2026 Final Gross Rate Changes - Illinois: +28.8% avg

originally posted 6/23/25

via the Illinois Dept. of Insurance:

Affordable Care Act (ACA) - Illinois Rate Filings

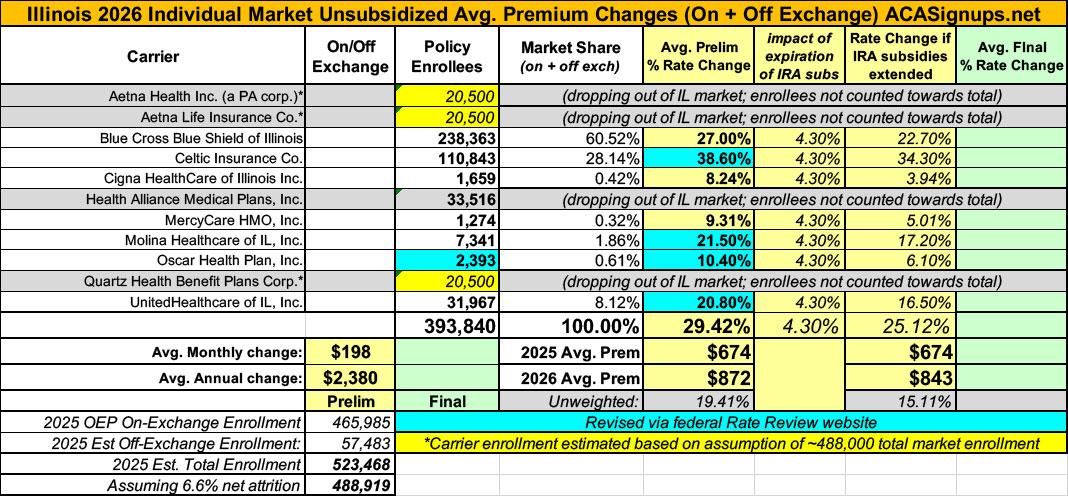

The chart below contains proposed rates for Plan Year 2026, which will be reviewed for compliance with federal and state requirements.

Please submit any comments on the initially proposed Plan Year 2026 rates to DOI.HealthRateReview@illinois.gov by July 11, 2025.

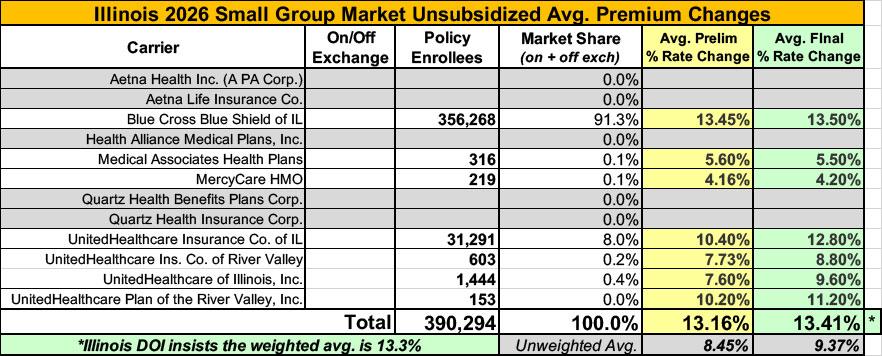

The good news is, the Illinois Insurance Dept. now provides a handy, simple table with the actual average rate changes as well as direct links to the actuarial memos & other filing forms for every carrier, which made it easy for me to plug in the effectuated enrollment & calculate the weighted average rate hikes for every carrier in both the individual and small group markets.

The bad news is, some of the actuarial memos themselves are heavily redacted, meaning I'm unable to see how much of the rate hikes are due to the IRA subsidies expiring, CSR payments being reinstated or Trump's tariffs.

It's also worth noting that Aetna and Health Alliance Medical Plans are dropping out of both markets, as is Quartz Health.

The individual market for the remaining carriers only adds up to 394,000 enrollees, plus another 33,500 in Health Alliance. That leaves ~61,500 unaccounted for, which I'm allocating to Aetna Health, Aetna Life and Quartz equally.

In any event, the weighted average hike being requested is a painful 23.4% on the individual market and a less-painful (but still ugly) 13.2% for small group plan enrollees.

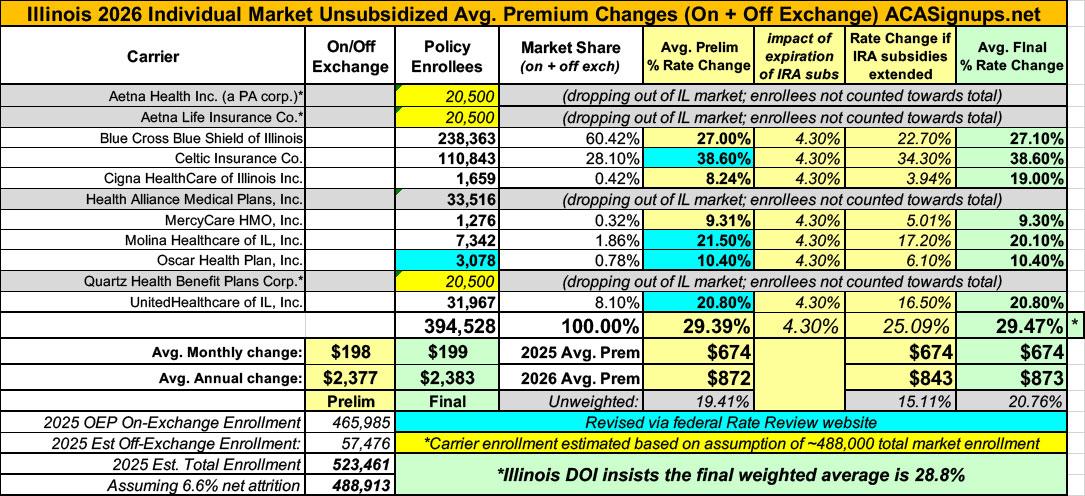

UPDATE 8/14/25: Ugh. Revised rate filings have been submitted to the federal rate review database (see file attachments below), and several of them have dramatically increased their 2026 average rate hike requests:

- Celtic: from 18.7% to 38.6%

- Molina: from 14.8% to 21.5%

- Oscar: from 0.2% to 10.4%

- UnitedHealthcare: from 17.9% to 20.8%

In addition, I was able to find the actual number of current enrollees in Health Alliance Medical Plans (which is dropping out) while also revising my estimate of the total market size to ~488,000 people, which allows me to estimate the number of enrollees in Aetna (dropping out) and Quartz.

The net result of all of this is that the weighted average for Illinois individual market rate hikes has risen by 6 more points to 29.4%.

UPDATE 9/8/25: The Illinois Dept. of Insurance has issued their final/approved decisions on the 2026 rate filings, and the net result is a slight decrease in the weighted average to 28.8% (even though my own math has it coming in ever so slightly higher).

The same is true with the small group market, where they've shaved the avg. rate hikes down a smidge to 13 .3%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.