Trump set to reverse himself on tax credits...but with several poison pills included (updated)

Via Politico this morning, a mixed bag of good & bad news on the enhanced ACA tax credit saga today:

The White House expects to soon unveil a health policy framework that includes a two-year extension of Obamacare subsidies due to expire at the end of next month and new limits on eligibility, according to three people granted anonymity to discuss the unannounced plans.

...The White House plan is expected to include new income caps for enrollees to qualify for the ACA tax credits as well as minimum premium payments, according to the two people with direct knowledge of the proposal.

The planned eligibility cap would limit the subsidies to individuals with income up to 700 percent of the federal poverty line — aligning with what a bipartisan group of senators have been discussing separately, according to a fourth person granted anonymity to share knowledge of the negotiations.

Enrollees would also pay a minimum premium payment — a nod to concerns from conservatives that millions of Americans pay nothing in premiums while being unaware they are enrolled in ACA insurance plans.

The White House’s plan would call on Congress to appropriate funds for cost-sharing reductions, which would reduce out-of-pocket health costs for ACA plans.

The administration is also set to propose an option for enrollees to receive part of their tax credit in a tax-advantaged savings account if they move down to a lower-premium health plan. Many Republicans lawmakers favor the idea as a way to provide funds directly to people, as opposed to relying on indirect subsidies to insurance companies to drive down health costs. Trump himself has publicly endorsed the concept.

(sigh) OK, once again, the devil is in the details and obviously any or all of the provisions above could change dramatically as negotiations happen, but here's my initial take on each of them as presented above:

- Two years?

As I noted in my analysis of the bipartisan "HOPE Act" last week, bumping the enhanced subsidies out by only 2 years is clearly designed to simply kick the can down the road past the midterms. Again, this is one of the things I strongly argued against Dems agreeing to before the government shutdown, but there's no way Republicans are gonna agree to a permanent extension, and if nothing else, limiting it to two years would put the healthcare issue right back on the table again ahead of the 2028 election cycle when Democrats will hopefully have flipped at least one chamber of Congress, so...fine, I can live with this one.

- Subsidy Cliff returns at 700% FPL?

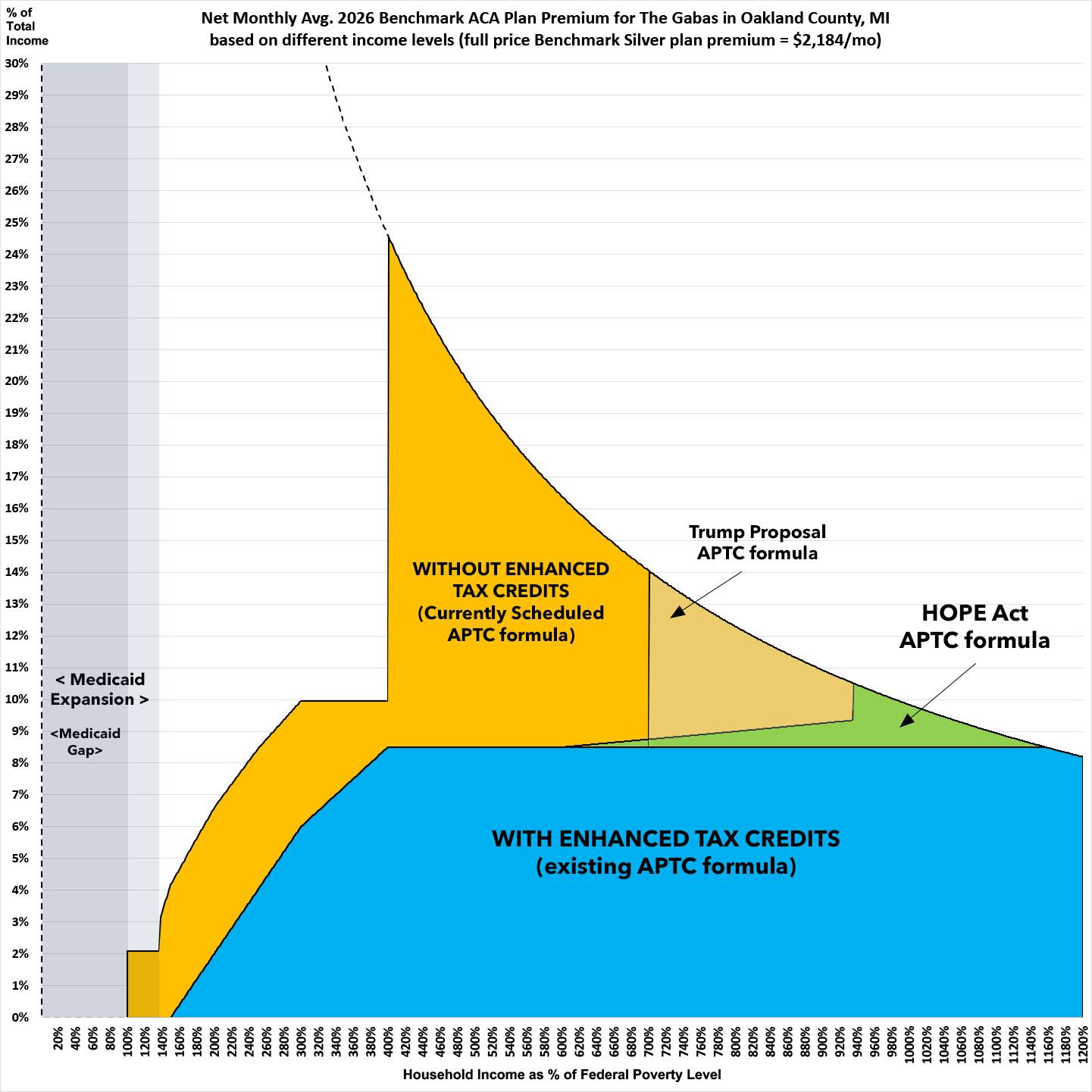

Ugh. In my breakout of the HOPE Act, I noted that while I'd prefer not to bring back the Subsidy Cliff at all, I could live with it being brought back at perhaps 1000 - 1200% of the Federal Poverty Level (FPL). The HOPE Act would bring it back at 935% FPL, along with slightly ramping up the percent of income enrollees earning 600 - 935% FPL would have to pay for the benchmark Silver plan...and while I didn't find this to be ideal, I said it was reasonable and that if that was where the line ended up settling, I'd be OK with it.

Letting the Subsidy Cliff return at 700% FPL, on the other hand, would be a pretty major concession on Democrats part.

700% FPL will be $109,550/yr in 2026 for a single adult or $186,550 for a family of four. While that's a solidly middle-class income, it still means that even a vanilla Silver HMO plan would cost a huge chunk of income for anyone even one dollar over those thresholds in most states.

On the one hand, in Idaho, which has the least-expensive ACA plans next year, it would be fine: At 701% FPL, the benchmark plan would cost less than 8% of a single 50-yr old's income and a not-too-terrible 10.4% of a family of four's income.

In West Virginia (which has the most-expensive ACA plans), however, it would still be a disaster: At 701% FPL, the benchmark plan would cost 16% of the 50-yr old's income and a stunning 22% of the family of four's income.

But it's really older enrollees with higher income who would be screwed just as badly as they're currently scheduled to be: A 64-yr old couple earning $150,000 would still be hit for over 18% of their income for premiums alone even in Idaho, and in West Virginia that same couple would have to pay a jaw-dropping 40% of their gross income in premiums alone.

The graph below shows what this would look like for my own family here in Michigan, which is in the towards the lower end when it comes to average full-price premiums. Again, we're a couple in our 50's with one college-age son.

Only around 8% of ACA exchange enrollees earn more than 700% FPL, but we're really starting to push into unacceptable thresholds here, especially for households in states like WV, AK, WY, VT, AK & CT where the enrollees are over 55.

My take: If the 700% FPL cut-off was the only change to the current tax credit arrangement involved and there were no other provisions included in the bill, I'd probably reluctantly take it, though I'd push hard to bump it up to 800% or higher.

- Mandatory minimum premium?

Unfortunately, the 700% FPL cliff is not the only change apparently involved.

It looks like Trump's proposal is going to include a requirement that every enrollee pay a minimum of $5/month, even if the normal tax credit formula would normally make them eligible to pay $0/month in premiums.

The purported rationale for this is supposedly to crack down on enrollment fraud. As I explained back in September:

One legitimate criticism of how the ACA functions which was first reported on by Julie Appleby of KFF has been the rise of broker fraud, in which unscrupulous health insurance brokers have apparently been secretly either enrolling people into ACA exchange plans without the enrollee's knowledge or permission, or switching them from one plan to another without their knowledge/permission, in order to pocket the commission.

There are various ways this has been taking place, and there have been a variety of measures taken by both HealthCare.Gov and state-based ACA exchanges to crack down on this issue, but one reason the instances have grown over the past few years is because the eAPTC also mean millions more Americans have become eligible for $0-premium plans.

While this is a good thing in terms of administrative burden and affordability for very low-income enrollees, it does make it easier for brokers to commit fraud as well, since if the enrollee never actually receives an invoice (even for just $1 or so), they're far less likely to find out that they're even enrolled in an insurance policy (at least until they file their taxes the following year and have to reconcile their income vs. the APTC via IRA form 8962, that is).

The problem with this is twofold: First, while $5/mo may sound like a nominal price to pay, for lower-income enrollees who may earn as little as ~$16,000/year (just ~$1,333/month), even $5/month could mean the difference between paying your insurance premium and putting food on the table or keeping your electricity on. Since the sole official justification for having a mandatory minimum is supposedly to ensure that all enrollees receive an invoice every month to make sure they're aware that they're enrolled in a given policy, there's no reason to make such a minimum any more than $1/month (or even $0.01/month).

Even then, as my friend & colleague David Anderson has repeatedly pointed out (and as Matt Fiedler of the Brookings Institute has published a study proving), the administrative burden imposed by even a token minimum premium (whether $5, $1 or even $0.01/month) would likely lead to hundreds of thousands of lower-income Americans losing coverage entirely:

A substantial research literature has examined how being subject to a $0 premium—as opposed to a small positive premium—affects insurance enrollment outcomes. Across a variety of settings, the clear finding is that being required to pay a premium, even a very small one, meaningfully reduces enrollment relative to being subject to no premium at all.

Two studies have examined this question in the Marketplaces specifically. One study examined instances in Massachusetts’ Marketplace in which an enrollee’s plan changed from having a $0 premium in one year to a $1 premium the next plan year. The authors estimate that enrollment was 12% lower among those subject to a $1 premium relative to those who remained subject to a $0 premium. Another study examined Colorado’s Marketplace and compared people just above and just below income thresholds at which enrollees lost eligibility for $0 bronze plans; the results imply that being subject to a positive premium reduced enrollment by 8-16% (depending on the precise methodology used).

Research has also examined this question in contexts beyond the Marketplace. A study of Wisconsin’s Medicaid program compared enrollment outcomes just above and just below an income threshold at which the state applied nominal premiums to some enrollees. It finds that being subject to a premium reduced average enrollment duration by 13%. Similarly, a study of Massachusetts’ pre-Affordable Care Act insurance exchange examined instances where enrollees newly became subject to a small positive premium at the start of a new plan year (much like in the study of Massachusetts’ Marketplace described above); it finds that being subject to a small premium would have substantially reduced coverage absent a state policy that automatically transitioned enrollees back to $0 coverage.

These studies also examine why being subject to even a very small premium reduces enrollment. In each case, the main factor appears to be that paying a premium adds an additional administrative step to the process of enrolling and staying enrolled in coverage: remitting the premium. That step appears to trip up some enrollees

The Trump Regime tried to impose a $5/mo minimum premium on every enrollee no matter what via regulatory changes last spring. Thankfully, a federal court put the kibosh on them doing so. Now, I admit that I suggested a $1/month minimum premium could be a potential negotiation point for Democrats, but $5 would be utterly unnecessary, and after discussing it with Anderson and reading Fiedler's analysis I'm walking that back myself.

Furthermore, as I noted last week, if the actual goal was to crack down on enrollment fraud, imposting stricter penalties & enforcement of the law over broker fraud is a much more logical area to focus on, since that's where the actual problem lies. The HOPE Act includes several strong measures to resolve these problems without having to use invoices as an alert system.

My take: I'd probably very reluctantly accept a $1/mo mimimum, but $5/mo should be a non-starter as far as I'm concerned....and again, I've mostly come around to Anderson & Fiedler's view that any sort of mandatory minimum should be unacceptable...especially if it was in conjunction with the remaining two provisions, both of which would be devastating to lower-income enrollees on the exchange:

- Goodbye Silver Loading?

Hoo boy. The irony involved if this were to happen would be absolutely off the charts. As I wrote back in May when this provision was being considered by Senate Republicans (they eventually removed it from the #BigUglyBill at the time, thankfully):

In a bit of tremendous irony, in attempting to sabotage the ACA, Donald Trump ended up unintentionally strengthening it. (And no, I guarantee you this was not some type of 11th Dimensional Chess move on his part; he barely understands how the ACA works much less how CSR subsidies operate).

By 2019, nearly every carrier in every state was Silver Loading, and as of today I think Mississippi is the only state which doesn't, though I could be wrong about that.

Silver Loading has resulted in millions of subsidized ACA exchange enrollees receiving more financial help than they would have otherwise, since a Bronze or Gold plan would now cost either about the same, less, or even nothing in premiums depending on where the enrollee lives.

This meant that the carriers got to be made whole on their CSR losses while millions of enrollees received more financial help and thus had lower net premiums for their policies.

...Here's the thing: If cutting off CSR reimbursement payments resulted in Silver Loading becoming widespread, and Silver Loading led to higher APTC subsidies...what would be the results if the reverse were to happen?

Well, if CSR reimbursement payments were to be reinstated, that would mean that Silver Loading would end...and if Silver Loading ended, that should lead to Silver plan premiums dropping again...and if Silver plan premiums dropped, that would lead to reduced APTC subsidies.

The only people who would be helped by officially reinstating CSR reimbursement payments would be unsubsidized enrollees...and as I noted above, only a small portion of ACA enrollees earn more than 400% FPL and an even smaller percent earn more than 700% FPL...while in the meantime, Silver Loading (which is enhanced further yet by Premium Alignment) is hugely helpful for all subsidized enrollees who earn more than 200% FPL (who make up around 35% of the ~24 million total ACA exchange enrollees).

In other words, funding CSR reimbursement payments would help a tiny sliver of higher-income enrollees while actively hurting huge numbers of moderate-level enrollees.

Now, if the offer on the table was a permanent extension of the current enhanced APTC formula without the (higher) Subsidy Cliff or the minimum premium, I might be open to it...but not on top of those.

Everything about the way that Silver Loading works sounds ass-backwards, so it's only fitting that I, a die-hard supporter of the ACA, am recommending NOT letting CSR reimbursement payments be formally reinstated.

- HSAs Luring People into Bronze Plans?

I already wrote up my take on the "Health Savings Accounts for All!" (or Flexible Spending Account) proposal which LA GOP Senator Bill Cassidy has such a fixation on a week or so ago. At the time I said:

In summary, my best read of Cassidy's proposal is that it would be cumbersome, confusing and pointless at best, and a complete disaster at worst...especially if they try to ram it through in the next 6 weeks without thinking through the ramifications of such a drastic policy change on such short notice.

Even my most favorable take on the proposal assumed that it would include a dollar-for-dollar equivalent for all enrollees regardless of what plan they enrolled in...which clearly isn't what they have in mind. Instead, enrollees would only be eligible to convert "part" of their tax credits into an HSA if they enroll in a Bronze plan only. This would be a serious push in the wrong direction towards less-comprehensive coverage instead of more comprehensive coverage as the current APTC/CSR arrangement encourages.

Over the past few years, the combination of the enhanced premium tax credits along with Silver Loading policies in most states and Premium Alignment policies in over a dozen states have led to a dramatic increase in the average actuarial value of ACA enrollees nationally.

Anything pushing people into low-AV Bronze plans--especially lower income enrollees who are normally eligible for 94% or 87% AV "Secret Platinum" plans--is a bad idea whether the enrollees realize it or not.

If killing off Silver Loading hurts those in the 200 - 700% FPL income brackets, pushing people into Bronze plans when they should be embracing "Secret Platinum" Silver plans hurts those who earn less than 200% FPL...who also make up a whopping 65% of all ACA exchange enrollees. PASS.

In short, the first two bullets (2 years, 700% Cliff) are barely acceptable; the third (minimum $5 premium) is a borderline deal killer for me, and the last two (killing Silver Loading & pushing Bronze HSAs) are deal killers in my book.

UPDATE: Welp. Apparently Trump's proposal, which hasn't even been actually rolled out yet, was already dead before I even hit "publish" on this post:

absolutely incredible -- CNN host introduces a segment about Trump's "new healthcare proposal," but less than two minutes later breaks into her script to announce "breaking news" that Trump's healthcare proposal is being postponed

CONFIRMED: Trump WH is delaying an announcement on a health care plan — will not be this week. (As of now.) This as Republican members of Congress, including senior members expressed outrage at being left out of any process on what they all know is a critical issue - affecting huge #s of constituents. Anger is not just at the WH but also at @SpeakerJohnson. This has been quickly rising and the idea of a WH-only sudden hc plan has rank and file fuming at their leader.

UPDATE x2 DANGER WILL ROBINSON:

I'll be posting a more detailed follow-up later today, but it looks like Trump's aborted (?) proposal is even worse than I thought...CNN provides some additional details, all of which are MASSIVE red flags:

The framework floated a range of other conservative priorities, such as expanding the availability of plans outside the ACA exchanges and imposing new restrictions on the use of federal funds for gender-affirming care or health care for undocumented immigrants.

...and even more details from the conservative Washington Times:

...One option is a requirement that everyone pay 2% of their income, or at least $5 per month, for lower-tier plans.

...The draft of the White House plan would allow those in lower-tier plans, such as the bronze-level or catastrophic plans, to put money into health savings accounts.

It would also codify the “program integrity rule” to further help root out fraud, waste and abuse.

Again, I'll be writing a deeper dive into each of these later, but suffice to say that they're all horrible, and Democrats should fight against any of the above conditions.