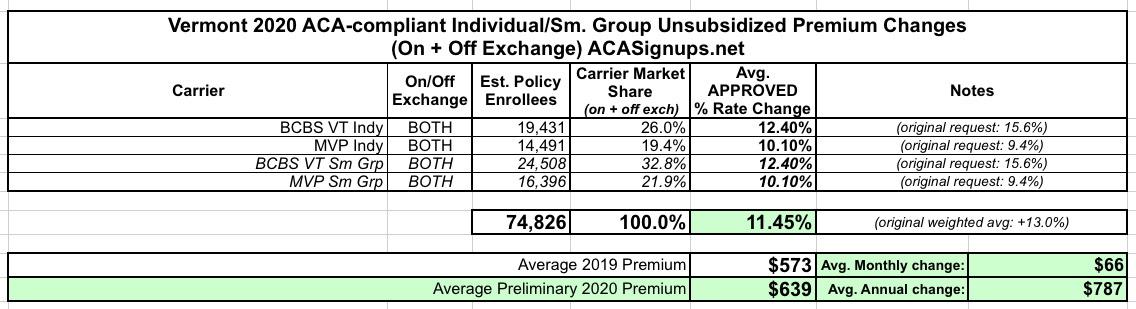

Vermont: APPROVED avg. 2020 #ACA premiums: +11.5% (down from +13%)

Vermont is the fourth state to announce their approved 2020 ACA individual/small group market premium rate changes. VT (along with Massachusetts and DC) has (wisely, in my opinion) merged the risk pools for the two markets into one, meaning I have to plug the numbers in differently on my spreadsheet.

Back in mid-May, my initial analysis of the two carriers participating in both Vermont markets put the weighted average rate increase being requested at an even 13.0% statewide: Blue Cross Blue Shield of VT was requesting a 15.6% increase, while MVP Health Care asked for a 9.4% bump.

From the Green Mountain Care Board a few days ago:

GREEN MOUNTAIN CARE BOARD MODIFIES AND APPROVES RATE REQUESTS FOR 2020 VHC PLANS

The Green Mountain Care Board (GMCB) announces its decision regarding BlueCross BlueShield of Vermont’s (BCBSVT) and MVP Health Care’s (MVP) requested rate increases for insurance plans offered through Vermont Health Connect (VHC) in 2020. Amended from the original filings, BCBSVT requested a 14.3% to 14.5% average annual rate increase while MVP requested a 10.9% average annual rate increase. Based on the submitted filings, there are 43,939 BCBSVT members and 30,887 MVP members enrolled in these plans.

Hmmmm...the hard enrollment numbers are exactly the same as what I had back in May, but the requested increases are different (14.4% vs. 15.6% for BCBSVT and 10.9% vs. 9.4% for MVP). I presume those initial filings were modified at some point or another between May and August.

"The Board is very frustrated about the unaffordable rate increases but must adhere to our statutory obligations," said Board Chair Kevin Mullin. The underwriting loss for the Individual and Small group lines of business were over $10 million for BCBSVT and over $1 million for MVP for 2018. By law, the Board must consider whether the requested rate is affordable and promotes quality and access to care, while also protecting insurer solvency. Both insurers cited growing pharmaceutical costs and use of medical services, as well as changes in state and federal taxes and fees as major cost drivers behind the requested rate increases. In recent years, BCBSVT’s reserves have trended downward, as has its riskbased capital (RBC) ratio, a measure of an insurer’s solvency. In 2018, BCBSVT’s RBC ratio had fallen nearly 100 points below the bottom of the new RBC range approved by the Department of Financial Regulation for the company.

The reinstatement of the ACA's "Carrier Tax" (which Congress has played hokey-pokey with since its inception...it was charged in 2014 & 2015, waived in 2016 & 2017, charged again in 2018, waived again in 2019 and is being brought back again for 2020) is responsible for around 2-3% of any rate increases.

The rate requests filed by the insurers on May 10, 2019 were subject to a 90-day analysis and review by the Board and their actuaries and by the Office of the Health Care Advocate (HCA) as an interested party to the filing. The GMCB held hearings open to the public at the Vermont State House on July 22, 2019 and July 23, 2019. The Board solicited public comment on the rates in writing, by phone and in person at the close of the hearings at a separate public comment forum on July 23, 2019 from 4:30 to 6:30 pm. The Board received oral and written comments from nearly 600 Vermonters.

After a complete review, the Board decided to reduce BCBSVT’s rate request to 12.4% and MVP’s rate request to 10.1% for VHC plans beginning January 1, 2020. These rate increases represent averages across different benefit plans with varying levels of cost sharing. Vermonters enrolled in a VHC plan may see higher or lower increases in their premiums depending on the benefit plan they are enrolled in. When considering what plan to purchase during open enrollment, the Board encourages Vermonters to use the online plan comparison tool available at the Department of Vermont Health Access’s website to see if they are eligible for financial assistance that will offset the cost of premiums or cost sharing requirements. Approximately two thirds of Vermonters enrolled in VHC receive financial assistance. Vermonters will have the ability to compare 2020 VHC plans starting October 15, 2019.

For questions about your health insurance or health care access, please contact Vermont Legal Aid’s Office of the Health Care Advocate at 1-800-917-7787.

The discrepancy between my own May analysis and the original requests noted in the press release make this confusing, but compared to my initial findings, they've knocked 2.2 points off of BCBS but increased MVP's request by 0.7 points. This still results in a small overall decrease since BCBS has a larger change and a larger market share, to a revised average increase of 11.5%:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.