2026 FINAL Gross Rate Changes - North Carolina: +27.7%; what happened to ~263,000 "missing" enrollees?? (updated)

Originally posted 8/04/25

via the North Carolina Insurance Dept:

Initial Affordable Care Act Rates for 2026 have been posted

The North Carolina Department of Insurance has posted the rate changes requested by insurers for the 2026 plan year individual and small-group market plans offered under the Affordable Care Act.

Posting of the requested rates is part of the rate review process required by the Centers for Medicare and Medicaid Services (CMS). Unlike some types of insurance, the NCDOI does not set rates for health insurance.

All insurers participating in the individual market are requesting increases for the 2026 plan year and some of the requested increases are significant. According to the insurers, in addition to the cost of health care, which continues to increase, there are other factors this year that are creating uncertainty and contributing to the requested increases. These other factors include the expiration of the enhanced subsidies that were introduced in the American Rescue Plan Act and then extended in the Inflation Reduction Act. The enhanced subsidies have reduced what many people pay for premiums and have led to increased enrollment in the individual market. Now, the expiration of these subsidies will make it more difficult for people to afford their premiums, and it is anticipated that many people will become uninsured.

As a result more healthy and younger people are expected to drop their coverages, leaving the pool more costly.

The effects of CMS’ 2025 Marketplace Integrity and Affordability Final Rule and the One Big Beautiful Bill Act, which make changes to the enrollment process are also impacting requested rates.

“These factors are affecting rates not just in North Carolina but all across the country,” said North Carolina Insurance Commissioner Mike Causey. “As part of the rate review process, NCDOI reviews the requested rates to make sure they are not excessive, inadequate or unfairly discriminatory, and exhibit a reasonable relationship to the benefits provided in the policy. NCDOI is carefully reviewing the requested rates to ensure that they are supported and meet all statutory requirements.”

Consumers with questions regarding their health insurance plans can contact NCDOI at 855-408-1212.

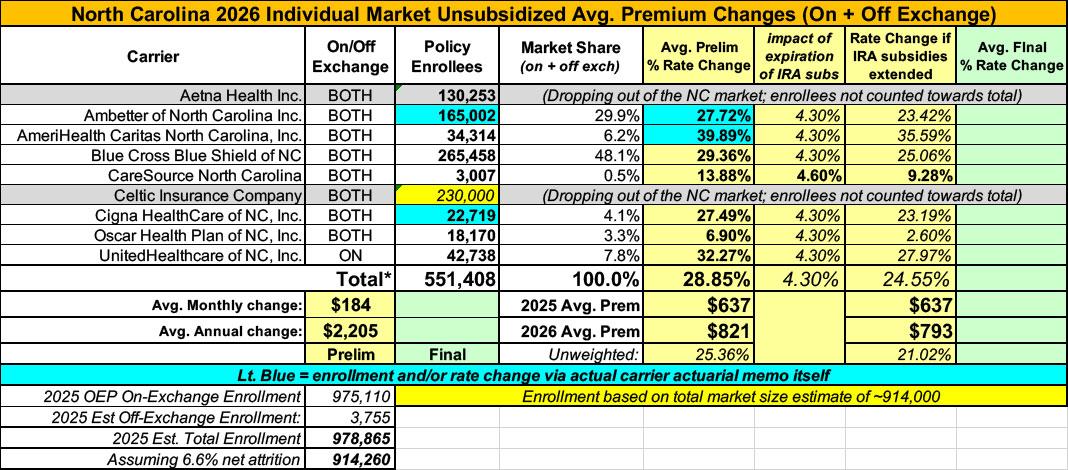

Here's the rate filing summary, although interestingly the initial filings are different for some of the carriers in the actual actuarial memos (in blue) than they are in the summary.

It's also important to note that while the filings listed only add up to around 551,000 enrollees, North Carolina actually as nearly twice as many as that enrolled in on-exchange plans alone, plus an unknown number of off-exchange enrollees. I'm assuming that most of the gap is due to both Aetna and Celtic dropping out of the NC individual market.

For carriers which don't publicly clarify how much the IRA subsidies expiring are impacting unsubsidized rate changes I'm substituting the CBO's projection of 4.3% for 2026 from last December.

It's important to remember that these are just for unsubsidized, full price premiums. The impact on net rate hikes for the vast majority of ACA exchange enrollees will be much higher than 28.9%.

UPDATE 8/14/25: I was able to get ahold of the withdrawal letter from Aetna, which clarifies that they have just over 130,000 current enrollees. That leaves ~230,000 presumably enrolled in Celtic plans, which sounds high to me but I'm not sure where else they could be.

I've also dropped my estimate of the total NC market size to ~914,000 based on CMS reporting a 6.6% net enrollment drop from January through April 2025.

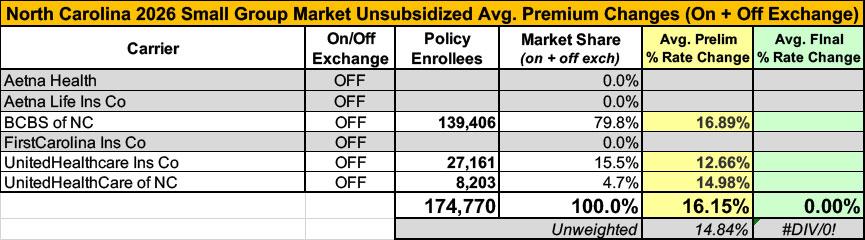

The NC small group market carriers are down to just three statewide: BCBS and 2 divisions of UnitedHealthcare, as Aetna and FirstCarolina are both dropping out of that market as well:

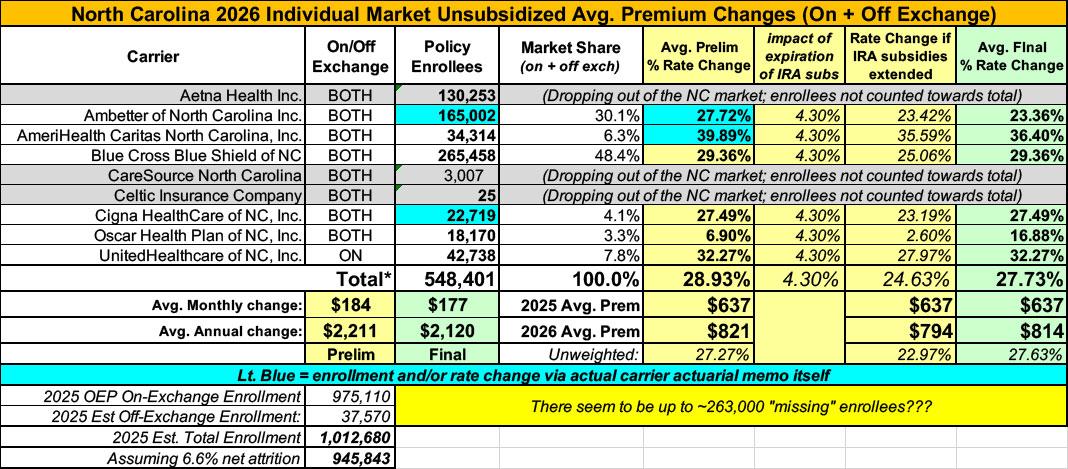

UPDATE 8/29/25: OK, the NC carriers have all published their approved 2026 rate filings. Three were approved as is; the other four:

- Ambetter: From 27.7% > 23.4%

- AmeriHealth: From 39.9% > 36.4%

- CareSource: From 13.9% > 30.8%

- Oscar: From 6.9% > 16.9%

However, there's also something weird: I had been assuming that the "missing" ~263,000 or so enrollees could be found in Celtic Insurance plans, which is also leaving the NC market. However, I managed to get ahold of Celtic's withdrawal letter after all (see PDF below), and according to it, they only have 25 enrollees. Not 25,000 or 2,500, but...25.

If all these numbers are accurate, that means there's still something like ~260,000 "missing" ACA enrollees in North Carolina. The only way to reconcile this would be if NC's enrollment attrition rate in 2025 has literally been 33% instead of the 6.6% national average as of April.

I find this extremely difficult to believe, especially given that every other state's confirmed enrollment number has been fairly close to my estimates. Furthermore, there hasn't been any noteworthy economic or policy change in North Carolina which would account for this, nor have there been any news stories about NC ACA enrollees fleeing in droves this year.

For a moment I thought the issue was that the NC DOI filing summary listed the enrollees as projected (that is, projected for 2026, not currently enrolled in 2025), except that the enrollment numbers listed match up with the current (spring 2025) numbers in 5 of the 7 actuarial memo summaries (the other two are redacted).

So...I'm not sure what to make of this.

In any event, NC's final/approved rate increase is down slightly, from 28.9% to 27.8%.

UPDATE 11/01/25: Oy, talk about a last-minute change. Someone tipped me off that CareSource is pulling out of the North Carolina ACA marketplace as well.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.