How much more will ~200,000 MINNESOTA residents pay if the enhanced ACA subsidies expire? (updated)

Originally posted 12/03/24

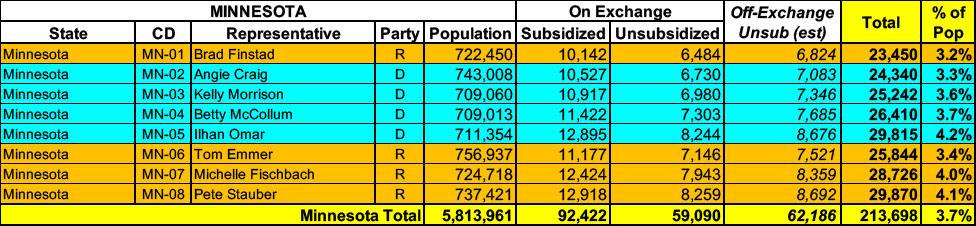

Minnesota has around 151,000 residents enrolled in ACA exchange plans, 61% of whom are currently subsidized. I estimate they also have another ~62,000 unsubsidized off-exchange enrollees.

Combined, that's ~213,000 people, although assuming the national average 6.6% net enrollment attrition rate applies, current enrollment would be back down to more like 200,000 statewide.

In early 2021, Congressional Democrats & President Biden passed the American Rescue Plan Act (ARPA), which dramatically expanded & enhanced the original premium subsidy formula of the Affordable Care Act, finally bringing the financial aid sliding income scale up to the level it should have been in the first place over a decade earlier. They then extended the subsidy upgrade out by another 3 years via the Inflation Reduction Act.

In addition to beefing up the subsidies along the entire 100 - 400% Federal Poverty Level (FPL) income scale, the upgrade eliminated the much-maligned "Subsidy Cliff" at 400% FPL, wherein a household earning even $1 more than that had all premium subsidies cut off immediately, requiring middle-class families to pay full price for individual market health insurance policies.

Unfortunately, the improved subsidies are currently scheduled to end effective December 31, 2025. Needless to say, with Republicans holding a trifecta, it's highly unlikely that the IRA's enhanced subsidies are going to be be extended further. They had the opportunity to do so as part of H.R. 1 (the so-called “Big Beautiful Bill”), but chose not to.

It gets worse:

In addition, the so-called “Affordability & Integrity Rule” put into place by RFK Jr., & Dr. Oz at the Centers for Medicare & Medicaid Services (CMS) is causing 2026 subsidies to be even less generous and gross premiums to increase even more.

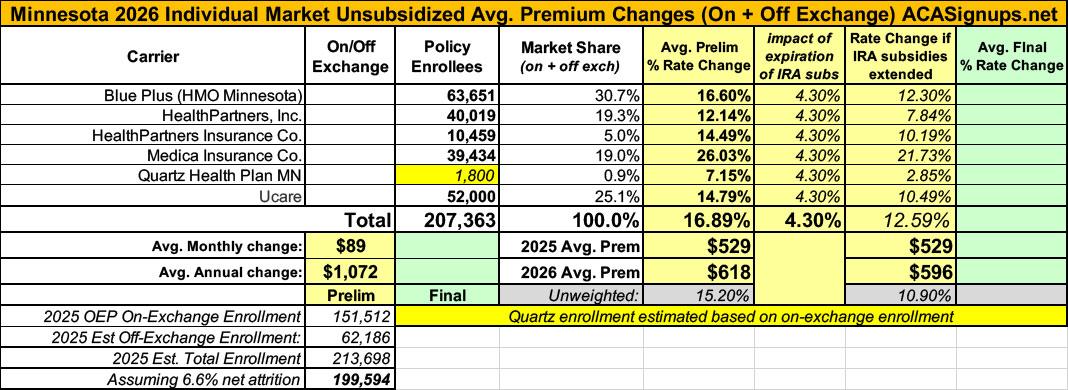

In Minnesota specifically, all of this will result in average gross premiums hikes of 16.9%.

I decided to run the numbers myself to get an idea of just how much the combination of expiring IRA subsidies and the CMS "Affordability/Integrity Rule" will cause net premiums to increase starting in January 2026.

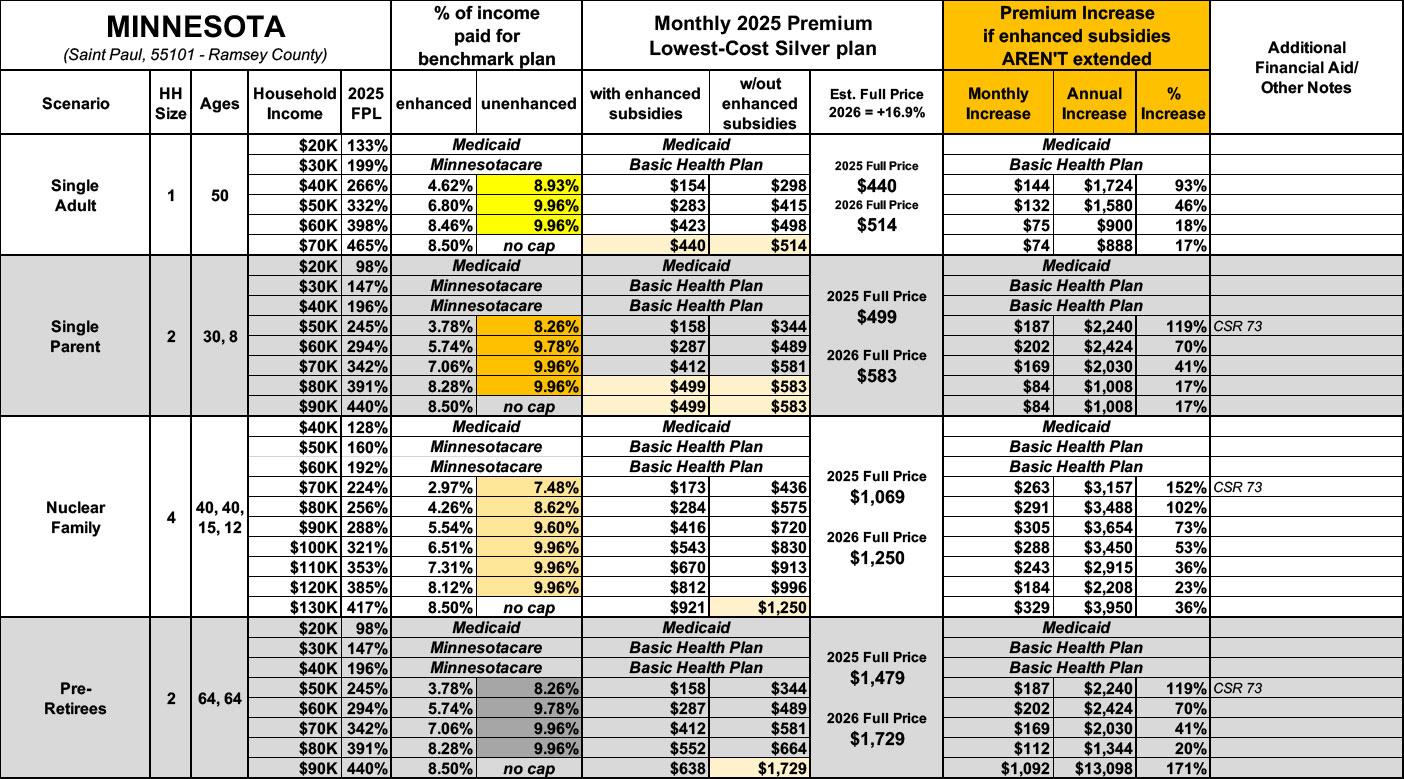

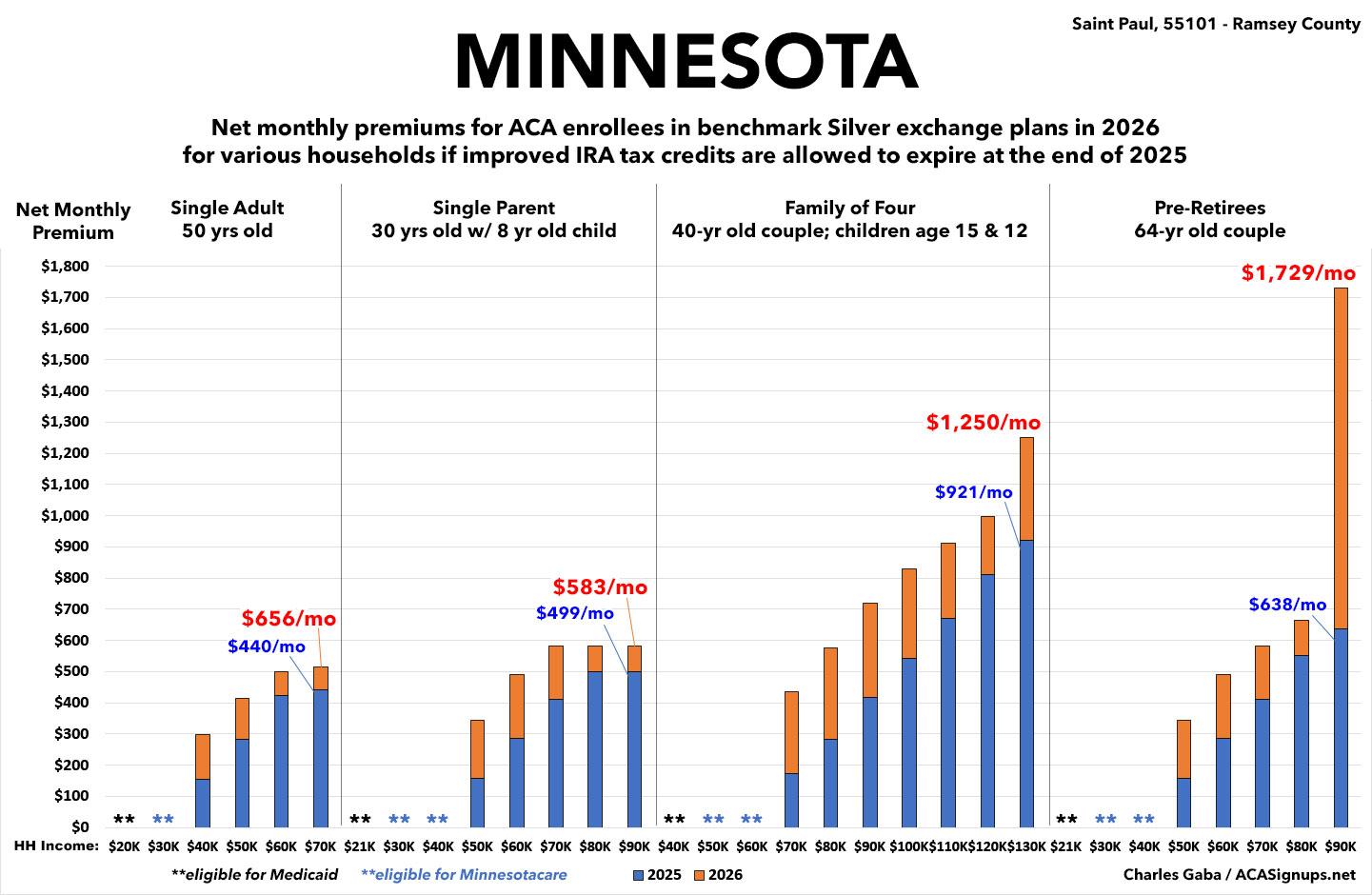

I'm using four household scenarios, at several different income levels for each:

- a 50-yr old single adult earning between $20K - $70K/year

- a 30-yr old single parent w/an 8-yr old child, earning between $20K - $90K/year

- a 40-yr old couple w/2 children age 15 & 12, earning between $40K - $130K/year

- a 64-yr old couple earning between $20K - $90K/year

There's several caveats:

-

The average Benchmark Silver ACA premiums are based on 2026 levels.

-

Benchmark Silver premiums vary widely depending on where you live & other factors.

-

In some states, children under 19 are eligible for CHIP or Children's Medicaid at a significantly higher household income level. This can cause a sudden jump in full-price premiums as the household income moves over that eligibility threshold.

-

These analyses assume that the enrollees choose the benchmark Silver plan, and that the benchmark plan remains the same both years (the actual benchmark plan often changes from one year to the next).

-

NEW: The original version of this analysis included a 4.3% increase in the unsubsidized benchmark plan premium based on a projection by the Congressional Budget Office. However, that was a national average projection which didn’t take into account other factors like increased utilization, medical inflation and so on. This updated version assumes the actual avg. 2026 rate filings.

-

NEW: The original version of this analysis assumed that the Applicable Percentage Table would revert back to the pre-2021 levels. However, the Trump Administration recently modified the formula used to calculate this which means that ACA subsidies will be even less generous starting in 2026.

-

NOTE: Minnesota has a "Basic Health Plan" (BHP) program in place for residents who earn between 138 - 200% of the Federal Poverty Level; I'm not entirely sure how the funding for this will be impacted by the lost federal subsidies.

With all that understood, let's take a look:

-

A single 50-yr old earning $40,000/yr would go from paying $154 in premiums to $298/month...nearly twice as much.

-

A single parent earning $60,000/year would go from paying $287/month to $489/month...70% more.

-

A family of four earning $70,000/year would see their premiums jump from $173/month to $436/month...2.5 as much as they're paying now.

-

A 64-yr old couple earning $90,000/yr would go from paying $638/mo to $1,729/mo...2.7x as much as they're paying today for the same policy.

There’s still a chance that Congressional Republicans might agree to extend the improved subsidies when they reconvene next month, but:

- The odds of it happening are slim;

- They would likely only agree to a watered-down version and/or would include poison pill demands of Democrats in return;

- Even if they do so, the actual rate hikes will likely already be baked in for 2026 (which would still leave unsubsidized enrollees stuck with the 29%+ rate hikes), and…

- even if they do, some of the Trump Admin’s other regulatory changes would still leave ACA enrollees with higher costs (including raising the cap on out of pocket expenses by $900/yr more than it would be otherwise).