2026 Final Gross Rate Changes - Nevada: +22.3% (updated - significant increase from preliminary)

Originally posted 8/05/25

via the Nevada Insurance Dept:

JULY 31st, 2025 - Nevadans Get a Preview of 2026 Proposed Health Insurance Rate Changes for Upcoming Open Enrollment

[CARSON CITY, NV] - Starting August 1st, Nevada consumers who shop for their health insurance on the individual health insurance market can view and provide comments on proposed rate changes for Plan Year 2026.

The Nevada Division of Insurance (Division) has received and made public on its website the 2026 proposed rate changes from health insurers intending to sell plans on and off the Silver State Health Insurance Exchange (the "Exchange"). The Exchange is the state agency that assists eligible Nevada residents to purchase affordable health and dental plans.

"Transparency and consumer choice remain top priorities for the Division," said Acting Insurance Commissioner Ned Gaines. "This preview gives Nevadans a valuable opportunity to assess upcoming options, including the new Battle Born State Plans, and make informed decisions about their health coverage ahead of the Open Enrollment period starting November 1st."

For the first time, on-exchange consumers will also have access to the Battle Born State Plans, new plan options that may offer additional opportunities for savings and expanded coverage tailored to the needs of Nevadans.

From the Nevada State Health Authority:

"The Nevada Health Authority was granted a federal waiver that allows the State of Nevada to offer high-quality individual health insurance plans, known as Battle Born State Plans, at a discounted monthly premium. Beginning in 2026, these qualified health plans will be available statewide exclusively through NevadaHealthLink.com. Like all plans on the Marketplace, they cover all ten essential health benefits, including hospitalization, doctor visits, emergency care, lab work, and prescription drugs. The key difference: Battle Born State Plans must meet specific premium reduction targets, meaning more Nevadans may have access to affordable coverage, regardless of income.

Additionally, thanks to the Governor's Market Stabilization Program, the federal savings from the Battle Born State Plans will support a new market-wide reinsurance program beginning in 2026 that will also support lower premium costs for all Nevadans.

We encourage all Nevadans to review their coverage options on NevadaHealthLink.com during the October window-shopping period to find a plan that best fits their needs and budget. Free assistance from a certified enrollment professional can be obtained using Nevada Health Link's 'Find Local Assistance' tool. This year's Open Enrollment runs from November 1, 2025, through January 15, 2026."

The Open Enrollment period for 2026 will run from November 1, 2025, through January 15, 2026. During open enrollment, Nevadans can shop for On-Exchange health insurance plans by visiting NevadaHealthLink.com or by calling (800) 547-2927.

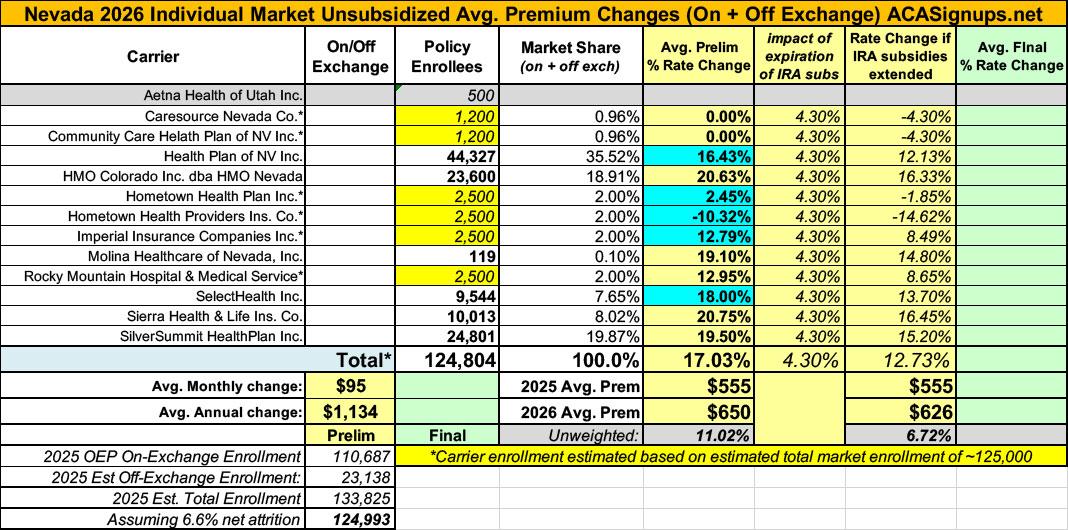

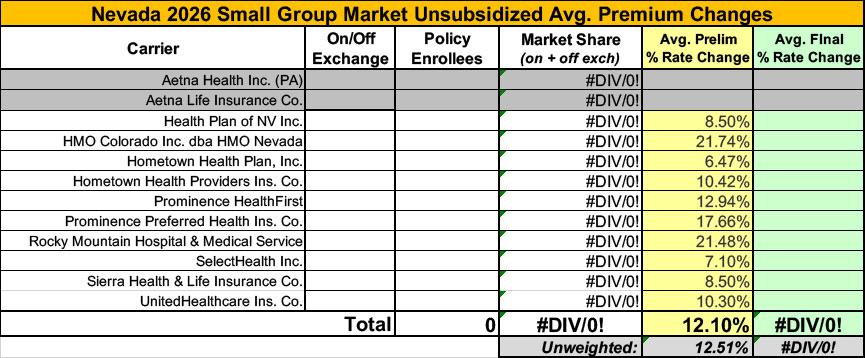

Based on the rate submissions received by the Division for 2025 plans, the overall individual market has a proposed average rate increase of 17.5% with a total of twelve companies and 210 plans from which consumers can choose. Of those plans, 157 will be available to consumers through the Exchange. The small group market has a proposed average rate increase of 12.1% with a total of ten companies and 276 off-exchange plans.

Below is a breakdown of all insurance companies that will be offering health insurance plans on the 2026 individual health insurance market:

- CareSource Nevada

- Community Care Health Plans of Nevada dba Anthem Blue Cross and Blue Shield

- Health Plan of Nevada

- HMO Nevada

- Hometown Health Plan

- Hometown Health Providers (Off-Exchange only)

- Imperial Insurance Companies (On-Exchange only)

- Molina Healthcare of Nevada (On-Exchange only)

- Rocky Mountain Hospital & Medical Service, Inc., D.B.A. Anthem Blue Cross

- Select Health

- Sierra Health & Life (Off-Exchange only)

- SilverSummit

For additional information or to submit comments on proposed rate changes, Nevadans can visit http://doi.nv.gov/rate-filings and select search criteria from the drop-down menus: Company Name, Status (defaults to Under Review), and Insurance Type. From there consumers can select a specific carrier to view rate filing details and input comments in the text box towards the bottom of the page.

Approved rates will be posted on the Division's website on October 1, 2025.

Unfortunately I've only been able to acquire the actual enrollment totals for about half of the NV carriers, but the press release clarifies that the weighted statewide average rate increase is 17.5%. Also, while the total of the 6 carriers with enrollment data add up to 112,404 enrollees, on-exchange enrollment alone as of the end of the 2025 Open Enrollment Period was 110,687, so there are definitely some missing enrollees across the remaining 6 carriers.

For carriers which don't publicly clarify how much the IRA subsidies expiring are impacting unsubsidized rate changes I'm substituting the CBO's projection of 4.3% for 2026 from last December.

It's important to remember that these are just for unsubsidized, full price premiums. The impact on net rate hikes for the vast majority of ACA exchange enrollees will be much higher than 17.5%.

UPDATE 8/14/25: There were some revised rate filings submitted, plus I've revised my estimate of total market enrollment to ~125,000; this has resulted in a slight reduction of the weighted overall average to 17.0%.

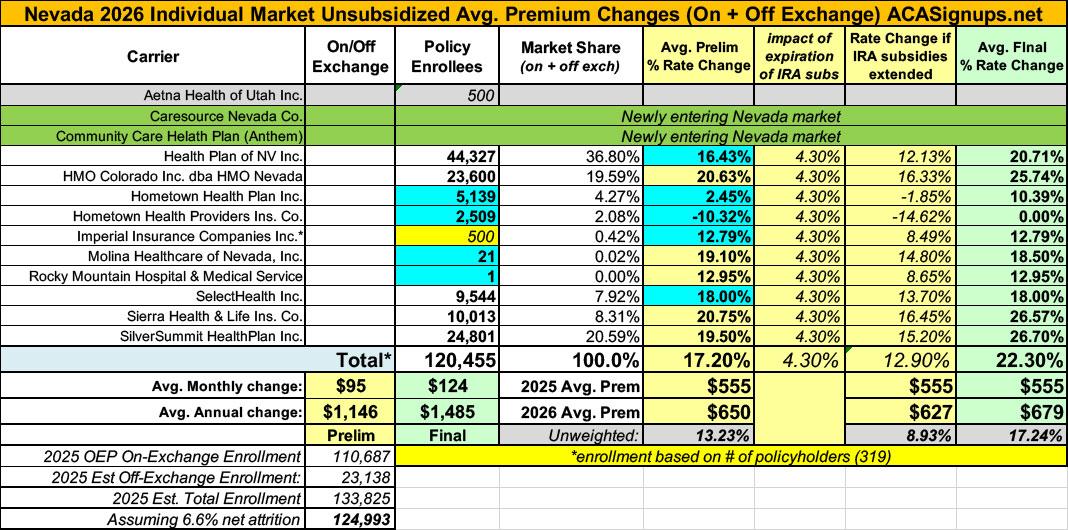

UPDATE 9/2/25: Nevada insurance carriers have posted their approved 2026 individual market filings, which also fill in some of the data gaps I had.

- It turns out Caresource and Community Care Health Plan are both newly entering the market, which means neither one has any current enrollees

- I was able to fill in the actual current enrollment figures for both Hometown Health Plan and Hometown Health Providers (with a caveat on the latter) as well as Rocky Mountain, which only has a single enrollee.

- I reduced the estimated enrollments for both Imperial and Molina based on the actual number of policyholders in each.

- In addition, the final/approved rate changes for most of the carriers was increased beyond the original request (a few were approved as is and one was reduced slightly)

The end result of all of this is an increase in the weighted average rate hike from 17.2% to 22.3%.

Health Plan of Nevada:

This Health Plan of Nevada, Inc. (HPN) individual health rate filing (SERFF Tracking Number: SRHA-134556761) submitted 06/03/2025 has been reviewed by the Nevada Division of Insurance (DOI). HPN had proposed an overall average rate increase of 20.70% with a maximum increase of 28.13% to be effective 01/01/2026. The DOI’s review focused on compliance with Chapters individual 689A, and 686B of the Nevada Revised Statues and the Health and Human Services Final Rate Review Regulation Part 154 Health Insurance Issuer Rate Increases: Disclosure and Review Requirements. Based on the reviews of the relevant items listed in section 154.301 of the HHS Final Rate Review Regulation, it has been determined that a 20.70% rate increase is not unreasonable.

HMO Colorado dba HMO Nevada:

This HMO Colorado, Inc DBA HMO Nevada (HMO Colorado) individual health rate filing (SERFF Tracking Number: ATEM-134471264) submitted 05/30/2025 has been reviewed by the Nevada Division of Insurance (DOI). HMO Colorado had proposed an overall average rate increase of 25.74% with a maximum increase of 33.76% to be effective 01/01/2026. The DOI’s review focused on compliance with Chapters individual 689A, and 686B of the Nevada Revised Statues and the Health and Human Services Final Rate Review Regulation Part 154 Health Insurance Issuer Rate Increases: Disclosure and Review Requirements. Based on the reviews of the relevant items listed in section 154.301 of the HHS Final Rate Review Regulation, it has been determined that a 25.74% rate increase is not unreasonable.

Hometown Health Plan:

The average rate change from January 1, 2025 to January 1, 2026 is 10.4%. The average change for a given plan ranges from 6.6% to 14.7%. The increase will impact 5,139 individuals. The primary factors causing a range of rate changes are as follows:

Hometown Health Providers Insurance Co:

The average rate change from January 1, 2025 to January 1, 2026 is 0.0%. The average change for a given plan ranges from 0.0% to 0.0%. The increase will impact 2,509 individuals. The primary factors causing a range of rate changes are as follows:

NOTE: There's some discrepancy here, since another filing form for Hometown Health Providers states their rates are being reduced by 3.8% but that they have 0 enrollees,

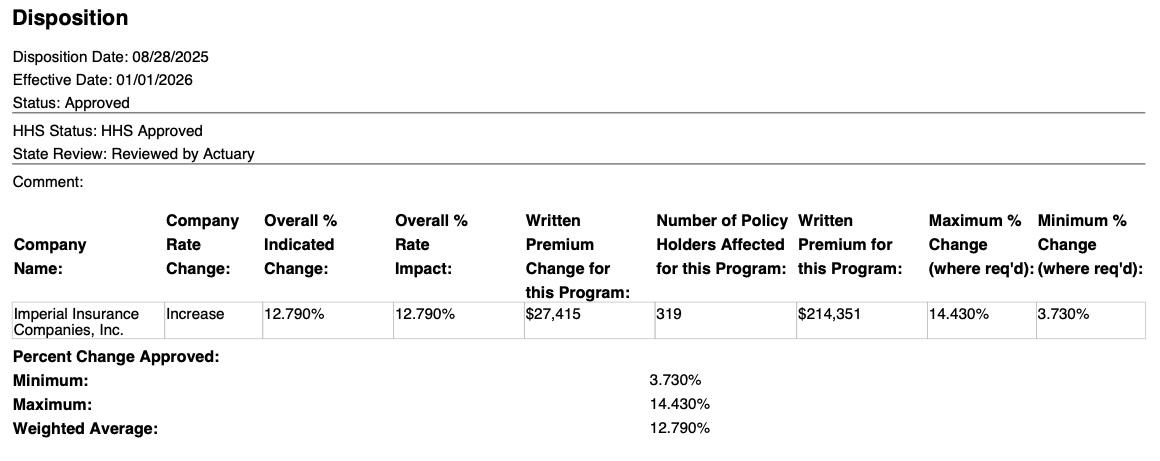

Imperial Insurance Companies:

Molina Healthcare of NV:

1. Scope and range of the rate increase: Molina’s proposed rates represent an average rate decrease of 18.5% for the 21 Molina members enrolled in continuing plans effective April 2025. The proposed rate changes vary by metal tier. Members would receive premium increases of on average of 18.5% and the rate increase would range from 15.3% to 19.2% depending on their geographic location, metal tier, and age.

Rocky Mountain Hospital & Medical Service:

Rocky Mountain Hospital & Medical Service has made an application to the Nevada Department of Insurance for premium rate changes for its fully ACA‐compliant individual health plan products. This increase will impact approximately 1 Nevada insured members renewing on 1/1/2026 with Rocky Mountain Hospital & Medical Service. The rate increase for this plan is 13.0%. A subscriber’s actual rate could be higher or lower depending on the geographic location, age characteristics, dependent coverage and other factors.

Sierra Health & Life:

SHL is filing 2026 rates for individual products. The proposed rate change is 26.57% and will affect 10,013 individuals. The rate changes vary between 21.76% and 32.85%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

SilverSummit:

Explanation of the Rate: SilverSummit Healthplan, Inc. has filed rates with the Nevada Division of Insurance for its Individual Affordable Care Act (ACA) products in Nevada. The proposed rate change of 26.7% applies to approximately 24,801 individuals. These rates will be offered statewide and will be in effect for the entirety of 2026.