 2, 3, 4, 5, 6, 7, 8, and 9);

- UnitedHealthcare of PA: Average rate increase request 20% (rating areas 1, 2, 3, 4, 5, 6, 7, 8, and 9);

- UPMC Health Benefits: Average rate increase request 6.5% (rating areas 1 and 5);

- UPMC Health Options Inc.: Average rate increase request 8.9% (rating areas 1, 2, 4, and 5); and

- UPMC Health Plan Inc.: Average rate increase request 8.2% (rating areas 1, 2, 4, and 5).

UPMC Health Plan is a new plan for UPMC in the small group market, transitioning from the previous plan, UPMC Health Coverage. Highmark Care Benefits is a new plan for Highmark in the small group market, transitioning from the previous plan, First Priority Life Insurance Company.

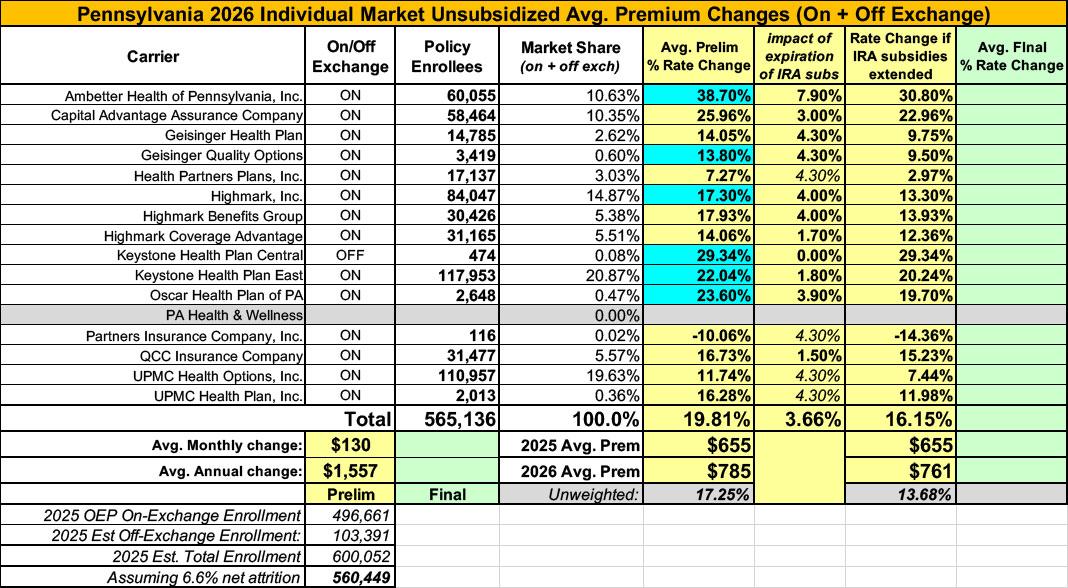

For carriers which don't publicly clarify how much the IRA subsidies expiring are impacting unsubsidized rate changes I'm substituting the CBO's projection of 4.3% for 2026 from last December.

It's important to remember that these are just for unsubsidized, full price premiums. The impact on net rate hikes for the vast majority of ACA exchange enrollees will be much higher than 19.2%.

NOTE: This press release and the accompanying filings were posted by the official Pennsylvania Insurance Dept. on August 1st. However, the federal rate review database has some different requested rate changes (for instance, they have Ambetter (30.08%) down as requesting a 39.51% avg. rate hike)...and even then, some of the actual actuarial filings themselves list a third requested rate (Ambetter Health of PA's says it's 38.7%).

UPDATE 8/14/25: I've decided to go ahead and update the rate changes for the carriers which differ from the PA PID website with revised rates on the filings themselves.

This results in a slight increase in the overall weighted average to 19.8%.

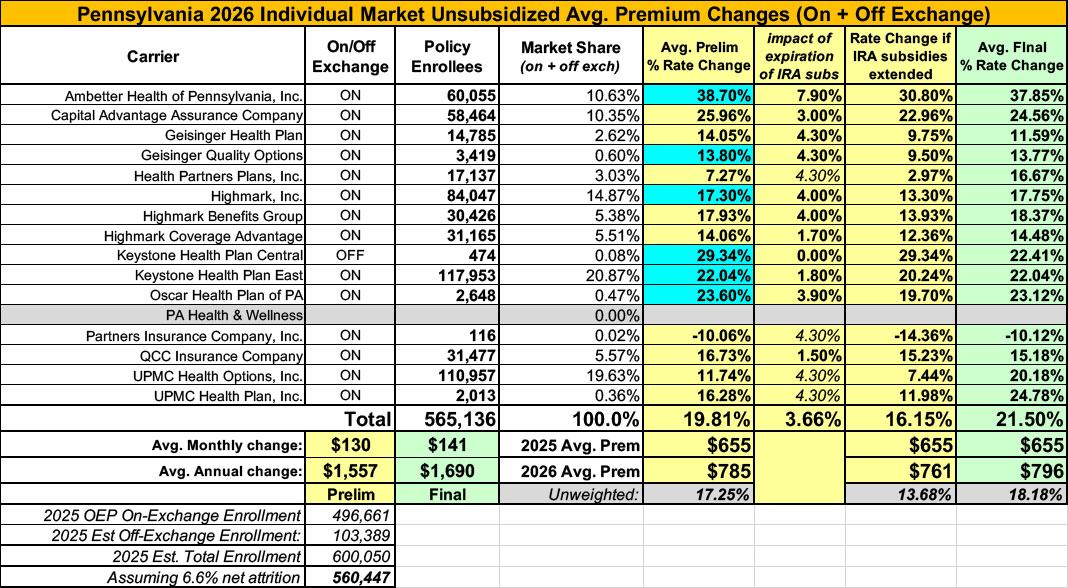

UPDATE 10/15/25: The Pennsylvania Insurance Dept. has posted the final/approved 2026 individual and small group market rate filing decisions:

Pennsylvania Insurance Department Releases Affordable Care Act 2026 Health Insurance Rates

Congress’s inaction is driving uncertainty and leading to higher costs for Pennsylvanians.

- Most Pennsylvanians will continue to find the lowest prices and financial savings through Pennie, but are encouraged to carefully compare plan options and costs.

- Shapiro Administration continues to advocate to Pennsylvania’s Congressional delegation for an extension of the premium tax credits to immediately reduce prices.

Harrisburg, PA – Today, the Pennsylvania Insurance Department (PID) released the final Affordable Care Act (ACA) health insurance rates for 2026. New federal rules on enrollment put in place by the Republican budget bill and Congress’s failure to extend enhanced premium tax credits (EPTCs) before Open Enrollment that begins November 1 has resulted in significant price increases for Pennsylvanians. Without swift action in Washington, Pennsylvania families will face significant increases on their insurance premiums for plan year 2026.

PID and Pennie, the state’s official health insurance marketplace, have repeatedly urged Congress to extend EPTCs and have sent multiple letters outlining the consequences of inaction on families throughout the Commonwealth. For example, a 60-year-old married couple in York County with $82,000 in annual income will see their yearly premium skyrocket from $7,032 to $35,712 per year. Congress can act now to extend the EPTCs and immediately reduce insurance rates by three to five percent. PID and Pennie stand ready to update insurance rates if Congress chooses to extend the EPTCs, but time is running out.

“These increases are higher than in recent years, even after PID’s strong rate review process blocked a number of excessive increases that insurers requested. Soon, Pennsylvanians who purchase their own coverage will be receiving renewal letters from their insurers and from Pennie that will contain prices that will be shocking. Congress still has the ability to act to protect Pennsylvania families, as well families across the country,” said Pennsylvania Insurance Commissioner Michael Humphreys. “Now, more than ever, we encourage consumers to shop when Open Enrollment begins this November.”

Overall premiums will rise in both the individual market (for people who purchase coverage on their own) and the small group market (for small businesses). The rate adjustments reflect ongoing uncertainty at the federal level along with an increase in medical and drug cost trends and utilization.

The spikes in premium rates are being seen across the country. In addition to new federal regulations and Congress’ failure to extend EPTCs, Rising health care costs, increasing cost and use of prescription drugs – as well as the number of individuals using more services and higher-cost care than insurers originally expected – have contributed to these nationwide premium increases.

PID’s Rate Approval Process

During the rate review process, PID carefully reviewed rate requests submitted by health insurance companies to confirm that their assumptions used to determine the premiums are reasonable and properly supported. Through the rate review process, PID denied $50.1 million in unjustified insurance premium increases.

Approved Rates

Pennsylvanians who buy their own coverage will see an average aggregate weighted rate increase of 21.5% in the individual market. These increases will vary significantly based on plan type, region, and individual circumstances

During the rate review process, PID worked directly with insurers to correct their projections when the data didn’t match current conditions. PID reduced the small group average increase to 12.7 percent, down from initial requests that averaged 13.1%.

In some cases, insurers offering coverage in the individual market had to correct their rate filings to account for higher medical prescription drug costs and worsening health trends (morbidity) in their rating area due to new federal regulations and Congressional inaction on EPTCs.

Specifically, in the individual market:

- Ambetter Health of Pennsylvania, Inc.: Requested rate increase of 30.1%; approved rate 37.8% due to worsening morbidity;

- Capital Advantage Assurance Company: Requested rate increase of 26.0%; approved rate 24.6%;

- Geisinger Health Plan: Requested rate increase of 14.1%; approved rate 11.6%;

- Geisinger Quality Options: Requested rate increase of 16.2%; approved rate 13.8%;

- Health Partners Plans, Inc.: Requested rate increase of 7.3%; approved rate 16.7% due to worsening morbidity and medical/drug trends;

- Highmark, Inc.: Requested rate increase of 17.2%; approved rate 17.7%;

- Highmark Benefits Group: Requested rate increase of 17.9%; approved rate 18.4%;

- Highmark Coverage Advantage: Requested rate increase of 14.1%; approved rate 14.5%;

- Keystone Health Plan Central: Requested rate increase of 27.9%; approved rate 22.4%;

- Keystone Health Plan East: Requested rate increase of 23.5%; approved rate 22.0%;

- Oscar Health Plan of PA: Requested rate increase of 21.6%; approved rate 23.1%;

- Partners Insurance Company, Inc.: Requested rate decrease of 10.1%; approved rate -10.1%;

- QCC Insurance Company: Requested rate increase of 16.7%; approved rate 15.2%;

- UPMC Health Options, Inc.: Requested rate increase of 11.7%; approved rate 20.2% due to worsening morbidity and federal regulatory changes; and,

- UPMC Health Plan, Inc.: Requested rate increase of 16.3%; approved rate 24.8% due to worsening morbidity and federal regulatory changes.

What this means for Pennsylvanians

Despite rising premiums, Pennie will continue to offer a range of coverage options, along with financial assistance for those who qualify. No two circumstances are alike. One Pennsylvanian may see premiums decrease, while another may see an increase – even if both purchase coverage through Pennie. Factors such as age, location, household income, family size, and market competition all affect what someone pays and what level of subsidy they may receive.

"At Pennie, we’ve heard from Pennsylvanians in every county about how essential high quality, affordable health coverage is both for life-saving care and protection from medical bankruptcy. We know that the end of the enhanced premium tax credits will put many across Pennsylvania in extremely difficult positions,” said Devon Trolley, Executive Director of Pennie. “Throughout these changes, Pennie will be here to provide up-to-date information and support about plan costs and options for 2026. All current Pennie enrollees should update their information and review their 2026 plan options during Pennie’s Open Enrollment Period, starting this November."

Most Pennsylvanians will continue to find the lowest prices and financial savings through Pennie, the state’s official health insurance marketplace. Only Pennie offers financial assistance to help lower monthly premiums and out-of-pocket costs.

All plans on Pennie include important consumer protections:

- Coverage for pre-existing conditions;

- Essential health benefits like preventive care, prescriptions, and hospital visits;

- Limits on what you pay each year and protection against emergency care cost; and,

- Multiple plan levels (bronze, silver, gold, platinum) and network types (HMO, EPO, PPO) with different coverage options.

Pennie's upcoming Open Enrollment period is the only time of year to enroll in individual and family health coverage for 2026. Open Enrollment typically runs from November 1 to December 15 for coverage that starts on January 1, 2026. Outside of Open Enrollment, only individuals with life changes – such as losing coverage from Medicaid and family events – can enroll.

Pennie offers free help by phone and in-person across the state. Visit pennie.com or call 1-844-844-8040 for assistance.

Consumers with questions or complaints about their health insurance can visitpa.gov/consumer or call 1-866-PA-COMPLAINT (1-866-722-6675).